Read more of the

The W.T.F. Report

#16 Market Marionettes: How Big Funds Dance Around Liquidity Laws

"Stock manipulation is like magic—it's only fun if you’re the magician, not the audience."

–Anonymous Trader

# 16

Market Marionettes: How Big Funds Dance Around Liquidity Laws

Why Market Manipulation Exists

(Hint: It’s All About Money)

Let’s pull back the curtain: market manipulation happens because big players want to make more money, plain and simple.

Think of it like this:

- Retail traders (that’s you) are swimming in a sea of market sharks (institutions, hedge funds, and algorithms).

- Sharks want to eat. Instead of working hard, they "herd the fish"—a.k.a. retail traders—into traps, gobbling up profits while you’re left wondering what just happened.

Here’s the “why”:

Big players need liquidity to buy or sell large amounts of assets without moving the price against them. So, they manufacture "fear" (to make you sell) or "greed" (to make you buy) and create those liquidity pockets.

They win because their moves are deliberate.

Retail traders lose because they’re emotional.

What Market Manipulation Looks Like

Retail traders are the unwitting audience, often gasping in shock as their stop-losses mysteriously vanish into thin air. Behind the curtain, it’s not magic—it’s calculated misdirection, turning predictable human behavior into profit, all while leaving retail traders wondering, “Was it me, or did the market just mug me in broad daylight?”

There three (3) key market manipulations that you should be aware of:

1. Fake Sell-Offs (a.k.a. “Let’s Trigger Their Stop-Losses”)

Imagine the market starts dipping like a bad rollercoaster ride. Your emotions scream, “SELL NOW!” You panic and sell, locking in a loss. Moments later, the market miraculously bounces back like nothing happened.

What just happened? Market makers pushed the price down to shake out weak hands (you), so they could grab those shares at a discount. They didn’t cry over your loss—those were crocodile tears.

2. False Breakouts (a.k.a. “Gotcha!”)

You see a stock climbing. It breaks a resistance level, and your excitement hits 100. “This is the move! To the moon!” You buy in, only for the price to plummet right after.

Here’s the deal: that breakout was fake. Institutions engineered it to lure you into buying so they could unload their positions at premium prices.

3. Flash News Catalysts

Sometimes, they’ll even use news to spark your emotions.

“Breaking: The market’s on fire! Experts predict a crash!”

But is it real? Not usually. It’s just fuel to amplify fear or greed.

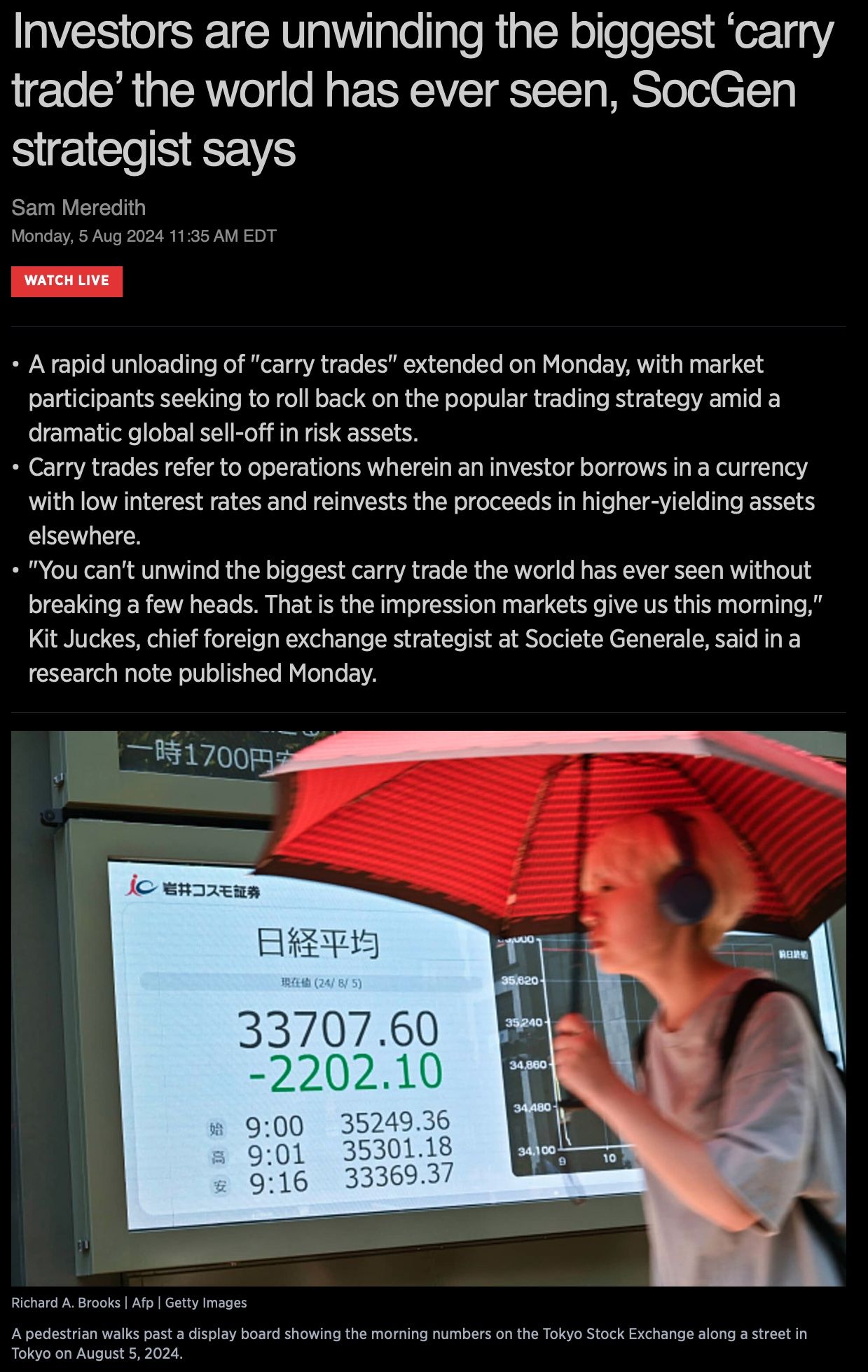

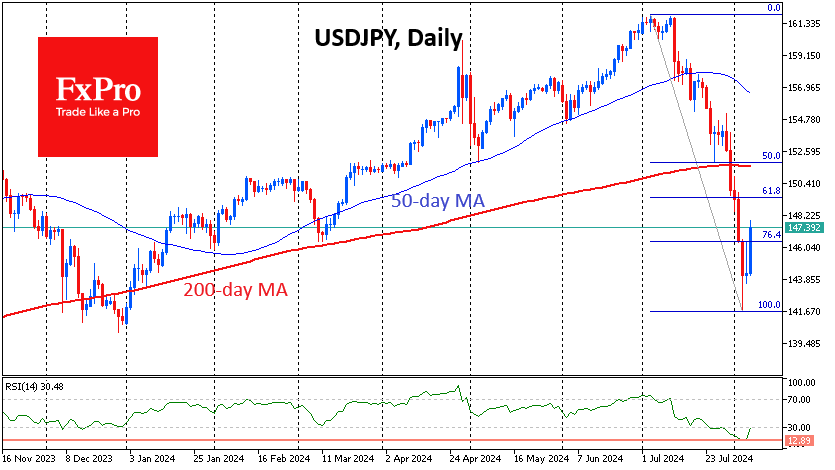

The Japan Carry Trade

Last summer, in late July into August, the global market had a meltdown that turned into an overnight contagion event: The Japan carry trade unwinded with the BOJ raising the YEN on a Sunday night into Monday morning.

This event effected the entire market with a violent sell off and bounce - all within 24 hours.

As the yen devalued, big players exploited the panic.

They forced fake sell-offs in liquidity zones, buying assets on the cheap as retail traders bailed.

Then, as greed returned to the market, they pushed prices higher and unloaded for massive profits.

It was fear, greed, and manipulation 101.

If you knew better, you’d do better.

Learn to profit from the fear!

As Warren Buffett says:

“Be fearful when others are greedy, and greedy when others are fearful.”

Why “Buy the Fear, Sell the Greed” Works

When everyone’s selling in a panic, prices are artificially low. Buy the fear, and you’re setting up for gains when the dust settles.

Greed creates traps.

When everyone’s buying in euphoria, prices are inflated. Sell the greed, and you’re locking in profits while others chase the hype.

Leverage Liquidity Zones to Profit

These zones often represent levels where significant market activity is likely to occur due to traders' interest in these price levels.

Liquidity zones can act as support or resistance levels where the market tends to react, reverse, or consolidate due to the influx of orders being executed.

Types of Liquidity Zones

- Found above the current market price.

- These zones represent areas where sellers are likely to dominate, leading to downward pressure on price.

2. Demand Zones (Buying Liquidity)

- Found below the current market price.

- These zones represent areas where buyers are likely to dominate, pushing the price upward.

Key Characteristics of Liquidity Zones

These zones are created by a large accumulation of limit orders (buy or sell) placed by institutional players, retail traders, or algorithms at specific price levels.

2. Market Behavior Around Liquidity Zones

- Price Reversals: When price reaches a liquidity zone, it may reverse due to the fulfillment of pending orders.

- Breakouts: Strong momentum can push through these zones, triggering stop-losses or new orders, leading to breakouts.

- Consolidation: Price may oscillate within the zone, as buying and selling pressures balance each other out.

3. Institutional Interest

Big players like hedge funds, banks, and institutional investors often place large orders at these zones, as these levels allow them to execute trades without significantly impacting the market.

4. Stop-Loss Hunting (Liquidity Grabs)

- Traders often place stop-loss orders near obvious support or resistance levels.

- Market makers or algorithms may push price into these zones to trigger stop-loss orders, creating liquidity for their trades.

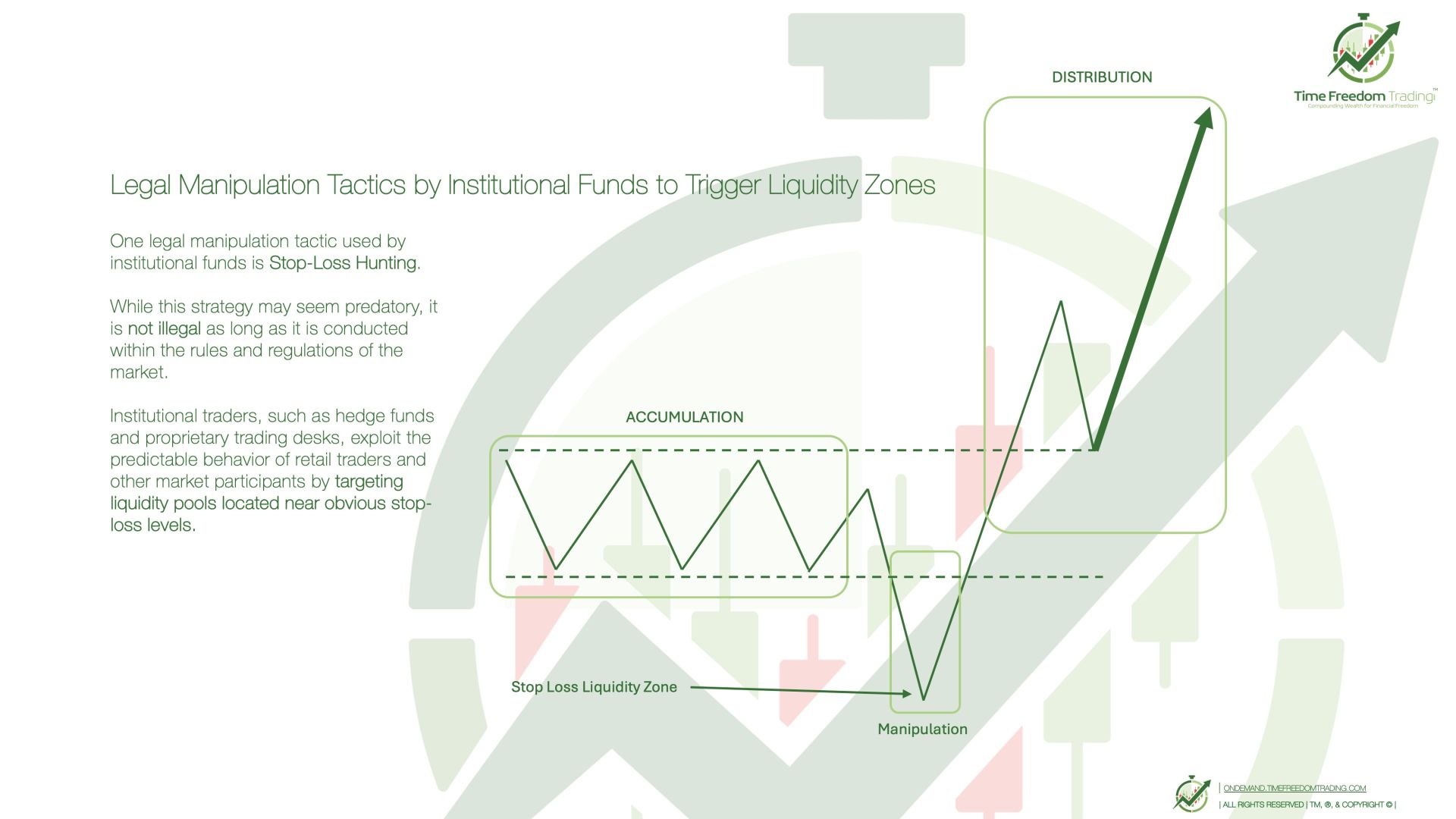

Legal Manipulation Tactics by Institutional Funds to Trigger Liquidity Zones

While this strategy may seem predatory, it is not illegal as long as it is conducted within the rules and regulations of the market.

Institutional traders, such as hedge funds and proprietary trading desks, exploit the predictable behavior of retail traders and other market participants by targeting liquidity pools located near obvious stop-loss levels.

How Stop-Loss Hunting Works

- Retail traders commonly place stop-loss orders near visible support and resistance levels.

- For example:

- Below swing lows in an uptrend.

- Above swing highs in a downtrend.

- These areas are often obvious on the price chart.

2. Triggering Liquidity Zones

- Institutions will push the price into these zones by executing large market orders or using algorithmic trading strategies to create a temporary price spike.

- When the price enters these zones, stop-loss orders are triggered, causing a surge in market orders (buying or selling).

3. Capitalizing on the Liquidity

- Once liquidity is triggered, institutions execute their trades at better prices, often in the opposite direction of the initial spike.

How to Spot Stop-Loss Hunting Using Wicks on a Chart

- Long Wicks (or Shadows):

- Sudden Price Spikes:

- Low Volume in the Spike:

2. Chart Patterns to Watch For

- False Breakouts:

- Rejections at Key Levels:

- Swing Failure Patterns (SFPs):

3. Timeframes and Context

- Smaller Timeframes: Use 5-minute or 13-minute charts to spot sharp moves and wicks into liquidity zones.

- Larger Timeframes: Use daily or 55min charts to identify the broader liquidity zones where stop-loss hunts are likely to occur.

Example of Wicks Indicating a Stop-Loss Hunt

- Price is in an uptrend and approaches a previous swing high (resistance).

- A long wick breaches the resistance level, triggering stop-loss orders placed above it.

- Price reverses sharply and closes below the resistance level, forming a bearish rejection.

2. Interpretation:

The long wick shows that institutional players entered the market, triggered liquidity, and executed large sell orders at a premium price.

By learning to recognize these patterns, retail traders can better anticipate institutional behavior, avoid common traps, and position themselves to trade profitably with the "smart money."

| Anonymous Trader

A Mindset for Time Freedom

Ready to Make Your "When" Happen?

Time Freedom Trading offers one-on-one coaching to help you dominate the market, and reclaim your most precious resource: time.

So, I’ll ask again… When is your "when"?

Start earning time freedom. Start today. Not someday.

SIGN UP TODAY!

Let’s make it happen.

Freedom awaits—are you ready to claim it?

For your Freedom;

| THE BALD BULL

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it ( and remember ) you for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

Want to Read more?

#15 Mastering Divergence: How Price Action Reveals the Truth Hidden Behind Indicators

# 14 The Secrets of Longevity (in Life and Trading)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it"tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS