Read more of the

The W.T.F. Report

November 12th, 2025

WEDNESDAY

November 12th, 2025

Hump Day Hustle

"The Market’s Got a Camel Complex"

“The Dow’s at Records, but Tech’s in Timeout”

Welcome to Hump Day, where the market’s acting like it just realized it left its wallet at the gas station halfway across the desert.

The Dow is flexing like it skipped leg day for ten straight years — fresh record highs, blue-chips bulging. Meanwhile, the Nasdaq is wheezing in the backseat, wondering why the AI hype train suddenly ran out of gas. The rotation is real, and it’s glorious. Banks and healthcare are out here doing burpees while Nvidia naps off its gains like a hungover prom king.

Over in D.C., it’s Day 43 of the world’s longest government “pause”—because apparently, fiscal responsibility now runs on dog-years. The House promises to vote on the shutdown deal today… assuming the politicians can stop auditioning for cable news long enough to read the bill. Tune in around 4-7pm.

Meanwhile, airlines say, “Even if this circus ends, we’re still canceling flights.”

Translation: The FAA backlog’s thicker than your uncle’s Thanksgiving gravy.

And in the middle of all this chaos, AMD walked into its Analyst Day and dropped a flex that could power half the S&P — projecting 60% data-center growth in the next few years. Wells Fargo immediately slapped a “Buy me, baby” sticker on it.

So, while AI stumbles and “ghost jobs” haunt the labor market, the old-school Dow just made history — proving once again: When the nerds lose their mojo, the suits take the stage.

Strap in, traders. It’s hump day. The market’s shifting gears. And the question isn’t “Will it last?” — it’s are you rotated, or are you roadkill?

So here we are — midweek on the market’s camelback, and you can almost hear the sand grinding between the gears. The bulls are bragging, the bears are brooding, and the bots are still backtesting last week’s fakeouts. It’s that awkward middle ground where conviction feels expensive, and hesitation costs even more.

Every headline today screams rotation — money’s leaving the shiny AI stocks and moving into the grown-up table: banks, healthcare, industrials. The Dow just hit all-time highs like it’s showing off for prom photos, while Nvidia and the AI crew are licking their wounds from yesterday’s sell-off. Add a 43-day government shutdown, “ghost jobs” haunting the employment data, and airlines canceling flights faster than Congress cancels accountability, and you’ve got the perfect cocktail of chaos and opportunity.

Translation? This isn’t a day to chase — it’s a day to choose. Smart traders know when to surf the rotation and when to sidestep the sandstorm. Let’s break it down—what’s strong, what’s weak, and where the next move is hiding.

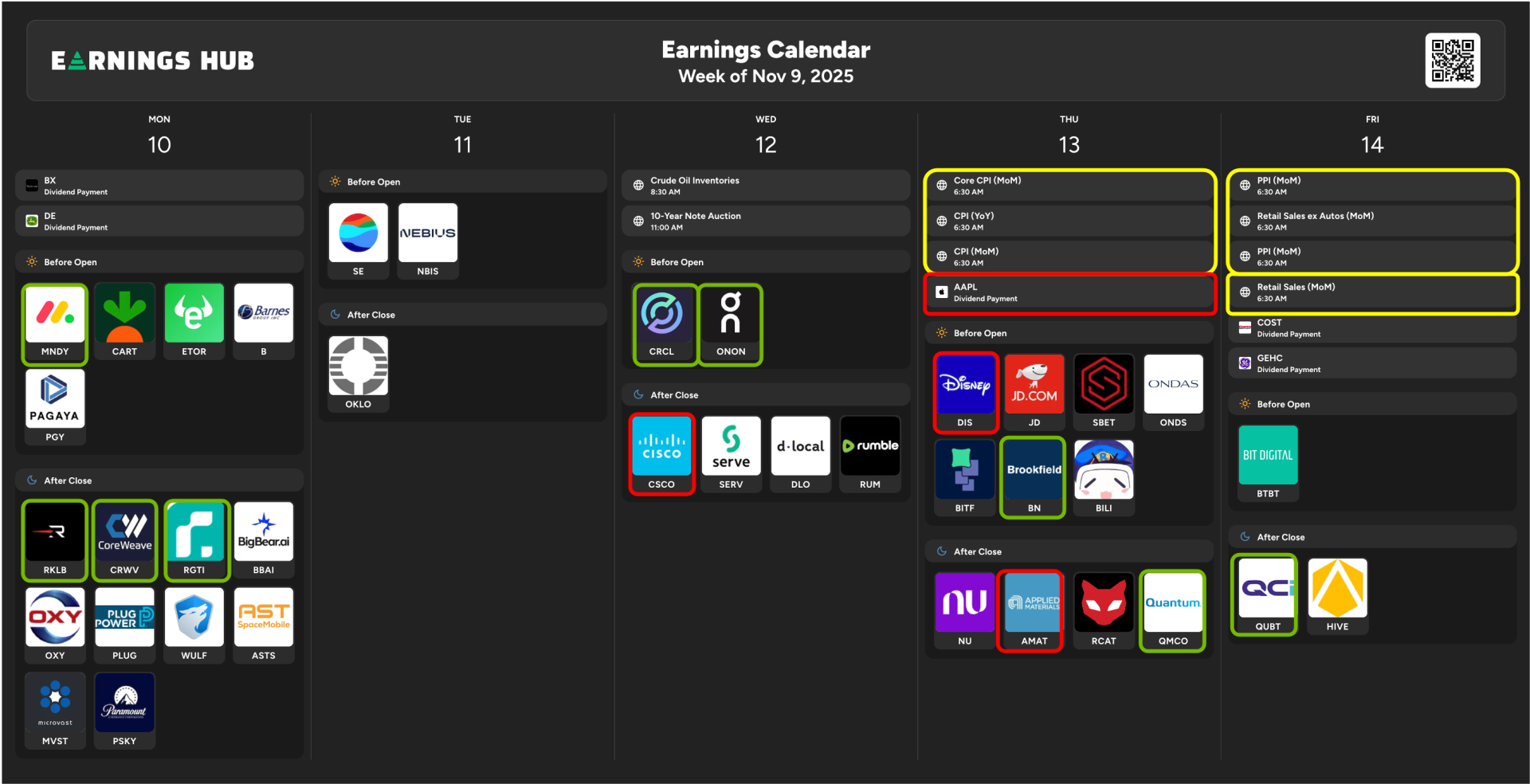

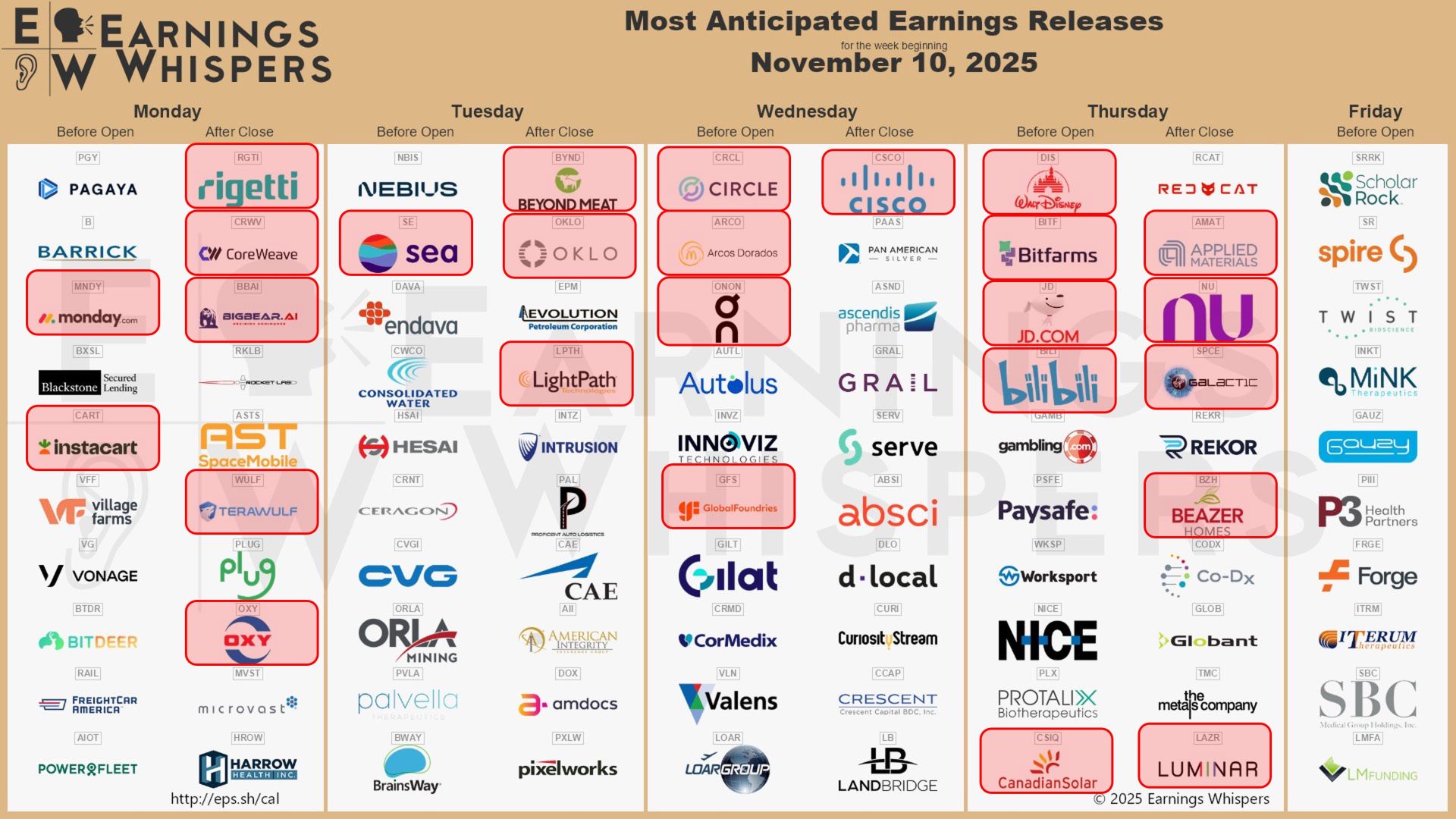

KEY EVENTS TO WATCH:

Shutdown vote in the House: If passes, the shutdown could end — but any tweaks by Dems may delay it further.

Airline-travel disruption: Job-cut clouds hang over airports — more cancellations possible.

Analyst day tailwinds for Advanced Micro Devices (AMD) — the guidance shocker emerges.

Mortgage purchase applications hit highest since Sept despite rising rates: housing flow still bubbling.

On Holding (ON) reports strong earnings + raised guidance — a surprise bright spot.

Tech/AI stocks (e.g., Nvidia, CWRV) remain under pressure — watch for further rotation into old-economy sectors.

“The four most dangerous words in investing are: This time it’s different.”

— Sir John Templeton

MARKET HEAT MAP - LIVE

PreMarket: “The Winners and Losers"

STOCKS IN THE GREEN (+)

+12% — BILL Holdings (BILL)

The fintech firm is flirting with a buyout. Rumor has it private equity’s circling like sharks that smell discounted growth. Nothing attracts Wall Street like blood in the water — and potential M&A fees.

+9% — Clearwater Analytics (CWAN)

Cloud-native finance platform reportedly weighing a sale. Translation: when you can’t scale, you sell the cloud instead. Smart exit, solid pop.

+8.5% — On Holding (ONON)

The Swiss sneaker savant is sprinting ahead of the pack. Beat earnings, raised guidance, and basically said, “Black Friday? Never heard of her.” Consumers still buying kicks that cost more than gym memberships.

+6% — Advanced Micro Devices (AMD)

Dr. Lisa Su dropped a mic at Analyst Day: +60% forecasted data-center revenue growth in 3–5 years. Wells Fargo instantly fell in love and raised its target. Tech rotation? Maybe. Leadership? Definitely.

+6% — Alcon (ALC)

The eye-care giant beat on earnings and reaffirmed guidance. Looks like seeing clearly is back in style — pun very much intended.

+5% — BigBear.AI (BBAI)

The AI defense darling keeps roaring. Announced acquisition of Ask Sage, adding more buzzwords to its battle plan. Traders love it; analysts shrug.

+4% — Sony (SONY)

The PlayStation parent got a tariff break worth ~$324 million in operating profit. Fewer tariffs = more Mario Kart racing (we know, wrong console — relax).

+1% — Nvidia (NVDA)

Minor bounce after Tuesday’s tantrum. Investors buying the dip because, well, it’s Nvidia. Just remember: not every dip is a discount.

STOCKS IN THE RED (–)

Down 4% despite beating on earnings and revenue. Stablecoin dominance (29% market share) isn’t buying investor love. The crypto crowd’s still recovering from too many “to the moon” hangovers.

“THE TALE of the TAPE"

Strengths:

-

Dow strength signals broad market participation—not just tech.

-

Rotation into healthcare and banks suggests hidden momentum.

-

Select high-growth names (AMD, On) showing leadership and catalyst.

Weaknesses:

-

Tech/AI segment lagging — Nasdaq underperforming.

-

Government shutdown remains a drag on sentiment & mobility.

-

Job-opening ghost-posts add uncertainty to labour data.

Opportunities:

-

If shutdown ends: relief rally, restored travel flow, confidence boost.

-

Entering sector rotate phase: healthcare/banks get shine; find the trade.

-

High-growth tech with guidance shock (AMD) = leading candidate for tactical play.

Threats:

-

Shutdown may drag further if Dems insert amendments; risk of extended uncertainty.

-

Tech could roll over again if AI hype falters.

-

Macro risks: mortgage demand surprise may shift Fed / sentiment dynamics.

“Smart traders don’t fear volatility

—they invoice it."

MARKET MEMORY

TFT Takeaway: Be ready when the camel tops the hump — don’t climb awkwardly, climb confidently.

“The desire for constant action irrespective of underlying conditions is responsible for many losses on Wall Street, even among the professionals.”

— Jesse Livermore

❓PRIOR TRIVIA QUESTION:

What year did the Dow Jones first close above 1,000 points—a milestone traders once thought was impossible?

✅ ANSWER:

November 14, 1972

The Dow Jones Industrial Average first closed above 1,000 points on November 14, 1972.

It took 76 years from the Dow’s creation in 1896 to crack that four-digit ceiling — and traders back then treated it like the moon landing of Wall Street.

Fun fact: Within two years, the market face-planted into the 1973–74 bear market, wiping out nearly 45% of that milestone gain.

TFT Takeaway: Every “impossible” level eventually breaks — but only for the traders patient (and prepared) enough to profit from the pullback that follows.

❓Today’s Trivia:

When the Dow Jones first hit 10,000 points in 1999, traders celebrated like it was the financial Super Bowl.

But here’s your question:

How many times did the Dow fall back below 10,000 in the decade that followed?

A) 2 times

B) 6 times

C) 11 times

(Hint: Volatility doesn’t destroy wealth — complacency does.)

📊 Tune in to tomorrow’s WTF Pre-Market Report for the answer — and the lesson every trader should’ve learned from that wild decade.

“Treasure, Time, and True Freedom”

|— Matthew 6:21

Let’s be honest — most people don’t serve their purpose; they serve their paycheck.

They say they want freedom, but what they really want is security dressed as certainty.

Christ wasn’t talking about money alone. He was talking about alignment.

Whatever you worship with your attention eventually owns your direction.

If your treasure lives in your job, your heart stays in a cubicle.

If your treasure lives in your fear, your faith stays unemployed.

Trading is more than charts and candles — it’s a mirror for your mindset.

Every position reveals whether you’re operating from creation or compensation, faith or fear, purpose or panic.

When you shift your treasure from wages to wealth — from clocking time to compounding freedom — your identity transforms.

You stop chasing profits and start building Providence: the point where money works for you because you finally stopped working for it.

So here’s today’s reflection:

Are you trading for income, or are you trading for impact?

Because one fills your wallet — the other fills your life.

TFT Application:

Your true wealth isn’t in your account balance — it’s in your alignment balance.

Each disciplined trade, each moment of patience, each smart rotation — that’s you reclaiming your heart from the wage cage and placing it back where it belongs: in freedom, purpose, and Providence.

“Your capital compounds

where your conviction lives.”

The Time Freedom Trading Cohort kicks off this Sunday.

Don’t crawl into 2026 with the same excuses and paycheck panic.

It’s time to turn your layoff into your payoff—

and build your Financial Flywheel before Wall Street eats another year of your life.

Start your journey to Providence now.

You’re just one trade away.

LIVE LIKE A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS