Read more of the

The W.T.F. Report

January 16th, 2026

Friday

JANUARY 16, 2026

1st Option Expiration Friday of the Year!

The market’s first real stress test.

Think of it as Wall Street’s sobriety check

after the champagne.

OPEX Friday

Welcome to OPEX Friday, aka the day the market takes your

confidence, shakes it upside down, and checks for loose change.

Yesterday the chip complex strutted around like it owns the place (because right now… it kind of does), and this morning futures are green-ish while the S&P sits just under 7,000 like a bouncer outside a club you swear you’re on the list for.

Overhead resistance is real.

So is the temptation to YOLO into it.

Don’t.

Today is about flows, pinning, and dealer gravity.

Not “vibes.”

PRE-MARKET STATS

The tape looks calm.

That’s how it lies before it moves.

-

DOW: +0.03%

Flat and polite. No conviction. Just standing there pretending it has a plan. -

S&P 500: +0.13%

Inch-by-inch toward 7K… still knocking, not kicking the door in. -

NASDAQ: +0.45%

Tech doing tech things. Chips lifting. Risk appetite quietly flexing. -

RUSSELL 2000: +0.09%

Small caps showing up late. Coffee in hand. No leadership badge yet. -

VIX: 15.70

Volatility wearing a calm mask. Don’t confuse quiet with safety. -

BITCOIN: $95,970

Still acting like it wants six figures. Risk is alive, just selective. -

GOLD: $4,603/oz — more upside

Not fear… foresight. Big money still hedging with intention. -

SILVER: $88.91/oz

Gold’s rowdy little brother refusing to sit down. -

OIL (WTI): $59.80

Energy holding firm. Inflation whispers aren’t gone. -

OIL (Brent): $64.09

Global pricing still sticky. Geopolitics never clocks out. -

10-Year Yield: 4.192%

Rates creeping higher. Gravity reminder for over-levered dreams. -

U.S. Dollar: 99.248

Firm, not flexing. A steady backdrop for risk rotation.

TFT Read:

Nothing here is screaming panic.

Nothing here is screaming euphoria.

That’s exactly when OPEX does its best work.

Big Market Themes Driving Today

1) S&P vs 7,000

-

Market is camped under resistance.

-

OPEX amplifies “magnet” behavior near big levels.

-

Breakouts today love to fake first and confirm later.

TFT Take: If we pop 7K and stall, don’t worship the first candle. Wait for the reclaim + hold

2) Chips Still Running the Show

-

MU +4% premarket (again… because why not).

-

TSMC’s results lit the match: Q4 profit +35% YoY (AI demand doing AI demand things).

-

Big clients (NVDA / AMD / AVGO) caught the sympathy bid because the market loves a good “AI mega trend” excuse.

TFT Take: When semis lead, the tape gets faster… and punishments get louder. Trade clean setups. Not adrenaline

3) U.S. / Taiwan Chips Deal = “Strategic Supply Chain Theater”

-

Taiwan investing $250B to expand U.S. chip capacity.

-

Tariffs adjusted (blanket lowered; select exports zeroed).

TFT Take: This is not just economics. It’s positioning. Markets will treat chips like national security… with a price tag

4) Trump Healthcare Plan Headline Risk

-

“Most-favored-nation” drug pricing concept.

-

ACA subsidy negotiations still messy.

TFT Take: Healthcare can whip. Don’t marry a position because a headline made you feel patriotic.

5) Prediction Markets: Wall Street Sniff Test

-

Goldman CEO says they’re exploring involvement.

-

Translation: “If it’s regulated enough, we want fees.”

TFT Take: Anything that smells like derivatives eventually gets a suit and a spread.

“Earnings are an opinion;

cash flow is a fact.”

| Alfred Rappaport

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

MARKET HEAT MAP - LIVE

STOCKS IN THE GREEN (+)

ImmunityBio (IBRX) +13% — guidance heat; revenue expectations screaming higher.

PNC +4% — beat + guidance flex.

Coupang +3% — upgrade tailwind.

Honeywell +2% — breakup optimism + upgrade love.

Energy names (GEV / BE / OKLO) — power-plant funding narrative for data centers.

STOCKS IN THE RED (–)

STRENGTHS — The Tape Has a Pulse

Let’s start with the obvious: the market isn’t dead. It’s just disciplined. Semiconductors are still carrying the water like they’ve got equity in the gym. AI demand didn’t slow, it sent a press release. TSMC prints +35% YoY profit growth and suddenly everyone remembers why chips are treated like the new oil—except they don’t spill, they compound. Nasdaq leading, VIX asleep, and liquidity flowing back into risk assets says one thing: capital still wants in. This isn’t a market begging for safety. It’s a market selectively allocating power.

Translation: strength exists, but it’s concentrated. That’s bullish… if you know where to look.

WEAKNESSES — Resistance Is Not a Myth

Now the buzzkill. The S&P squatting under 7,000 isn’t “consolidation optimism.” It’s overhead supply. Big money doesn’t chase round numbers—they defend them. OPEX only amplifies this because dealer gamma loves pinning price right where hope goes to die. Add in rising yields (10Y creeping north of 4.19%) and you’ve got a market that can stall fast if buyers hesitate. Breadth is still selective, small caps are passengers not drivers, and one bad macro headline could turn confidence into confusion in a heartbeat.

This isn’t weakness like “sell everything.”

This is weakness like “earn every dollar.

OPPORTUNITIES — Precision Beats Bravado

This is where amateurs panic and professionals sharpen knives. OPEX + resistance + leadership concentration = tell-rich environment. Chips leading means momentum traders have something to rotate into, while laggards quietly set up mean-reversion trades. Breakouts today matter only if they stick. Failed moves? Even better. That’s where asymmetric risk lives. Late-day flows, VWAP reclaims, and post-OPEX positioning resets can seed some of the cleanest January swing entries of the year.

Opportunity doesn’t scream on days like this.

It whispers, waits, and rewards patience.

THREATS — Headlines, Leverage, and Ego

The biggest threat isn’t macro—it’s behavioral. Healthcare headlines, tariff chess, Supreme Court noise, and prediction-market theatrics all add fuel to knee-jerk reactions. Combine that with OPEX leverage and a 3-day weekend and you get traders overextending because “it feels like it should move.” Yields creeping higher also threaten over-loved growth names if momentum stumbles. And let’s be honest—the real danger is traders confusing activity with edge.

Markets don’t bankrupt people.

Ego does.

TRUMP TACTICS — ACTIVE

(2nd Term Playbook So Far)

Strategic restraint on military escalation

-

Targeted pressure on consumer credit markets

-

AI export control leverage as negotiation tool

-

Energy price suppression via signaling, not supply

-

Capital market optics over rate theatrics

-

NATO leverage through Arctic positioning

Policy by pressure. Markets trade the pause.

NET NET : THE BOTTOM LINE

This is not a market to dominate.

It’s a market to out-think.

Strength is real.

Weakness is structural.

Opportunity is tactical.

Threats are psychological.

Trade the turn.

Respect the level.

Protect the flywheel.

Because average traders guess.

Time Freedom Traders operate.

First Options Expiration Friday of the New Year

What This Event Really Is

The first options expiration Friday of the year is when fresh capital, fresh positioning, and fresh delusions collide.

It’s the first time:

-

New institutional risk is actually expressed

-

Dealers adjust hedges after holiday illiquidity

-

Gamma exposure resets from December gamesmanship

-

“New Year, New Portfolio” meets reality

Translation:

This is not random chop. This is positioning revealing itself.

Key Characteristics to Expect

Short. Sharp. Revealing.

-

Elevated Gamma Sensitivity

Small moves = exaggerated price action near key strikes -

Pinning Is Common

Price gravitates toward high open-interest levels -

False Breakouts Are Frequent

Liquidity hunts trap impatient traders early -

Late-Day Reversals Increase

Dealer hedging flows flip near the close -

Volatility Compression… Then Expansion

Premium gets crushed early → directional move late

This is not a “predict direction” day.

It’s a read-the-flow day.

How Time Freedom Traders Approach It

We don’t chase.

We observe first. Execute second.

1. Map the Battlefield

Before the open:

-

Identify max pain and top 3 open-interest strikes

-

Note where weekly calls vs puts are stacked

-

Check VIX behavior relative to SPX/NDX movement

If price is glued to a strike… that’s not boredom.

That’s dealer control.

2. Let the First Hour Lie

Early moves are often:

-

Emotional

-

Illiquid

-

Designed to bait retail

No trade is a position.

Let the first fake move expose itself.

3. Trade the Turn — Not the Noise

Best setups:

-

Midday compression → late-day expansion

-

VWAP reclaim after a failed breakdown

-

Fade extended moves INTO heavy OI zones

Options tactic:

-

Defined-risk spreads

-

Short-duration

-

Small size

-

Surgical timing

This is scalpel trading, not sledgehammer swinging

4. Respect the Close

The last 60–90 minutes matter more than the first two hours.

Why?

-

Dealer hedging flips

-

Institutions clean up exposure

-

Price often resolves toward true intent

If you’re trading this day…the close is the story.

Surprising Stats Most Traders Don’t Know

These will mess with your assumptions:

-

Historically, the first January OPEX has a higher pin-rate than average weekly expirations

-

Directional conviction is lower than it feels, but range expansion late-day is higher

-

Many of January’s best swing entries are seeded by OPEX fake-outs

-

Overconfidence spikes — because traders confuse activity with edge

Movement ≠ Opportunity.

Structure = Opportunity

TFT Tactical Lens

This day isn’t about being bold.

It’s about being precise.

-

Don’t guess direction — track pressure

-

Don’t force trades — let positioning reveal

-

Don’t marry bias — marry confirmation

How To Trade OPEX + A 3-Day Weekend

Today is the perfect storm for theta games and trap doors.

Tactics that keep you rich (and sane):

-

Trade smaller. OPEX makes moves look “obvious” right before they reverse.

-

Avoid emotional 0DTE heroics. You’re not a hedge fund. You’re a human.

-

Let the first hour lie. Early fakeouts are basically a holiday tradition.

-

Take profits faster. Liquidity gets weird into the close.

-

If you hold options over the weekend: you’re paying for time you can’t trade.

(Market prices that weekend decay in… and it’s not a charity.)

Hint for the 3-day weekend play:

If we grind into resistance (7K) with VIX calm, that’s a classic setup for compression → pop or drop. Don’t predict it. Wait for the break + confirmation, then press the winner.

Compounding is the only legal cheat code most professionals never use.

If you improve your account by just 1% per week (not per day… per week), you’re looking at roughly ~67% growth over a year through compounding alone.

That’s why we build a system.

Not a lottery ticket habit.

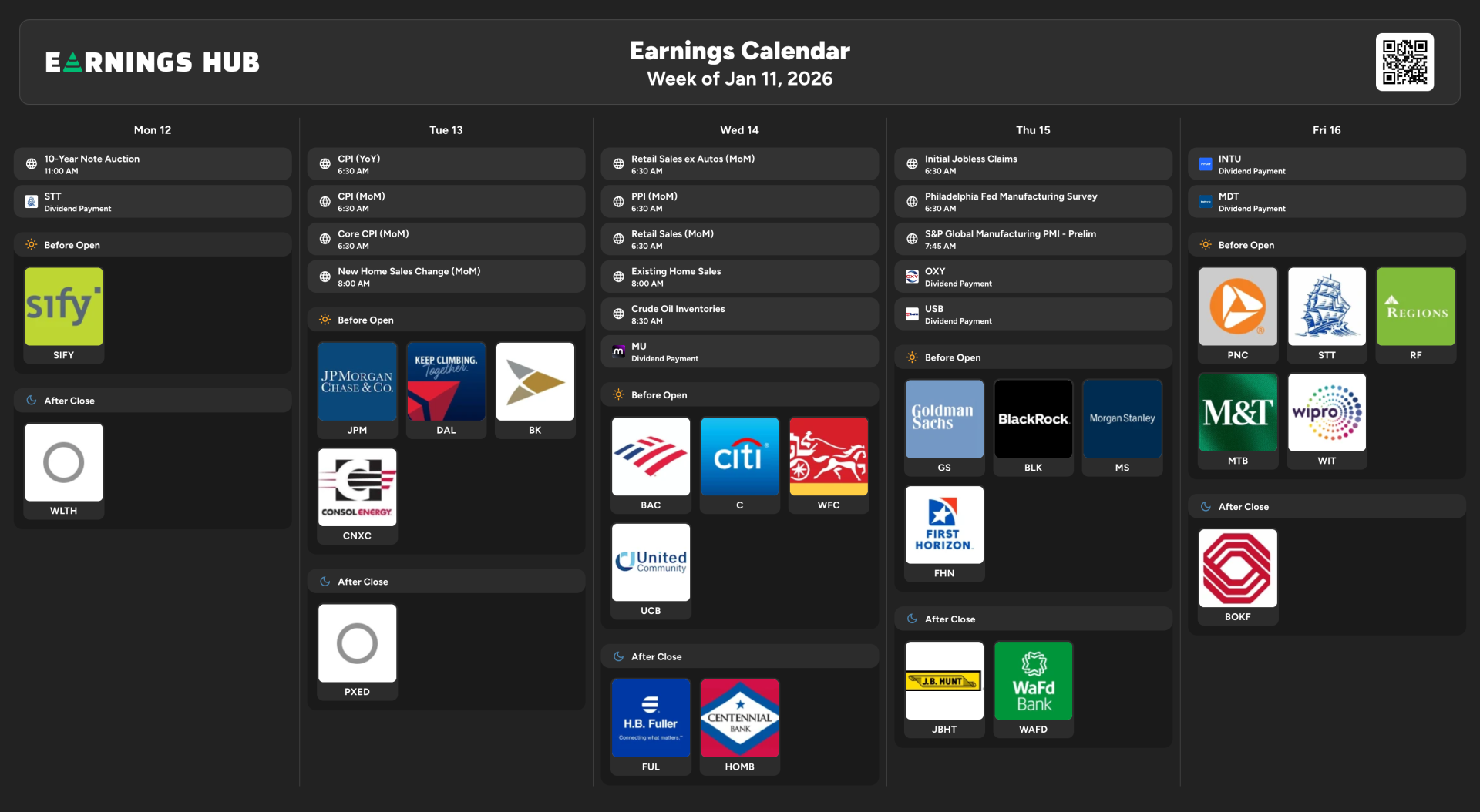

January Earnings Season

January earnings season is basically the market’s annual performance review.

What tends to matter most:

Not the “beat.” The guidance and the tone. That’s why a name like ImmunityBio can rip on forward expectations while the broad index still hesitates under a round number.

Surprising stat (today’s tape):

IBRX is up 18% today, after a 30% rip yesterday, because guidance didn’t whisper… it shouted.

“The big money is not in the buying or selling, but in the waiting.”

- Jesse Livermore

OPEX Fridays expose who you really are as a trader.

Not your indicators.

Not your watchlist.

Your discipline.

This is the day the market dangles motion in front of you like a shiny object. Candles move fast. P&L flashes. Twitter screams “BREAKOUT.” And suddenly, perfectly rational adults start clicking buttons like they’re swiping right at 2 a.m.

Here’s the uncomfortable truth:

Most losses don’t come from bad analysis.

They come from broken obedience.

You knew the level mattered.

You knew OPEX pins price.

You knew the first move lies.

And yet… the urge to participate overrides the commitment to process.

That’s not a strategy problem.

That’s an identity problem.

Time Freedom Traders understand something most never will:

The market is not a slot machine.

It’s a stewardship test.

You are not here to be entertained.

You are here to execute only when alignment is earned.

OPEX teaches patience the hard way. It rewards traders who can sit in discomfort, watch money not be made, and still trust the system. That restraint compounds faster than any lucky win ever could.

“The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.”

— Proverbs 21:5

This verse isn’t poetic.

It’s procedural.

-

Plans → framework

-

Diligent → disciplined execution

-

Hasty → emotional clicking

Abundance doesn’t come from speed.

It comes from obedience to process.

Mental Model for Today

Faith → Stoicism → System → Providence

-

Faith reminds you why you trade (freedom, stewardship, legacy).

-

Stoicism governs how you respond (calm, patient, controlled).

-

System dictates what you do (wait, confirm, execute).

-

Providence handles the outcome (you don’t chase it—you earn alignment).

The Real Win Today

The real win isn’t a green trade.

The real win is:

-

Passing on a low-quality setup

-

Letting the first fake move go

-

Protecting capital into a long weekend

-

Closing the platform with confidence, not regret

If you can’t sit still on a day designed to trap impatience…

how will you ever scale when the stakes are higher?

Patience isn’t passive.

It’s positioned power.

Trade less.

See more.

Operate like a professional.

Because time freedom isn’t built on excitement.

It’s built on discipline that compounds.

“FAST FORWARD to DECEMBER of 2026"

If you want 2026 to be the year you stop reacting and start operating… join Time Freedom Trading.

You’ll learn to:

-

Trade the retracement instead of chasing breakouts late

-

Use the 50MA/200MA like a pro (structure, bias, risk)

-

Build a Wealth Operating System that compounds skill into freedom

Because the clock’s not ticking — it’s compounding.

And the market doesn’t pay hope… it pays execution.

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep living the way you lived in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, build a Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

IS TIME FREEDOM TRADING TAX DEDUCTIBLE?

If you’re paying for trading education but not structuring it properly…

you might be overpaying twice.

Once to learn.

Again at tax time.

Most traders guess.

The IRS doesn’t reward guessing — it rewards structure.

We broke down exactly when trading education may qualify as a tax deduction, how active traders set it up CPA-clean,

and what documentation actually matters.

👉 Read this before your CPA does:

Trading Education Tax Deduction – CPA-Ready Guide

If you’re already investing in your edge…

why let bad structure erode it?

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doom scrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your

broker that allow you to place a simple trade on autopilot and minimize

your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

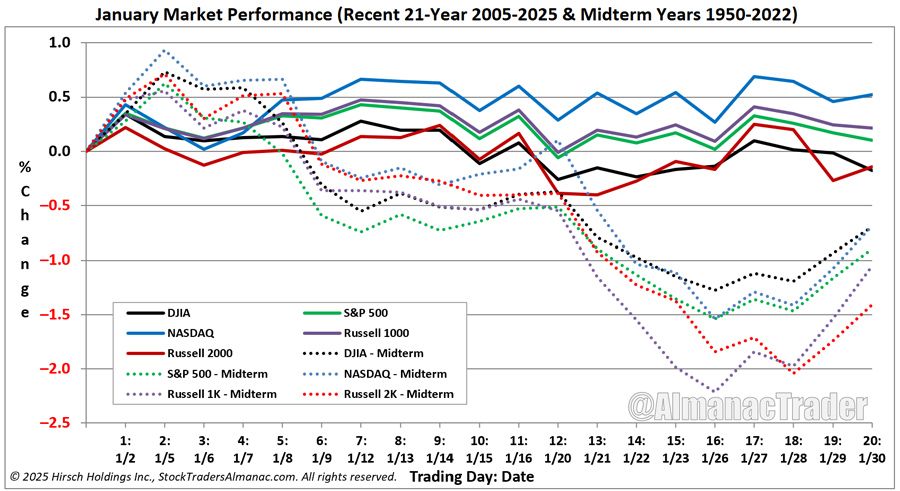

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

26 DECISIONS THAT WILL DECIDE YOUR 2026

NEW YEAR: UNCERTAIN TIMES. CERTAIN EDGE.

#44 YOUR TRAINING YOUR AI REPLACEMENT.

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS