Read more of the

The W.T.F. Report

November 20th, 2025

Thursday

November 20th, 2025

The Market Just Mainlined NVDA Earnings

Like It’s Pre-Workout for Billionaires

AI is caffeinated. Futures are levitating. And Jensen Huang basically walked on stage last night, ripped off his leather jacket, and yelled,

“Bubble? I AM THE BUBBLE.”

Welcome to Tactical Thursday — where we sharpen the spear, tighten the stops, and remember: You don’t chase — you retrace.

The edge is earned. The turn is traded. The flywheel spins.

PRE-MARKET INTERNALS

NVDA IS DRAGGING THE WHOLE MARKET UP THE MOUNTAIN

FUTURES (UP BIG — NVDA JUICED EDITION):

-

DOW: +0.77%

-

S&P: +1.42%

-

NASDAQ: +1.87%

-

RUSSELL: +1.13%

FEAR GAUGE:

-

VIX: 20.10 (still elevated, but the market’s suddenly feeling spicy)

THE ALTAR OF RISK:

-

BITCOIN: $91.8K (+2.38%) — Crypto bros chanting “Jensen is Satoshi.”

-

GOLD: $4091 — Freedom hedge still flexing.

-

OIL: $59.75 — Deflationary vibes intensify.

-

10YR YIELD: 4.11% — Steady. Waiting for the Fed to blink.

-

DOLLAR INDEX: 100.10 — Chill. Not wrecking tech for once.

KEY CATALYSTS TODAY

1. SEPTEMBER JOBS DATA — FINALLY

After a 44-day data drought, the BLS finally rebooted:

-

119,000 jobs added (vs 50,000 expected)

-

Unemployment up to 4.4% (highest since Oct 2021)

-

Wage growth: +0.2% MoM, +3.8% YoY

-

Government shutdown backlog = distorted prints

-

Translation: Labor’s cooling, but not collapsing.

This is a Goldilocks-ish report for markets—warm enough to avoid recession panic, cool enough for the Fed to lie awake at night wondering whether they should’ve cut already

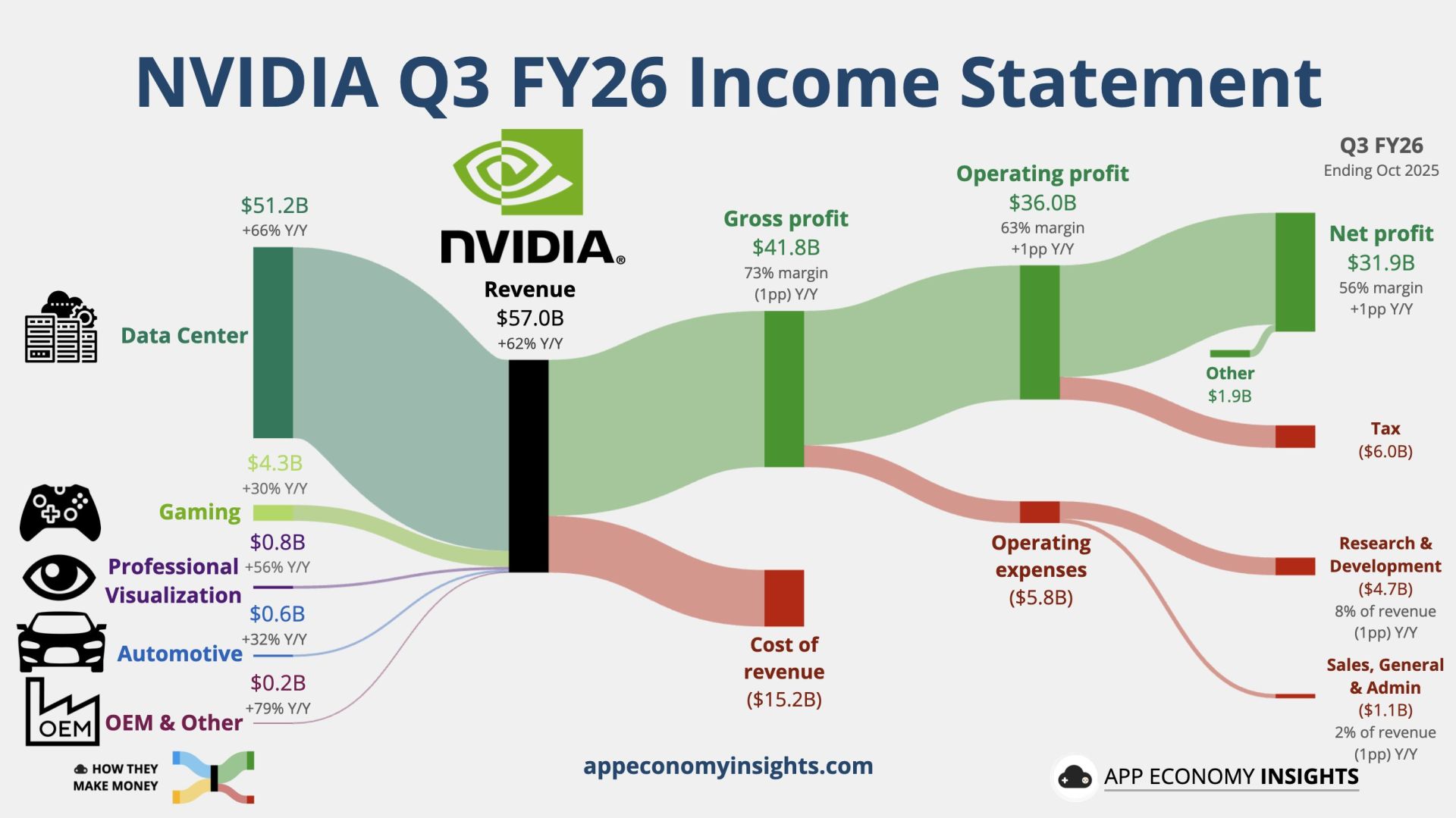

2. NVDA EARNINGS — THE MAIN EVENT

Nvidia did what Nvidia does:

Beat. Raised. Flexed. Rewrote physics.

-

Revenue: $57B

-

Next quarter guidance: ~$65B

-

Blackwell demand: “OFF THE CHARTS”

-

Jensen Huang: “AI bubble? We see something different.”

-

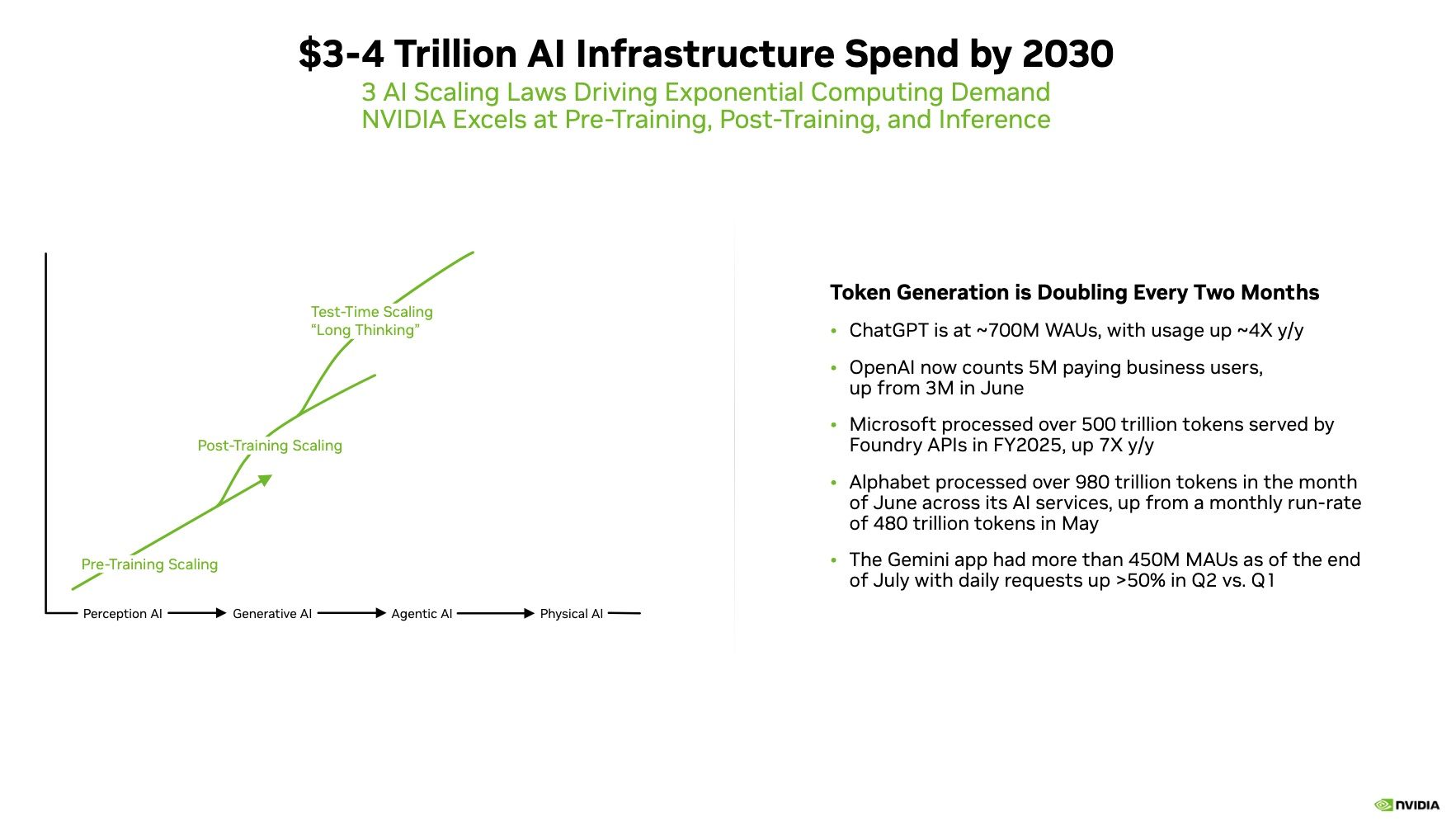

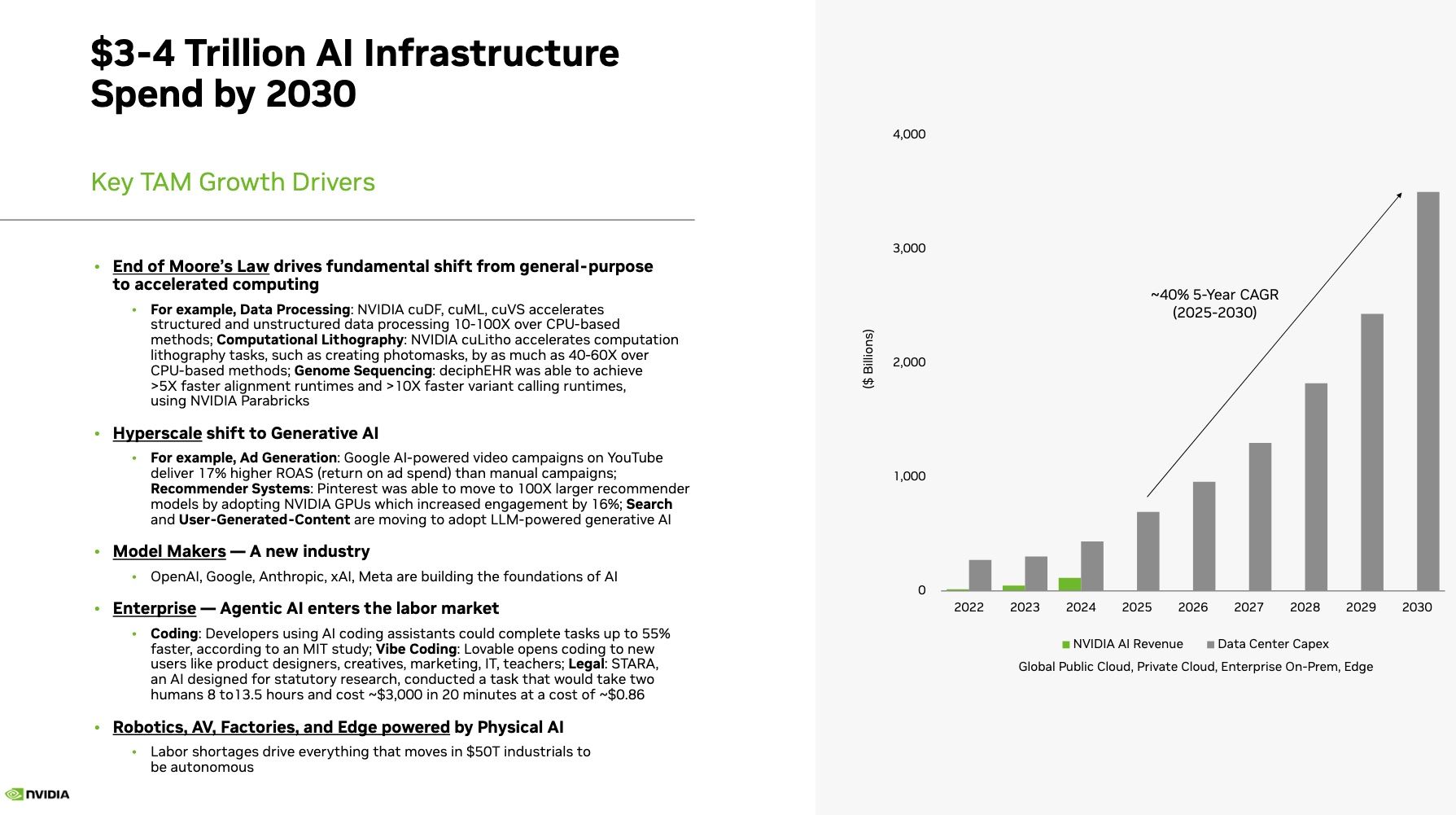

He laid out the 3 drivers of a generational supercycle:

-

CPU → GPU infrastructure transition

-

Generative AI → New apps → New demand curves

-

Agentic AI → Autonomous reasoning → Even bigger compute needs

-

NVDA up 5% overnight, lifting all indices

3. WALMART E-COMMERCE BEAST MODE

-

Beat on both lines

-

Raised outlook again

-

Big takeaway: Consumers aren’t dead — they’re just shopping at Wally World instead of bougie boutiques

4. FED MINUTES — NO DECEMBER CUT FOR YOU

-

Officials divided

-

“Many” said NO MORE CUTS THIS YEAR

-

Trump screaming at Powell to lower rates is… not helping with credibility

5. HOUSING — BUYER’S MARKET (IF YOU’RE RICH)

-

36% more sellers than buyers

-

But affordability is destroyed

-

Translation: Great time to buy… if you have actual money

6. GEOPOLITICS — UKRAINE UNDER PRESSURE

Reports swirl of a potential U.S.–Russia peace framework.

Markets like peace.

Markets love certainty.

“The big money is not in the buying or selling, but in the waiting.” — Jesse Livermore

MARKET HEAT MAP - LIVE

PreMarket: “The Winners and Losers"

STOCKS IN THE GREEN (+)

Oddity (ODD) — +17%

Beat estimates, raised guidance, beauty booming.

Nvidia (NVDA) — +5%

Earnings blowout. Agentic AI sermon from the mountaintop.

Walmart (WMT) — +0.8%

A slight win, but a win is a win. Consumers love Rollbacks.

Copart (CPRT) — Slightly green

Earnings tonight. Anticipation building.

Intuit (INTU) — Slightly green

TurboTax gang waiting for earnings.

Jacobs Solutions (J) — Flat but steady

Beat estimates, market shrugged.

STOCKS IN THE RED (–)

Bath & Body Works (BBWI) — -14%

Missed estimates big. Pumpkin Spice Soap didn’t save Q3.

Palo Alto Networks (PANW) — -3%

Acquiring Chronosphere. Market hates M&A more than leg day.

STRENGTHS

The Wind at the Market’s Back

The AI supercycle just got rocket fuel. NVDA didn’t just beat expectations—

it obliterated them, reaffirming the 3-tier compounding engine:

CPU → GPU migration, Generative AI adoption, and Agentic AI demand.

That narrative just rescued the entire tech complex from its “AI exhaustion” doom loop.

Mega-caps (NVDA, MSFT, AMZN, GOOGL) are showing leadership strength, pulling futures up with synchronized velocity — exactly what you want in a healthy risk-on environment. Bitcoin ripping above $91K signals broad risk appetite returning. The September jobs data, while messy, paints a picture of cooling without collapsing. That’s the Goldilocks cocktail that keeps the Financial Flywheel spinning.

Market internals show early signs of improvement — advancers outpacing decliners, volatility trending sideways, and yields no longer punishing tech.

Translation: The floor beneath this rally is sturdier than last week

WEAKNESSES

The Soft Spots Beneath the Surface

Despite the adrenaline shot, breadth remains narrow — most of the market is still watching NVDA do all the heavy lifting like the lone gym bro at 6 a.m. A handful of mega-caps are carrying indexes, which creates concentration risk. The VIX above 20 shows stress lurking beneath the surface, suggesting traders haven’t fully re-risked.

Labor data distortions from the 44-day shutdown mean the market is flying with incomplete instruments — not ideal when navigating macro turbulence. Unemployment at 4.4% and wage growth slightly below forecast is a mixed bag that could be interpreted negatively once the sugar rush fades.

Housing affordability is collapsing, consumer credit stress is rising, and several sectors (retail ex-WMT, industrials, regional banks) are showing weak rotation. Palo Alto’s drop and Bath & Body Works’ 14% smackdown remind us: earnings are still punishing the unprepared

OPPORTUNITIES

The Tactical Plays Hiding in the Chaos

This is a retracement trader’s paradise.

Big gap-up days create high-probability pullback setups for disciplined traders using the T.U.R.N. Framework. Tech, semis, cloud, and AI-infra names offer multi-day swing potential once the initial froth fades.

The September jobs surprise opens the door for a potential December Fed repricing if data stabilizes — rate-sensitive sectors (tech, growth, homebuilders) are primed for rotation.

Crypto strength + falling yields = risk-on environment conducive to momentum setups. Small caps (Russell +1.13%) are showing signs of waking up — early rotations here often precede broader advances.

This environment also favors mean-reversion trades, volatility crush setups, and options strategies targeting IV contraction following NVDA’s event.

Where amateurs see “it’s up too much,” TFT traders see:

“It hasn’t pulled back yet — and that’s the opportunity.

THREATS

The Landmines to Respect, Not Ignore

Fed minutes poured cold water on December rate cut fantasies — and the market hates losing its hopium supply. One stubborn inflation print and the entire narrative could flip.

Geopolitical tensions (Ukraine peace rumors, US-Russia negotiations) can flip risk sentiment instantly. Markets never price war risk properly until it’s too late.

Labor market deterioration (unemployment rising) could spook recession watchers if next month confirms the trend. September data distortions mean revisions could hit harder than usual.

NVDA’s blowout creates its own risk:

If NVDA is the entire AI trade’s backbone, any sign of production delays, supply constraints, or regulatory pressure could break the rally’s spine.

VIX at 20+ means traders are still jumpy, liquidity is thinner, and market reactions to news will be exaggerated. A fragile rally runs hot—until it doesn’t.

And finally, political noise (“Fire Powell!”) raises uncertainty right when markets crave stability.

This is a bullish environment wrapped in fragile psychology, powered by AI, but vulnerable to macro landmines.

Perfect for tactical traders who follow a system.

Deadly for those chasing candles.

Process over prediction.

Turn over temptation.

Clarity over chaos.

“Smart traders don’t fear volatility

—they invoice it."

The 3 Levels of NVDA Compounding

Nvidia earnings aren’t just a number —they’re a map of the future.

A ledger of who’s getting rich… and who’s getting replaced by a robot with better hair and fewer HR complaints. NVDA’s growth is stacked like a three-tier missile silo of compounding demand.

One catalyst on top of another.

One flywheel feeding the next.

This is why betting against Jensen is basically recreational self-harm.

Let’s break down the three compounding engines powering NVDA’s story:

1. CPU → GPU Adoption

The Industrial Revolution of Compute

This is the first compounding layer — the “duh” layer.

Every enterprise is realizing their dusty CPUs are basically rotary phones in a smartphone world.

-

GPUs don’t upgrade performance…

they change the physics of computing. -

Every workload that can move to GPU will move to GPU.

-

And every time a company swaps CPU for GPU, it triggers the next upgrade cycle.

This is the foundational compounding loop:

More GPU adoption → more workloads → more spend → more lock-in → more NVDA dominance.

NVDA isn’t selling chips.

They’re selling escape velocity.

2. Generative AI Demand

The Gold Rush of Infinite Content

This is layer two — the viral flywheel.

GenAI is the moment every company realized:

“Oh no… we actually need real compute or we’re gonna look like a Blockbuster trying to fight Netflix using fax machines.”

-

Every Fortune 500 wants LLMs, copilots, assistants, optimizers.

-

Every startup wants to build “the next ChatGPT but for X.”

-

Everyone wants fewer employees and more models.

GenAI is the second compounding curve:

More AI tools → more model training → more GPU clusters → more revenue → more NVDA monopoly.

Generative AI isn’t a trend.

It’s the tech equivalent of caffeine —

everyone’s hooked and nobody’s quitting.

3. Agentic AI Demand

The Economic Super-Cycle

This is where the real money piles up —

the compounding curve Wall Street still hasn’t priced in.

Agentic AI isn’t about generating text…

it’s about doing the work.

Not copilots.

Co-workers.

-

AI that acts.

-

AI that takes multi-step tasks.

-

AI that self-corrects, self-plans, and self-executes.

-

AI that replaces entire departments, not just interns.

This requires 10× more compute than GenAI.

More memory.

More multi-modal reasoning.

More inference capacity.

More training cycles.

More everything.

Agentic AI triggers the third compounding loop:

More agents → more continuous compute → more GPU refresh cycles → exponential NVDA revenue → total market domination.

This is the compounding curve that bends the future.

This is why NVDA isn’t a chip stock —

it’s a new asset class.

The VIX hit 80.74, its highest intraday level during the Great Financial Crisis.

Markets were frozen. Liquidity vanished.

Everyone thought capitalism was flatlining.

TFT TAKEAWAY:

When fear maxes out, opportunity begins.

Extreme moves = future mean-reversion fuel.

Miss the explosive days — miss the financial freedom.

NVDA last night?

Yeah. One of those days.

“The desire for constant action irrespective of underlying conditions is responsible for many losses on Wall Street, even among the professionals.”

— Jesse Livermore

❓PRIOR TRIVIA QUESTION:

Which company has never had a single losing year over any rolling 12-month period since going public?

A) Visa

B) Costco

C) Nvidia

✅ ANSWER: A) VISA

And here’s why this fact is jaw-dropping…

Visa is one of the most machine-like compounding businesses ever created.

Since going public in 2008, Visa has never posted a single negative return over any rolling 12-month period.

That’s right — not one. Zero. A perfect scorecard.

Why? Because Visa is a financial cheat code:

1. It doesn’t lend money — it just takes a cut.

Banks eat credit losses.

Visa eats fees.

That means recessions barely dent it.

2. Global secular trend: cash → digital → tap → frictionless payments.

Every time someone buys:

-

a coffee,

-

a car,

-

a crypto mining rig,

Visa clips a fraction of a penny.

Micro-tolls across billions of transactions add up to mega-profits.

3. Insane margins. Insane scale. Insane network effects.

Visa’s margins have sat above 50% for years.

You don’t get that unless you own the rails.

4. It’s basically a toll booth on global capitalism.

The world buys, Visa wins.

The world sells, Visa wins.

The world panics? Still swipes.

Compared to the other options:

Costco — Elite compounding machine, but yes, it’s had negative rolling 12-month stretches (inflation scares, rate cycles, recession wobbles).

Nvidia — A generational compounder, but extremely volatile. NVDA has had multiple 30–70% drawdowns despite its long-term monster returns.

The punchline:

Visa’s consistency is so rare that analysts refer to it as the closest thing to a “risk-free equity” the market has ever seen.

It’s not flashy.

It’s not volatile.

It’s not dramatic.

It just mints money — every… single… year.

❓Today’s Trivia:

A) Nvidia

B) Apple

C) Microsoft

Tune in tomorrow for the answer.

Tune in tomorrow for the answer.

— Proverbs 16:3

Why it matters:

Trading without a plan is gambling.

Trading with intention is stewardship.

Align your actions with purpose — and your profits with Providence. Your time is too valuable to waste. Your money is too powerful to leave unemployed.

Commit your work.

Establish your flywheel.

Earn your freedom.

THE TACTICAL TAKEAWAY

“Your capital compounds

where your conviction lives.”

Want to "SEE" the Market Correctly?

SEE the Market Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doomscrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

If you want a system that compounds clarity, confidence, and cashflow—

not cute tips, not YouTube noise…

but a proven Operating System to GET FREE:

👉 Join the Fall Cohort today.

You’re just one trade away from changing your life.

LIVE LIKE A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS