Read more of the

The W.T.F. Report

Monday October 27th, 2025

Monday, October 27th, 2025

OPTIMUS HANDS OUT CANDY EARLY

New All-Time Highs. Robots. Rate Cuts. Welcome to Halloween Week on Wall Street.

Welcome to Trick-or-Treat Week on Wall Street, where the bots are bullish, the bears are hiding, and Elon just turned Halloween into a shareholder roadshow.

Futures are flying. The QQQ is up +1.27%, global markets are glowing green, and optimism is oozing out of every algorithm. Why? The U.S.–China trade truce is pumping life into stocks worldwide — even as it tanks rare earth miners, the very backbone of the EV and AI revolutions. Irony, thy name is market rally.

Meanwhile in New York, Tesla’s Optimus robot is literally handing out Halloween candy to kids and cameras in Times Square — part sugar rush, part shareholder seduction. All this as investors gear up to vote on Elon’s $1 trillion pay package next week. RoboTaxi and robo-lobbying: the future is automated, and it’s wearing a suit.

Earnings are growing at a 15% clip, and clarity is fueling confidence into what’s shaping up to be the busiest week of the season. Chipmakers — the sector with the most to lose from China — are leading the charge early Monday. Nvidia, Broadcom, and AMD all up around +2%, while Tesla and Apple each add about +1%.

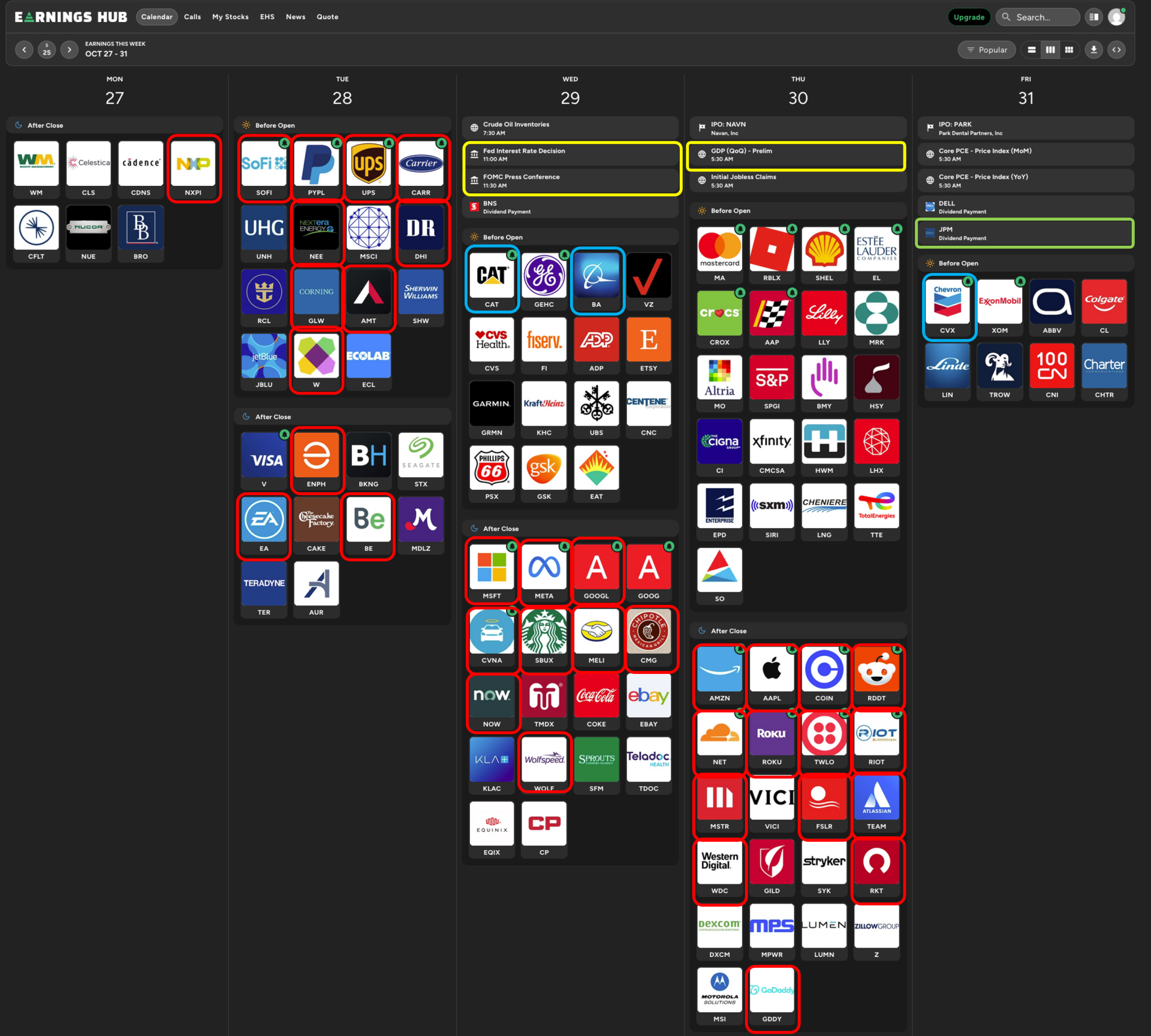

This week is loaded:

NVDA’s AI in DC conference, Mag 7 earnings, Fed decision Wednesday, and the Trump–Xi tariff truce summit Thursday. Then Friday caps it off with Halloween trading — because nothing says “volatility” like candy-fueled traders and costumed algos.

So grab your candy bag and your conviction. Because this week, the market’s full of tricks — and Optimus is already passing out the treats.

The stock market is designed to transfer money from the active to the patient.”

— Warren Buffett

KEY CATALYSTS THIS WEEK:

Monday: NVDA’s AI in DC Summit — where chips meet politics

Tuesday: META & MSFT earnings — ad budgets meet AI budgets

Wednesday: Fed rate decision — pause baked in, Powell’s tone still the wildcard

Thursday: AMZN & AAPL earnings + Trump–Xi handshake trade truce

Friday: Halloween finale — window dressing and volatility fireworks

PREMARKET MOVES

Rare Earth Stocks:

The China trade truce sent miners into meltdown. United States Antimony plunged 15%, Critical Metals dropped 9%, and USA Rare Earth fell 7%. MP Materials and Energy Fuels lost 4%. The irony? The sector that enables the AI boom just got tricked by the truce.

Avidity Biosciences (RNA):

Soared 44% after Novartis announced a $12B cash buyout at $72/share — a 46% premium. Novartis dipped 1.3% for paying up, proving even Big Pharma hates paying full price.

Lululemon (LULU):

Up 3.3% after teaming with the NFL and Fanatics for a new apparel line. Expect your Sunday yoga pants to go full quarterback chic.

Chip Stocks:

Semis are surging on trade truce hopes — AMD, Nvidia, Broadcom all up around 2%. Silicon diplomacy is officially a thing.

Gold Miners:

Down bad as trade fears fade. Newmont, Coeur, Hecla all -5%, Barrick -3%. Fear premium? Gone. Safe haven? Overrated.

Five Below (FIVE):

Up 3.8% after JPMorgan upgrade citing strong Halloween sales. When skeletons fly off shelves, you buy dips, not candy corn.

Carter’s (CRI):

Down 7% on weak Q3 results and 15% workforce cut. That’s not a baby bump — that’s a diaper disaster.

Keurig Dr Pepper (KDP):

Up 8.6% after blowing past estimates ($4.31B vs. $4.15B). Guidance raised, caffeine intact. Traders clearly needed the boost.

Revvity (RVTY):

Down 2% on a razor-thin miss ($699M vs. $699.4M est.) and trimmed guidance. Revenue flat, energy flatter.

Harley-Davidson (HOG):

Revved backward 2% after Morgan Stanley downgrade. Apparently, rebellion doesn’t sell like it used to.

Life Time Group (LTH):

Up 5% on an upgrade. Analysts see upside from new club openings. Gains fueled by biceps and balance sheets.

DoorDash (DASH):

Up 2.9% on a Goldman Sachs Buy rating. Inflation might hurt wallets, but convenience addiction is forever.

Beyond Meat (BYND):

Down 5% after last week’s 238% melt-up. Meatless, yes. Volatile, absolutely.

GameStop (GME):

Up 5% after the White House reposted GME’s meme declaring “console wars are over,” featuring Trump as a Halo Spartan. Politics, memes, and market manipulation — truly the holy trinity of modern finance.

SWOT SNAPSHOT

STRENGTHS — The Fuel Behind the Rally

-

Earnings Engine Roaring (+15% Growth):

Corporate America is printing profits again. The Mag 7 (META, MSFT, AMZN, AAPL, NVDA, TSLA, GOOG) are driving double-digit earnings growth while cost-cutting and AI efficiency unlock higher margins. Market confidence is compounding because the fundamentals are finally catching up to the hype. -

AI & Chip Momentum:

NVDA’s AI in DC summit this week isn’t just hype — it’s a signal that semiconductors are now national strategy. With Washington treating chips like oil, the sector’s leadership looks durable. Broadcom, AMD, and NVDA are all pushing the NASDAQ higher with coordinated rotation and institutional volume. -

Fed Certainty = Market Clarity:

The Fed is locked in on a pause this Wednesday. The inflation downtrend and soft-landing narrative have given traders room to lean long with confidence. Rate certainty = volatility suppression = risk appetite. -

Global Trade Thaw:

The Trump–Xi tariff framework this week injects global optimism. The trade truce sent world indices higher — Europe and Asia followed U.S. futures into breakout territory. Global capital flows are rotating back into risk assets. -

Liquidity Tsunami:

Massive buyback programs (Apple, Meta) + cash-rich balance sheets + sidelined hedge fund capital = dry powder waiting to chase performance. Managers are being forced back into the market or risk underperforming into year-end.

WEAKNESSES — The Cracks Beneath the Candy-Coating

-

Rare Earth Reality Check:

The same China trade truce that’s fueling equities is crushing miners and strategic resource plays. The U.S. dependency on imported rare earths just got spotlighted. This is the market’s quiet Achilles’ heel — geopolitical supply risk hiding under the surface of the AI boom. -

Valuations at Oxygen Levels:

The S&P and NASDAQ are trading near historic P/E levels (S&P 24x, NASDAQ 33x). With growth already priced in, even perfect earnings could trigger “sell the news” reactions. -

Mag 7 Concentration Risk:

Over 35% of S&P 500 weighting sits in seven stocks. That’s not diversification — that’s dependency. If one falters (especially Apple or Nvidia), the index could unravel fast. -

Complacency in the VIX:

The volatility index sitting near 12-13 signals greed and overconfidence. Historically, that level precedes volatility spikes, especially during heavy catalyst weeks like this one. -

Retail Euphoria Rising:

Meme stocks are stirring (GameStop, Beyond Meat). Retail inflows are back, chasing short-term pops. That’s often a sign of late-stage exuberance, not smart money conviction.

OPPORTUNITIES — The Setups for Smart Operators

-

Post-Earnings Mean Reversion:

The biggest opportunities this week lie after the big earnings releases. Once implied volatility collapses, disciplined traders can pick up discounted options or fade emotional overreactions. -

Sector Rotation into Forgotten Corners:

As capital crowds into mega-cap tech, smart money may start rotating into financials, energy, or small-cap industrials — sectors that benefit from a global trade thaw and stable rates. Watch XLF, XLE, and IWM for silent accumulation. -

AI Infrastructure Boom Plays:

The NVDA DC Summit is more than optics — expect renewed interest in data-center REITs, networking hardware (ANET, CSCO), and secondary chip players (TSMC, MRVL). These are the “picks and shovels” of the AI gold rush. -

Rate-Sensitive Rebounds:

With the Fed pause baked in, beaten-down rate-sensitive sectors — housing, REITs, and utilities — could stage multi-week relief rallies. The opportunity is in early confirmation, not chasing the move. -

Momentum Breakouts:

A breakout to new all-time highs invites trend-following funds and algorithmic inflows. The momentum trade is real — if price consolidates above breakout levels, that’s your green light for continuation setups.

THREATS — The Monsters in the Market Closet

-

Earnings Landmines:

Even one bad print from AAPL, MSFT, or AMZN could derail sentiment. With expectations sky-high, even “good” results might not be good enough. -

Geopolitical Whiplash:

The Trump–Xi meeting could swing from truce to tantrum in a single tweet. If talks stall or tariffs resurface, the rally could reverse instantly. -

Liquidity Trap in Small Caps:

While the mega caps fly, small caps remain weak — the Russell 2000 hasn’t confirmed the breakout. If liquidity dries up, this divergence could morph into a structural weakness across broader markets. -

Bond Market Flashpoints:

Yields have dipped recently, but any surprise inflation print or hawkish Fed commentary could spike rates again, instantly deflating equity multiples. -

AI Bubble Behavior:

Tesla’s Optimus stunt is part of a broader narrative inflation around AI and automation. Every cycle has its mascot — and markets tend to correct when hype outruns revenue.

TIME FREEDOM TAKEAWAY

Strengths fuel the FOMO. Weaknesses hide the warning signs. Opportunities reward the disciplined. Threats punish the distracted.

This week, precision is profit.Trade the turn, not the trendline hype.

Because when the charts are dressed up for Halloween, only the traders with 3D vision see through the costume.

HISTORICAL MIND-BLOWER

Translation: portfolio managers love to put on their Halloween masks and dress up those year-end numbers. It’s the week where rallies rise from the grave.

TIME FREEDOM TACTICS FOR THE WEEK

Trade the Turn, Not the Talk.

Wait for the post-event reaction, not the pre-event hype. Clarity compounds.

Follow Rotation, Not Rumor.

Watch where capital hides after Mag 7 fireworks — defensive plays often get the quiet bid.

Stack Small Edges.

Play earnings volatility with spreads or short-term reversions. Precision beats prediction.

Defend the Flywheel.

Scale profits. Reset risk. Keep your powder dry for the post-Fed whipsaw.

Elevate Your State.

Patience is your edge. The trader who breathes before clicking, banks before breaking.

THE MASK & THE MARKET

Fear hides as “caution.” Greed hides as “momentum.”

But Time Freedom Traders? We don’t disguise discipline.

We trade truthfully. We follow frameworks.

Because freedom isn’t found in luck — it’s forged in clarity.

| 1 Peter 5:8

Distraction is the devil’s favorite trade. Stay alert, not emotional. Guard your focus — your capital will follow.

“

Freedom isn’t found in the trades you take — it’s in the trader you become.”

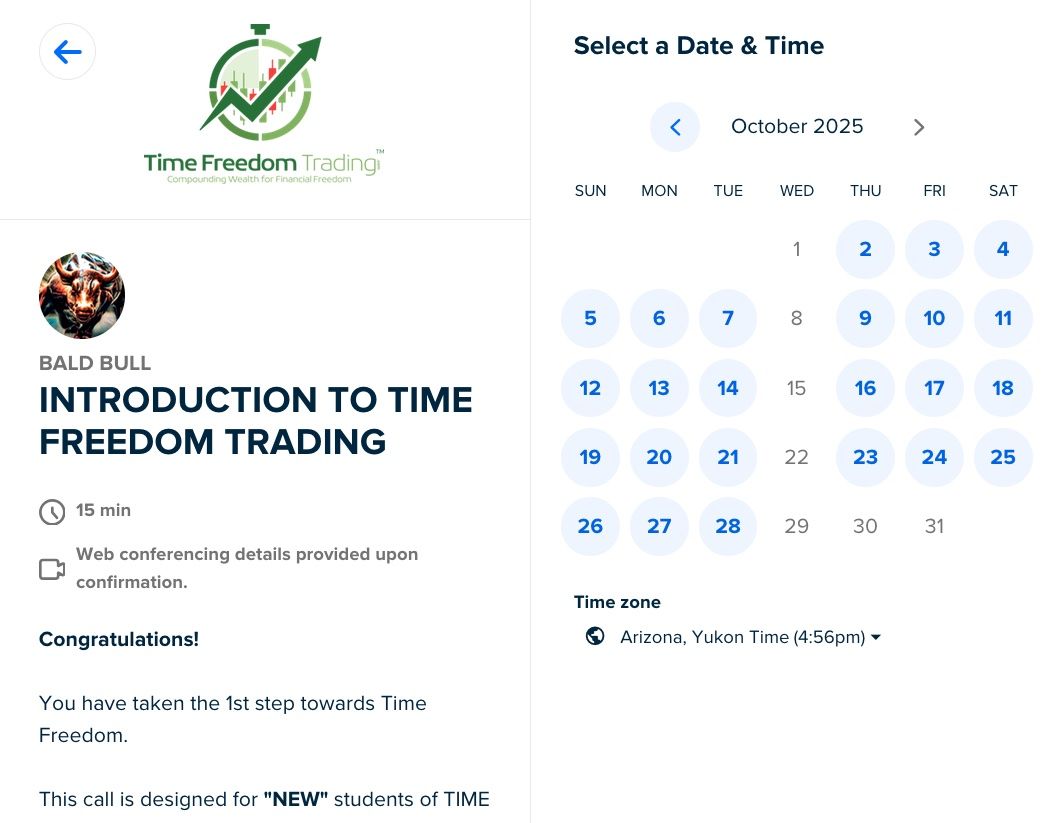

BUILD YOUR WEALTH OPERATING SYSTEM

Optimus is out here handing out candy and Elon’s cashing in on hype — but don’t forget who’s really in control: the disciplined trader with a plan.

Trade the turn. Protect your edge. Compound with conviction.

One trade. One turn. One moment of clarity.

That’s all it takes to start compounding your way to freedom.

Because time freedom isn’t a fantasy — it’s a formula.

You’re just one trade away.

LIVE LIKE A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS