Read more of the

The W.T.F. Report

December 10th, 2025

WEDNESDAY

December 10th, 2025

It's Fed DAY and Traders are Performing Hawkish CPR

“

The market this morning looks like a patient on a hospital monitor:

Flat line on the futures… but everyone’s staring at the heart surgeon.

Jerome Powell walks in today with the monetary defibrillator.

-

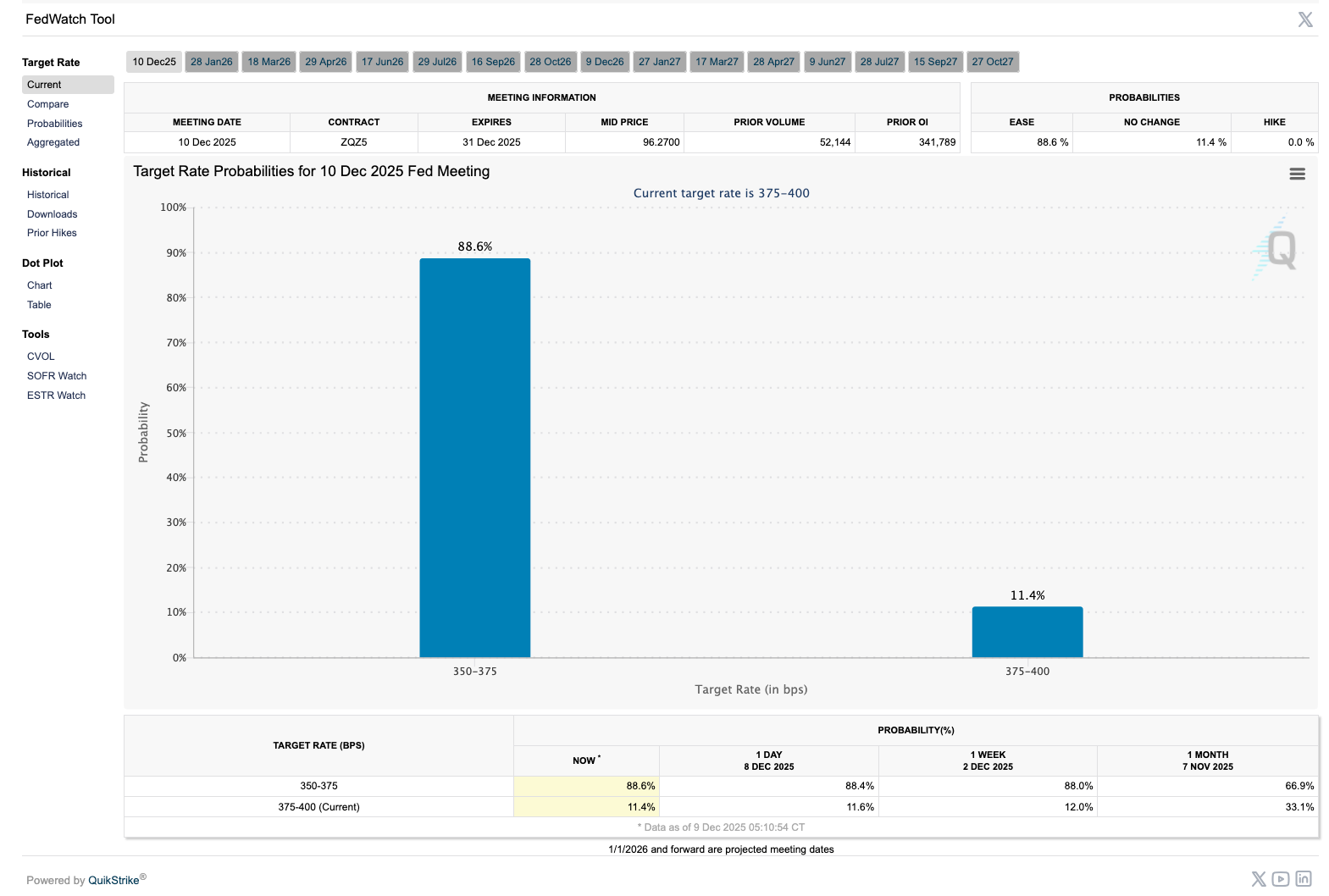

Futures have priced in ~90% odds of a 25 bps cut to 3.5%–3.75%.

-

But the buzzword is “hawkish cut” – rate down, tone up, and a DOT plot that basically says:

“Enjoy this one, don’t expect another soon.”

Meanwhile, the Russell 2000 just tagged all-time highs as small caps and regional banks front-run a lower-rate world.

Lower funding costs = oxygen to the real economy… if you know how to trade the rotation instead of watching CNBC like it’s financial Netflix.

Today isn’t “just another Fed day.”

It’s the mid-December pivot point that can either fuel the Santa Claus Rally… or pull the plug on the year-end melt-up.

FED DAY translation:

Today is the “voting” circus.

Your job is to position where the weight of money is going next.

what exactly are you waiting for… another decade of “maybe next year”?"

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

— The Bald Bull

““It never was my thinking that made the big money for me.

It always was my sitting.”

— Jesse Livermore

You’re paid to wait for the turn, not chase the noise.

Key Market Head lines:

What’s Moving the Tape

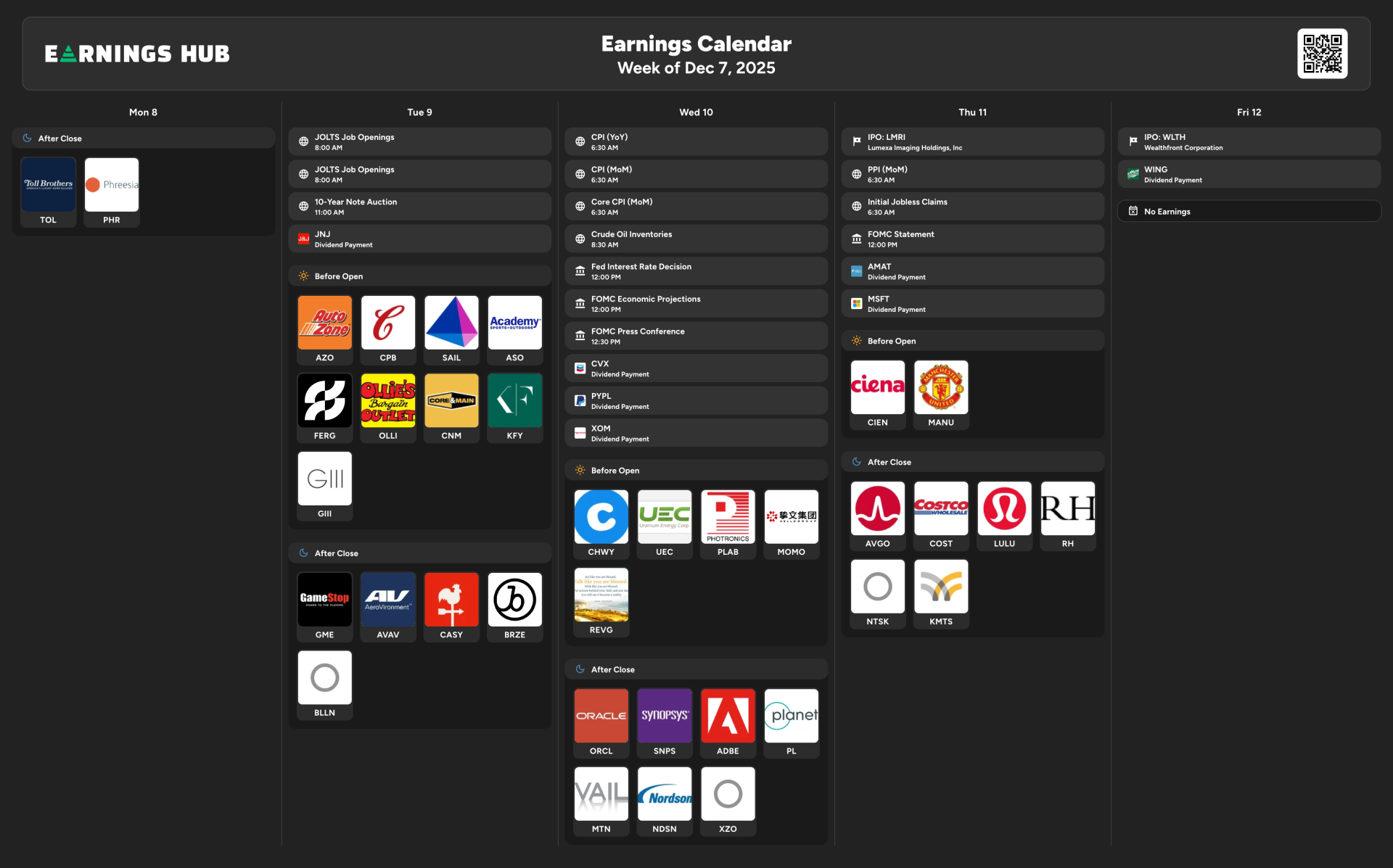

Macro: Fed, Yields & DOT Plot Drama

-

Fed decision this afternoon: Market expects a third straight 25 bps cut to 3.5%–3.75%, but with a divided FOMC and a “hawkish cut” vibe.

-

Fed funds futures: ~90% odds of the cut, but far less conviction about follow-through cuts in 2026.

-

Treasury curve this morning:

Bond market message:

“Yes, cut. No, don’t get cute

Eli Lilly (LLY): Dropping a $6B plant in Huntsville, Alabama to crank out its oral GLP-1 obesity pill orforglipron and other small-molecule meds.

-

Pfizer (PFE): Signs a $2.1B global deal with YaoPharma for an experimental oral obesity pill (YP05002) to chase the GLP-1 gold rush after buying Metsera.

Translation:

Obesity is now a multi-trillion-dollar macro factor.

If you’re not mapping this GLP-1 trade into your 2026 playbook, you’re trading like it’s 2012.

Infrastructure & Innovation

Oracle earnings tonight: Street wants proof that Larry can fund his AI infrastructure moonshot without turning the balance sheet into a debt piñata.

-

Walmart x Alquist 3D-Printed Buildings:

-

Thrive Market:

Macro takeaway:

Real estate is getting printed, booze is getting ghosted, and AI infra is the new railroad.

Apple & The Analyst Hype Machine

-

Apple (AAPL) just grabbed another big price target hike – Wedbush lifted PT to $350 on iPhone momentum and AI optimism, one of the most bullish calls on the Street.

Apple isn’t trading like a sleepy mega-cap anymore.

It’s being repriced as an AI hardware + ecosystem toll booth.

Today’s “Big Analyst Calls”

– AI & Consumer Heavy

Top notes out this morning:

-

Nvidia (NVDA) – still a Street darling with repeated PT bumps in recent weeks on AI demand.

-

Amazon (AMZN) – initiated Buy at Guggenheim, $300 PT.

-

PepsiCo (PEP) – upgraded to Overweight at JPMorgan, $164 PT.

-

Roblox (RBLX) – Buy at B. Riley, $125 PT.

-

SharkNinja (SN) – Buy at TD Cowen, $135 PT.

-

GE Vernova (GEV) – Outperform at Oppenheimer, $855 PT plus raised outlook.

Street is screaming one thing:

AI + Infrastructure + Brand-moat Consumers are where the big boys are allocating.

PRE-MARKET INTERNALS

The Flatline Before the Shock

-

DOW: +0.03%

-

S&P 500: 0.00%

-

NASDAQ: -0.06%

-

RUSSELL 2000: -0.16%

-

VIX: 17.31

-

BITCOIN: $92,340

-

GOLD: $4,226

-

OIL: $58.34

-

10-YR: 4.199%

-

DOLLAR INDEX: 99.101

Calm… but not comfortable.

This is the silence right before Powell opens his mouth.

MARKET HEAT MAP - LIVE

PreMarket: “The Winners and Losers"

STOCKS IN THE GREEN (+)

GE Vernova (GEV) – ~+10%

-

Raised multi-year revenue outlook, targeting $52B revenue and 20% EBITDA margin by 2028, and doubled its dividend plus bigger buyback.

-

-

EchoStar (SATS) – >+5%

-

Blue Owl Capital (OWL) – ~+3%

The Read:

Smart money loves cashflows + yield + duration in a lower-rate world.

STOCKS IN THE RED (–)

AeroVironment (AVAV) – >-4%

-

Missed FQ2 EPS (0.44 vs 0.78 expected) and cut full-year guidance; market clipped the drone premium.

-

-

GameStop (GME) – about -6%

-

Revenue slipped ~4.5% to $821M, missing expectations, even as EPS came in positive. Meme magic isn’t paying the bills.

-

-

Cracker Barrel (CBRL) – roughly -8%

The Read:

Miss your numbers in December and the market doesn’t give you biscuits—it gives you a beatdown.

Strengths:

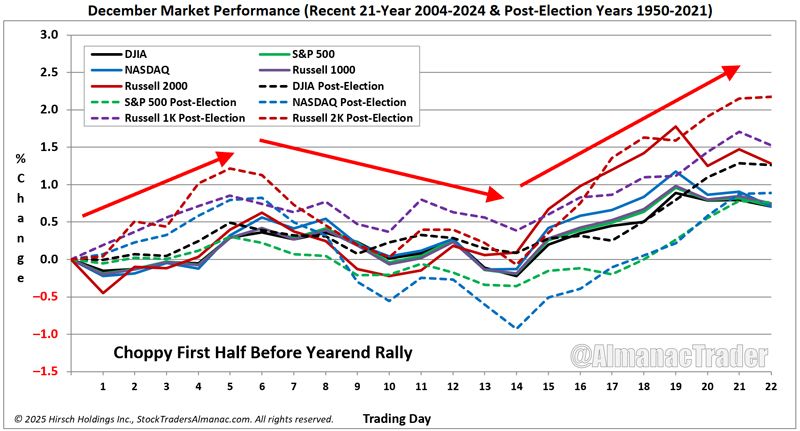

The rate-cut narrative plus December seasonality is still working in the bulls’ favor. Historically, December has been one of the strongest months, with the S&P 500 posting around +1.3% average gains over the last 35 years and the Santa Claus Rally period averaging similar returns with a high hit rate.

Add in a ripping Russell 2000 and a fresh high for small caps, and you’ve got risk appetite expanding beyond the mega-cap Magnificent Few.

Weaknesses:

Treasury yields are trying to bottom, not collapse. A 10-year camping around 4.2% means the cost of capital is still real, not free.

Plus, the Fed is politically fractured—“hawkish cut” means the committee is split between protecting jobs and fighting inflation. That indecision can translate into choppy tape and head-fake moves on intraday charts.

Opportunities:

GLP-1 obesity wars (Lilly, Novo, Pfizer) and AI infrastructure (Oracle, hyperscalers, chip leaders) are turning into multi-year capital flows, not one-quarter fads.

Add in 3D-printed commercial real estate and the alcohol-free consumer trend, and you have new secular themes that can be harvested with options and swing trades across 2026.

Threats:

If Powell’s tone is too hawkish—or the DOT plot signals fewer cuts ahead—the Santa Claus setup can stall, just like December 10, 2024, when the market’s year-end rally hit resistance ahead of inflation data and stocks faded.

A failed rally into year-end is often a warning shot for the next year’s returns. Santa doesn’t always show up… and when he doesn’t, bears tend to wander down to Broad and Wall.

“Smart traders

don’t fear volatility

—they invoice it."

On Dec 10, 2024, the S&P 500 stumbled for a second straight session, as the year-end rally hit resistance ahead of key inflation data. Bulls got a reminder that even strong December seasonality can pause when macro catalysts loom.

Holiday Trend Stat:

-

Since 1950, the Santa Claus Rally window (last 5 trading days of December + first 2 of January) has delivered around +1.3% average returns, with positive outcomes roughly 76%–79% of the time.

TFT Takeaway:

The end of the year historically favors bulls—but not in a straight line.

Dec 10 is often the “check-point candle”:

-

Are we pulling back to launch?

-

Or rolling over into a failed Santa setup?

Your edge: Treat each December pullback as a diagnostic, not a disaster.

December is statistically the best month of the year for U.S. stocks. Since 1950, the S&P 500 has averaged about +1.3% in December, and the Santa Rally seven-day window has delivered ~1.3% average gains with positive returns about 79% of the time—far higher than the typical 7-day stretch.

Trading Nuance:

-

Light holiday volume + tax-loss selling fatigue + year-end bonus flows = asymmetric upside for strong names on dips.

-

But failed Santa rallies often foreshadow weaker returns next year.

So ask yourself:

Are you positioned like someone hoping December works out…

or like someone systematically harvesting this seasonal edge with a playbook?

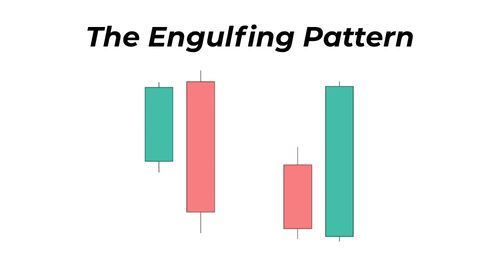

Engulfing Candle Reversal in a Trend

An engulfing candle occurs when a new candle’s body completely “swallows” the prior candle’s body, signaling a sharp shift in control from buyers to sellers (bearish engulfing) or sellers to buyers (bullish engulfing).

Backtests show bullish engulfing patterns have roughly a 60%+ reversal success rate when used with context and confirmation, with some studies citing around 63%.

One engulfing-candle algo on ES 30-min even showed ~66% win rate and 237%+ returns in a recent backtest.

How to Trade It – TFT Style:

-

Start with the T.U.R.N. Framework (Trend Context)

-

T – Tune In:

-

Confirm the bigger trend (e.g., daily uptrend) and check market internals (VIX, breadth, volume).

-

-

U – Understand Rotation:

-

Is this stock in the current money flow? Example: GLP-1, AI infra, small-cap financials.

-

-

R – Retracement Zone:

-

Price pulls back into a key zone: prior support, VWAP, daily trendline.

-

-

N – Nail the Power Zone:

-

Watch for StochRSI turning up through 20 or down from 80 as the engulfing candle prints.

-

-

-

Bullish Engulfing Entry (Trend Reversal / Turn to the Upside)

-

Look for:

-

Clear down-swing within a bigger uptrend.

-

A bullish engulfing candle that closes near its high and fully engulfs the prior red candle.

-

-

Entry idea:

-

Enter on the next candle above the engulfing high (confirmation).

-

Stop below the engulfing low.

-

Target: prior swing high for options, choose a slightly ITM call dated 1 week - to 5 months out depending trade time frame chart to capture trend continuation.

-

-

-

Bearish Engulfing Entry (Trend Reversal / Turn to the Downside)

-

In a clear uptrend, wait for:

-

Price running into resistance (prior high, supply zone).

-

A bearish engulfing candle that swallows the prior green candle and closes near the low.

-

-

Entry idea:

-

Enter below the engulfing low on the next candle.

-

Stop above the engulfing high.

-

Use puts or short-biased spreads when broader market internals support downside.

-

-

-

Risk Management – Defend the Flywheel.

-

Only take engulfing setups aligned with the macro tide (e.g., don’t slam bearish engulfings right into Santa Claus Rally season unless yields and Fed tone support a breakdown).

-

KEY PRINCIPLE:

You don’t chase the candle;

you trade the context around it.

Engulfing candles are “power handoff bars” – they show where one side finally rips the steering wheel away from the other. You’re not predicting the turn—you’re waiting for the handoff, then riding the direction of force.

“The goal of a successful trader is to make the best trades. Money is secondary.”

— Alexander Elder

Your job is to trade better setups with less noise and more edge.

“Let us not grow weary of doing good, for in due season we will reap, if we do not give up.”

— Galatians 6:9

Harvest Season, Holiday Effect & Biblical Truth

Why this matters to Time Freedom Trading & Fed Day:

December is harvest season in the markets.

-

All year you’ve been sowing: learning setups, refining risk, logging trades.

-

The holiday effect (Santa Rally, lighter volume, upbeat sentiment) is the reaping window—if you’ve been faithful to the process.

-

-

The verse doesn’t say when the season hits. It just promises:

“In due season… if we do not give up.”

Trading application:

-

You don’t force trades just because it’s December.

-

You stay faithful to your system (T.U.R.N., E.D.G.E., Consistency Code), let the market’s seasonality align with your preparation, and harvest only the high-probability turns.

-

Time Freedom isn’t about one miracle trade.

It’s about compounded obedience to your edge.

Mindset check:

Are you trading today like a gambler chasing Santa…

or like a steward of your capital, patiently sowing and reaping with intention?

“The abundant

mind compounds.

The fearful mind

cancels its own future.”

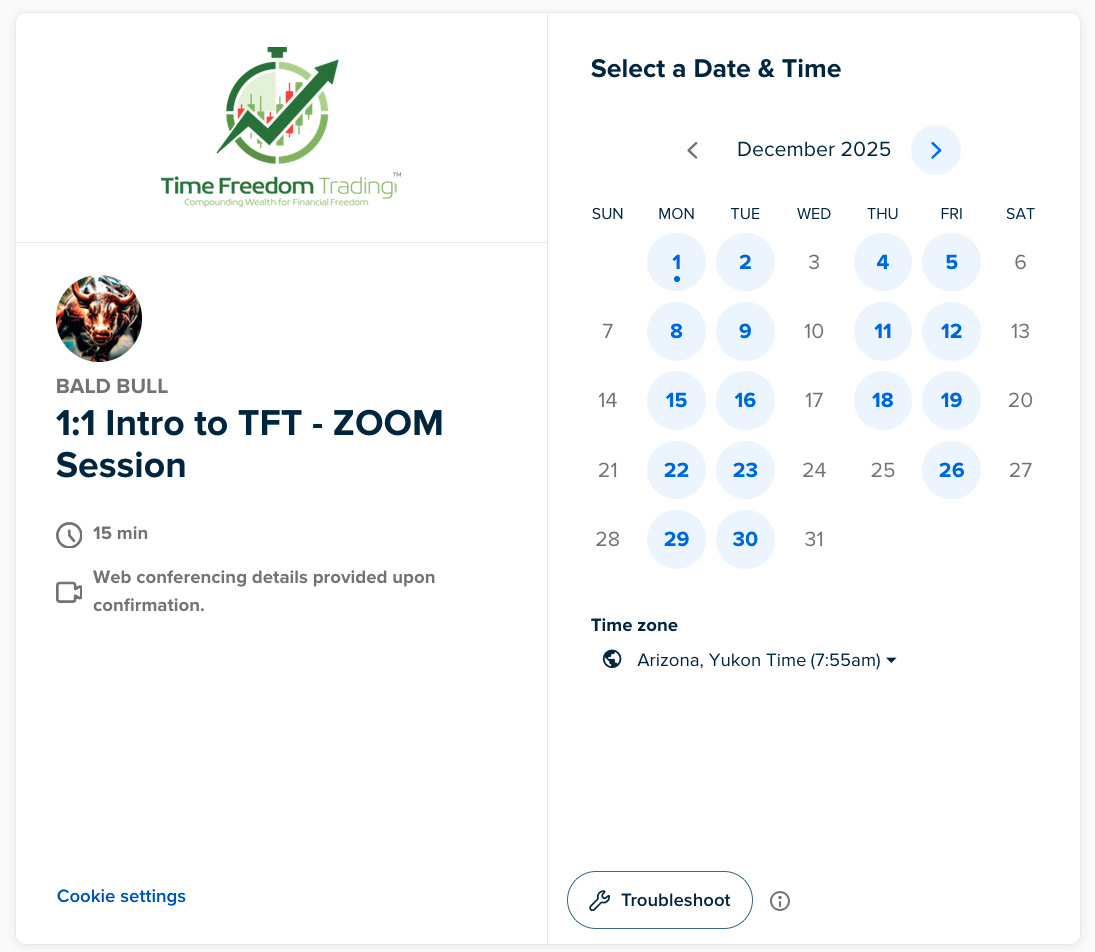

“Make 2026 the Year You Stop Renting Your Life.”

If you’re tired of letting the market, the Fed, and your calendar boss you around, it’s time to install a Wealth Operating System instead of winging it:

-

Build your Financial Flywheel so capital compounds while you work, travel, or sleep.

-

Learn to trade the turn, not the noise using the T.U.R.N. Framework and the E.D.G.E. Protocol.

-

Design a system that respects your career, your capital, and your calling—not just your FOMO.

Join Time Freedom Trading today and set up 2026 as the year your portfolio stops behaving like a side hustle and starts operating like a business.

Imagine this:

-

One year from now, looking back at Fed weeks not as “stress weeks,” but as planned opportunity windows your system already knows how to handle.

Would that change how you show up in the market?

Would that change how you show up in your life

One trade. One turn. One moment of clarity.

That’s all it takes to start compounding your way to freedom.

You’re not just waiting on the Fed.

You’re one trade away from changing your life.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doomscrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS