Read more of the

The W.T.F. Report

December 19th, 2025

"QUAD WITCH FRIDAY!"

December 19th, 2025

Quad Witch Friday = the market’s “magnet night.”

Price doesn’t “discover.” It gets dragged… toward the biggest strike like a drunk uncle to the dessert table. Expect PIN action and last-full-week-of-the-year weirdness.

Futures are barely green… which is Wall Street’s way of saying: “We’re calm… but we’re holding a live grenade.”

Today is quadruple witching—index options, single-stock options, index futures, and futures options all expire. Goldman says this one is the largest expiration on record. Translation: more hedging, more chop, more “why did my candle just teleport?”

Also: Nike face-planted premarket after warning sales slide (holiday season, but make it awkward).

Oracle pops on the TikTok U.S. sale headline, trying to re-inflate the “AI trade” balloon after it squeaked this week.

And yes—Trump signed an executive order directing marijuana be reclassified to Schedule III, a real policy catalyst with real sector implications.

What’s Driving the Tape...

PRE-MARKET STATS

DOW +0.01%

S&P +0.11%

NASDAQ +0.23%

RUSSELL +0.20%

VIX 16.44 (translation: not panic… but not cuddly)

BTC 88,055

Gold 4,361

Oil 56.53

10-Yr 4.150

DXY 98.57

Today’s Market Catalysts

1) “CPI was softer… but maybe too soft.”

NY Fed’s Williams basically said the CPI print had “technical factors” because data collection got weird (shutdown distortions). So the number might be understated by roughly a tenth. The market heard: “Rate cuts later?” and started smiling with one eyebrow raised.

2) Quad Witch = gamma games + closing magnets

Big expirations can turn price into a tug-of-war between dealers hedging and traders gambling. That’s where PIN shows up: price hovering near heavy open-interest strikes into the close.

3) AI trade: shaky, not dead

Oracle headline helps stabilize the “AI infrastructure” mood. Micron strength is the emotional support animal. Semis still aren’t back at highs, but the market is trying to remember why it loved them in the first place.

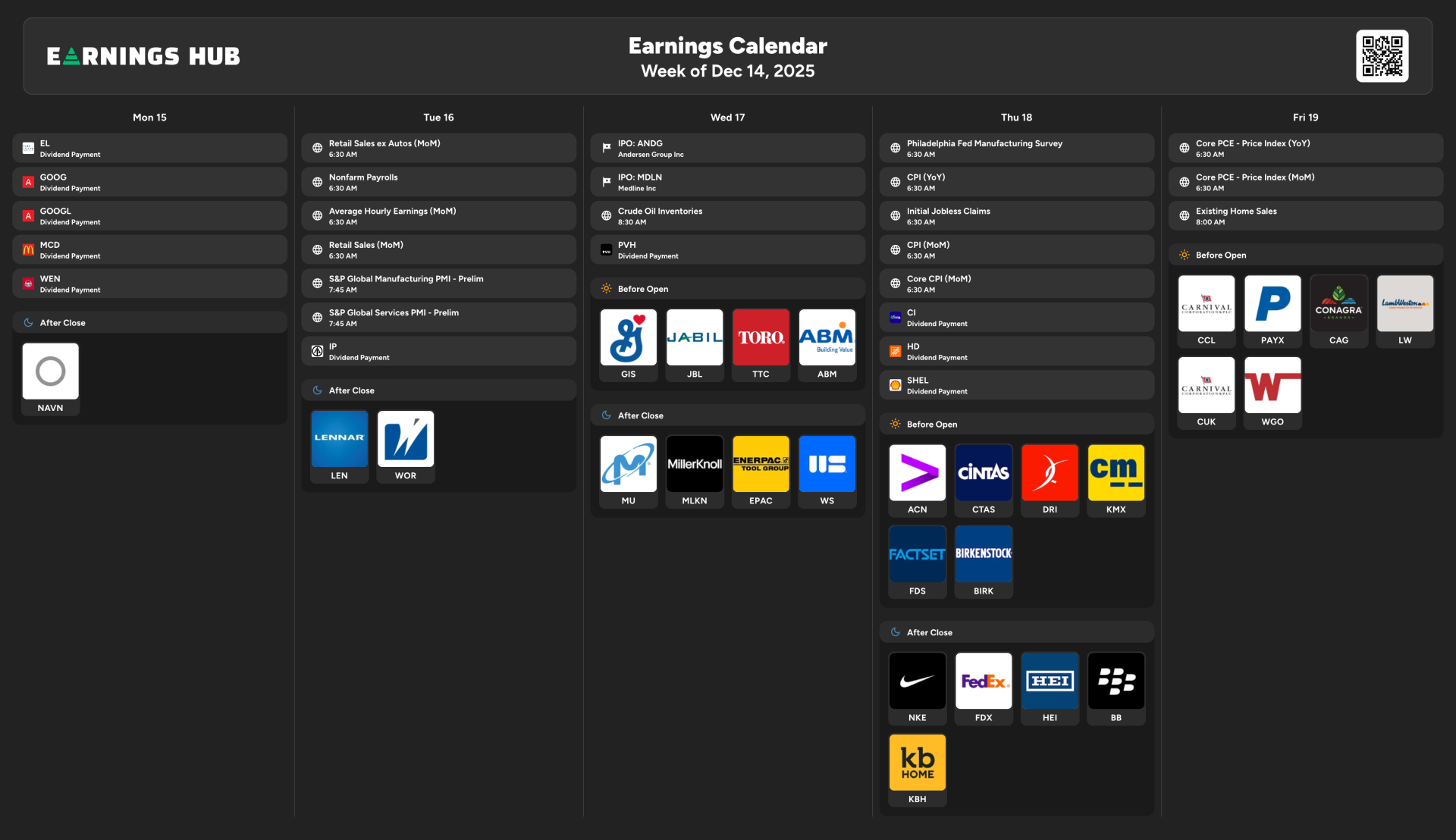

Key Market Events Today

-

8:30am ET: NY Fed President John Williams TV appearance (markets love a central banker with a microphone).

-

Consumer data remains noisy (shutdown hangover). Treat “precision” like it’s optional today.

““It never was my thinking that made the big money for me.

It always was my sitting.”

— Jesse Livermore

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

MARKET HEAT MAP - LIVE

PreMarket: “The Winners and Losers".

STOCKS IN THE GREEN (+)

CoreWeave +5.5% — DOE “Genesis Mission” + Citi coverage restart.

Oracle +5.0% — TikTok U.S. ops sale JV headline = sentiment jolt.

Generac +3.0% — upgrade fuel; AI data centers still need backup power.

Coinbase +3.0% — SEC guidance = clarity drip.

Bitcoin miners ~+3.0% — Terawulf, CleanSpark, Riot riding the risk-on bounce.

STOCKS IN THE RED (–)

Quad Witch Friday / Final Full Week Energy

Strengths — Structure still exists under the chaos

Despite the quad witch circus, the market is not falling apart. Breadth is bruised, not broken. The S&P is still holding above key trend structure, and dips this week have been met with buyers who know exactly where they want inventory. AI didn’t implode—it wobbled, reset, and is now selectively rebidding (Oracle, Micron, Nvidia). That tells you institutions aren’t abandoning risk; they’re rotating and re-pricing it. Strength right now isn’t speed—it’s selectivity. The market still rewards traders who wait for alignment instead of chasing headlines.

Weaknesses — Distorted data + distorted price action

CPI being “technically soft” is a polite way of saying conviction is fuzzy. When macro data reliability drops, options and gamma flows start driving price more than fundamentals. Add quad witching and you get candles that look drunk, not directional. This is where overtrading gets punished fast. Holiday liquidity thins out. Spreads widen. Stops get hunted like it’s open season. The weakness isn’t the trend—it’s execution risk for undisciplined traders.

Opportunities — Pin action is a professional’s playground

Quad witch creates one of the few times where price behavior becomes predictable—not because it trends, but because it sticks. Heavy open interest at key strikes can magnetize price into the close. That’s an opportunity if you’re trading defined risk or harvesting premium, and a landmine if you’re chasing breakouts. Sector-wise, the opportunity is in rotation confirmation: AI infrastructure stabilizing, energy staying bid, crypto equities waking up, and defensives quietly holding ground. The market is whispering, not shouting. Pros listen to whispers.

Threats — Ego, boredom, and false confidence

The biggest threat isn’t volatility—it’s boredom-driven clicks. Traders see green futures, hear “record options expiration,” and think today must deliver fireworks. Sometimes quad witch explodes. Sometimes it pins like paint drying. Misreading that reality leads to forcing trades in low edge conditions. Add headline risk (policy, geopolitics, AI regulation), and you’ve got snap reversals that can erase a week’s work in minutes. The real threat is forgetting that not trading is a position—and often the best one this time of year.

TFT Bottom Line:

This is a market for professionals protecting capital, not tourists chasing dopamine. Strength is patience. Opportunity is precision. Weakness is impatience. Threat is ego. Trade accordingly—or let December teach you the lesson again.

“Smart traders

don’t fear volatility

—they invoice it."

The Close Imbalance Playbook |

Quad Witch Edition (Pre-Christmas)

Over the last decade, more than 30% of total daily volume on Quad Witch Fridays prints in the final 15 minutes, and nearly half of that flows through the closing auction—not the regular tape.

Translation?

The real trade doesn’t happen all day.

It happens when the bell is already breathing down your neck.

Why This Quad Witch Is Different

This December Quad Witch is shaping up to be the largest notional expiration in history, landing one week before Christmas—when liquidity thins, emotions rise, and institutional books must rebalance.

That combination creates a rare condition:

- Forced flows

- Mechanical execution

- Price moves without headlines

That’s not chaos.

That’s structure

The Close Imbalance Playbook (Simple. Tactical. Repeatable.)

1. Respect the Clock — Not the Candle

From 3:30–4:00pm ET, price stops telling stories and starts following orders.

This is not TA theater.

This is supply and demand getting finalized.

2. Imbalance > Indicators

Large buy or sell imbalances into the close matter more than RSI, MACD, or your favorite squiggly line.

Why?

Because these orders must be filled. No opinions. No delays.

3. Direction Follows Force

On Quad Witch Fridays:

- Buy imbalance → late squeeze

- Sell imbalance → air pockets into the bell

Especially in:

- Index ETFs (SPY, QQQ, IWM)

- Mega-cap hedges

- High-volume names tied to index weighting

4. December Rule: Don’t Chase — Anticipate

The edge is positioning before 3:50pm, not reacting at 3:59pm.

Institutions show their hand early.

Retail reacts late.

5. Monday Matters More Than Friday

Here’s the nuance most traders miss:

Quad Witch flows often echo into the following Monday open, especially in December when desks want clean books before holidays.

The close is the signal.

The next session is the payoff

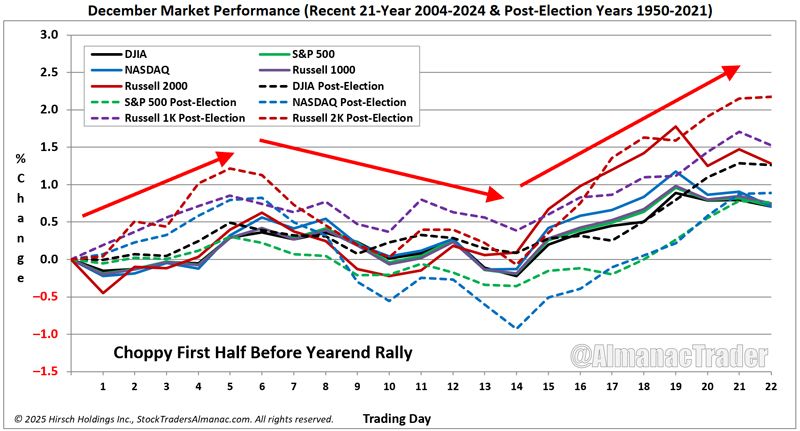

Seasonal Nuance (Pre-Christmas Edge)

December Quad Witch isn’t about speculation.

It’s about inventory control.

Funds aren’t trying to be right.

They’re trying to be done.

That creates:

- Cleaner directional closes

- Faster resolution

- Less chop, more intent

Perfect conditions for traders who wait instead of guess

“Most traders watch candles.

Professionals watch clocks.

Gut Check

If institutions are forced to move billions at the close…

and you’re still trading like it’s a random Friday—

what exactly are you competing against

One trade. One close. One moment of clarity.

That’s how freedom compounds.

Tomorrow’s letter will break down how to spot the imbalance early—and when not to touch it.

Because average traders react.

Time Freedom Traders operate.

“Amateurs think about how much money they can make. Professionals think about how much money they could lose.” — Jack Schwager

Market Memory: Dec 19, 2018 sits inside the brutal Q4 2018 slide—when tightening + fear + liquidity stress turned “normal pullbacks” into a clinic on pain tolerance. The Fed meeting wrapped Dec 19, 2018, and the tone of that period became part of the market’s long memory about policy risk.

The Santa window doesn’t start “early December.” It’s a specific 7-session stretch—and when traders front-run it, you often get chop first… then the move later. In other words: the market loves to make impatient people pay tuition.

TFT Takeaway:

Holiday edges reward precision and patience, not “I’m bored, so I clicked.”

“In investing, what is comfortable is rarely profitable.” — Robert Arnott

Holiday volume is thin. Your discipline can’t be.

“The goal of a successful trader is to make the best trades.

Money is secondary.”

— Alexander Elder

Harvest, Seasonality, and 2026 Providence

“The sluggard does not plow in the autumn; he will seek at harvest and have nothing.”

— Proverbs 20:4.”

December is harvest season emotionally: everyone wants results now. But markets don’t pay you for urgency. They pay you for alignment—catalyst, trend, setup, confirmation.

Why it matters:

Your weekend prep is the plow. Your rules are the furrows. Your patience is the seedbed. If you skip the process, don’t act shocked when the market hands you… nothing.

NEPQ gut-check:

If you keep trading holiday chop like it’s a normal week… what do you think that teaches your nervous system—skill… or sabotage?

Rhetorical Consequence Question (call-out for inaction):

If you refuse to plan this weekend, and you get chopped up next week… are you going to blame the market again… or finally admit you didn’t deserve better results?

“The abundant

mind compounds.

The fearful mind

cancels its own future.”

IS TIME FREEDOM TRADING TAX DEDUCTIBLE?

If you’re paying for trading education but not structuring it properly…

you might be overpaying twice.

Once to learn.

Again at tax time.

Most traders guess.

The IRS doesn’t reward guessing — it rewards structure.

We broke down exactly when trading education may qualify as a tax deduction, how active traders set it up CPA-clean,

and what documentation actually matters.

👉 Read this before your CPA does:

Trading Education Tax Deduction – CPA-Ready Guide

Rhetorical Consequence Check:

If you’re already investing in your edge…

why let bad structure erode it?

“FAST FORWARD to DECEMBER of 2026"

If you want 2026 to be the year you stop reacting and start operating… join Time Freedom Trading.

You’ll learn to:

-

Trade the retracement instead of chasing breakouts late

-

Use the 50MA/200MA like a pro (structure, bias, risk)

-

Build a Wealth Operating System that compounds skill into freedom

Because the clock’s not ticking — it’s compounding.

And the market doesn’t pay hope… it pays execution.

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep living the way you lived in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, build a Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doomscrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your

broker that allow you to place a simple trade on autopilot and minimize

your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

#23 Bear Markets: How to Spot One Before It Mauls Your Portfolio (And Your Sanity)

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#39 The Liability of Concentration Risk

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS