Read more of the

The W.T.F. Report

#5 HIDDEN 2% FEES COULD BE COSTING YOU MORE THAN 50% of YOUR RETIREMENT PROFITS!

But in the investment world, somebody who believes in American business — and who will seek out the lowest way to participate in business and do it consistently— will achieve results that exceed those of investment professionals as a group.

It's the only industry I can think of where the professional's efforts **subtract value** from what the layman can do himself.“

***Warren Buffet - CFA Magazine, Jan-Feb 2003***

# 5

HIDDEN 2% FEES COULD BE COSTING YOU MORE THAN 50% of YOUR RETIREMENT PROFITS.

But this has a hangover.

This one hurts.

The math does not lie. Wall Street does!

Wall Street likes us to be dumb and blind.

Once upon a time, you were told to work hard, invest in your retirement, and fund your 401k and if you do it consistently you will have enough to retire comfortably. ( hopefully )

But what is comfortable?

When can you retire?

How much is enough?

What will be left over for your family or your legacy?

If you are like me, most folks took this to heart and signed up for their employer's matching program and “set it and forget it." You bought some forced choice funds that looked good at first pass, but the details were buried in the fine print and the mechanics you never saw or understood.

And that is where the hidden lie begins.

WALL STREET's LIE

We will manage your money for you."

But the smart money will tell you, "Your money should always be working harder than you do! Put it to work or fire it!"

The familiar finance marketing ads tease you to let WALL STREET manage your money “passively” in an ETF or pay a premium to get a top-notch "active manager" to grow your funds. And you will become rich and live the good life "some day." (A new AI tool to manage your funds should be hitting your inbox as you read this.) We are told.... "Buy this special ETF fund, or get in on this new hot fund and you should be good!"

So we all fall in line and set the deposits on auto withdrawal from our monthly paychecks and off we go. We may look at it once or 2x per year to see if the balance is going up. It becomes invisible, hard to read, harder to understand, and Wall Street likes it that way. We shift to "hopium" investing. We hope it will all work out - eventually.

But do we really understand what is going on?

You tell yourself, I won't have to live off this money until ”someday” so it is really not real money yet.

I will worry about it later... you can't time the market.. right?

For some reason, money does not seem real unless we get to spend it. We feel it when we get the “all-inclusive band” at the resort on vacation. Then the money is real.

The 1-2% our advisor takes out as fees every year is not. Everybody has to pay it ....so it is ok right?

Unfortunately, that is the status quo and Wall Street likes it that way. Compounding is a quiet tsunami that can sneak up on us - for or against us without warning and often too late. For most of us, our parents outliving their retirement funds is often the brutal reality check we need to realize the error in our ways.

TLDR: WHAT?

- The real effect of inflation on your investments over time (i.e. the compounded value of your declining dollar) is that it is going down in real buying power.

- Managers have to stay FULLY INVESTED all the time to justify their FEES. (ie AUM - ASSETS UNDER MANAGEMENT ) They can not sidestep a downturn in the market. A 50% loss in the market will require a 100% return to break even. Most people don't comprehend the asymmetrical effect losses have on their portfolio. Most people can not think in negative returns.

- By definition, a passive index fund exhibits pro-cyclical behavior, buying more of the stocks that have risen and selling more of those that have declined as their weightings move during index re-balancing. They routinely buy after high price appreciation and sell after high price depreciation. NET NET: You BUY HIGH and SELL LOW!

- Your ADVISOR gets their fee's no matter what! Your FEES are not paid based on performance! There is NO fiduciary duty in most funds. But there are always commissions..and it's those commissions that kill your retirement benefits and you don’t even see it.

SO WHAT? DON'T BELIEVE ME?

Let’s let AI show you the lie! ( and try not to cry )

GO TO URL : https://www.perplexity.ai/

"What is the amount lost to fees on an investment for 50 years with a 7% annual return with a 2% annual fee? Give the answer in % of total capital."

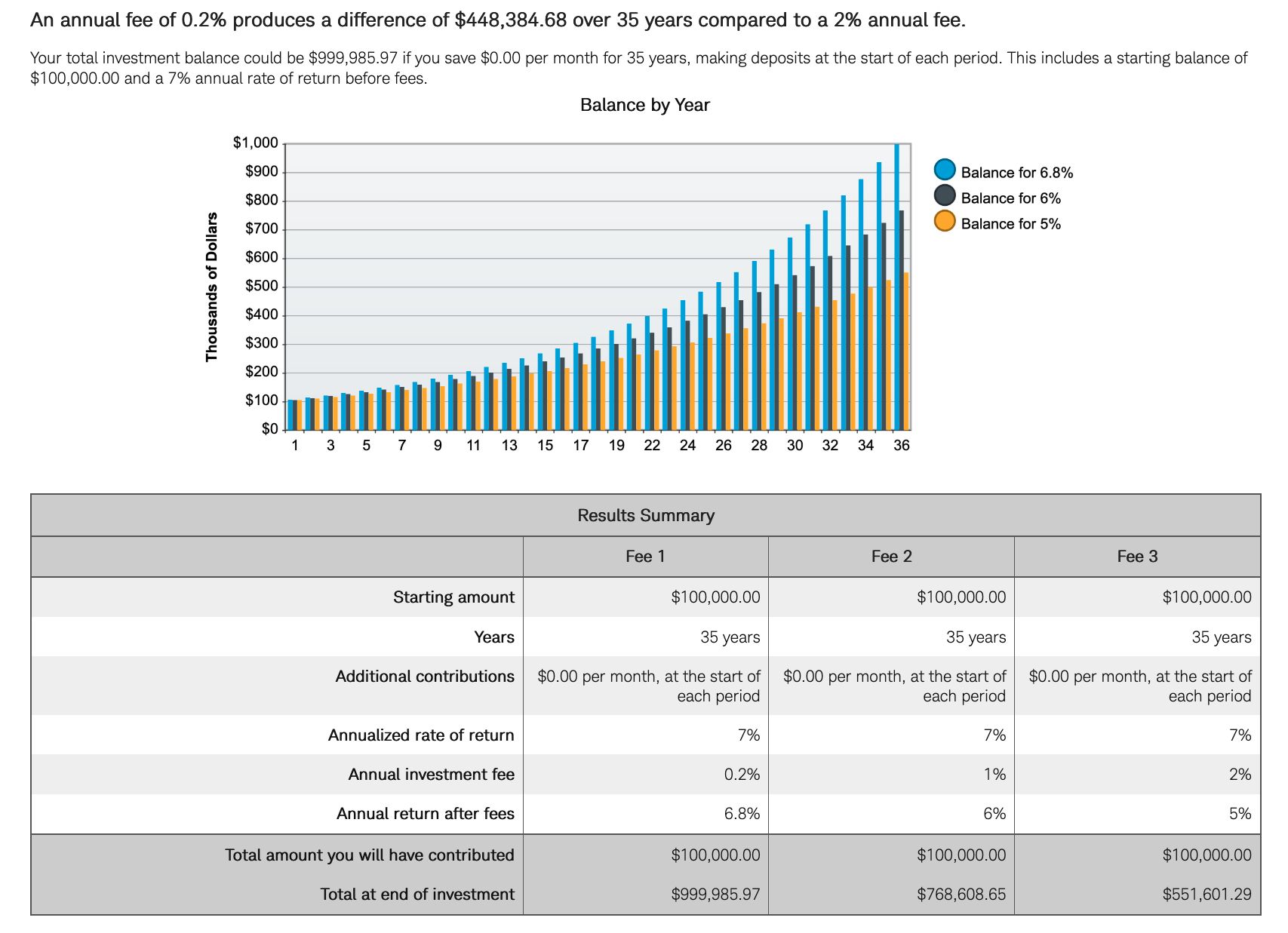

The amount lost to fees over 50 years with a 7% annual return and a 2% annual fee is approximately -61.07% of the total capital.

A FEW FACTS TO NOTE:

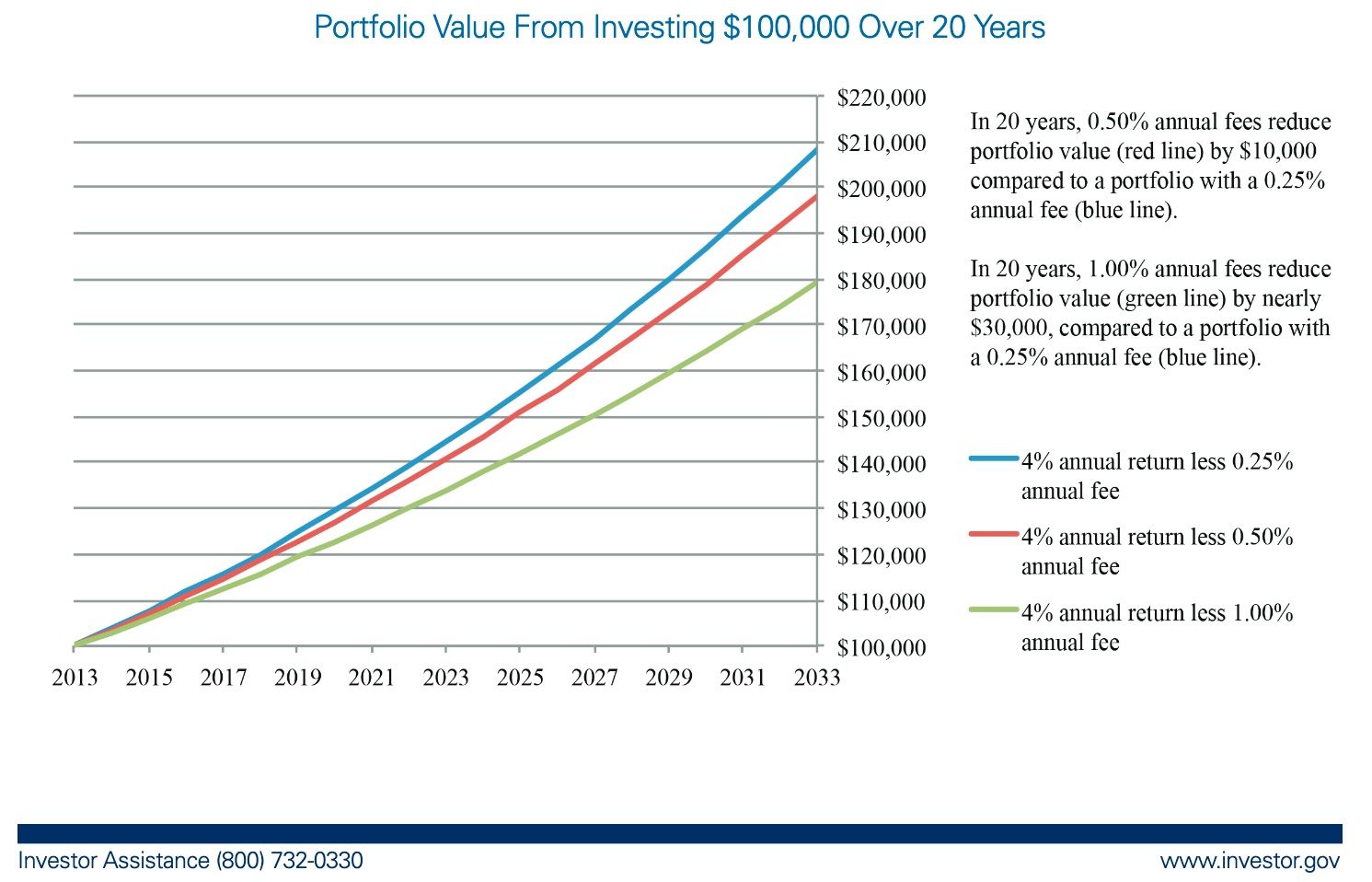

- It has been estimated that each one-quarter (.25) percent increase in annual fees can push one’s retirement back by one full year. The U.S. Department of Labor has also weighed in on the issues of fees, warning 401(k) plan participants that each percent in fees can reduce a worker’s 401(k) balance by 28% over a 35-year working lifetime.

- Many investors never find out how much they are paying for their mutual funds because the cost of each mutual fund is automatically deducted from the fund’s gross return – and not broken out as a separate expense on the account statement. In other words, there is no “aha, these are my fees!” moment.

- Most investors don’t realize that (90%) ninety percent of financial advice is provided by advisors who are under no legal obligation to put the client's “best interest” ahead of their own.

- Investors are often directed to high-fee mutual funds, or other products that generate much higher revenue for the advisor than ultra-low-cost index funds do. In contrast, less than 10% of financial advice is provided by an investment fiduciary.

- 401(k) participants are often subject to a limited menu of high-fee mutual funds. Sellers of 401(k) plans rarely discuss investment fees before the employer actually purchases the plan, because, under current law, plan sellers are only required to disclose investment fees during enrollment, after employers have purchased the plan, making it difficult for participants and employers to effectively “comparison shop”. Worse, one General Accounting Office study showed that 80% of plan participants were unaware that they were paying any fees!

- For mutual funds that primarily hold equities, costs are significantly greater for retail shares. Annual expenses for median retail shares were 0.34 percentage points higher than those for institutional shares. Although this seems like a small difference, it represents about 37% higher fees.

It’s a mathematical fact.”

- Vanguard founder John Bogle.

NOW WHAT?

You WILL have to live off of your investments one day....

( not someday).

How will you live?

How will you manage?

Will your assets work harder than you?

Will you know what and how to manage it?

Will you have enough?

If you are unsure of these answers, how will you close the gap?

If you want to learn to do it yourself, Time Freedom Trading is a great place to start. Volatility can be your friend. Trading stocks and options can be done safely and with minimized risk to replace your income. The stock market does not have to be a scary place. Trading with a proper system and the proper tools is within your reach. You just need the right knowledge, process, and skills. If you can do 5th grade math, you can trade and invest in the stock market. Don't let Wall Street steal you money from you 2% at a time.

Whether with us or not... please start somewhere.

Just start!

No one cares more about your money than you do.

Protect your money from hidden fees and learn to make it earn and work harder for you.

Everyone deserves to earn time freedom.

Learn to earn the time freedom you deserve.

Life is better with Time Freedom.

For your Freedom;

| THE BALD BULL

1. The Cold Math of Investment Fees: How 2% in Annual Fees Can Reduce Returns by 40%.

2. How Fees and Expenses AffectYour Investment Portfolio

3. Burton G. Malkiel: You're Paying Too Much for Investment Help

4. The $1 Million Long-run Effect of Fees and Expenses on Stock Market Investing

5. Small Differences in Mutual Fund Fees Can Cut Billions From Americans’ Retirement Savings

P.S.S. PLEASE PAY IT FORWARD!

Every one deserves Time Freedom! If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it"tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS