Read more of the

The W.T.F. Report

Thursday, October 16th, 2025

Thursday, October 16th, 2025

“When the market smiles at you during a storm, it’s not flirting — it’s setting you up for the next wave.”

“Welcome to Oscillation Nation — Where the Market’s Got Mood Swings, Not Moves.”

Alright, strap in. It’s Thursday — the tactical tease before the Friday frenzy — and the market is acting like a caffeinated toddler with an iPad: distracted, hyper, and one bad headline away from a meltdown.

Yes, the government’s still shut down, so we’re flying blind without fresh economic data — which means Jerome Powell’s basically piloting the plane using a Magic 8 Ball and vibes.

Meanwhile, Wall Street’s trying to get cozy with rare earth metals, because apparently, we’re all junior geologists now. The irony? We can’t even mine an agreement in Congress, but hey — let’s go dig for lithium in Nevada.

Then there’s PayPal, who just “accidentally” printed $300 trillion in stablecoins. That’s not a typo — that’s 300 trillion, with a T. One fat finger and they almost became God. Paxos says they burned it, but the crypto world just relearned the oldest trading lesson there is: trust, but verify, and maybe double-check your zeros.

Markets? Oh, they’re green… for now.

We’re officially in oscillation mode — big retail buys the dips, while the hedge funds sip their lattes and quietly unload their bags. Retail poured $1.4 billion into last Friday’s dip — the fifth-largest buy since 2008 — while the “smart money” said, “Nah, we’re good.”

Translation: the surf looks calm, but the riptides are forming underneath. Charts are whispering weakness, earnings guidance is muttering doom, and yet futures are smiling like nothing’s wrong.

Welcome to Thursday — where the market’s pretending it’s fine, the traders know it’s not, and every bounce feels like the setup before the next slap.

Let’s break down the madness.

Pre-market Pluse:

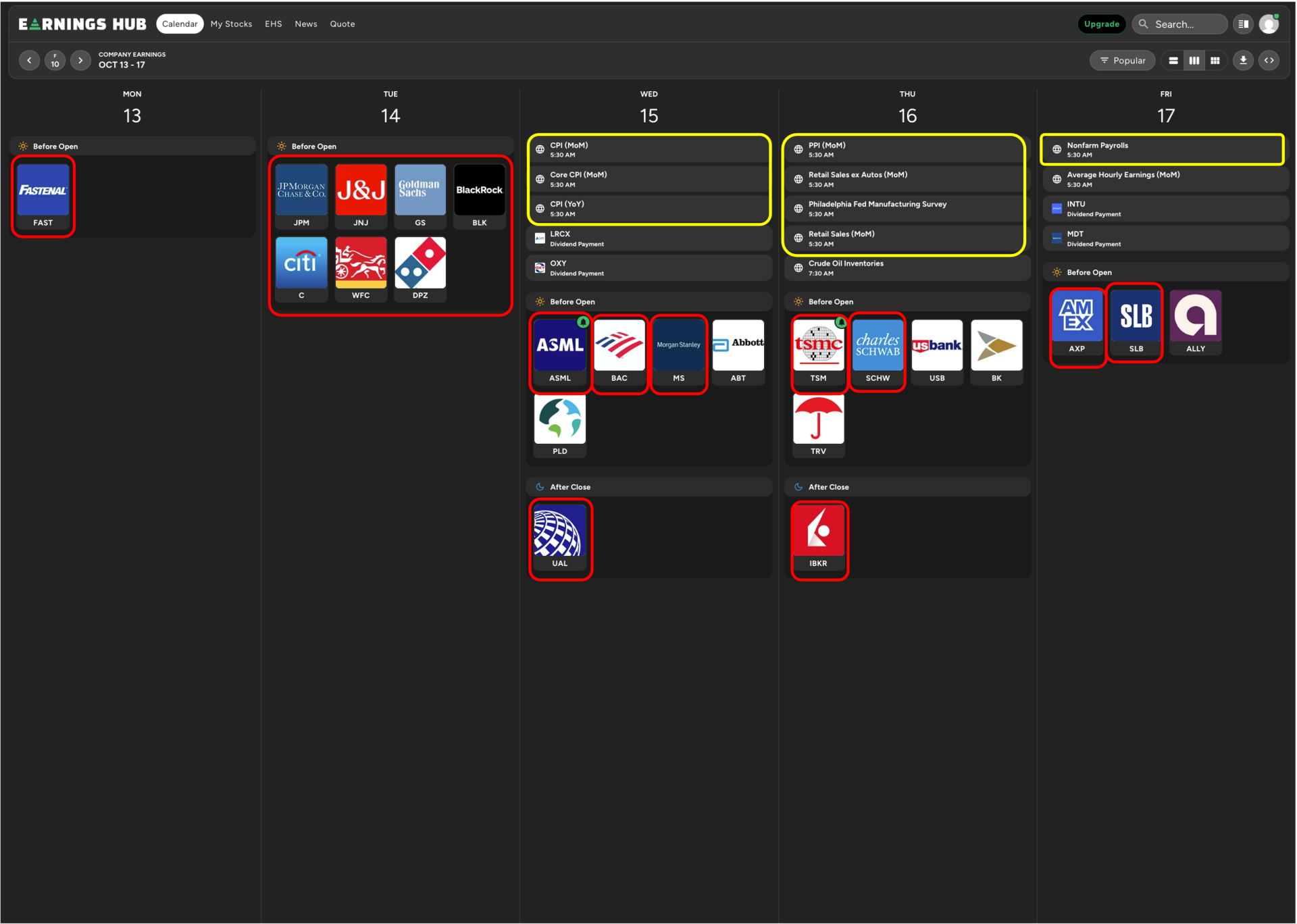

J.B. Hunt Transport Services (JBHT) jumped ~14%+ after an impressive Q3: $1.76 EPS on $3.05B revenue vs. $1.46 expected. A logistics bellwether showing demand still in motion.

Schneider / Werner Enterprises also popped ~2.5-3%, riding the logistics momentum wave.

Salesforce (CRM) climbed ~6.1% after projecting > $60B in revenue by 2030 — much more aggressive than Street’s $58.37B view. The “AI + workflow” narrative is front and center here.

United Airlines (UAL) fell ~1%. While their adjusted EPS of $2.78 beat estimates, revenue of $15.23B missed the ~$15.33B consensus. Yield pressure and cost inflation still bite.

Taiwan Semiconductor (TSMC / TSM) rose ~2% as profits jumped 39%, revenue +30%. CEO C.C. Wei called AI demand “very positive.” That’s a growth engine validation. Reuters+2Barron's+2

Sea Ltd (SE) got upgraded to Buy from Neutral by BofA, citing an overblown sell-off. The stock rallied ~4% premkt.

T-Mobile (TMUS) got boosted by Wells Fargo, upgrading to overweight. They see continued postpaid subscriber strength. Up ~1%.

Arm / Meta – Arm shares +1% after a multiyear AI efficiency deal with Meta. Meta is modestly higher — positioning itself deeper in AI infrastructure.

Micron Technology (MU) broke higher +3% after UBS raised their price target, citing anticipated supply tightness in memory chips.

Charles Schwab (SCHW) popped ~4% after reporting adjusted EPS of $1.31 vs. $1.21 consensus. Revenue of $6.14B beat estimates. Client assets soared 17% Y/Y to $11.59T.

Travelers (TRV) slid ~5+%. Core EPS beat $8.14 vs $6.35 consensus, but revenue of $11.47B underwhelmed vs $11.81B expectations.

Hewlett Packard Enterprise (HPE) was punished (~10% drop) after forecasting weak FY 2026. They expect EPS in $2.20–2.40 (Street was at $2.40) and revenue growth 5–10% vs expectations near 17%. This one stings the “growth to value” rotation.

Tactical Tilt (for Today)

Strengths

-

Big tech / AI / chip earnings are delivering upside surprises, giving bulls ammo in a soft macro regime.

-

Retail buying continues to be a counter‐party force. Those $1.4B buys Friday weren’t random.

-

Markets’ optimism about rate cuts and easing monetary policy is still alive — it’s hanging by threads, but still a tailwind.

Weaknesses

-

Guidance is weak across many names (HPE, cyclicals).

-

Hedge funds remain sidelined, net sellers — the institutional “smart money” is not showing up.

-

Chart internals are deteriorating: breadth is weakening; new highs vs new lows divergence.

-

The government shutdown blackout means key data is missing; we’re flying under instrument failure.

Opportunities

-

Focused plays in AI infrastructure, rare earth / critical minerals, memory & semiconductors.

-

Mistakes like the $300T stablecoin mint remind us that structural integrity (governance, controls) will be premium. Opportunity in crypto infrastructure names with strong oversight.

-

Volatility — there will be chop, but that can produce asymmetric setups. The rotation from weak to strong names is where edge lies.

Threats / Risks

-

A negative surprise in Fed commentary (or hawkish tilt) could collapse any optimism.

-

Macroe surprises (inflation, weak consumer) in absence of data could spook markets.

-

The governance risk in crypto / fintech (e.g. that PayPal error) can reverberate.

-

If retail fatigue sets in, the rally breaks — no institutional backstop.

That’s not luck. That’s timing, not guessing.

Here are 3 surprising market stats and a Freedom Fact to kick off this Rocktober bank earnings week — straight from the Bald Bull’s trading trench:

1. Bank Stocks Rally Before Earnings — Not After.

Over the past 10 years, the KBW Bank Index (BKX) has averaged a +2.4% gain in the 10 trading days leading up to earnings — and then often fades post-earnings as reality meets optimism.

Translation: Smart money trades the expectation, not the announcement.

Time Freedom Insight: Trade the turn, not the talk. When the crowd celebrates results, the pros are already cashing the move

2. 70% of Bank Earnings Surprises Come from Rate Moves — Not Loan Growth.

In Q2 and Q3 cycles since 2019, more than 70% of earnings “beats” were driven by net interest income shifts from rate spreads, not core lending or trading gains.

Translation: Banks don’t just profit from business — they profit from policy.

Time Freedom Insight: When the Fed blinks, the banks bank. Follow the yield curve, not the CEO spin.

3. Traders Underestimate Bank Volatility by 40% During Fed Cut Cycles

Historically, implied volatility on bank options is 40% lower than realized volatility during the first two months of a rate-cut cycle.

Translation: Traders price in calm — but the storm is just starting.

Time Freedom Insight: That mispricing is your edge. Volatility isn’t danger. It’s discounted opportunity.

Wall Street banks aren’t just reporting numbers this week — they’re revealing where the real money flow is going next quarter.

So tune in, track the trend, and remember:

You just need the timing.

“For God gave us a spirit not of fear but of power and love and self-control.”

— 2 Timothy 1:7 (ESV)

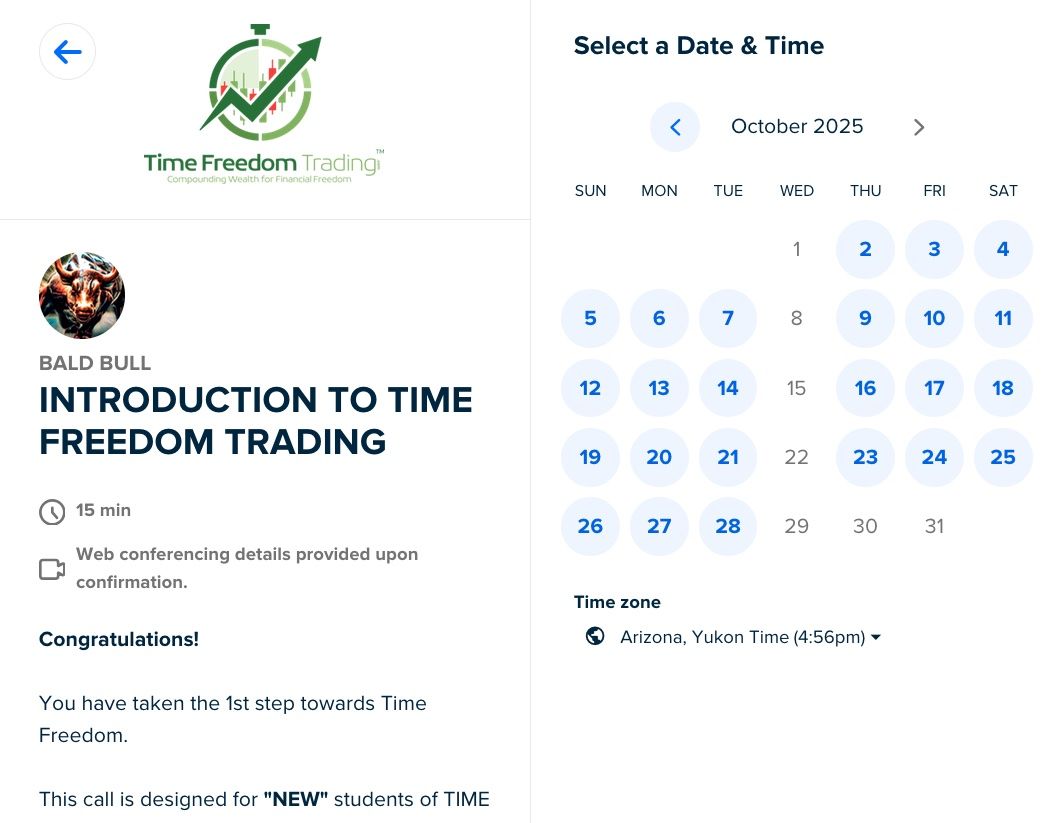

This Sunday, the Time Freedom Trading Fall Cohort opens its final seats.

Learn to think like a tactician, trade like a strategist, and earn like it’s on purpose.

We’ll show you how to turn red days into runway and volatility into victory.

🔥 Join now before the bell rings on your freedom:

👉THE TIME FREEDOM TRADING FALL COHORT

Thursday is a slender rope we walk between opportunity and risk. The charts are unstable, but momentum pulses under the surface. Use today to scout setups, test strength, and let the winners reveal themselves. Be hyper-selective.

If you want my live trade playbook or setup scans throughout the day, I’ll send them to the TFT inner circle.

Will you join me?

Onward with clarity, capital, and conviction.

LIVE LIKE A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS