Read more of the

The W.T.F. Report

January 8th, 2026

THURSDAY

JANUARY 8, 2026

The Counter-Punch Day”

The Dow Jones Industrial Average tagged another all-time high, took a victory lap… then promptly sat down. Santa skipped Wall Street this year—no rally, just sideways chop dressed up as optimism. Now it’s Thursday, the market’s favorite day to fake left and hook right. Futures are red. Not panic red. More like “trim the fat, test conviction” red.

This is where amateurs chase and operators wait.

“Price is the final arbiter of truth.”

— Paul Tudor Jones

What’s Driving the Tape...

Defense ripped higher after Donald Trump floated a $1.5T “Dream Military” budget for 2027.

Northrop Grumman, Lockheed Martin, and RTX caught bids like it’s a Cold War reboot.

Housing chatter cooled as policy talk swirled around limiting institutional buyers. Translation: less BlackRock, more backyard BBQ dreams.

Treasury Secretary Scott Bessent hinted rate cuts are the missing spice—markets heard “eventually,” not “tomorrow.”

Tech divergence widened. Alphabet briefly leapfrogged Apple in market cap. AI arms race, different lanes.

Private AI is on steroids: Anthropic inks a $10B term sheet at a nose-bleed valuation. The gap between users and used keeps widening.

What the Tape Is Whispering

Equities are backing up, not breaking. The Dow (-0.33%) and Russell (-0.32%) are doing the heavy lifting on the downside, classic early-year profit trimming after flirting with all-time highs. The S&P (-0.10%) and Nasdaq (-0.13%) are barely bruised—more yawn than panic. This is digestion, not distress.

Volatility is awake but not dangerous. VIX at 15.71 says traders are alert, not afraid. Think espresso, not Red Bull. Enough movement to price risk, not enough to scream “run.”

Risk assets are still flexing. Bitcoin at $91,000 remains a billboard for excess liquidity and speculative confidence. No fear here—just conviction with a smirk.

Hard assets are quietly screaming inflation. Gold at $4,438 and Silver at $74.62 aren’t hedges anymore—they’re statements. The market is pricing long-term currency skepticism while smiling politely about it.

Energy is soft but stable. WTI at $57.11 and Brent at $60.88 suggest supply optimism mixed with geopolitical noise. No energy panic—just range-bound realism.

Rates are sticky. The 10-year at 4.178% tells you the bond market still isn’t buying the fairy tale of aggressive cuts. Higher for longer is still in the room, arms crossed.

The Dollar at 98.89 is firm, not dominant—strong enough to matter, not strong enough to choke risk.

Bottom line:

This is a controlled pullback with confidence intact. Capital isn’t fleeing—it’s rotating. Thursday is doing what Thursdays do best: shaking weak hands before the next decision point.

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

MARKET HEAT MAP - LIVE

STOCKS IN THE GREEN (+)

Kratos Defense ~+13% — small cap, big rockets.

Northrop Grumman ~+8.5% — stealth wealth.

Lockheed Martin ~+8% — cashing the budget check.

L3Harris Technologies ~+8%.

Applied Digital ~+5% — hyperscaler whispers.

Gap ~+4% — Wall Street loves a comeback story.

STOCKS IN THE RED (–)

Shell ~-2% — trading desk taking a breather.

Alcoa ~-3.8% — downgrade gravity.

Strengths

The market’s spine is still straight. Indexes are pulling back from record highs, not collapsing through trapdoors. That matters. Volatility is contained, liquidity is present, and leadership hasn’t vanished—it’s rotating. Defense, AI infrastructure, and selective tech strength tell us capital is repositioning, not retreating. This is a market that still believes in growth but insists on better entries. Strength right now isn’t price acceleration—it’s structure. Higher lows. Controlled VIX. Orderly profit-taking. That’s how bull markets rest without breaking.

Weaknesses

Momentum has gone on vacation without leaving a forwarding address. Breadth is thinning, follow-through is inconsistent, and breakouts are getting sold faster than bad ideas at a risk committee meeting. The Santa rally fizzled, and that psychological letdown matters—expectations were high, delivery was sideways. Add in sticky rates and policy noise, and you’ve got a tape that punishes impatience. Weakness here isn’t bearishness—it’s friction. The market is forcing traders to slow down, size down, or get chopped up.

Opportunities

This is a professional’s playground. Thursday counter-trend behavior, pre-earnings positioning, and January rebalancing create clean, tactical windows for those who wait. Pullbacks into defined support. Volatility pops you can sell. Rotation you can follow—defense, energy-adjacent plays, AI infrastructure, and selective cyclicals tied to real cash flow. Opportunity right now is not about predicting headlines; it’s about executing process. The setups are there for traders who respect timing and risk. Precision beats prediction—again.

Threats

Policy roulette is the wild card. One comment, one tweet, one surprise headline can whipsaw entire sectors before lunch. Rates remain the quiet assassin—higher-for-longer keeps valuation multiples on a short leash. Earnings season looms, and it will expose who’s been swimming naked under the liquidity tide. Add geopolitical noise and overconfident retail positioning, and the biggest threat becomes emotional decision-making. This market will happily punish leverage, laziness, and late entries. The threat isn’t the market—it’s traders ignoring what the market is telling them.

Bottom line:

This isn’t a market to chase. It’s a market to operate. Strength is structural. Weakness is tactical. Opportunity rewards patience. Threats punish ego. Trade accordingly.

“Smart traders

don’t fear volatility

—they invoice it."

Pre-Earnings January Play: The Thursday Counter-Trend Fade

The Setup:

-

Identify stocks extended from Monday–Wednesday.

-

Look for Thursday morning pullbacks into VWAP/21-EMA.

-

Use defined-risk options (short-dated puts/calls against the prior move).

-

Take profits quickly. This is a rotation scalp, not a marriage.

Why It Works (Surprising Stat):

Over the last 20 years, Thursdays ahead of major jobs data see counter-trend moves ~62% of the time as funds de-risk and rebalance exposure. Professionals hedge.

Retail chases. Guess who wins.

“Markets are strongest when they frustrate the most people."

— Mark Douglas

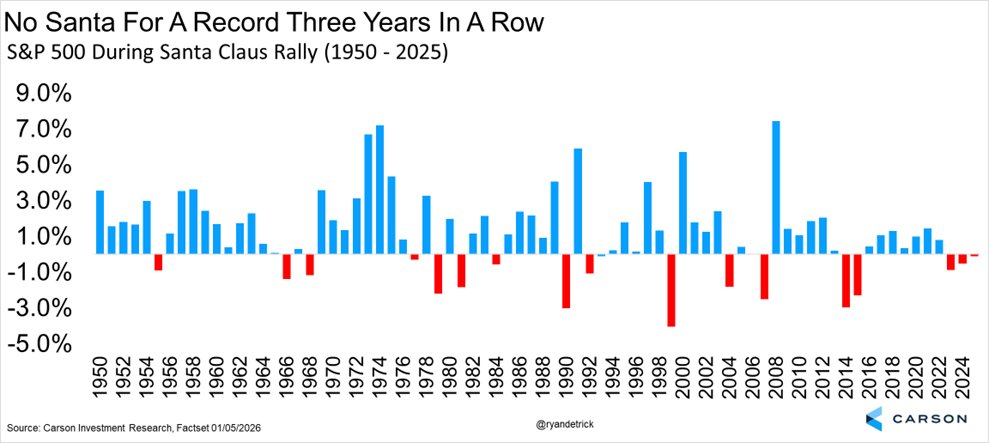

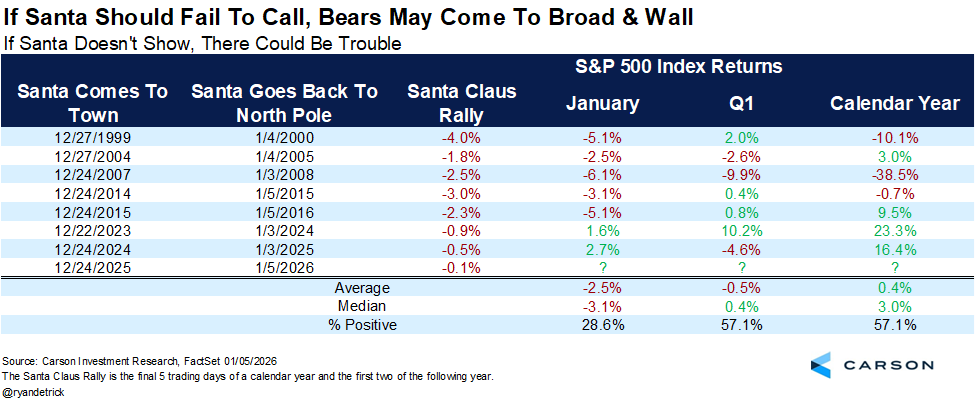

When Santa Doesn’t Show Up:

The January That Follows

When the Santa Claus Rally fails—the last 5 trading days of December plus the first 2 of January—the market isn’t whispering.

It’s warning.

History treats a missing Santa like a yellow light, not a crash alarm. But it does change how January tends to behave.

Here’s the reality traders need to respect.

What a Failed Santa Rally Signals

A no-show Santa usually tells you one thing clearly:

risk appetite is selective, not generous.

Funds didn’t chase year-end performance.

Managers protected books instead of window-dressing.

Liquidity stayed cautious.

That means January doesn’t start with a party—it starts with positioning.

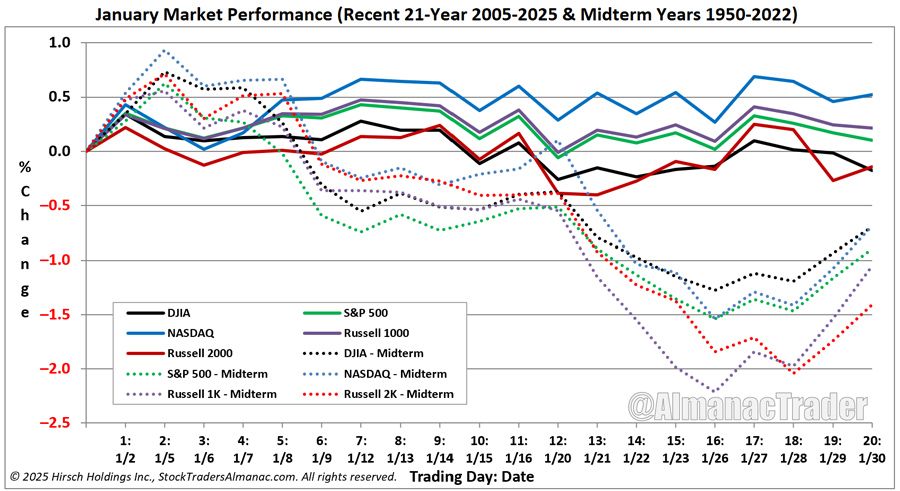

How the Rest of January Typically Trades

1. January Becomes a “Reset Month,” Not a Runway

Instead of trend continuation, January often delivers:

-

Choppier price action

-

Deeper pullbacks

-

Faster rotations

This is where weak hands get shaken and narratives get tested.

2. Early-January Strength Gets Sold

When Santa fails, early January pops—if they appear at all—are often:

-

Sold into resistance

-

Used to rebalance risk

-

Opportunities for counter-trend trades

Think fade the enthusiasm, not chase it.

3. Volatility Expands Before Direction Emerges

A missing Santa increases the odds that:

-

VIX creeps higher through mid-January

-

Ranges widen

-

False breakouts multiply

Direction usually doesn’t clarify until earnings season forces the truth.

4. Stock Pickers Win, Index Chasers Suffer

Broad indexes struggle to trend cleanly.

But underneath the surface:

-

Defense, energy, and cash-flow names often outperform

-

Over-owned growth gets repriced

-

High-multiple hope stocks lose patience premiums

January becomes a rotation market, not a momentum market.

The Psychological Trap

Retail traders expect January to “make up” for December.

That expectation is dangerous.

Historically, when Santa fails:

-

January is more likely to underperform its reputation

-

The real opportunity shifts to late January → February, after positioning and earnings clarity

The market doesn’t owe anyone a bounce.

TFT Tactical Takeaway

When Santa doesn’t show:

-

Trade levels, not opinions

-

Favor counter-trend Thursdays and mean reversion

-

Use January to build cash and data, not hero trades

-

Let earnings, not hope, set direction

January becomes a training ground for discipline.

Those who survive it with capital intact tend to thrive when trends return.

The Big Insight

A missing Santa doesn’t predict doom.

It predicts work.

The market shifts from celebration to inspection.

From generosity to judgment.

From narratives to numbers.

And that’s where prepared traders quietly build their edge.

Because in markets—just like life—

when gifts don’t arrive, skill starts to matter.

“You don’t need to trade often.

You need to trade well.”

| Jesse Livermore

In multiple historical cycles, markets paused or pulled back just before major macro releases, only to resume trend after clarity.

Takeaway: The pause is the signal. Patience prints.

Discipline in the Pause

Today isn’t about being right.

It’s about being ready.

Thursday is the market’s lie detector. It exposes who’s trading a system—and who’s trading a feeling. After record highs, sideways action, and headline noise, the temptation is to do something just to feel productive. That urge is expensive. Professionals understand a hard truth: rest is part of the trend.

The market is pausing to test your discipline.

Most traders confuse motion with progress. They click to feel smart. They chase to feel in control. But control in trading is an illusion—stewardship is the skill. You don’t command outcomes. You manage risk, timing, and behavior. When the tape slows, the edge shifts from execution to restraint.

This is where maturity shows up.

A disciplined trader can sit through boredom without forcing a trade.

A professional investor can watch others chase, knowing patience compounds faster than panic.

A Time Freedom Trader measures success by process fidelity, not dopamine hits.

Ask yourself the uncomfortable question today:

Am I trading to grow my account—or to soothe my emotions?

Because Thursday doesn’t reward urgency.

It rewards alignment.

“Be still before the Lord and wait patiently for Him; do not fret when people succeed in their ways.” — Psalm 37:7

Stillness isn’t passivity. It’s confidence without noise. Waiting isn’t weakness. It’s trust in process. In trading—and in life—those who rush usually pay those who wait.

Mental Model for Today:

Faith gives you why.

Stoicism trains you how.

The system tells you what.

Providence handles the outcome.

Your job today is simple—but not easy:

Protect capital.

Honor the plan.

Let patience do the heavy lifting.

Because the real edge isn’t speed.

It’s self-mastery.

“FAST FORWARD to DECEMBER of 2026"

If you want 2026 to be the year you stop reacting and start operating… join Time Freedom Trading.

You’ll learn to:

-

Trade the retracement instead of chasing breakouts late

-

Use the 50MA/200MA like a pro (structure, bias, risk)

-

Build a Wealth Operating System that compounds skill into freedom

Because the clock’s not ticking — it’s compounding.

And the market doesn’t pay hope… it pays execution.

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep living the way you lived in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, build a Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

IS TIME FREEDOM TRADING TAX DEDUCTIBLE?

If you’re paying for trading education but not structuring it properly…

you might be overpaying twice.

Once to learn.

Again at tax time.

Most traders guess.

The IRS doesn’t reward guessing — it rewards structure.

We broke down exactly when trading education may qualify as a tax deduction, how active traders set it up CPA-clean,

and what documentation actually matters.

👉 Read this before your CPA does:

Trading Education Tax Deduction – CPA-Ready Guide

If you’re already investing in your edge…

why let bad structure erode it?

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doom scrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your

broker that allow you to place a simple trade on autopilot and minimize

your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

26 DECISIONS THAT WILL DECIDE YOUR 2026

NEW YEAR: UNCERTAIN TIMES. CERTAIN EDGE.

#44 YOUR TRAINING YOUR AI REPLACEMENT.

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS