Read more of the

The W.T.F. Report

November 10th, 2025

Money Monday!

November 10th, 2025

“Kick the Can, Catch the Bid.”

MARKET SNAPSHOT

Futures are in the green—Wall Street smells a reopening deal like a shark smells blood. After the Nasdaq’s worst week since April, the bounce is back, fueled by government optimism, Buffett nostalgia, and AI bargain hunting.

-

Dow Jones: +0.37%

-

S&P 500: +0.96%

-

Nasdaq: +1.56%

-

10-Year Yield: Steady at 4.117%

-

Bitcoin: Still playing chicken with $106K—yawns from crypto bros!

VIX = 18.34

Today’s Mood: “Please, just sign the damn deal so the TSA can go back to losing luggage instead of jobs.” Charts tapped the 50 day MA and bounced... showing the Fall move is still in play for 2025! Catch the bounce into Thanksgiving!

Shutdown Day 42: The Senate said “let’s not ruin Christmas yet” with a kick-the-can-til-January deal. The House now holds the hot potato.

FAA Grounded: Even private jets got clipped—when the rich start feeling turbulence, suddenly government efficiency becomes a national priority.

Buffett’s Farewell: The Oracle of Omaha drops his last shareholder letter today—expect wisdom, humility, and at least one subtle jab at AI hype.

AI Overload: The sector’s in hangover mode. The smart money’s rotating from fantasy AI plays into functional ones. Translation: Apple’s eating everyone’s lunch again.

Travel Chaos: Airlines are up on reopening hopes, but the irony? No one can fly to celebrate.

“It never was my thinking that made the big money for me. It was always my sitting.” — Jesse Livermore

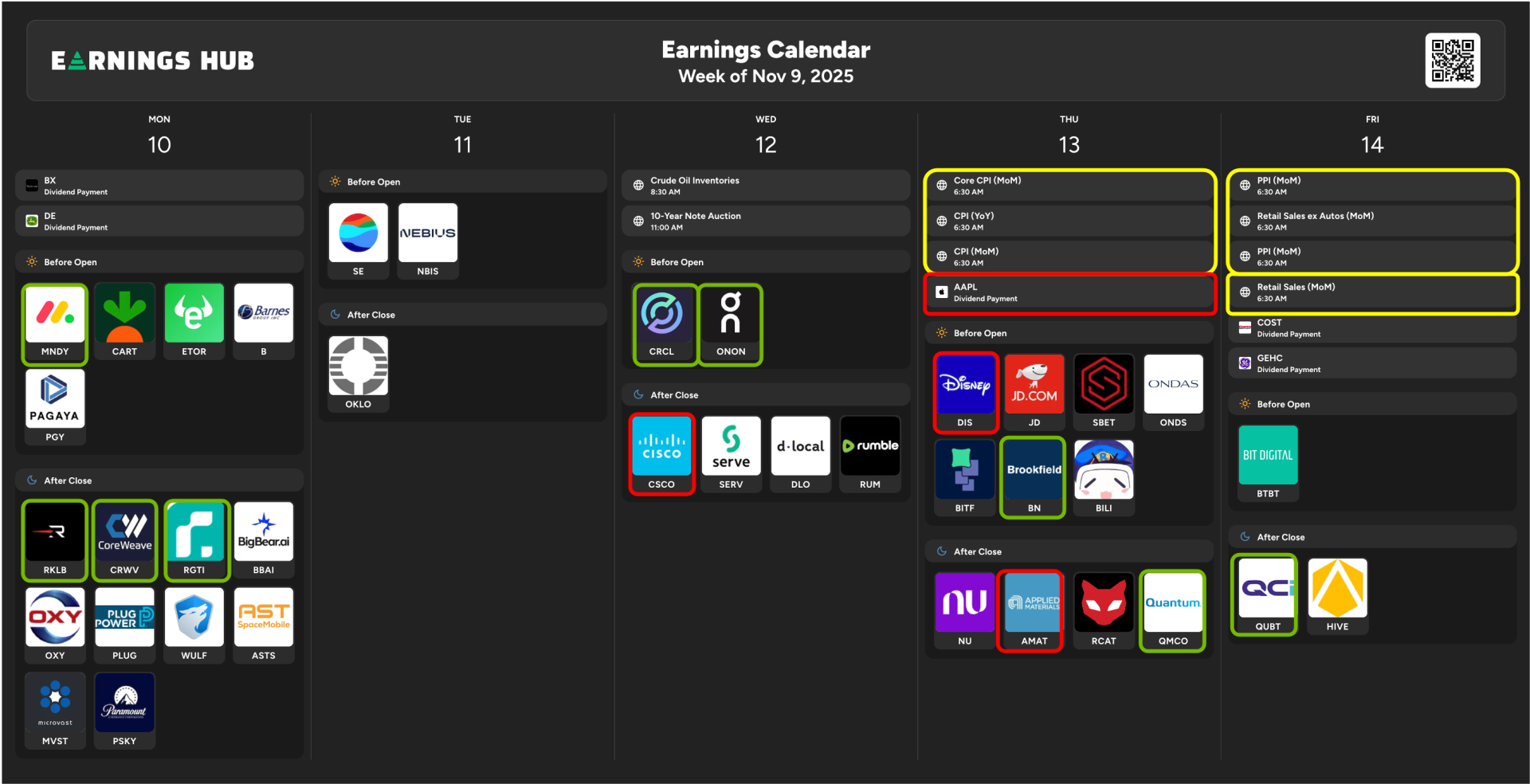

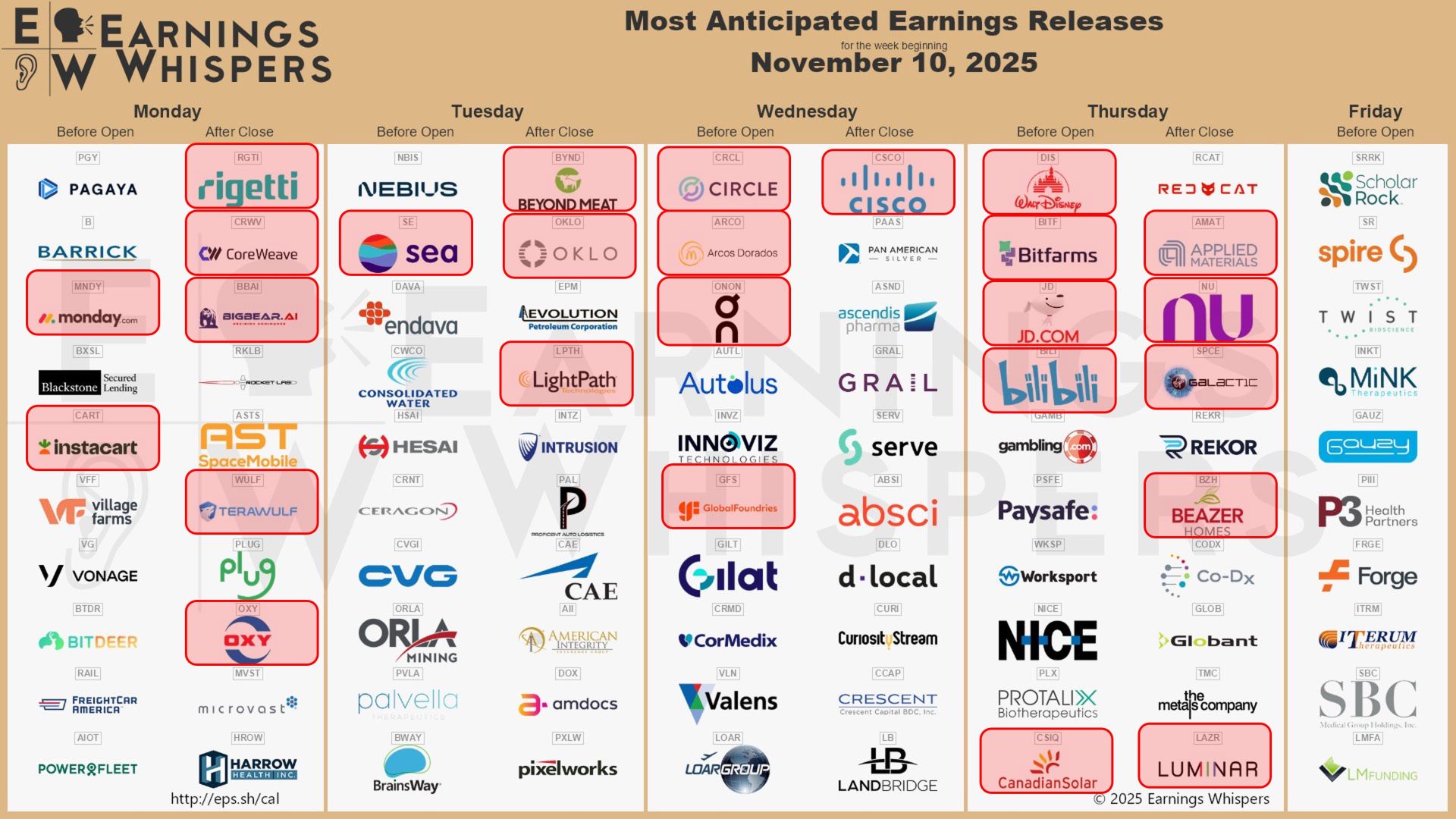

MARKET HEAT MAP - LIVE

Premarket: “The Winners, the Whiners, and the Walking Dead”

STOCKS IN THE GREEN (+)

Positive (+)

-

Rumble (+17%) — $100M ad deal from Tether + German AI acquisition = Rumble flexing like a meme stock on caffeine.

-

Viasat (+12%) — Narrower loss and Raymond James upgrade. Turns out, space internet is a thing.

-

Diageo (+8%) — New CEO Dave Lewis brings Tesco discipline—and probably stronger drinks.

-

MP Materials (+3%) — Deutsche Bank upgrade makes rare earths cool again. Buy dirt, sell drama.

-

Palantir (+3%) — AI selloff survivor; Big Brother’s favorite data dealer rebounds.

-

American, United, Delta (+2%) — Nothing like a government reopening rumor to make airlines fly again.

-

NVDA, AMD, INTC (+2–3%) — Semis bouncing after their worst week since April. Dip buyers prepping for Thanksgiving leftovers.

STOCKS IN THE RED (–)

“THE TALE of the TAPE"

Strengths:

Momentum is leaning risk-on as shutdown resolution odds rise, giving indices a relief bid and semis a tradable bounce after their worst week since April. Airline complex has a natural catalyst on reopening hopes, while cash-flow moats (Apple, Berkshire, staples/spirits) anchor sentiment. Buffett’s farewell letter is a credibility tailwind for “quality at a fair price.” Liquidity is decent into a data-heavy week, and seasonality favors dip-buys into Thanksgiving. Implication: Favor high-quality tech, leaders in AI enablement, and reopen-sensitive travel names on confirmed higher lows.

Weaknesses:

AI over-investment narrative is biting—balance sheets are exposing pretenders, not just contenders. The “deal” is temporary, extending policy fatigue; headline risk stays elevated until the House signs and pens hit paper. Recent tech breadth has been thin, making rallies fragile. FAA/ops disruptions plus weather snarl travel logistics even if stocks bounce. Implication: Don’t chase green candles. Require confirmation (volume + market internals) and keep stops tight—especially in second-tier AI and crowded momentum.

Opportunities:

Mean reversion setups in semis and AI adjacents (software, data infra) after a multi-day flush; rotation into quality cash generators with pricing power (platforms, beverages, premium brands). Rare earths and defense-tech have fresh catalysts; options traders can target IV normalization post-headline with call calendars or debit spreads. Shutdown clarity + CPI/PPI could unlock a clean “trend day” if data cooperates. Implication: Build a focused bounce basket (SMH leaders, selective AI infra, travel) and express with defined-risk options; scale on pullbacks to VWAP/key EMAs, not breakouts.

Threats:

Deal stalls in the House and markets retrace fast. CPI/PPI or jobless claims surprise hawkish, pressuring the long end of the curve and compressing multiples. Continued AI de-rating hits high-beta growth again; a USD spike or crude pop tightens financial conditions. Operational bottlenecks in aviation persist longer than expected, muting travel’s follow-through. Implication: Define a No-Trade Zone around binary events; hedge with index puts or put spreads; avoid illiquid small-cap AI and late-cycle breakouts until volatility cools.

“Smart traders don’t fear volatility

—they invoice it."

MARKET MEMORY

The DOT.COM RALLY! NOVEMBER, 10, 1999

Event: The Nasdaq broke above 3,000 for the first time—driven by the dot-com boom.

TFT Takeaway: Every bubble looks like innovation until it pops. That’s why we trade the wave, not marry the tide.

“Precision Over Prediction”

Trade the TURN, not the talk.

Wait for the confirmation candle—not the Capitol headline.

Government noise creates fake breakouts; discipline catches the real reversals.

Today’s setup is about discipline, not dopamine.

Follow the T.U.R.N. Framework™:

-

Tune In — Check market breadth, shutdown chatter, and VIX.

-

Understand Rotation — AI and tech cooling means cash flow plays rising.

-

Retracement Zone — Wait for a clean VWAP pullback before entering.

-

Nail the Power Zone — Momentum confirmation only. No guessing.

You don’t chase—you retrace. One clean setup can pay your month.

Freedom Stat: 80% of traders’ profits come from less than 10% of their trades. Master patience. That’s how you buy time freedom.

“The desire for constant action irrespective of underlying conditions is responsible for many losses on Wall Street, even among the professionals.”

— Jesse Livermore

❓PRIOR TRIVIA QUESTION:

In 1987, the infamous “Black Monday” crash saw the Dow Jones drop a record 22.6% in a single day.

If that same percentage decline happened today, roughly how many points would the Dow fall in one session?

A) About 4,500 points

B) About 7,000 points

C) About 8,500 points

(Hint: It’s the kind of move that would make your broker forget how to answer the phone.)

✅ ANSWER: C. 8,500 Points

On Black Monday 1987, the Dow dropped 22.6%.

If that happened today, it’d be roughly 8,500 points.

— Enough to turn CNBC anchors into therapists.

❓Today’s Trivia:

In 2013, what tech company briefly surpassed Apple as the world’s most valuable firm—before quickly losing the crown again?

A) Microsoft

B) ExxonMobil

C) Amazon

(Hint: Oil’s slick, but tech’s quicker.)

Answer revealed in Tuesday’s WTF Report!

“Don’t Trade the Drama, Trade the Discipline.”

|— Galatians 6:95

The markets are fueled by two forces today: hope and hype.

Hope that the government finally ends its 42-day shutdown.

Hype that AI and semis are ready to rebound.

But here’s the truth: hope isn’t a strategy—and hype isn’t a signal.

Traders who survive the noise don’t react to headlines; they respond to structure. They wait for confirmation, not conversation. They trade the turn, not the talk.

When everyone else is chasing news cycles, your edge is clarity.

When the crowd trades emotion, you trade execution.

Because consistency doesn’t come from confidence—it comes from conditioning.

That’s how you build your Financial Flywheel:

-

You protect your capital when others chase.

-

You plan your entries when others panic.

-

You grow your edge one disciplined trade at a time.

Remember, patience pays compound interest.

TFT Lesson:

The market rewards those who show up, stay steady, and sow seeds of structure every single day—especially when everyone else is distracted by drama.

So before you hit buy this Monday, ask yourself:

Are you trading to feel right—or trading to get free?

Stop winging it.

Start winning with a system that compounds clarity and cash flow.

In 90 days, you’ll learn to trade with T.U.R.N. precision, operate with the E.D.G.E. Protocol, and grow your Financial Flywheel like a pro.

Six months from now, you’ll thank yourself for starting today — or you’ll still be scrolling, watching others do it.

Choose your timeline. Choose your freedom

LIVE LIKE A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS