Read more of the

The W.T.F. Report

November 5th, 2025

Wednesday, November 5th, 2025

Hump Day Hangover & Political Plot Twist

The market’s halfway up the hill

— tired, dizzy, and fueled on post-election

caffeine and confusion.

HUMP DAY — NEW MAYOR, NEW MAYHEM

Well, New York just elected its first Muslim socialist mayor — Zohran Mamdani — and Wall Street’s collective eyebrow is twitching harder than the VIX on CPI day. Democrats swept big on election night, snagging victories in New Jersey, Virginia, and California’s redistricting playbook. Translation? Gridlock is officially back in fashion.

Overnight futures are rebounding, but let’s not confuse relief with conviction. The market’s climbing the Wednesday wall of worry — rates, valuations, and post-AI hangovers — all fighting for the spotlight.

Mortgage demand just dropped faster than your motivation after leg day, even as ADP Payrolls surprised to the upside with +42K new jobs (mostly from companies over 250 workers). Small businesses? They’re bleeding talent like a bad startup in a bear market.

MARKET SNAPSHOT

Futures are on the rebound — but fragile. Day 36 of the Government shut down.Air travel continuing the grind down. The AI trade took a gut punch yesterday, with Palantir down 8% despite positive earnings, AMD guiding flat margins, and Super Micro missing expectations. Even Pinterest got un-pinned with an 18% drop.

S&P 500 and Nasdaq futures still look a little hungover, with the 50-day moving average just 2–3% below current levels — the market’s version of a slippery banana peel.

“In the short run, the market is a voting machine,

but in the long run,

it is a weighing machine.”

— Benjamin Graham

Everyone’s voting on hype — but gravity still works, even in the age of AI.

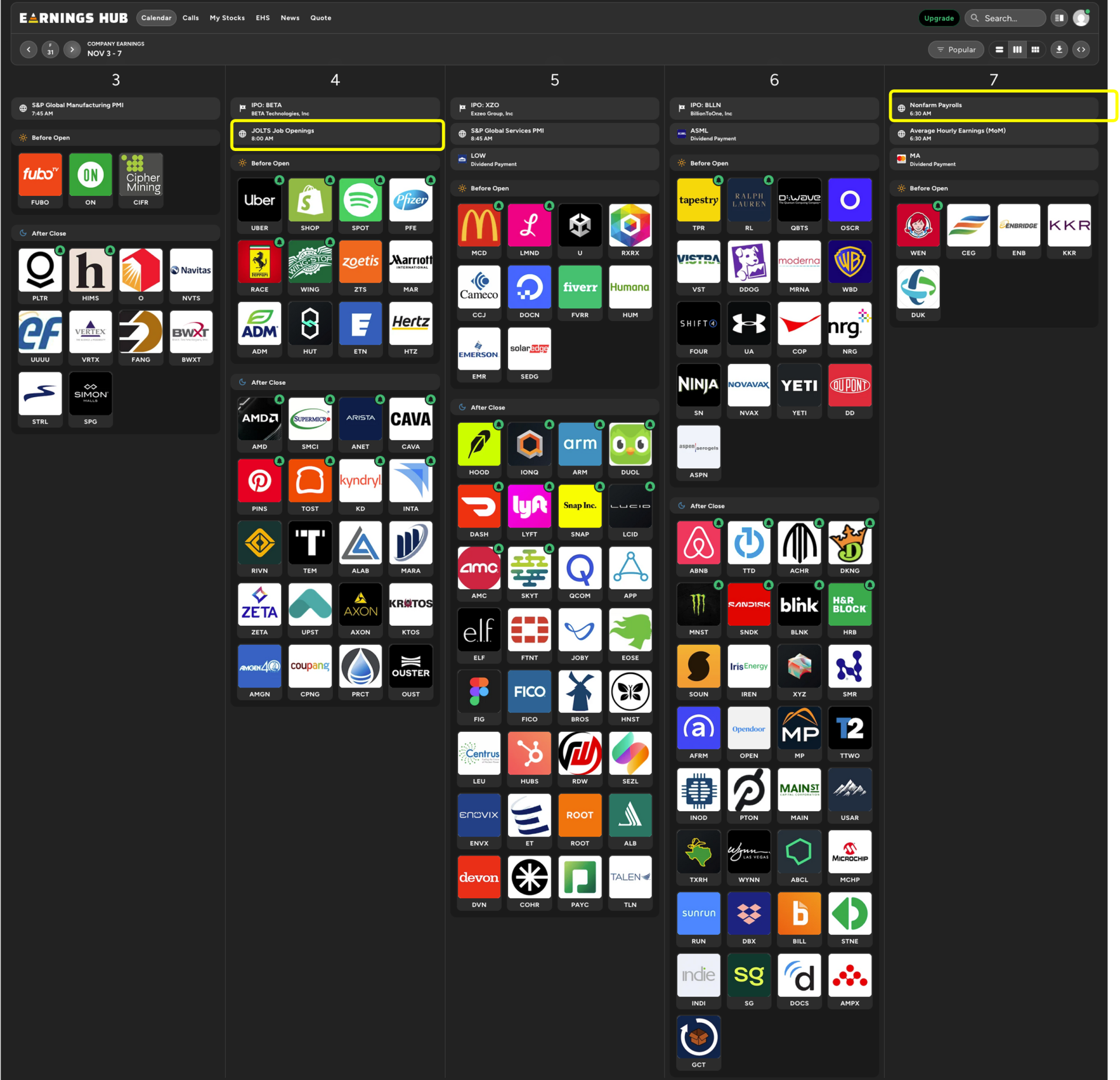

CATALYSTS ON WATCH — WEEK AHEAD

Note: Some data may be delayed thanks to our “out-of-office” government.)

MONDAY:

-

Palantir (PLTR) earnings (After the Bell)

-

ISM Manufacturing Index

-

September Construction Spending

TUESDAY:

-

Election Day

-

Uber (UBER), Spotify (SPOT), Shopify (SHOP), Norwegian Cruise Line (NCLH), Pfizer (PFE), Yum Brands (YUM) earnings (Before the Bell)

-

AMD, Pinterest, Super Micro (SMCI), Hinge Health, Amgen, Rivian earnings (After the Bell)

-

September International Trade Data

-

JOLTS Job Openings & Labor Turnover Survey

WEDNESDAY:

-

McDonald’s (MCD) earnings (Before the Bell)

-

Qualcomm (QCOM), Snap (SNAP), Arm Holdings (ARM), Lyft (LYFT), Figma, e.l.f. Beauty (ELF), Lucid Group (LCID) earnings (After the Bell)

-

Weekly Mortgage Apps

-

ADP Private Payrolls

-

ISM Services Index

THURSDAY:

-

Warner Bros Discovery (WBD), Tapestry (TPR), Under Armour (UAA), Moderna (MRNA) earnings (Before the Bell)

-

Airbnb (ABNB), Affirm (AFRM), Block (SQ), Peloton (PTON) earnings (After the Bell)

-

Weekly Jobless Claims

-

Q3 Productivity & Costs (Prelim)

FRIDAY:

October Jobs Report

-

Preliminary Consumer Sentiment Data

MARKET HEAT MAP - LIVE

PRE-MARKET MOVERS:

Check out the companies making waves before the bell:

-

AMD — Down 5% after margin guidance matched expectations. Earnings and revenue still beat, but investors wanted fireworks, not sparklers.

-

McDonald’s — Down 1%. Missed both earnings and revenue. Even the fries couldn’t save them.

-

Arista Networks — Down 11% after soft forward guidance. AI networking is turning into AI “not working.”

-

Cava — Down 8%. Slashed guidance on same-store sales and margins. Apparently, inflation’s eating the falafel.

-

Teradata — Up 14%. Beat on both top and bottom lines, raised outlook. Somebody’s finally managing data and not drama.

-

Lumentum — Up 17%. Blew past forecasts. Laser-focused comeback.

-

Zeta Global — Up 12%. Strong revenue and EBITDA. Maybe marketing can print money.

-

Pinterest — Down 17%. Missing on revenue and vibes.

-

Super Micro — Down 8%. Missed again. Server stock feeling the heat.

-

Kennedy-Wilson — Up 24% after a $10.25/share takeover offer. Money talks, premiums scream.

-

Upstart — Down 13%. Lowered guidance. The AI lending “revolution” still needs credit.

-

Trex — Down 34%. Housing slowdown snapping their deck dreams in half.

-

Kratos Defense — Down 10%. Guidance miss. Looks like the defense trade just surrendered.

-

Axon — Down 18%. Big miss. Somebody call a Taser.

-

Veracyte — Up 13%. Diagnostics on fire — clarity pays.

-

Bio-Techne — Down 9%. Missed on revenue.

-

Zimmer Biomet — Down 8%. Slight miss, big reaction.

-

Humana — Down 5%. Rising medical costs eating margins faster than inflation eats your paycheck.

Strengths:

Corporate earnings, while messy, still show resilience. Large-cap balance sheets remain solid, and ADP jobs growth signals economic durability. Market internals suggest buyers still lurking beneath the surface, waiting for clarity.

Weaknesses:

AI valuations are running hotter than campaign promises — Palantir at 254x forward P/E makes NVDA’s 35x look like a bargain bin. Rising yields and weak small-business data hint at hidden cracks in the real economy.

Opportunities:

The pullback in AI and growth sectors could reload setups for the next leg — watch for mean reversion plays. Energy and defense could get rotation inflows as geopolitics heat up post-election.

Threats:

Valuation compression, Fed uncertainty, and continued government shutdown (no payroll report this Friday) keep volatility on deck. Add in political reshuffling and potential tax policy chatter — and traders better keep helmets on.

MARKET MEMORY

The Great Reopen Rally (January 2019)

Picture this: it’s early 2019.

The U.S. has just stumbled out of the longest government shutdown in history — 35 days of political posturing, furloughs, and fear headlines about “economic collapse.”

Sound familiar?

But here’s what most traders missed:

While the news was screaming crisis, the market was quietly loading the spring.

When the government reopened on January 25, 2019, the S&P 500 had already climbed nearly 15% off its December lows, kicking off one of the strongest Q1 rebounds in modern history. The Dow ripped over 3,000 points in the following month, and the Nasdaq went full phoenix — up nearly 20% before the end of February.

What changed?

Not policy. Not politics.

Certainty.

The minute Washington went back to work, traders went back to buying.

The headlines didn’t drive the rally — the removal of uncertainty did.

TFT Lesson: Shutdowns are emotional noise.

The real opportunity comes in the aftermath, when the fog lifts and liquidity returns.

That’s why Time Freedom Traders don’t trade the panic — they prepare for the pivot.

When the world hits pause, you study the setup.

When it hits play again, you strike the turn.

Because history doesn’t just rhyme — in this market, it compounds.

Wednesday (Post-Election Day Edition)

“Trade the policy drift, not the result.

”Election week is like market karaoke — everyone’s loud, off-key, and overconfident. The real melody starts after the applause fades. The smart money isn’t trading the outcome — it’s trading the reaction

Here’s how Time Freedom Traders Trade it:

1. Pause before you pounce.

Right after an election, markets move on emotion, not logic. Everyone’s guessing which candidate is “good for stocks.” Translation: overreaction city. The real move begins once the headlines fade and the policies start to hit balance sheets.

2. Trade the drift, not the drama.

Forget who won — focus on where money rotates. Policy-driven sectors (energy, defense, infrastructure, healthcare) start to shift as new agendas get priced in. Track that rotation. That’s where the edge lives.

3. Execute with process, not prediction.

Time Freedom Traders don’t chase noise — we trade the turn. Wait for confirmation through price, volume, and market internals. The T.U.R.N.™ Framework exists for days like this.

4. Manage risk like a sniper, not a cowboy.

Post-election volatility loves to fake-break. Keep your position sizing tight, stops defined, and ego out of it. Nobody remembers who guessed right — only who managed right.

5. Watch for the “relief rally” fade.

Markets often pop the day after an election because uncertainty disappears. Then, once reality checks in, it drifts right back down. Don’t chase the sugar rush — position for the sober rotation that follows.

Why it matters for TFT

This is where identity trumps impulse.

The Mindset of Lack says “I missed the move.”

The Myth of Control says “I know what’s coming next.”

The Time Freedom Trader says: “I’ll wait for confirmation and strike when the edge is real.”

That’s not luck — that’s leverage.

TFT Tactical Application (T.U.R.N.™ Framework)

-

T – Tune In: Watch market internals, sentiment, and VIX after the election.

-

U – Understand Rotation: Identify which sectors are quietly absorbing capital.

-

R – Retracement Zone Setup: Look for overreactions that revert to the mean.

-

N – Nail the Power Zone: Execute only when momentum, volume, and catalyst align.

Remember: Time Freedom Trading isn’t about reacting to red or blue — it’s about compounding through clarity.

Because average traders guess.

Time Freedom Traders operate.

The Post-Shutdown Snapback

Here’s the truth they don’t teach in econ class: Markets hate uncertainty… but they love resolution.

Since 1976, the U.S. has had 22 government shutdowns, and in almost every case, the market didn’t crash — it paused, yawned, then rallied once D.C. stopped holding its breath.

Fact Check the Freedom:

-

During the 2018–2019 shutdown (the longest in U.S. history at 35 days), the S&P 500 rose over 10% in the following two months once the government reopened.

-

Historically, the S&P’s average gain one month after a shutdown ends is about +2.5%, and +6% after three months.

-

Translation: once Washington gets its act together, Wall Street gets back to compounding.

Why? Because clarity is oxygen — and uncertainty suffocates risk-on behavior. Once the “will they/won’t they” drama ends, liquidity floods back into the market.

Time Freedom Takeaway:

Shutdowns are noise. Recovery is math.

You don’t trade the tantrum — you trade the turn.

When the government clock starts ticking again, that’s your signal to rotate in, not run away.

Because volatility is temporary — but time freedom compounds forever.

❓PRIOR TRIVIA QUESTION:

Since 1950, what’s the average market draw down before a new bull market begins?

✅ ANSWER:

33%

Since 1950, the average market draw down before a new bull market begins is roughly 33% from peak to trough.

That’s right — thirty-three percent.

Not 5%. Not 10%. Not even 20%.

On average, the market doesn’t flip the “bull switch” until it’s eaten a third of its value.

Here’s the breakdown:

-

According to historical S&P 500 data, every major bear market since 1950 — from the post-WWII slowdown to the dot-com bust, the Great Financial Crisis, and the COVID crash — has averaged a 32–34% decline before bottoming out.

-

The median duration of those drawdowns is about 12 months, meaning the market doesn’t recover in a weekend.

-

The largest was the 2008 crash (-57%), and the fastest was the 2020 pandemic panic (-34% in just over a month).

-

Once the low is in, the first 12 months of the new bull market typically deliver +45% returns on average — proof that the pain creates the premium.

Translation for Traders:

By the time the headlines scream “RECESSION,” the smart money is already buying.

By the time the average investor gets brave again, the real profits are gone.

At Time Freedom Trading, we call that “The Turn Zone.”

The chaos before clarity.

The pain before the power move.

That’s where conviction meets compounding.

“Every crash is a clearance sale

for the courageous.”

Time Freedom Takeaway:

Most traders panic during a 10% pullback.

Professionals prepare for the 30% one — because that’s where time freedom gets priced in.

Be patient. Be tactical.

The market’s biggest wealth transfers don’t happen in rallies — they happen in resets.

❓Today’s Trivia:

(Hint: You’re not trading against Reddit — you’re trading against robots that don’t sleep, don’t eat, and don’t care about your feelings.)

🔥Tune in to tomorrow’s WTF Pre-Market Report for the full answer — and find out how Time Freedom Traders use precision, patience, and the E.D.G.E.™ Protocol to out-think, out-time, and out-trade the machines.

Because average traders react.

Time Freedom Traders operate

|— Galatians 6:9

When the world feels uncertain, remember: clarity is a discipline, not a gift.

That’s not just scripture — that’s strategy. Stay the course, stay consistent, and compound with purpose. Time freedom isn’t found in the noise; it’s forged in the process.

The market’s rotating. Are you?

If you’re done guessing and ready to start compounding — join the Time Freedom Trading Fall Cohort today.

We’ll install your Wealth Operating System so you can trade with clarity, conviction, and confidence.

Because freedom isn’t found in the trades you take — it’s in the trader you become.

Like. Subscribe. Share.

LIVE LIKE A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS