Read more of the

The W.T.F. Report

December 1st, 2025

Monday

December 1st, 2025

Welcome to December – Cyber Monday Stress Test”

Welcome to December — the month where everyone pretends to be disciplined while secretly praying for Santa to bail out their portfolio. It’s Cyber Monday, but the only things on sale this morning are risk assets, because pre-market decided to wake up in a mood.

After last week’s Thanksgiving sugar rush, markets are now acting like they’ve discovered the calories. Futures are red, crypto is getting folded like a cheap lawn chair, and Nvidia just dropped a casual $2 billion into Synopsys like it’s paying rent. Meanwhile, OpenAI and Accenture are teaming up to automate half of corporate America — again — and China is reminding crypto degens that “illegal activities” is still on the banned list.

Oh, and Airbus found another quality issue… because apparently “Oops, we broke the plane again” is a recurring theme. Could this finally be Boeing’s sloppy, undeserved, year-end redemption arc? Stay tuned.

This is what December does best: kicks open the door wearing Christmas lights and chaos, dumps a bucket of catalysts on your lap, and whispers:

Cyber Monday meets Risk-Off Reality Check — where the deals are everywhere except your portfolio, and the only thing rising is your caffeine intake.

Buckle up. December isn’t here to play. It’s here to expose anyone who coasted through November without a plan.

PRE-MARKET INTERNALS

We just finished a November to Remember:

-

Dow + S&P: 7 straight winning months.

-

Nasdaq: finally tripped, -1.5% in November, AI hangover included.

-

-

Now we kick off December + Cyber Monday + Super Six positioning

-

Money is underexposed to U.S. stocks.

-

Managers are behind their benchmarks.

-

The final month of 2025 is basically career risk vs Santa Claus.

-

Pre-market is red across the board after last week’s holiday rally:

-

Dow: -0.46%

-

S&P: -0.66%

-

Nasdaq: -0.91%

-

Russell: -1.07%

Vol & Macro:

-

VIX: 18.12 (calm… but twitchy)

-

10-Year: 4.07%

-

Dollar Index: 99.06 (sub-100 = tailwind for multinationals)

-

-

Hard Assets & Crypto:

-

Bitcoin: $86.135K (currently wearing a red cape)

-

Gold: $4,293

-

Oil: $58.99

-

This is the market whispering:

“You sure you want to coast into year-end without a plan, champ?”

Net takeaway:

Slightly risk-off open.

Vol is contained.

This is positioning, not panic.

“Markets can remain irrational longer than you can remain solvent.” — John Maynard Keynes

MARKET HEAT MAP - LIVE

The MORNING DRIVE:

AI & CHIP CHAINS – POWER COUPLES EDITION

-

Nvidia → $2B stake in Synopsys (SNPS) at $414.79/share

-

Deep partnership to fuel next-gen compute + design automation.

-

Translation: Nvidia is buying tools AND toll roads in the AI build-out.

-

-

OpenAI + Accenture partnership

-

Enterprise AI rollout goes from “experiment” to line item.

-

Watch consulting, cloud, and AI infra tickers for follow-through.

-

Read-through: AI isn’t dying. It’s just rotating from “hype stocks” to picks, shovels, and plumbing.

CRYPTO: RISK-ON PARTY… FIRE-DRILL

-

Bitcoin: ~$85.9K, down almost 6%.

-

Ethereum: ~$2,827, down 6.6%.

-

China’s PBOC is barking about “illegal activities.”

-

Crypto-linked stocks catching a brick:

-

CLSK: -7% (giving back part of last week’s +55% rip)

-

MARA: -6.5%

-

COIN: -4%

-

Read-through:

-

This is a positioning flush, not the apocalypse.

-

But it does signal “risk-off for tourists.”

-

For us? It’s a reminder: volatility is a weapon, not a personality trait.

AIRBUS ISSUE – DOES THIS HAND BA A GIFT?

-

Airbus (A320 family):

-

New quality issue discovered on dozens of aircraft.

-

Comes right after software glitch fixes on ~6,000 A320s.

-

-

Question on the table:

Does this open a late-cycle order book tailwind for Boeing into year-end?

This is the kind of headline rotation you watch in December:

-

Quality scare in one name → incremental bid in the rival.

INTEL – THE “UNDERESTIMATED” CHIP PLAYER

-

Intel (INTC):

-

Holding a ~10% pre-market jump.

-

Fueled by expectations of a 2027 Apple M-series supply deal.

-

-

Translation:

-

Intel is trying to move from “dad chip” to trusted co-pilot in Apple silicon.

-

2027 is far away, but narrative matters now for December positioning.

-

HOLLYWOOD & THE BOX OFFICE BID

-

Thanksgiving box office: around $294M – likely top 3–4 all-time.

-

Disney’s “Zootopia 2”: ~$156M, carrying the weekend.

Not a direct market mover, but:

-

Strong consumer spend + packed theaters = the consumer isn’t dead.

-

That matters as we trade holiday retail, credit, and discretionary into year-end.

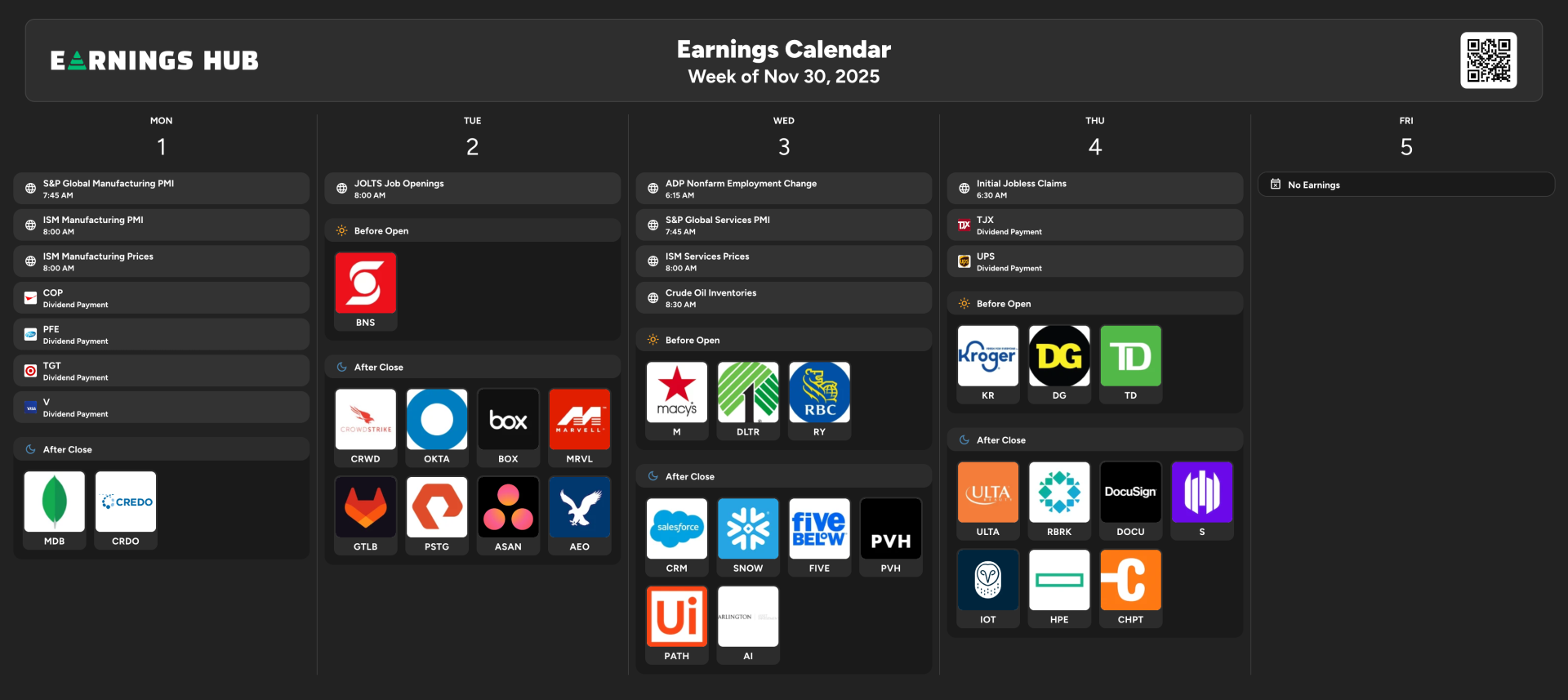

THE WEEK AHEAD:

We’re not easing into December.

We’re walking into a catalyst minefield:

-

Today: Powell speaks after hours

-

Pre-FOMC blackout vibe.

-

He can tilt sentiment into Tuesday without changing policy yet.

-

-

Fed backdrop:

-

Fed is in the blackout window heading into the Dec 10 meeting.

-

Market is still trying to price a “last cut” or a “we’re done” signal.

-

This Week’s Key Events:

-

Tuesday: Earnings – AEO, OKTA, CRWD (post-close)

-

Wednesday:

-

DLTR & M (pre-open)

-

CRM after the bell

-

Import prices, ADP jobs

-

-

Thursday: DG, KR (pre-open), ULTA (after)

-

Friday: PCE data – the Fed’s favorite inflation gauge

Plus:

-

Amazon IGNITE Event → AI + commerce headlines

-

Runway Gen 4.5 drops, claiming to beat Google & OpenAI on a key video benchmark.

-

AI video just quietly leveled up again.

-

This is long-term tailwind for compute, chips, storage, and content infra.

-

And yes, we survived a 10-hour CME outage Friday.

If you ever doubted counterparty risk… that was your wake-up call.

PreMarket:

“The Winners and Losers"

STOCKS IN THE GREEN (+)

Leggett & Platt (LEG): +14%

-

All-stock buyout proposal at $12/share from Somnigroup.

-

Takeover premium doing the heavy lifting.

Intel (INTC): +10%

-

Apple M-series supply hopes = narrative re-rating.

-

Watch for follow-through and upgrades.

Synopsys (SNPS): +8%

-

Fresh $2B check from Nvidia + strategic partnership halo.

-

This is “sell-side envy fuel.”

Wynn Resorts (WYNN): +~2%

-

Added to Goldman’s conviction buy list.

-

Best-in-class Vegas + Macao recovery = “VIP table” trade.

STOCKS IN THE RED (–)

Nvidia (NVDA): -1.4%

-

Irony: writes a $2B check, stock gets a mild hangover.

-

Profit-taking + “AI bubble” chatter.

Micron (MU): -2%

Marvell (MRVL): -2%

-

Group trade: AI-linked semis taking a breather after huge runs.

Moderna (MRNA): -4%

-

Internal FDA memo linking vaccines to child deaths in the headlines.

-

Litigation + sentiment risk = discount demanded.

Coinbase (COIN): -4%

Mara Holdings (MARA): -6.5%

Cleanspark (CLSK): -7%

-

Crypto beta names paying the price for BTC/ETH flush.

-

CLSK giving back some of that +55% moonshot from last week.

Trader’s lens:

-

Winners = M&A, AI infrastructure, select leisure.

-

Whiners = AI momentum darlings + crypto beta + litigation risk.

Strengths:

-

Seven-month winning streak in Dow & S&P anchors a strong uptrend.

-

Positioning is light – many funds underweight U.S. equities, which creates fuel for a chase into year-end.

-

Dollar under 100 + rates drifting lower = a supportive backdrop for risk assets, especially large-cap growth and global earners.

Weaknesses:

-

Nasdaq just broke its streak with a -1.5% November and very crowded AI trades.

-

Crypto flush highlights fragile risk sentiment in speculative corners.

-

Macro: we’re heading into a Fed decision + PCE + jobs with elevated expectations for a friendly tone. Any disappointment bites harder at these levels.

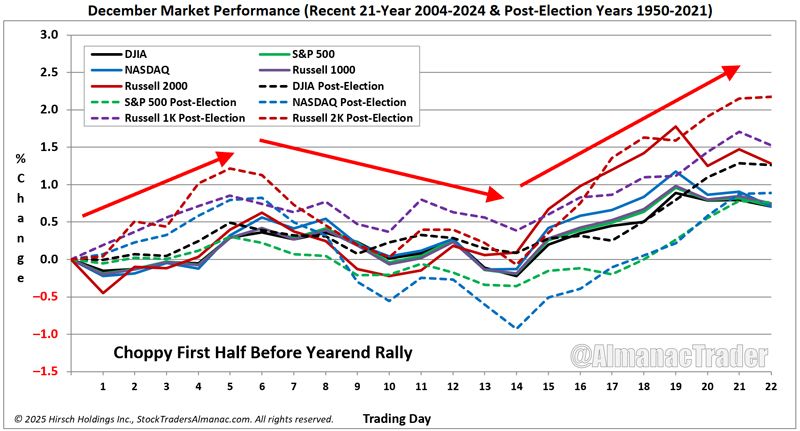

Opportunities:

-

Santa Claus Rally window – historically, the last 5 trading days of December + first 2 of January lean bullish.

-

Rotation possibilities:

-

From crowded Mega/AI trades into Super Six laggards, value, small caps, and cyclicals.

-

Airbus troubles may throw incremental love to Boeing and U.S. aerospace.

-

-

AI narrative keeps expanding:

-

Nvidia–Synopsys

-

OpenAI–Accenture

-

Runway Gen 4.5

→ The AI Capex wave is still building. Smart money will map that into chips, tools, cloud, and infra.

-

Threats:

-

Fed misstep risk – a hawkish nuance on Dec 10 or from Powell tonight can spark a December drawdown before any Santa pop.

-

Geopolitics + China – PBOC crypto warnings remind us that policy headlines can nuke risk quickly.

-

CME outage reminder: Infrastructure risk is real. When the plumbing breaks, liquidity disappears fast and moves get amplified.

-

Over-reliance on a handful of mega-caps (Super Six) turns indexes into single-factor trades. If one or two crack, the whole tree shakes.

“Smart traders don’t fear volatility

—they invoice it."

DECEMBER & THE SANTA CLAUS PATTERN

December is not one long sleigh ride. It’s two acts:

-

Act 1 (Now → mid-month):

-

Choppy, headline-driven, Fed-sensitive.

-

Great time for “Trade the Turn” plays on pullbacks in strong trends.

-

Use the T.U.R.N. Framework:

-

T – Tune In: Respect the Fed + PCE + jobs calendar.

-

U – Understand Rotation: Track where money is actually flowing – Super Six, small caps, value, or defensives.

-

R – Retracement Zone: Look for orderly pullbacks to the 20/50MA in leaders.

-

N – Nail the Power Zone: When momentum + volume + setup align, execute.

-

-

-

Act 2 (Santa Window – last 5 trading days of Dec + first 2 of Jan):

-

Historically a tailwind period as funds dress up books and retail money flows in.

-

Game plan:

-

Start building starter positions into quality leaders on controlled red days like today.

-

Use options for defined-risk call spreads instead of loading common at all-time highs.

-

Let the Financial Flywheel spin: compounding small, asymmetric edges, not swinging for one massive “Christmas miracle” trade.

-

-

“You don’t need Santa to save you.

You need a system that doesn’t care who’s in the red suit.”

CYBER MONDAY EDITION

Last year, Americans spent over $12 billion on Cyber Monday… while the average household had less than $5,000 invested in the stock market.

Let that hit:

People will drop thousands on TVs, gadgets, and glittery distractions…

but freeze up at the idea of investing $500 into an asset that could pay them for the rest of their life.

Here’s the freedom punchline:

Consumerism compounds your clutter.

Investing compounds your freedom.

Every Cyber Monday, millions buy things that lose value instantly.

Time Freedom Traders buy positions that gain value relentlessly.

Which side of the compounding coin do you want to be on?

The shopper or the shareholder?

Because one of them wakes up on December 26th with boxes.

The other wakes up with options.

The NBER officially declared the U.S. in recession.

-

The S&P 500 dropped nearly 9% in a single day.

-

Headlines screamed end of the world…

-

But traders who studied the panic instead of marrying it were buying assets that would 3–5x over the coming decade.

Cyber Monday Surprising Truth:

-

For over a decade, Cyber Monday has consistently ranked as the biggest online shopping day in the U.S.

-

Billions flood through “Add to Cart” in 24 hours while most people never ask:

“If I can impulse-buy a TV, why can’t I intentionally buy assets?”

TFT Takeaway:

-

Every Cyber Monday, the crowd buys things that depreciate.

-

Time Freedom Traders use those same consumer trends to buy businesses that appreciate.

-

One group gets boxes on the porch.

-

The other gets dividends, compounding and time freedom.

Which group are you training to be in?

.

“The desire for constant action irrespective of underlying conditions is responsible for many losses on Wall Street, even among the professionals.”

— Jesse Livermore

DECEMBER IS YOUR FINAL EXAM

- Proverbs 21:5

“The plans of the diligent lead surely to abundance,

but everyone who is hasty comes only to poverty.”

Why this matters for Time Freedom Trading today:

-

December is the final exam on your discipline this year.

-

You can:

-

Chase every red/green candle like it’s your last shot…

-

Or execute a clear plan built around catalysts, risk, and rotation.

-

Time Freedom Trading is about:

-

Diligence over drama.

-

Process over prediction.

-

Abundance over anxiety.

Ask yourself before you click today:

“Is this trade part of my plan… or part of my panic?”

Because God’s pattern is consistent:

-

Diligent planning → abundance.

-

Hasty reacting → regret.

“The abundant mind compounds.

The fearful mind cancels its own future.”

Want to "SEE" the Market Correctly?

SEE the Market Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doomscrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to THRIVE in 2025!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS