Read more of the

The W.T.F. Report

#33 Debunked & Exposed: The Top 10 Trading Lies Retail Traders Swear By

| Ed Seykota, Trend-Following Pioneer

Are you a retail trader holding onto some common myths?

You’re not broken. You’re just biologically set up to suck at trading.

Your brain’s #1 job? Keep you alive — not help you build wealth.

So what happens?

You chase green candles like they’re prey.

You avoid losses like they’re tigers.

You cling to comfort, dopamine, and certainty — three things the market feeds you *right before it eats you alive*.

These myths?

They feel safe.

But they’re silently draining your account and sabotaging your consistency.

In this blog, we’re going full myth-buster mode — exposing the Top 10 Trading Lies Retail Traders Swear By with hard-hitting stats from FINRA, the SEC, and beyond.

If you’re brave enough to challenge your beliefs…

You might finally become the trader you claim you want to be.

Let’s unlearn.

Let’s out-trade.

Let’s GET FREE!

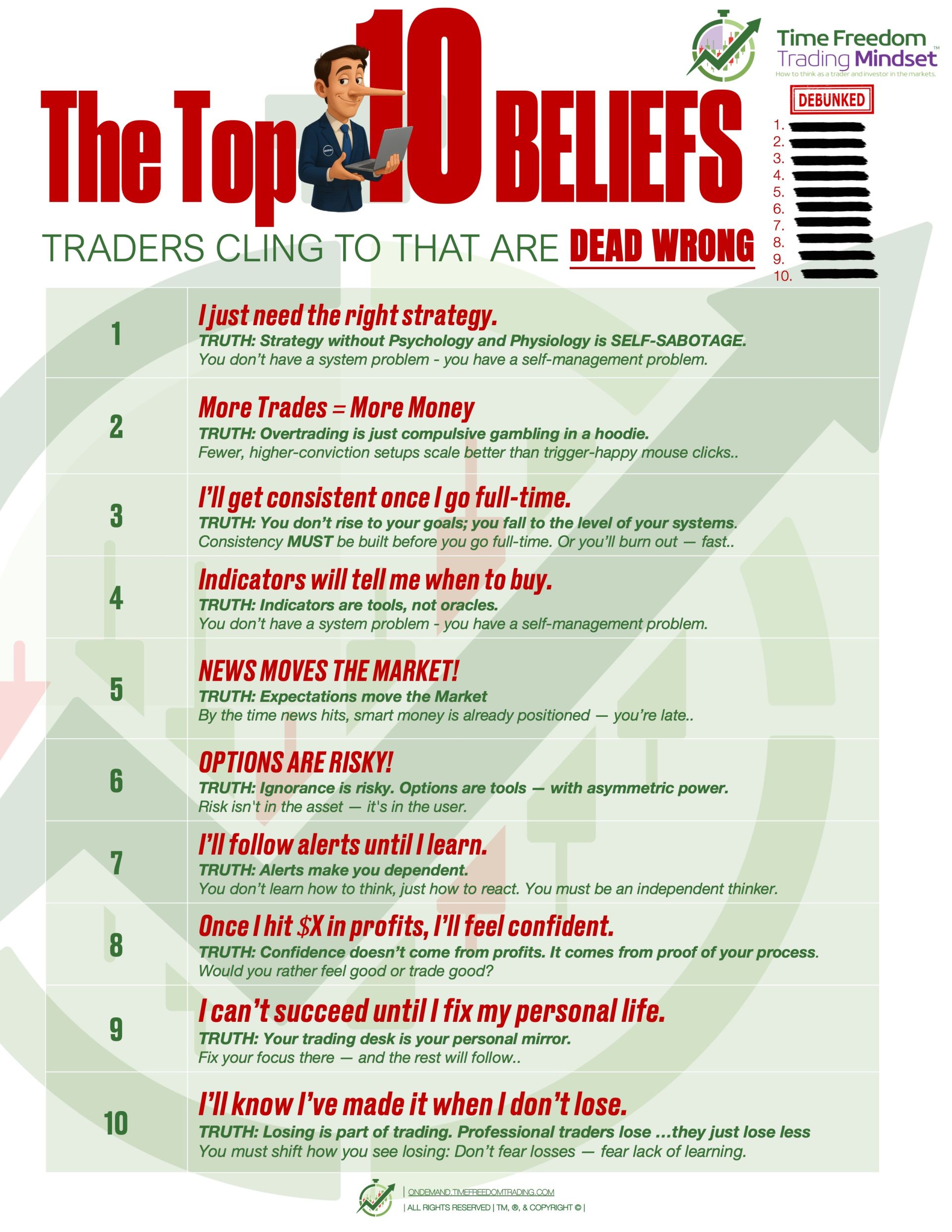

#1. BELIEF = “I just need the right strategy.”

STRATEGY without Psychology and Physiology is SELF SABOTAGE .

You don’t have a system problem — you have a *self-management* problem.

In other words, the majority are in the red despite whatever strategy they tried. Consistently profitable trading comes from skillful execution and risk management, not a magical formula. If most traders lose, the “right” strategy alone clearly isn’t a golden ticket.

“If the right strategy was all it took… why are so many smart traders still inconsistent?”

The OPERATING SYSTEM (OS) of TIME FREEDOM TRADING requires you to see the MARKET in 3D, define a proper edge, and execute a proven “consistency code”.

#2. BELIEF = “More trades = more money.”

Overtrading is just compulsive gambling in a hoodie.

Fewer, higher-conviction setups scale better than trigger-happy mouse clicks.

Those who traded the most lagged far behind those who traded sparingly. Why? Costs, overconfidence, and chasing too many setups eat into profits. Quality trades beat quantity. The data is clear: trading smarter, not harder, tends to make more money.

“What’s the real cost of feeling productive but compounding losses?”

Of the 22 trading days on average per month, 5-10 days per month will give potential setups with the proper catalysts.

#3. BELIEF ="I'll get consistent once I go full-time. "

YOU DON’T RISE TO THE LEVEL OF YOUR GOALS, YOU FALL TO YOUR LEVEL OF YOUR SYSTEMS

Consistency MUST be built before you go full-time.

Or you’ll burn out — fast.

The goal is to replace your living expenses through a few trades a month. A proper money management strategy is critical to growing and sustaining your profits with room for INCOME drawdowns.

#4. BELIEF ="Indicators will tell me when to buy."

INDICATORS ARE TOOLS, not oracles.

They lag — and they lie when you use them without context.

The market doesn’t care about your feelings — it reprices assets when a real catalyst shows up. Sometimes it’s news. Sometimes it’s a surprise. Either way, you better show up with a thesis, not a wish.

Only trade when your rules say so — backed by your edge, your system, and your ability to execute.

No thesis? No trade. No exceptions.

Because gambling is what happens when you skip the “why” and YOLO the “buy.”

#5. BELIEF ="News moves the Market."

Expectations move the market.

By the time news hits, smart money already positioned — you’re late.

Trading against High Frequency Algorithm systems on news is not TIME FREEDOM TRADING. Learning to trade when you have a proper EDGE for your ability is. Learning and advancing your skills with the proper maturity model is key.

#6. BELIEF ="Options are Risky!"

Ignorance is risky. Options are tools — with asymmetric power.

Risk isn't in the asset — it's in the user.

Learning to trade and invest is the key to compounding and building wealth. Learning to manage both with the proper risk and leverage will accelerate your financial flywheel to compound wealth and earn time freedom.

#7. BELIEF = "I’ll follow alerts until I learn."

Alerts make you dependent.

You don’t learn how to think, just how to react.

Master the skill. Build the system.

When you learn how to trade and invest with a proven operating system — you don’t just make money…you build self-sufficiency that prints financial independence for life.

Because once you know how to read the market — you’ll never need to beg it again.

#8. BELIEF = "Once I hit $X in profits, I’ll feel confident."

Confidence doesn’t come from profits. It comes from proof — following your process.

“Would you rather feel good or trade good?”

The process you follow.

The skills you sharpen.

The knowledge you apply.

Inside Time Freedom Trading, these unlock your Consistency Code — the blueprint to becoming a profitable trader and investor.

When you adopt a proven system, you stop guessing and start growing. Confidence compounds. Success becomes repeatable.

And you step boldly into Providence — not by luck… but by design.

You don’t rise to the market — you rise to your level of preparation.

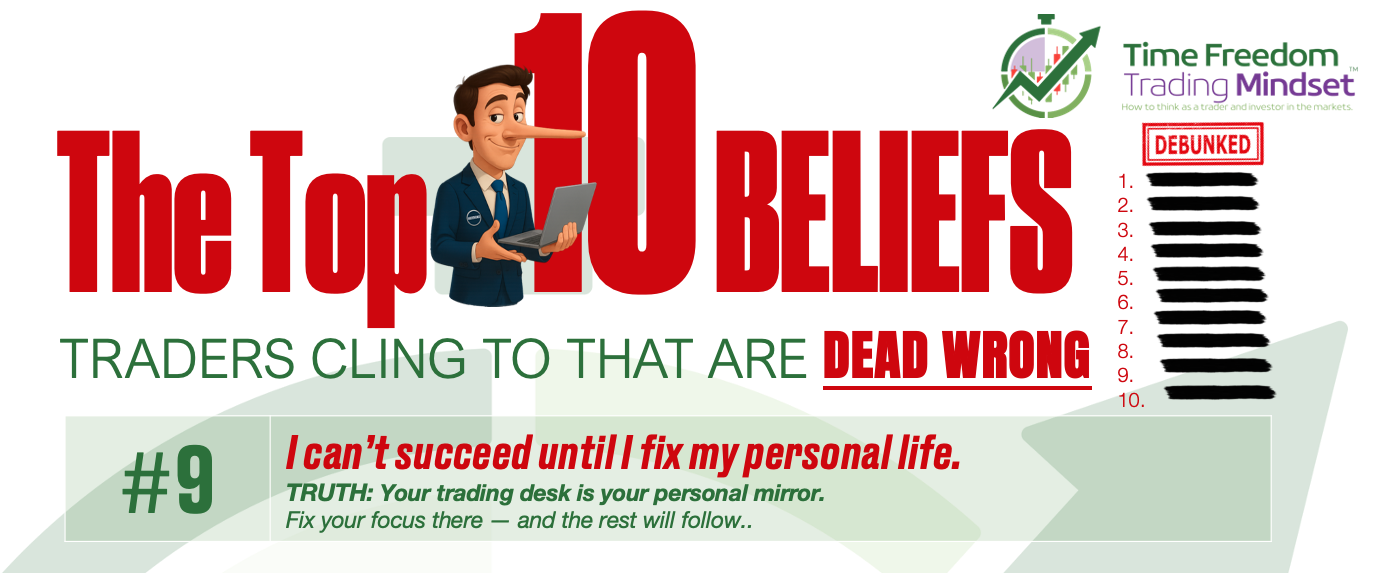

#9. BELIEF = "I cant' succeed until I fix my personal life."

Your trading desk is your personal mirror. Fix your focus there — and the rest will follow.

Becoming a Time Freedom Trader starts with an identity shift — not just a skill set. You don’t become a successful trader by accident.

You must think like one.

Act like one.

And most importantly… believe you are one.

You must first BE the trader,

Then DO what profitable traders do,

So you can HAVE the financial freedom they live.

Because results follow identity — not the other way around.

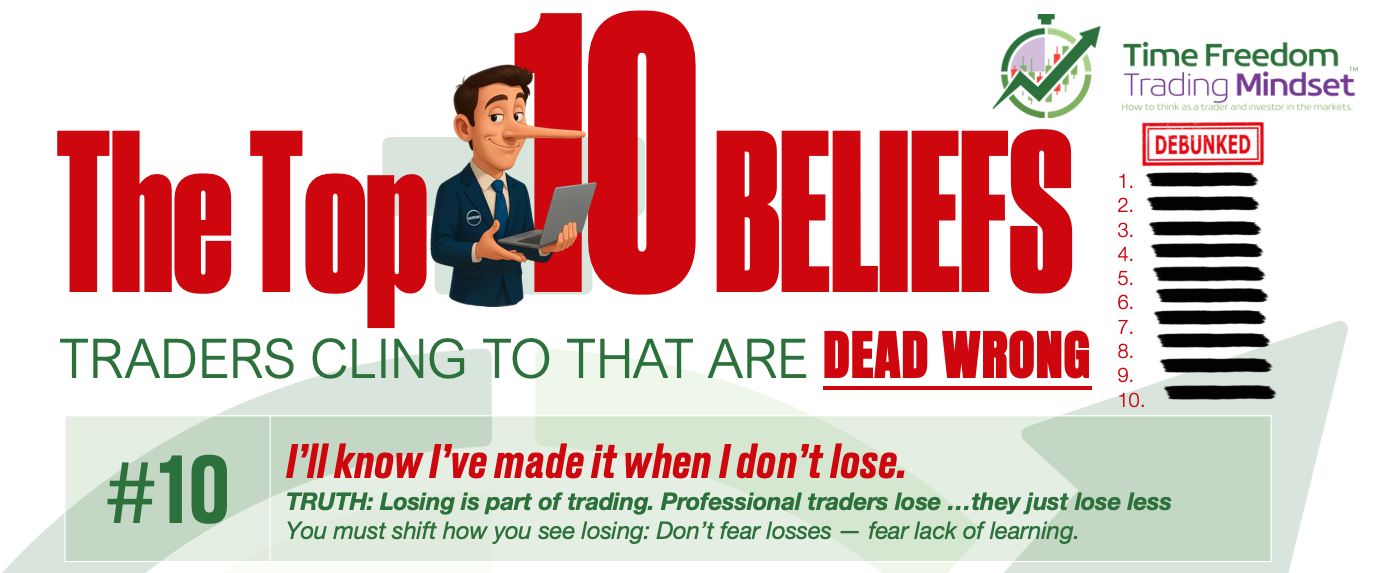

#10. BELIEF = "“I’ll know I’ve made it when I don’t lose.”

*The truth: Losing is part of the game. Professional traders lose all the time — they just lose less than they win and they don’t stay wrong.

You must shift how you see loosing: Don’t fear losses — fear lack of learning.

Show me a consistent trader — and I’ll show you a well-kept trade log.

If you don’t track it, you can’t improve it.

Every trade must be logged. Every result must be studied.

You need to know your numbers:

✅ Win rate

✅ Risk-reward

✅ Expectancy

That’s your Trader Triangle — and it’s not optional.

Your Expectancy isn’t just a stat…

It’s the gateway to building real Time Freedom.

Profits follow precision. Precision comes from performance tracking.

THE FINAL WORD

The data doesn’t lie — most traders lose because they’re believing bullsh*t, not because they’re missing some “secret strategy.”

Winning in the market takes:

✅ Realistic expectations

✅ Ruthless risk management

✅ A rock-solid mindset

✅ A proven system

Every trader deals with losses, doubt, and chaos.

But the ones who win?

They drop the myths.

They trust the math.

And they follow a blueprint that works.

This is your wake-up call.

Stop winging it. Start winning it.

Learn the system. Earn your Time Freedom.

Join us inside Time Freedom Trading.

Download the Top 10 Trading Lies Retail Traders Swear By

and read it daily like your account depends on it — because it does.

Print it.

Post it.

Tattoo it on your ego.

Just don’t keep pretending you “didn’t know.”

Unlearn the lies.

Trade like a legend — not a lunatic.

👉 Download the list.

LIVE LIKE A SUPER HERO!

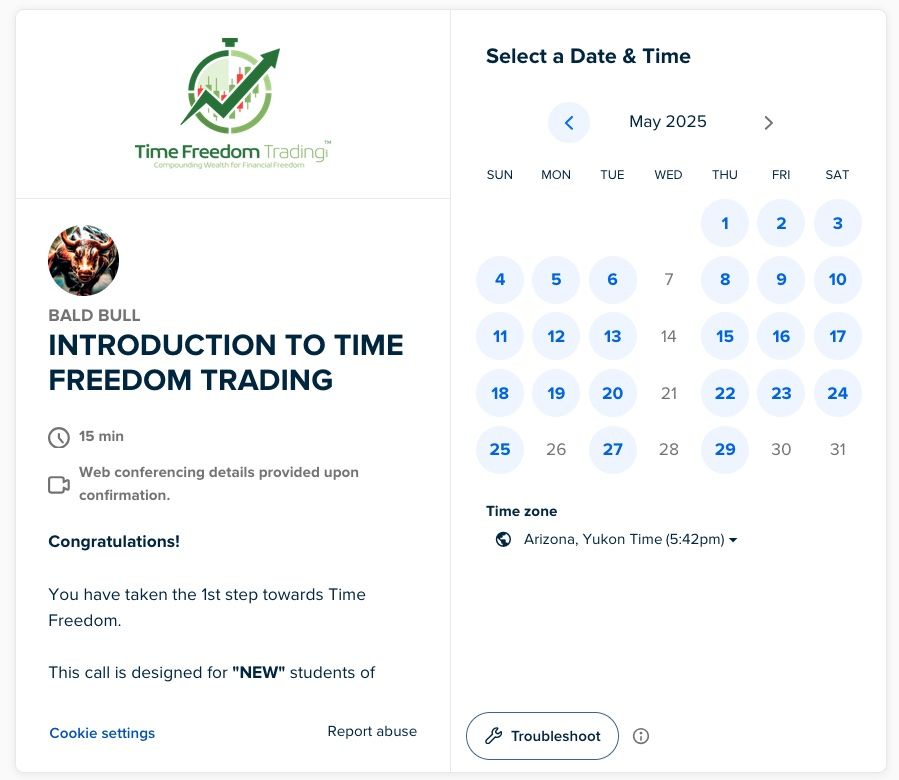

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

I have 2 slots available for our SPRING COHORT

Put your tax return to good use and learn to earn with the proper leverage!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 14 The Secrets of Longevity (in Life and Trading)

#15 Mastering Divergence: How Price Action Reveals the Truth Hidden Behind Indicators

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS