Read more of the

The W.T.F. Report

December 11th, 2025

THURSDAY

December 11th, 2025

The Morning After the Rate-Cut Rave

Yesterday Wall Street popped champagne for the third Fed rate cut.

This morning, everyone’s squinting at the bill… and it’s labeled “Oracle, layoffs, and AI hangover.”

The market loved Powell’s 25 bps “hawkish cut” and ripped about 1% higher. Then Oracle stepped in, missed revenue, and basically slapped the whole AI complex with a “maybe you’re overvalued, sweetheart” sticker. Meanwhile, the real story is the job market quietly wobbling while everyone pretends it’s fine.

Welcome to December: Santa rally dreams on one screen, layoff memos on the other.

The Hawkish Cut and the Shaky Job Chair

The Fed delivered rate cut #3: 25 bps off the top, language sharp enough to shave with. Markets heard “cut” and ignored “caution,” so stocks ripped and yields slipped.

But the vote was 9–3, with dissents on both sides — some wanted no cut, one wanted a bigger cut. That’s the most division since 2019, and it screams, “We’re not all convinced this easing continues.”

Powell called it an “extraordinary economy,” yet we’ve got long-term unemployed near 1.8 million and participation stuck in the low 60s.

Jobless claims around 1.838 million continuing, roughly 100K lower, sound good… until you remember layoff announcements have topped 1.1 million this year. Translation: the labor market isn’t collapsing, but the floorboards are creaking.

And yes, the Fed is quietly buying T-bills again — a stealth liquidity drip for funding markets that risk assets will happily front-run.

AI Bubble Check: Oracle Pulled the Fire Alarm

Oracle whiffed on revenue and lit $70B+ of market cap on fire, even with big AI contracts and a 400% surge in remaining performance obligations. Investors heard “massive AI capex, more debt, slower growth” and decided to hit the eject button.

The after-shock:

-

Oracle pukes double-digits.

-

AI darlings like Nvidia and friends catch friendly fire on bubble fears.

Moral of the story: you can’t just say “AI” and expect unlimited upside anymore. The market is finally asking, “Show me the cash flows, not just the capex.

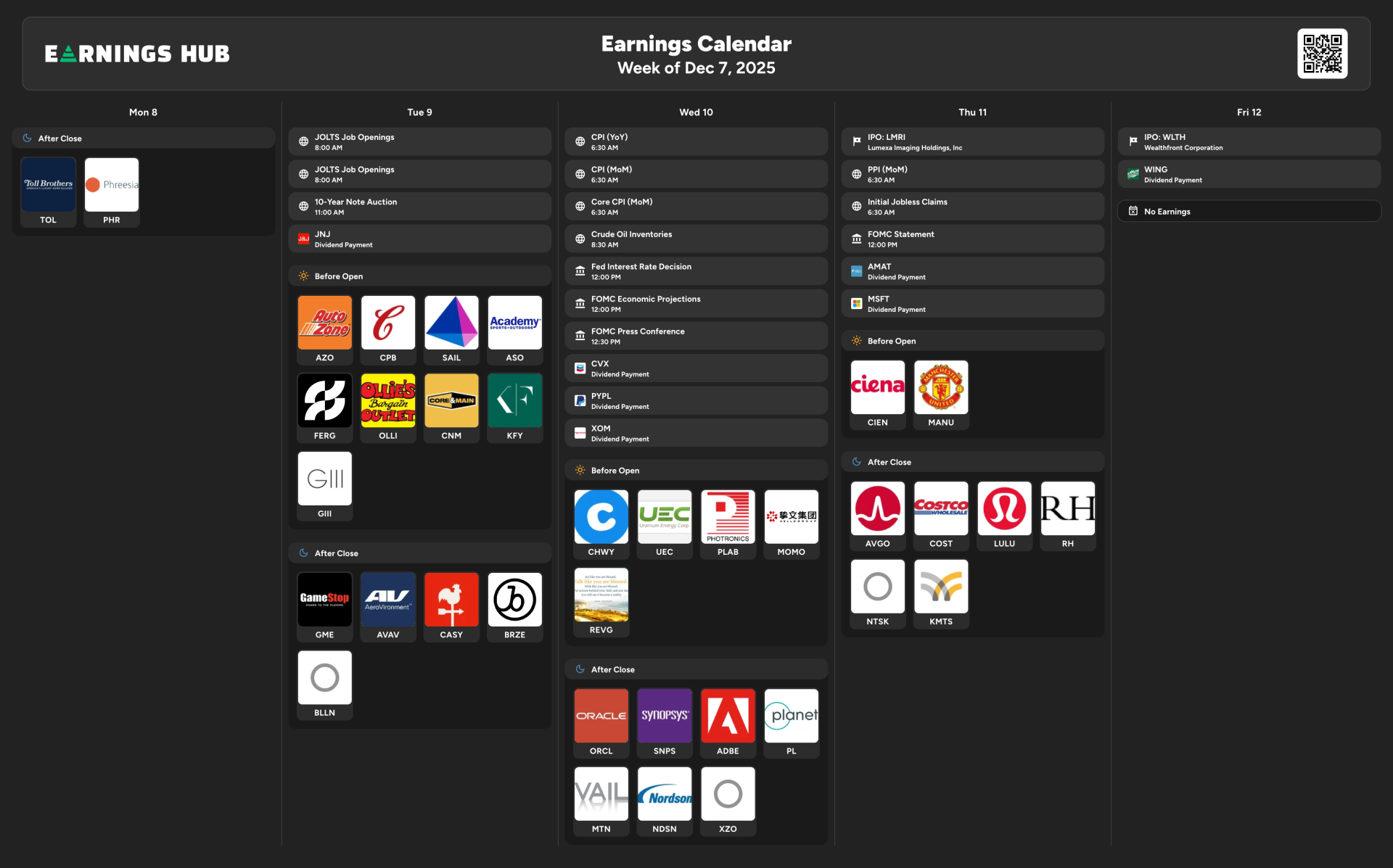

Wild Cards on Today’s Tape

-

Jobless Claims – Continuing claims near 1.838M, down about 100K. The headline is “resilient,” but Challenger’s layoff tally tells you companies are quietly tightening the payroll screws.

-

Fed Afterglow – First day of trading fully digesting Powell’s dot plot: just one cut penciled in for 2026, one in 2027. That’s not a flood; that’s a drip.

-

Rivian AI Day – EV maker trying to rebrand itself as an autonomy + AI story while still burning cash like a SpaceX booster.RFI

-

Trump Headlines – Tanker seizure off Venezuela adds a little extra geopolitical spice to an already jittery energy tape.

DISNEY + OPENAI – Disney making $1 billion investment in OpenAI, will allow characters on Sora AI video generator

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

— The Bald Bull

““It never was my thinking that made the big money for me.

It always was my sitting.”

— Jesse Livermore

You’re paid to wait for the turn, not chase the noise.

Key Market Head lines:

What’s Moving the Tape

PRE-MARKET INTERNALS

DOW ≈ +0.01% – barely breathing.

S&P 500 ≈ -0.40% – post-party pullback.

NASDAQ ≈ -0.62% – AI hangover in full effect.

RUSSELL 2000 ≈ -0.13% – small caps side-eyeing the Fed.

VIX ≈ 15.92 – calm… suspiciously calm.

BITCOIN ≈ 90,230 – still cosplaying as digital gold.

GOLD ≈ 4,241 – actual gold reminding everyone it still exists.

OIL ≈ 57.76 – cheap energy, expensive narratives.

10-YR ≈ 4.126% – yields down, questions up.

DOLLAR ≈ 98.396 – softer, but not surrendering.

MARKET HEAT MAP - LIVE

PreMarket: “The Winners and Losers"

STOCKS IN THE GREEN (+)

Planet Labs (PL)

Up around +17% pre-market after crushing revenue estimates. When you literally sell “eyes from space,” beating by almost $9M in Q3 revenue will wake up the algo crowd.

Gemini Space Station

Ripping about +15% after securing a license to run prediction markets in the U.S. This is “Vegas with data” dressed up as fintech. Regulators blinked; traders cheered.

Corbus Pharmaceuticals (CRBP)

Gaining 7%+ after Phase 1a data showed a promising safety profile and early weight-loss evidence for its obesity treatment. Another entrant in the “shrink the waist, grow the market cap” trade.

Eli Lilly (LLY)

Up roughly +2% as late-stage data on its next-gen obesity drug retatrutide shows record weight loss and reduced knee pain. The “GLP-1 plus joint relief” combo is the sort of thing actuaries and portfolio managers both drool over.

Visa (V)

Up about +1% after being tagged as a “preferred quality compounder” for 2026. When the street calls you a compounder, they’re basically saying, “Just keep swiping and send us the dividend.”

STOCKS IN THE RED (–)

Adobe (ADBE)

Off modestly after issuing meh guidance for fiscal 2026. Earnings were fine; the outlook just didn’t have enough fireworks for a market that expects every SaaS company to be a money printer on steroids.

Oracle (ORCL)

Down more than -12% after missing revenue, jacking up AI-driven capex, and spooking investors about an AI bubble. You can’t call it “chip-neutral” and expect Nvidia fanboys not to freak out.

Oxford Industries (OXM)

Getting absolutely smoked, down about -21.9% after weak guidance and a full-year EPS cut. Tommy Bahama might still sell island shirts, but the earnings aren’t sipping piña coladas right now.

Strengths

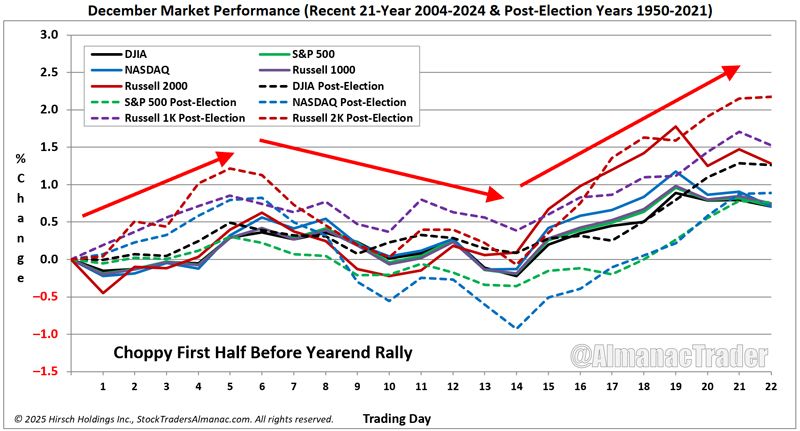

We’ve got a fresh rate cut, lower yields, and December seasonality still leaning bullish. Historically, December has delivered roughly 1.3–1.5% average gains on the S&P 500 and finished positive about 75–79% of the time. That’s a tailwind, not a headwind.

Weaknesses

The rally is increasingly narrow and AI-heavy. Oracle’s miss exposed how fragile AI sentiment is. The Fed is not promising a parade of cuts; they’re telling you the bar for more easing is high. Job data looks “fine” until you zoom out and see layoffs stacking up.

Opportunities

This kind of chop is perfect for selective rotation: quality compounders, cash-rich tech, and names that benefit from lower rates without needing AI fairy dust. Short-term, it’s a swing-trader environment where intraday reversals around catalysts are paying better than lazy buy-and-forget.

Threats

AI capex arms race, political noise, and a divided Fed. If labor cracks faster than the Fed expects, or the AI bubble narrative takes root, you get a “down, then up” December instead of a smooth Santa glide. And remember: December volatility actually ticks up on average — the VIX historically rises about +1.2 points this month.

“Smart traders

don’t fear volatility

—they invoice it."

“When the Market Blinks Before the Year Ends.”

On December 11, 2018, the stock market delivered one of the most ominous warning shots of the decade.

The S&P 500 plunged nearly 1.4%, the Dow fell over 500 points intraday, and the NASDAQ cratered more than 2% — all triggered by growing fears of a global slowdown and a hawkish Federal Reserve that refused to flinch.

It was the moment traders realized:

“Santa might skip this year.”

Yet here’s the twist…

Despite the chaos, the following two weeks staged one of the sharpest snapback rallies ever into year-end, laying the groundwork for the massive 2019 bull run.

Surprising Stat:

The S&P 500’s drop into Christmas Eve 2018 was the worst December decline since 1931 — but the rebound from Dec 26th onward was the fastest 7-day year-end recovery in modern market history.

TFT Takeaway:

December has a wicked sense of humor.

It scares you just enough to make you hesitate…

then pays the traders who stay ready.

The lesson?

Volatility in mid-December is not a threat — it’s a preview.

The real money shows up right after the shakeout.

Or in Bald Bull language:

“The market likes to yell ‘BOO!’ before it hands out the presents.”

DECEMBER = YOUR SEASONAL EDGE

Here’s a fun, slightly uncomfortable fact:

-

December is one of the strongest months of the year, with the S&P 500 averaging ~1.3–1.5% gains and finishing green about three out of four years.

-

Yet a huge chunk of that upside historically clusters in just seven trading days — the Santa window.

That means if you’re emotionally checked out, over-trading the chop before the window and under-prepared during it, you can easily miss the bulk of December’s statistical edge.

Skillful trading here isn’t about YOLO calls — it’s about knowing when not to trade and being ready with well-planned entries when the seasonal wind is finally at your back.

Freedom Fact: “Time freedom doesn’t require more trades. It requires better-timed trades.”

An engulfing candle occurs when a new candle’s body completely “swallows” the prior candle’s body, signaling a sharp shift in control from buyers to sellers (bearish engulfing) or sellers to buyers (bullish engulfing).

Backtests show bullish engulfing patterns have roughly a 60%+ reversal success rate when used with context and confirmation, with some studies citing around 63%.

One engulfing-candle algo on ES 30-min even showed ~66% win rate and 237%+ returns in a recent backtest.

“The goal of a successful trader is to make the best trades.

Money is secondary.”

— Alexander Elder

“The prudent see danger and take refuge,

but the simple keep going and pay the penalty.”

—Proverbs 22:3

THE SEASON OF SELECTIVE SOWING

December isn’t just holiday lights and market melt-ups.

It’s a spiritual checkpoint — the moment where your discipline gets tested harder than your ambition.

Everyone wants the “Santa Rally.”

Everyone wants the reward.

But the harvest belongs to the trader who knows what NOT to plant late in the season.

Too many traders force setups in December because:

-

“I want to end the year strong.”

-

“I need one more big trade.”

-

“I’ll fix my P&L before New Year’s.”

That’s not strategy.

That’s emotional agriculture.

Here’s the truth:

Late-season over-planting ruins harvests.

Late-season over-trading ruins accounts.

“The abundant

mind compounds.

The fearful mind

cancels its own future.”

December is filled with fakeouts, thin volume, and emotional traps.

The prudent trader — the one aligned with Providence — doesn’t chase noise.

They protect the flywheel, guard their edge, and wait for the moments when the market actually wants to pay them.

Mindset Reframe:

This month is not about proving yourself.

It’s about positioning yourself.

The trader who enters January with capital, clarity, and conviction will outrun the one who tried to hero-trade December.

Harvest season rewards patience — not pressure.

And the market doesn’t bless desperation; it blesses discipline.

Your mission today:

- Plant wisely.

- Protect your soil.

- Prepare for the season ahead.

Because the real compounding begins when the rest of the world stops paying attention.

“FAST FORWARD to DECEMBER of 2026"

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep trading the way you traded in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, the whole Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doomscrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your broker that allow you to place a simple trade on autopilot and minimize your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS