Read more of the

The W.T.F. Report

November, 4th, 2025

Tuesday, November 4th, 2025

ELECTION DAY EDITION

Tactical Tuesday Edition — The Harvest Is Red, Not Golden.

“Month of Abundance — We REAP What We SOW!”

Good morning, traders — it’s Election Day, but Wall Street’s voting with its wallet, and the ballot says: SELL some AI.

S&P 500 futures are down about 1%, Nasdaq’s bleeding pixels, and even the bulls are eyeing the exits. The culprit? Palantir, the so-called prophet of AI, just forgot to prophesy 2026 — stock down 7% pre-market. That’s your canary in the coal mine — or maybe the data miner in distress.

AI valuations have officially hit “nosebleed altitude” — S&P’s forward P/E is hovering near 23, right where it was back in 2000. You remember 2000, right? The last time everyone thought tech would never fall… right before it did.

Goldman Sachs CEO David Solomon says we’re due for a 10-20% drawdown, Morgan Stanley’s Ted Pick says “sure, let’s call it a healthy cleanse,” and 300 stocks in the S&P closed red Monday. That’s not a breadth problem — that’s a breathless market gasping for rotation.

Government shutdown? Day 35. The longest shut down in history. Washington’s still on an unpaid vacation. Markets don’t like “out-of-office” auto-replies from fiscal policy.

MACRO MADNESS

-

Goldman & Morgan Stanley – Both CEOs warned of a 10-20% market correction within two years. Translation: they’re already shorting your optimism.

-

SNAP Benefits – Trump admin raiding contingency funds to pay half the nation’s grocery bills. Fiscal responsibility meets coupon-clipping.

-

Starbucks – Selling 60% of its China biz to Boyu Capital for $4 billion. Guess they realized “Made in China” also applies to profit margins.

-

Layoffs – Amazon, UPS, and Target axed 60,000 jobs. The AI white-collar recession just RSVP’d.

Finance jobs? Fleeing NYC faster than pigeons at lunchtime. Texas and Florida are the new Wall Street zip codes.

“THE FIELD OF FEAR.”

The market’s that farmer who spent all year bragging about his golden crop, only to find out the corn’s plastic and the rainclouds are shorting futures.

Today’s Tactical Tuesday isn’t about planting new seeds — it’s about protecting the ones you’ve already got before the locusts (aka profit-takers) move in.

The stock market is designed to transfer money from the active to the patient.”

— Warren Buffett

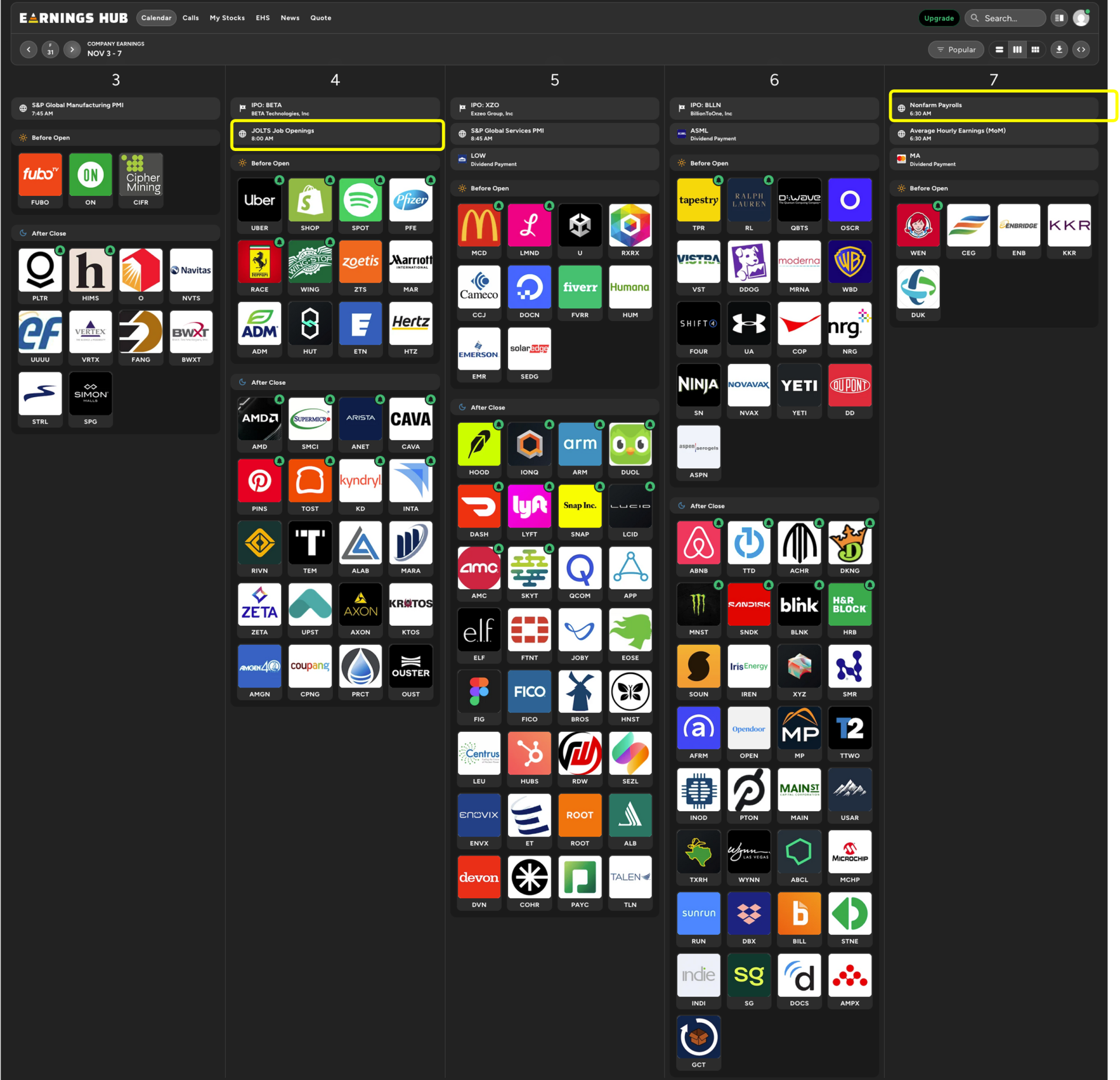

CATALYSTS ON WATCH — WEEK AHEAD

Note: Some data may be delayed thanks to our “out-of-office” government.)

MONDAY:

-

Palantir (PLTR) earnings (After the Bell)

-

ISM Manufacturing Index

-

September Construction Spending

TUESDAY:

-

Election Day

-

Uber (UBER), Spotify (SPOT), Shopify (SHOP), Norwegian Cruise Line (NCLH), Pfizer (PFE), Yum Brands (YUM) earnings (Before the Bell)

-

AMD, Pinterest, Super Micro (SMCI), Hinge Health, Amgen, Rivian earnings (After the Bell)

-

September International Trade Data

-

JOLTS Job Openings & Labor Turnover Survey

WEDNESDAY:

-

McDonald’s (MCD) earnings (Before the Bell)

-

Qualcomm (QCOM), Snap (SNAP), Arm Holdings (ARM), Lyft (LYFT), Figma, e.l.f. Beauty (ELF), Lucid Group (LCID) earnings (After the Bell)

-

Weekly Mortgage Apps

-

ADP Private Payrolls

-

ISM Services Index

THURSDAY:

-

Warner Bros Discovery (WBD), Tapestry (TPR), Under Armour (UAA), Moderna (MRNA) earnings (Before the Bell)

-

Airbnb (ABNB), Affirm (AFRM), Block (SQ), Peloton (PTON) earnings (After the Bell)

-

Weekly Jobless Claims

-

Q3 Productivity & Costs (Prelim)

FRIDAY:

October Jobs Report

-

Preliminary Consumer Sentiment Data

PRE-MARKET MOVERS:

Palantir (PLTR) – Down 7%. Beat earnings, raised guidance… and still got punished. That’s what happens when your “AI future” looks like “AI maybe later.”

-

Uber (UBER) – Down 5%. Revenue beat, guidance meh. The only thing accelerating here is investor nausea.

-

Norwegian Cruise Line (NCLH) – Down 10%. The only thing cruising here is straight into the red sea. Royal Caribbean & Carnival down ~4% in sympathy — or solidarity.

-

Spotify (SPOT) – Up 5%. Apparently, Taylor Swift’s breakup songs still move markets.

-

Yum Brands (YUM) – Up 2%. Taco Bell’s saving the day — because nothing says “economic resilience” like late-night burritos.

-

Sarepta (SRPT) – Down 35%. Their gene therapy missed the mark… looks like the DNA of disappointment.

-

Upwork (UPWK) – Up 20%. Freelancers eating while corporate layoffs roll in — poetic justice or AI irony?

-

Archer-Daniels-Midland (ADM) – Down 8%. The harvest report is ugly; farmers everywhere just muttered “same.”

-

Ferrari (RACE) – Up 1%. The only stock still speeding — because the rich don’t do recessions.

And let’s not forget Norway’s sovereign wealth fund just rejected Elon Musk’s $1 trillion Tesla payday. Even Vikings think that’s too much pillaging.

Strengths

-

Some companies still delivering solid beats + raised guidance (e.g., Upwork).

-

Liquidity remains ample; time-freedom traders can still engage with setups.

-

Market knows the narrative (AI), so deviations prompt reactions — meaning tactical edges exist.

Weaknesses

-

Valuations are elevated (forward P/E of S&P ~23 — near 2000 levels).

-

Breadth is weak: >300 stocks closed red Monday, equal-weight indexes showing clear under-performance.

-

Investors locking in profits; sentiment may shift abruptly.

-

Government shutdown drags macro sentiment and cost of capital unknown.

Opportunities

-

Use pullbacks to deploy capital at better risk-reward.

-

Time-Freedom Trading setups thrive in mean-reversion environments; when tech gets over-extended and starts wobbling, that’s your entry zone.

-

Diversification away from the AI/tech concentration. Industrials, commodities, value names may offer leverage.

Threats

-

A 10-20% drawdown risk identified by top-tier CEOs.

-

Macro shocks (shutdown, labor weakness, AI-led job cuts) could catalyze a broader downturn.

-

Crowded tech/AI bets may unwound quickly, triggering cascading tail-risk.

-

Market may pivot from growth-to-value abruptly—if you’re unaware, you’ll get smoked.

MARKET MEMORY

ELECTION DAY EDITION - TUESDAY

Tuesday, November 4 (Local/State Election Day)

What Happens:

On Election Days—even non-presidential ones—the market often enters a holding pattern. For example, on Election Day 2000, the S&P 500 dipped only ≈ 0.3% amid major corporate news, with traders sitting on their hands while results came in.

More broadly, around U.S. elections the market tends to rise modestly on the vote-day itself (average +0.92% for the S&P in presidential-election years) but then pull back the next day (average –0.71%).

In short: uncertainty rules. Until the fog lifts, the market paces, watches, and often trades sideways.

TFT Lesson:

As a Time Freedom Trader, your edge isn’t in pretending you know the outcome—it’s in respecting the uncertainty and using it to your advantage.

-

WHAT? The market is quiet or choppy on Election Day because participants are freezing mid-decision, waiting for the outcome.

-

SO WHAT? That means setups driven by uncertainty reduction (once results/clarity arrives) become higher-probability. Trading into the freeze zone increases risk.

-

NOW WHAT? Use Election Day as a screening period—not a go-time. Scan for distorted volumes, sector divergence, and emerging flows after the outcome becomes clearer. Then launch trades when the market picks a lane.

TFT Takeaway:

Don’t wrestle the market when it’s indecisive. Sit tight. Let the headline drop, breath reconnects with the market, then strike with clarity.

Because Time Freedom isn’t built on news-trading—it’s built on reaction-trading.

When everyone else is holding their breath, you’ll be already planning your move.

THE TURN BEFORE THE BURN

When the “everything AI” trade gets this crowded, the smart money doesn’t panic — it pre-plans.

If you see sector rotation from high-beta tech into staples or energy, that’s your tactical tell.

Trade the turn, not the trendline tears.

Freedom Fact:

When the S&P trades above a 23 P/E, the following year’s average return historically drops below 3%.

Translation: overpaying for hype rarely compounds into freedom.

❓PRIOR TRIVIA QUESTION:

MONDAYS TRIVIA

What percentage of total market gains historically come from the top 10 trading days each year?

(Hint: Miss those days, and your returns look like government efficiency.)

Because markets don’t just move in cycles — they rhyme in history.

✅ ANSWER:

90%

Roughly 90% of annual market gains come from just the top 10 trading days of the year.

Yep — miss those days, and your portfolio performance drops faster than Congress’ approval rating.

TFT Takeaway:

This is why Time Freedom Traders don’t try to time perfection — they prepare for participation.

We don’t chase every candle; we stay positioned for alignment — Catalyst. Trend. Setup. Confirmation.

You don’t have to trade every day… but you must be ready every day.

Because the day you skip prep is often the day the market pays.

Moral of the story: Stay disciplined. Stay engaged.

The market rewards the consistent — not the casual.

❓Today’s Trivia:

Question: Since 1950, what’s the average market drawdown before a new bull market begins?

👉Answer in tomorrow’s report. Hint: It’s deeper than your favorite dip-buy.

| — Galatians 6:7

WORK FOR FREEDOM, NOT FOR FRIDAY.

You can’t sow greed and expect gratitude. You can’t sow hype and expect harvest. You sow discipline, patience, and precision — that’s how you reap freedom.

And remember — you’re just one trade away from changing your life.

If you’re done guessing and ready to start compounding — join the Time Freedom Trading Fall Cohort today.

We’ll install your Wealth Operating System so you can trade with clarity, conviction, and confidence.

Because freedom isn’t found in the trades you take — it’s in the trader you become.

Like. Subscribe. Share.

LIVE LIKE A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS