Read more of the

The W.T.F. Report

November 24th, 2025

Monday

November 24th, 2025

Thanksgiving Week Trading

“TRADE LIKE A PILGRIM…

EAT LIKE A KING.”

(Yes, we’re bringing snark to your stuffing.)

Welcome to the

“THE THANKSGIVING LIFT-OFF”

Thanksgiving Week trading is like grandma’s gravy: thick, slow… but when it moves, it moves in one direction. UP.

Markets love holidays.

Traders love free money.

And algo desks love low-volume melt-ups like a toddler loves marshmallows on sweet potatoes.

This morning? The market is green, the VIX is chilled, and the bounce off the 100MA on the daily chart is whispering, “Don’t miss the feast.”

Last week’s correction = the pre-meal fast.

This week = the calorie binge.

Seasonal strength is REAL.

And Russell 2000 kicked the door in Friday with a “Remember me?” rally that sets up the classic small-cap turkey trot.

Japan’s yen is wobbling like cranberry sauce out of the can.

-

BoJ jawboning at 10-month lows

-

Intervention spotlight: 158–162 zone

-

Thin holiday liquidity = perfect time for a surprise slap

OCBC warning:

“Intervention may hit as early as Friday if price breaches 160.”

Translation: Don’t nap on FX — volatility can ignite equities.

In U.S. land:

-

Last week was rough for markets

-

Friday rally rescued the vibe

-

Fed futures now see 73% chance of December cut

-

John Williams: “room for further adjustment”

-

Bessent: “No recession in 2026.”

-

Collins: “Maybe calm down.”

Holiday travel?

31 million humans moving at once.

The only thing more chaotic is a low-volume Friday with a Fed rumor.

“Markets are Thanksgiving buffets — the gains go to those who show up early and know what to reach for.”

PRE-MARKET INTERNALS

“New Week. New Money. Let’s eat.”

FUTURES — UP

-

DOW: +0.29%

-

S&P: +0.57%

-

NASDAQ: +0.88%

-

RUSSELL: +0.33%

-

VIX: 21

-

BITCOIN: $86.4K

-

GOLD: $4,074

-

OIL: $58.10

-

10-YR: 4.051

-

DOLLAR: 100.08

AI trade took a punch in the mouth... NVDA stumbled... but here comes the bounce.

Lilly’s at ATHs.

GOOGL is shadowboxing with NVDA.

Gemini vs GPU — winner takes the AI crown.

Watch the breakout setups this week.

PRE-MARKET SNAPSHOT

-

DOW: +0.59%

-

S&P 500: +0.49%

-

NASDAQ: +0.46%

-

RUSSELL 2000: +0.83%

-

VIX: 25.27 (fear finally remembered its login)

-

BITCOIN: $84.2K

-

GOLD: $4,067

-

OIL: $58.36

-

10-YR YIELD: 4.06%

-

USD: $100.47

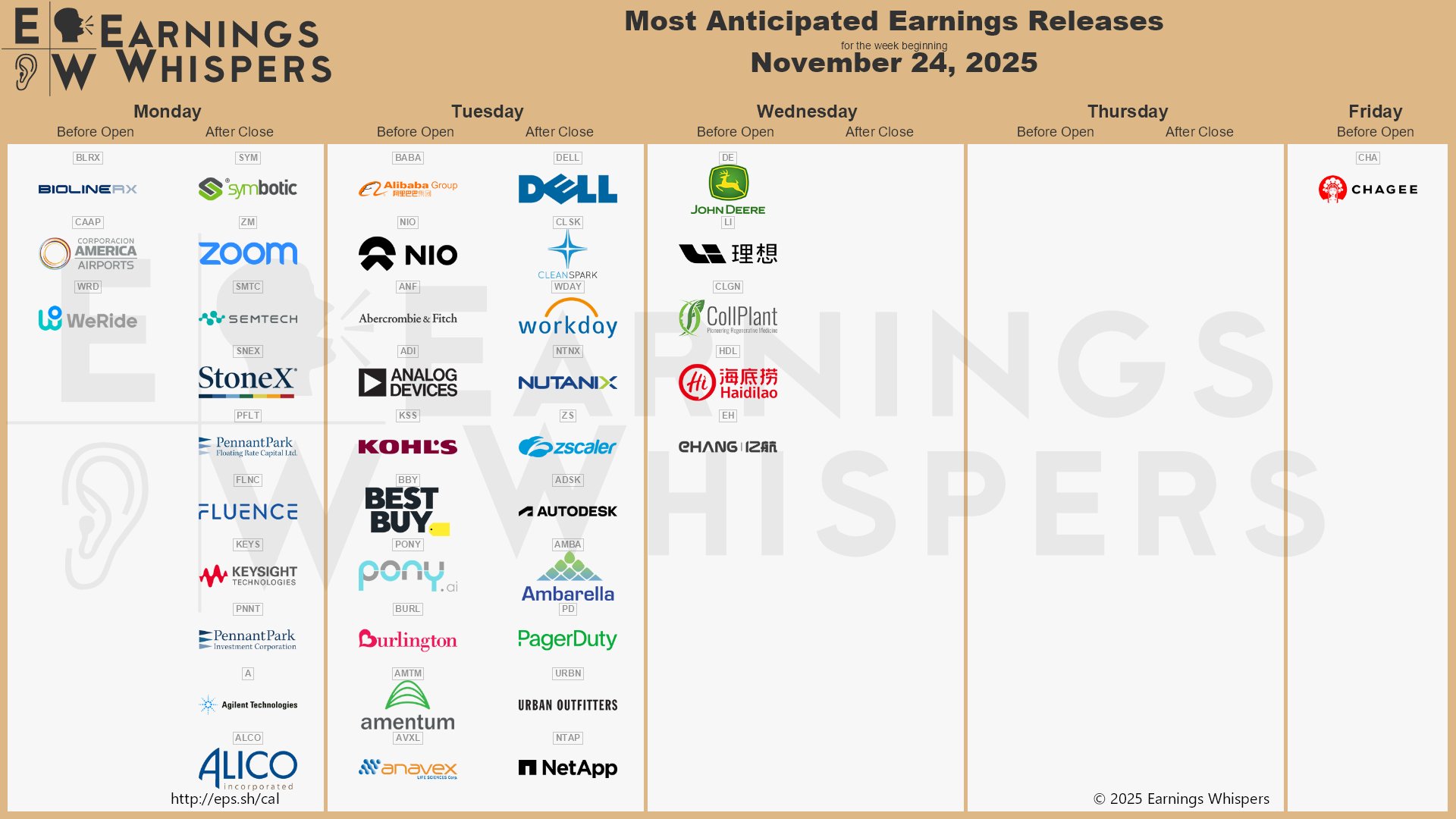

TUESDAY — THE RETAIL GAUNTLET

-

Best Buy, Dick’s, Abercrombie, Kohl’s — Before bell

-

Workday, Dell, HP — After bell

-

PPI + Retail Sales — Macro fireworks

WEDNESDAY

-

Fed Beige Book (the Fed's “Dear Diary I’m Confused Again” entry)

THURSDAY

-

THANKSGIVING — Markets closed. Your calories open.

FRIDAY

-

Early close — low liquidity… prime time for FX intervention and algo nonsense.

“The big money is not in the buying or selling, but in the waiting.” — Jesse Livermore

MARKET HEAT MAP - LIVE

PreMarket: “The Winners and Losers"

STOCKS IN THE GREEN (+)

+17.5% — Oscar Health (OSCR)

ACA subsidy extension = instant adrenaline shot.

+8% — Centene (CNC)

Healthcare rotation heating up.

+5% — Molina Healthcare (MOH)

Riding the subsidy wave.

+4% — Alibaba (BABA)

Qwen app hits 10M downloads in a week.

+4% — Baidu (BIDU)

JPM upgrade + AI transformation = gas pedal.

+3.5% — Alphabet (GOOGL)

Gemini 3 giving NVDA PTSD.

+3.3% — Carvana (CVNA)

Upgrade says drop was “overdone.” Traders agree.

+3% — MP Materials (MP)

Rare earths = rotation bait.

+2% — Merck (MRK)

Wells Fargo upgrade unlocks “catalyst-rich” runway.

+2% — Tesla (TSLA)

A15 chip nearly done; A16 on deck. Musk flexing again.

STOCKS IN THE RED (–)

–10% — Novo Nordisk (NVO)

Alzheimer’s trial misses main target. Ouch.

–10% — GRND Grinder App

Not going private → stock “not going higher.”

STRENGTHS

-

Seasonal tailwind: Historic Thanksgiving week melt-up.

-

VIX at 21: Calm enough to let trends breathe.

-

Friday’s Russell 2000 blast suggests rotation into small caps.

-

Fed cut odds climbing again — liquidity loves holidays.

WEAKNESSES

-

AI sentiment still wobbly post-NVDA stumble.

-

Market barely hanging above the 100MA on the daily chart — fragile bounce.

-

Low holiday volume = candles can get drunk.

-

Yen intervention threat could shock FX → spill into equities.

OPPORTUNITIES

-

GOOGL vs NVDA AI breakout race — catalyst-rich setup.

-

Healthcare rotation is loud (OSCR/CNC/MOH).

-

Rare earths (MP) and China tech (BABA/BIDU) gaining strength.

-

Black Friday + Cyber Monday retail catalysts.

THREATS

-

Fed messaging: Williams says “cut,” Collins says “maybe don’t.”

-

FX intervention could smash risk appetite.

-

Holiday thin liquidity = stop hunts + algo traps.

-

Friday half-day = textbook whipsaw conditions.

“Smart traders don’t fear volatility

—they invoice it."

TACTICAL INSIGHT of the DAY:

“The Thanksgiving Drift: Strike Early or Sit Still”

Thanksgiving Week has a very real, very tradable personality…

and Monday is the only day where the market still remembers how to behave like a grown-up.

By Tuesday?

Volume fades.

By Wednesday?

Algos nap.

By Friday?

Retail shows up like it’s a Black Friday sale on penny stocks.

But Monday?

Monday is your window.

If you’re trading Thanksgiving Week, you trade MONDAY with intention or you don’t trade at all.

"“Front-Load the Week" - Fade the Emotional Overreaction”

Historically, the Monday of Thanksgiving Week often:

-

Rebounds off the prior week’s volatility

-

Overcorrects in the first 30–60 minutes

-

Offers clean reversion-to-mean setups

-

Shows the REAL rotation before volume dries up

Your move:

Fade the morning extremes.

Not the middle of the week — Monday specifically.

Because the emotion from the previous week’s headlines, earnings reactions, and macro drama spills into the open…

and then the market spends the rest of the day unwinding that emotion.

It’s predictable.

It’s repeatable.

It’s exploitable

How to Trade It

(T.U.R.N. + Seasonality Edition)

T – Tune In

Check the VIX, breadth, gaps, and overnight futures move.

If the market gaps emotionally (up or down), your setup is brewing.

U – Understand Rotation

Thanksgiving Week loves safety rotations:

XLK → XLP

XLY → XLV

High beta → low volatility

Spot the early morning tells.

R – Retracement Zone Setup

Let the morning fakeout happen.

Then stalk your reversal zone:

-

VWAP reclaim

-

38.2% / 50% fib retrace

-

Stoch RSI curling off 20

-

Volume confirming the flip

N – Nail the Power Zone

The money is made when momentum flips back toward equilibrium.

Your setup is the reversion, not the chase.

Why This Works (Data Backed)

Over the last 25 years:

-

Thanksgiving Monday is green 72% of the time

-

And when the prior week was volatile, Monday’s morning move reverses 63% of the time

-

Monday carries more volume and cleaner intraday structure than Tue–Fri combined

Translation:

Monday is the only day that still respects your technicals.

TFT TAKEAWAY — “Trade Monday With Precision. Ignore the Holiday Noise.”

You’re not trying to be a hero this week.

You’re trying to be a sniper.

Thanksgiving Week rewards:

-

traders who wait

-

traders who fade extremes

-

traders who understand seasonality

-

traders who don’t get sucked into low-volume sludge

Strike Monday.

Coast the rest of the week.

Protect your Flywheel.

Because you’re not trading for activity… you’re trading for freedom.

On November 24, 2011, the U.S. markets were closed for Thanksgiving…

but Europe was wide open — and absolute chaos was unfolding overseas.

While Americans were carving turkey, Europe was carving up markets.

Italy’s bond yields were exploding.

Spain’s funding costs were skyrocketing.

The eurozone debt crisis was hitting a fresh panic peak.

And even with U.S. markets closed, futures began melting down:

-

S&P futures dropped sharply

-

VIX futures spiked

-

European markets slid into the red

-

Headlines screamed “contagion risk rising”

-

Analysts declared the bull run dead

Traders went to sleep worried the U.S. market would crater the next morning.

But here’s the twist:

On Black Friday (Nov 25), the U.S. market opened… and reversed hard.

The panic failed.

The fear fizzled.

Buyers stepped in.

Indexes closed green.

What looked like a global meltdown turned into a classic holiday reversion rally — the same seasonal behavior Time Freedom Traders stalk today.

“Holiday Panic Is Usually Mispriced.”

When the U.S. is closed and global markets freak out, emotional moves often overshoot.

Holiday futures amplify that emotion.

Thin liquidity exaggerates fear.

But once Wall Street opens, price usually rebalances — violently and quickly.

This is why Thanksgiving Week offers hidden edges:

-

Low liquidity amplifies mistakes

-

Headlines inflate fear

-

Futures misprice risk

-

Smart money uses the air pocket to reposition

The biggest returns happen where emotional traders misprice reality.

Over the last 30 years, Black Friday has closed green 76% of the time —

even when global markets were red the day before.

Meaning:

Fear sells fast. Discipline buys better.

“The desire for constant action irrespective of underlying conditions is responsible for many losses on Wall Street, even among the professionals.”

— Jesse Livermore

❓PRIOR TRIVIA QUESTION:

Which stock delivered the fastest 10x run of the 2010s… AFTER suffering a brutal 75% drawdown first?

A) Amazon

B) Nvidia

C) Apple

✅ ANSWER: B) NVDA

Nvidia didn’t just deliver one of the fastest 10x runs of the 2010s…

It delivered one of the fastest 10x runs in modern market history —

after being left for dead.

1. Nvidia suffered a brutal ~75% drawdown in 2008–2009.

The company got obliterated in the Financial Crisis.

Demand crumbled. Margins shrank.

Analysts slapped the “commodity chip stock” label on it and moved on.

Wall Street said:

“This thing’s cooked.”

Wall Street was wrong.

2. From 2015 to 2017, NVDA went parabolic — a true 10x sprint.

Fueled by:

-

the gaming explosion

-

CUDA dominance

-

early AI compute adoption

-

data center demand

-

the GPU-as-infrastructure shift

Nvidia ran from roughly $20 → over $200 in under 24 months.

That’s not a rally.

That’s a wealth event.

A generational compounding window disguised as a tech stock.

3. Amazon & Apple had monster runs — but NOT 10x off a 75% crash.

Amazon

-

Had massive compounding, yes.

-

But not a full 10x sprint immediately following a catastrophic drawdown.

Apple

-

Became the greatest wealth machine of the century.

-

But its growth was steady, not a post-crash vertical liftoff.

Only Nvidia combined:

-

catastrophic drawdown

-

technological inflection point

-

multi-year mega-cycle tailwinds

-

and a parabolic adoption wave into a supercharged 10x explosion.

The Real Lesson

The market’s biggest winners often rise from the ashes.

Everyone loves NVDA now.

But almost no one wanted it when it was down 75% and trading like a discounted semiconductor orphan.

This is the Time Freedom Trading insight most traders miss:

“The deepest pain often precedes the greatest upside.”

That’s why we study rotation.

That’s why we study catalysts.

That’s why we study reversion.

That’s why we TRADE THE TURN.

Because smart money shows up when fear fogs everyone else’s vision.

❓Today’s Trivia:

🦃 THANKSGIVING TRIVIA — MARKET EDITION

Which iconic American retailer has posted a Thanksgiving Week stock rally in 21 of the last 25 years — making it one of the most consistently green trades of the holiday season?

A) Walmart

B) Costco

C) Amazon

Tune in for tomorrow’s WTF Pre-Market Report for the answer… and the surprising reason why one of these names quietly dominates Thanksgiving Week like cranberry sauce dominates the side-dish rankings.

“Gratitude Is a Trading Edge”

Thanksgiving Week isn’t just turkey, travel, and trying not to check your portfolio between dinner rolls.

For a Time Freedom Trader, this week is about resetting your inner operating system:

-

Gratitude sharpens clarity.

-

Clarity improves discipline.

-

Discipline compounds returns.

This week, most traders coast.

They relax. They drift. They get sloppy.

They stop treating the market like a mission.

Not you.

This is your chance to strengthen the mental special ops part of your game — the part that thrives in calm while others get lazy.

Because when you begin from gratitude, you don’t trade from fear or scarcity.

You trade from awareness, alignment, and abundance.

— 1 Thessalonians 5:18

This isn’t about ignoring challenges — it’s about anchoring your mind.

A thankful heart is a stable heart, and a stable heart makes sound decisions in volatile markets.

Gratitude keeps you grounded when charts get choppy.

It reminds you that you’re operating from purpose, not panic.

It aligns your identity as a builder, creator, and steward — not a gambler

“Gratitude is a multiplier.”

When you begin the week with gratitude:

-

You see clearer.

-

You act cleaner.

-

You trade calmer.

-

You lead yourself better.

And that’s how you enter Thanksgiving Week with power — not passivity.

Take a breath.

Take inventory.

Take the week seriously.

The market rewards the trader who starts from thanks… and executes with purpose.

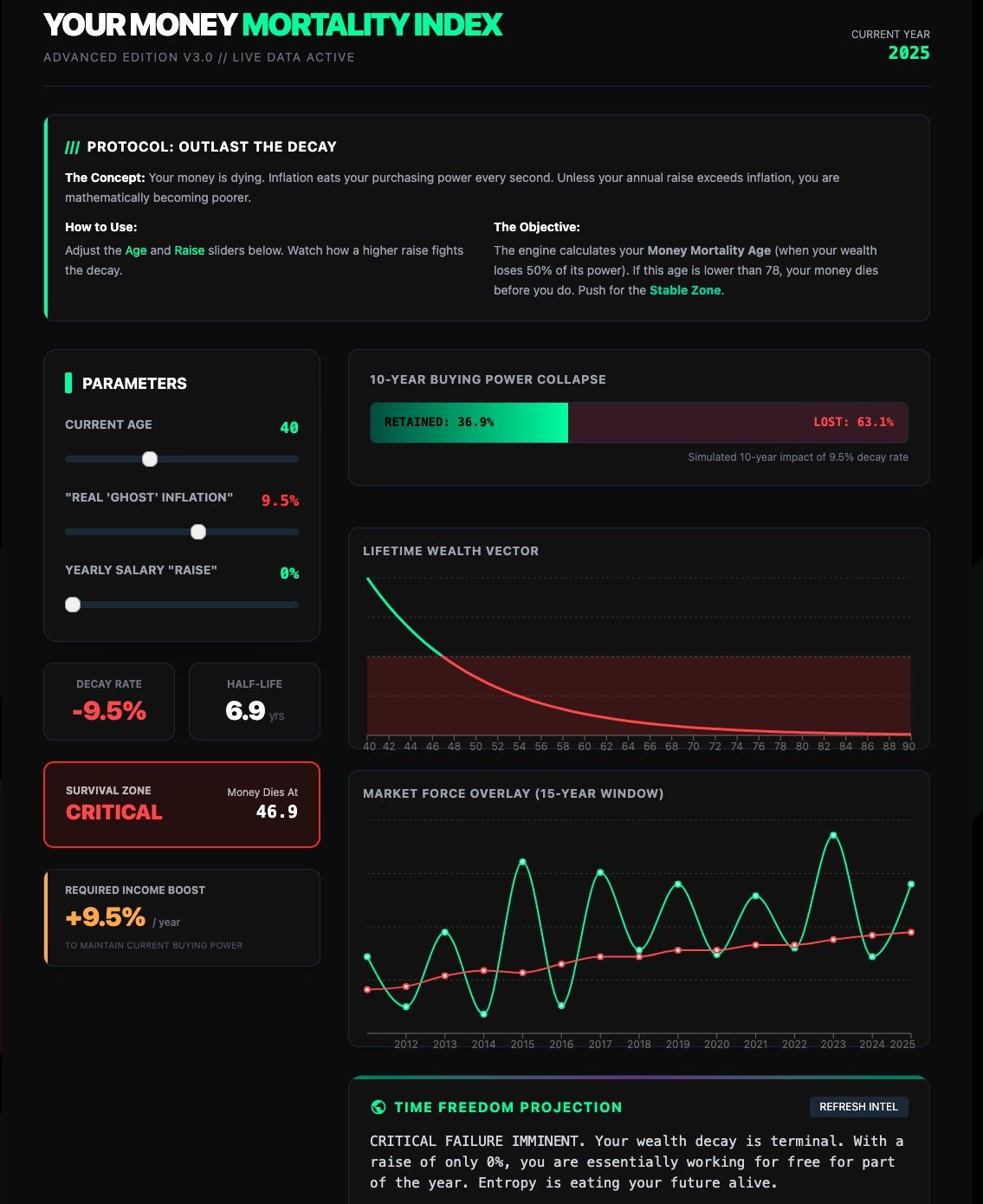

CHECK YOUR MONEY MORTALITY

If yesterday’s market drop rattled you… good.

But here’s the real question:

How many years is your money actually built to survive?

If you don’t know your Money Mortality Index, you’re trading blind.

👉 Tap into the Wealth Operating System and run the MMI tool now.

See exactly how long your money lives… and how to make it compound longer.

One trade. One turn. One moment of clarity.

You’re just one trade away.

“Your capital compounds

where your conviction lives.”

Want to "SEE" the Market Correctly?

SEE the Market Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doomscrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

BUILD YOUR WEALTH OPERATING SYSTEM

If you want a system that compounds clarity, confidence, and cashflow—

not cute tips, not YouTube noise…

but a proven Operating System to GET FREE:

👉 Join the Fall Cohort today.

You’re just one trade away from changing your life.

LIVE LIKE A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS