Read more of the

The W.T.F. Report

November 25th, 2025

Tuesday

November 25th, 2025

Thanksgiving Week Trading:

Where the Turkey Bounces…

But Do We Retake the 50MA?

Welcome to TACTICAL TUESDAY!

— where we sharpen our charts, sip our caffeine, and ask the market, "Hey big boy… you gonna reclaim that 50MA or just tease us like last year?"

Market mood this morning?

“Slightly hungover, cautiously optimistic, and pretending yesterday didn’t get out of hand.”

Yesterday’s 2% breadth-bomb was the best up-day since May…

But… it still didn’t reclaim the 50MA.

So we’re opening soft, like leftover rolls that didn’t get reheated.

Thanksgiving Week lit the fuse — 2% pop yesterday, powered by breadth AND depth.

-

We’re flirting with the 50MA like a high school crush.

-

Google hunting $4T into Thanksgiving — yes… FOUR TRILLION.

-

Meta → Google TPU shift triggered a mini NVDA hangover (-4%).

-

Broadcom soaring on that same Google partnership (11% yesterday, +2% premkt).

-

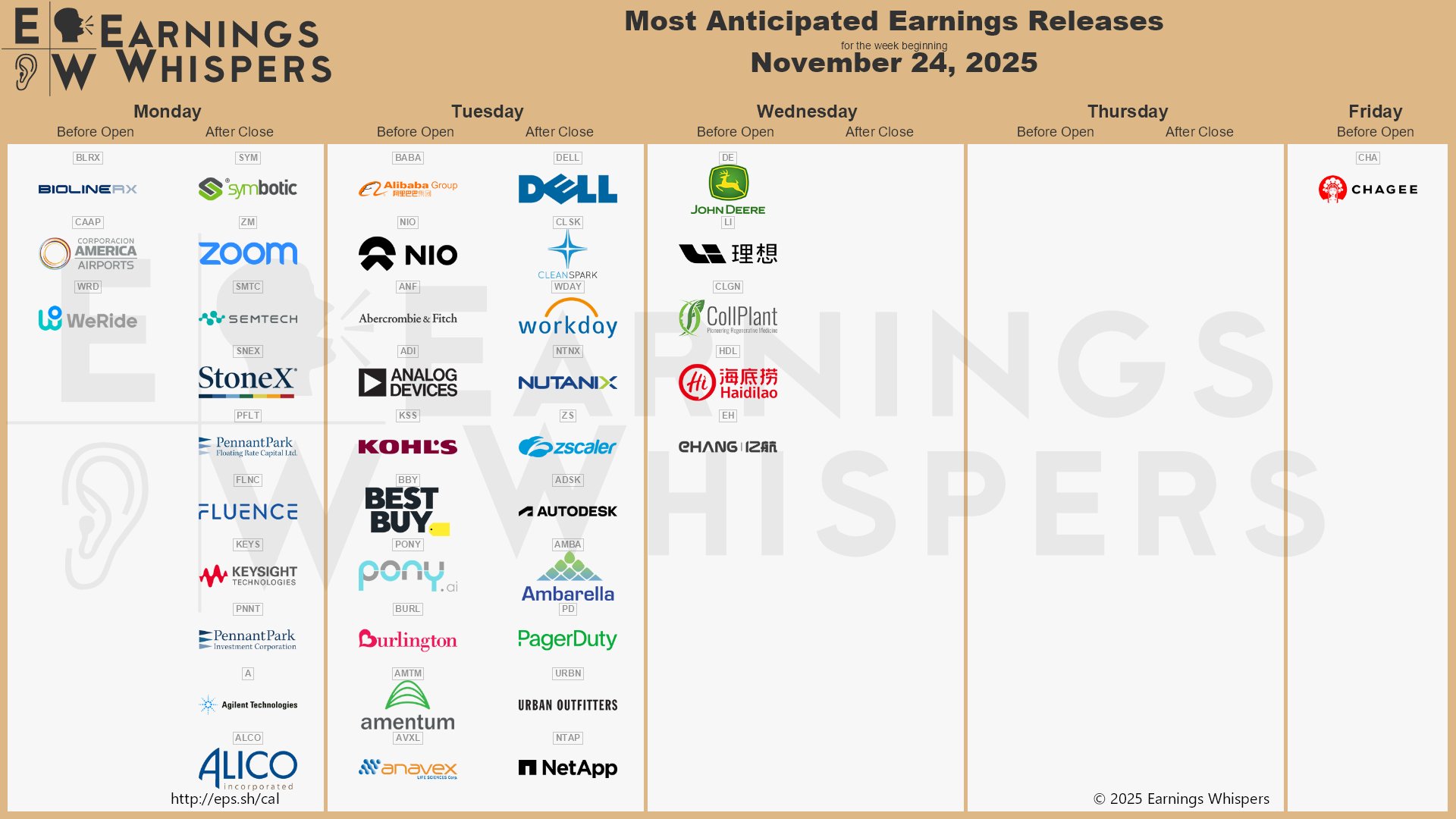

Retail earnings buffet:

-

Kohl’s: +23% (who knew?)

-

Abercrombie: +18%

-

Best Buy: +2.5%

-

Dick’s: -3% (and -9% later)

-

-

Amazon: spending $50 BILLION on AI cloud infrastructure for U.S. Gov.

-

ADP: layoffs trending up = labor market cooling.

-

Treasury Sec Bessent: New Fed Chair decision by holiday season.

-

AI trade rotated HARD into Alphabet & Broadcom.

-

Alibaba booms on cloud demand (34% jump in cloud).

Thanksgiving Week = rotation city.

The theme?

“Pass the chips, not the gravy.”

PRE-MARKET INTERNALS

DOW: +0.07%

S&P: +0.03%

NASDAQ: -0.14%

RUSSELL: +0.32%

VIX: 20.09

BITCOIN: $87.3K

GOLD: $4,141

OIL: $57.87

10-YR: 4.01%

DOLLAR: 99.91

““Markets can remain irrational longer than you can remain solvent.” — John Maynard Keynes

Don’t fight momentum. Don’t short a Thanksgiving rally. And don’t get cute fighting a trend when you can just ride it.

MARKET HEAT MAP - LIVE

PreMarket: “The Winners and Losers"

STOCKS IN THE GREEN (+)

+23% — Kohl’s (KSS)

+15% — Symbotic (SYM)

+14% — Keysight Technologies (KEYS)

+13% — Pony AI (PONY)

+11% — Amentum Holdings

+11% — Fluence Energy (FLNC)

+6% — Zeta Global (ZETA)

+5% — Zoom (ZM)

+4% — Alphabet (GOOGL)

+4% — Brinker (EAT)

+2% — Applied Materials (AMAT)

+2% — Alibaba (BABA)

STOCKS IN THE RED (–)

-2% — Agilent (A1GI3)

-3% — Estee Lauder (EL)

-5% — Burlington (BURL)

-9% — Dick’s Sporting Goods (DKS)

-3% to -4% — Nvidia (NVDA)

But NVDA’s getting chip-checked like a rookie at the tech combine.

STRENGTHS

— “Breadth, Beasts, and a Bullish Bounce”

-

Yesterday delivered the strongest up-day since May, driven by broad participation across mega-cap tech, retail, semis, and cyclicals.

👉 This isn’t a narrow bear-market rally — this is institutional positioning into the holiday drift. -

AI rotation back to life, but with a twist:

-

Alphabet + Broadcom leading

-

NVDA cooling

-

AMAT seeing upgrades

-

Cloud, chips, and robotics all posted strong breadth

👉 This is healthy sector rotation, not a breakdown.

-

-

Retail earnings stronger-than-expected, surprising Wall Street:

-

Kohl’s, Abercrombie, Best Buy all showing consumer strength

👉 This shores up Q4 holiday-spending narrative.

-

-

Dollar under 100 and yields falling near 4% provide a supportive macro backdrop for equities.

-

VIX at 20 → elevated but trending lower = enough fear to fuel upside without euphoria.

Time Freedom Read:

The tide is lifting, money is rotating with intention, and institutions are pressing their bets before liquidity evaporates for the holiday.

WEAKNESSES

— “NVDA Stumbles, 50MA Resistance, and Labor Cracks”

-

Daily chart still below the 50MA — and yesterday’s rip didn’t reclaim it.

👉 Momentum is present but not confirmed. -

NVDA is sliding on Meta’s shift toward Google TPUs, denting the AI leader’s aura of invincibility.

👉 NVDA weakness tends to drag semis and QQQ sentiment. -

AMZN’s $50B AI spend is bullish… but also signals rising capex arms race, compressing margins in the short term.

-

ADP showing rising layoffs — labor market cooling faster than expected.

👉 Softening labor can become a forward warning shot for the consumer. -

Negative premarket reaction to select retailers (DKS) → still pockets of weakness in discretionary.

-

Holiday week liquidity → thin markets amplify both directions.

Time Freedom Read:

The market wants up — but the structure is still fragile underneath, and one bad headline could knock us off the 50MA again.

OPPORTUNITIES

— “Rotation Goldmine + Thanksgiving Drift”

-

Thanksgiving Week is historically one of the strongest trading periods of the year with a high probability of upward drift.

-

Huge rotation opportunity:

-

NVDA weakness → GOOGL + AVGO strength

-

Retail leaders outperforming → A&F, KSS, BBY

-

China tech rebound → BABA gaining steam

-

Robotics + AI ops → SYM, PONY, ZETA

👉 Time Freedom Traders thrive when money rotates, not when it trends.

-

-

Semiconductor capex surge highlighted by AMAT upgrades — an early signal for 2026 tech spending cycles.

-

Amazon’s $50B cloud infrastructure investment = multi-year runway for AI hardware and software ecosystems.

-

Falling yields + weaker dollar = tailwind for tech and large-cap growth.

-

Retail consumer read-through could fuel holiday momentum trades through Black Friday + Cyber Monday.

Time Freedom Read:

This is a tactical trader’s playground — multiple catalysts, rotation flows, and seasonality lining up for asymmetrical setups.

THREATS

— “Thin Liquidity, Fed Uncertainty, and AI Fragmentation”

-

We are STILL under the 50MA — if today fails, yesterday becomes a “one-and-done” rally trap.

-

Meta’s shift toward Google chips signals the AI landscape is fracturing.

👉 Sector leadership uncertainty = volatility. -

Treasury Secretary hinting at a Fed Chair change by the holidays introduces policy risk.

-

Holiday liquidity → fewer buyers, faster reversals, more algo games.

-

Retail euphoria can fade quickly if Black Friday spending disappoints.

-

Geopolitical headlines (Middle East, Asia) still simmering beneath the surface.

-

NVDA dragging semis can weigh on the entire NASDAQ if contagion sentiment spreads.

Time Freedom Read:

We’re positioned for upside — but thin ice is still ice.

Don’t force trades. Let setups come to you. Defend the Flywheel before you attack.

Today’s SWOT says one thing clearly:

The path of least resistance is up… IF the market can reclaim the 50MA.

That’s the battlefield.

That’s the line in the sand.

And that’s where tactical traders make their week.

Because average traders chase.

Time Freedom Traders rotate.

“Smart traders don’t fear volatility

—they invoice it."

Thanksgiving WEEK - Tuesday Edition

Today is the “positioning day” before tomorrow’s airport chaos and Thursday’s holiday closure.

This is a rotation trader’s playground:

-

Identify where the money shifted yesterday

-

Confirm which sectors sustain today

-

Use the T.U.R.N. Framework:

-

Tune into the catalyst (AI reshuffle)

-

Understand rotation (NVDA → GOOGL/AVGO)

-

Retracement entry (look for pullbacks into support)

-

Nail the power zone (stoch RSI reclaim)

-

Thanksgiving Tuesday is historically:

“Trend + Rotation + Low Volatility = Easy Bread-and-Butter Trades”

Don’t overcomplicate it.

Trade the wave the big money is surfing today.

While Americans were stuffing turkeys, global markets were choking on a different kind of bird:

Dubai World requested a standstill on $26 BILLION of debt.

The announcement hit on November 25, sending a shockwave through every major index:

-

S&P futures tanked overnight

-

European markets went red instantly

-

Safe havens like gold and U.S. bonds surged

-

Banks with Middle East exposure got clipped hard

-

Volatility spiked as if someone kicked the VIX hornet’s nest

The fear?

A sovereign default contagion — the 2008 trauma was still fresh, and this headline felt like déjà vu with extra paprika.

But here’s the twist…

THE MARKET SNAPPED BACK FAST.

Just days later, global markets stabilized and resumed the post-crisis rebound.

What looked like the start of “Lehman 2.0” turned out to be just a panic blip in the early stages of a monster bull run.

This day reminds traders of a timeless principle:

Headline shocks fade. Structural trends dominate.

-

The scary thing rarely becomes the real thing.

-

First reactions are emotional.

-

Second reactions are rational.

-

The real money is made by the trader who watches, waits, and trades the turn, not the terror.

Today’s market noise?

AI chips, rate speculation, layoffs, geopolitical headlines…

History says: zoom out → find the tide → ride the wave.

Because average traders panic.

Time Freedom Traders rotate.

Over the last 25 years, the Tuesday before Thanksgiving has closed green 76% of the time.

Why?

Funds position early → retail travels → algorithms push trend → low liquidity amplifies drift.

This isn’t randomness.

It’s probability you can trade.

“The desire for constant action irrespective of underlying conditions is responsible for many losses on Wall Street, even among the professionals.”

— Jesse Livermore

❓PRIOR TRIVIA QUESTION:

Which iconic American retailer has posted a Thanksgiving Week stock rally in 21 of the last 25 years — making it one of the most consistently green trades of the holiday season?

A) Walmart

B) Costco

C) Amazon

✅ ANSWER: A) WALMART

Here’s why:

For 21 of the last 25 Thanksgiving Weeks, Walmart has delivered a positive return, making it one of the most reliable green trades of the entire holiday season.

Why does it dominate?

-

Holiday shopping flow: Walmart captures early holiday foot traffic before the Black Friday frenzy officially starts.

-

Defensive + consumer staple strength: When markets wobble, Walmart gets love as a safe haven.

-

Massive retail footprint: Their data and inventory cycles hit right as traders price in Q4 consumer strength.

-

Thanksgiving Week consistency: Big-cap retailers tend to drift upward on low liquidity, and Walmart is king of the drift.

Costco does well.

Amazon is volatile.

But Walmart?

Walmart is the turkey rally cheat code.

TFT Takeaway:

Seasonality is a weapon — and Walmart has been one of Thanksgiving Week’s most dependable swing trades for two decades.

Because average traders guess.

Time Freedom Traders operate.

❓Today’s Trivia:

A) Nvidia

B) Amazon

C) Tesla

👉 Tune in for tomorrow’s WTF Report for the answer.

Your Table Is Already Set.” ABUNDANCE IS YOUR PORTION

— Psalm 23:5

Thanksgiving isn’t just a holiday — it’s a masterclass in abundance psychology.

Look at the table:

No one brings one dish.

Everyone brings too much.

There’s always more than enough — leftovers for days, desserts nobody touches, and rolls nobody admits to eating.

Abundance is the default setting of creation. Scarcity is the invention of fear.

In trading, in wealth, in life…

Most people operate like they’re at a famine buffet:

Grabbing crumbs, rushing decisions, panicking at headlines, afraid the opportunity will vanish if they don’t “act now.”

But abundance says:

The market will open again tomorrow.

New setups will come again next week.

Your breakthrough is not a one-time chance — it’s a rhythm, not a lottery ticket.

Thanksgiving reminds you:

You are surrounded by cycles of provision…

If you slow down long enough to see them.

The Biblical Truth

David wasn’t describing a cup filled just enough.

He was describing a cup that spills past its edges — symbolic of God’s provision exceeding human fear.

Why does this matter for Time Freedom Trading?

Because trading requires:

-

A calm cup

-

An uncluttered mind

-

A belief that opportunities are infinite

-

And a heart rooted in provision, not panic

When you know your cup overflows, you stop chasing bad trades.

You stop forcing opportunities.

You start operating from clarity, not scarcity.

You stop reacting.

You start compounding.

TFT MINDSET SHIFT:

FROM SCARCITY TO SUPERNATURAL SUPPLY

Ask yourself today:

-

Where am I trading from fear instead of flow?

-

Where am I tightening my grip when God is trying to open my hand?

-

Where am I behaving like opportunity is limited — when the market resets every day?

Abundance is not an emotion.

It’s a worldview.

It’s the lens of a Time Freedom Trader.

Once you see it —

You can’t unsee it.

“The abundant mind compounds.

The fearful mind cancels its own future.”

Let this Thanksgiving remind you:

You’re not waiting for abundance.

You’re swimming in it.

You just have to trade like it.

Want to "SEE" the Market Correctly?

SEE the Market Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doomscrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

If you want a system that compounds clarity, confidence, and cashflow—

not cute tips, not YouTube noise…

but a proven Operating System to GET FREE:

👉 Join the Fall Cohort today.

You’re just one trade away from changing your life.

LIVE LIKE A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS