Read more of the

The W.T.F. Report

January 23rd, 2026

FRIDAY

JANUARY 23nd, 2026

OLD MAN WINTER IS

BLOWING POTENTIAL PROFITS

Welcome to the 2nd-half-of-January mood swing… where the market smiles at Davos soundbites, then remembers it still has bills due.

Yesterday’s rally?

Powered by CEO confidence theater at Davos… and the market’s favorite drug: “Maybe everything’s fine.”

Meanwhile, Trump’s T.A.C.O. Trade is back on the menu:

Buy the bounce after the Greenland U-Turn “framework” to “buy the region” without going full movie villain.

And metals?

Gold is creeping toward $5K like it heard the word “uncertainty.”

Silver flirting with $100 like it’s trying to get invited to the rich-asset party.

Congress did the thing: House passed final funding bills with 8 days to spare. Senate looks at it next week… because urgency is apparently a Monday problem.

And Tesla?

Musk removed some human safety monitors from Robotaxis in Austin.

TSLA popped +4.2% because nothing says “innovation” like “we’ll see what happens.”

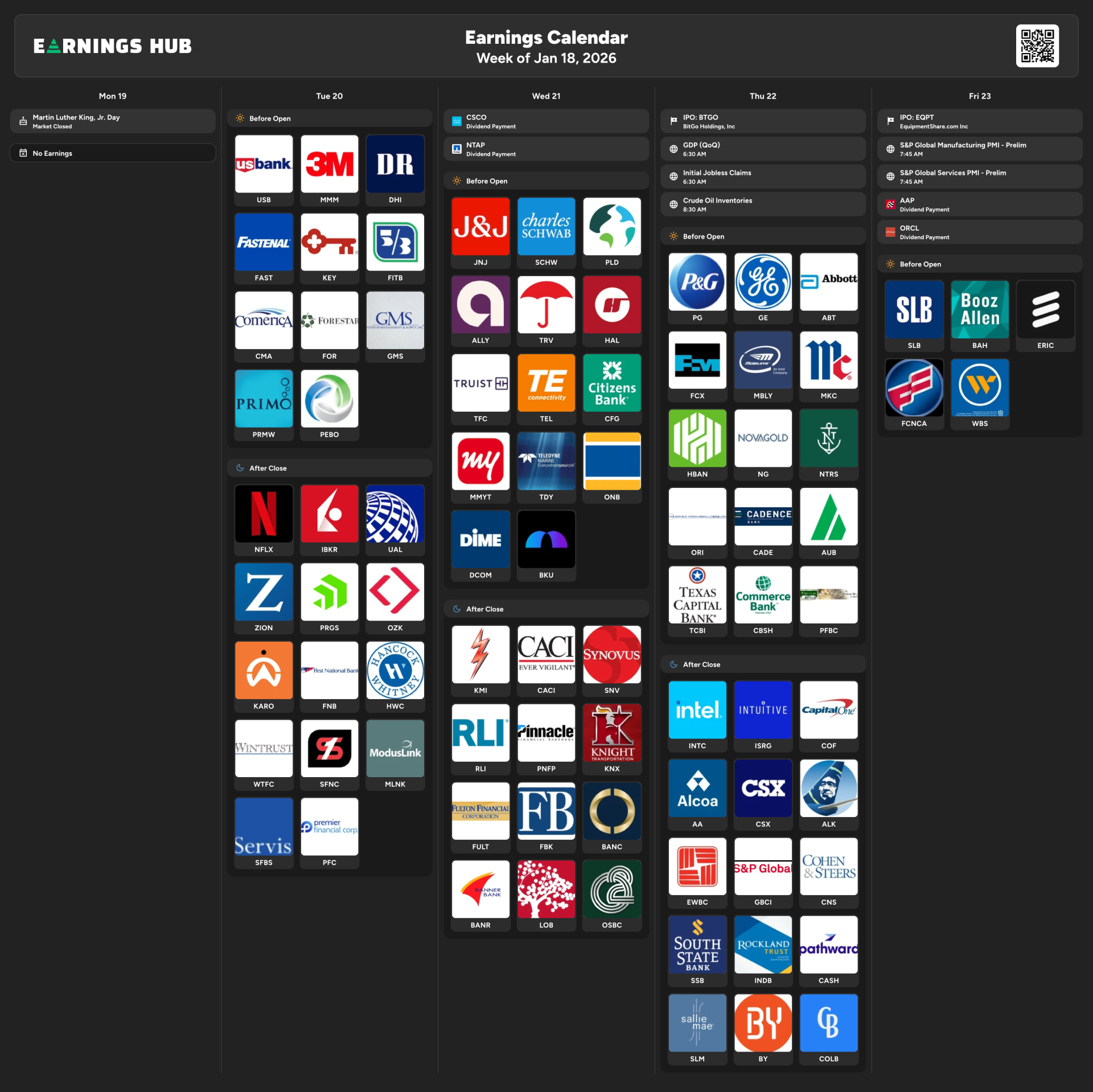

Key Catalysts Today

Old Man Winter is blowing… and volatility is listening.

Market still under 7K(SPX) , grinding sideways like a treadmill with a CNBC subscription.

INTC got humbled.

Beat expectations… then guided soft and got hit -13% pre-market.

Translation: “We did good… but don’t expect us to do good… right now.”

PCE came in 2.8% (headline + core)—still above the Fed’s happy place. And retail traders are still buying dips like it’s a hobby, not a strategy.

THE WEEK IN REVIEW — KEY EVENTS

Davos: CEOs selling confidence like it’s a product launch. Markets ate it up—briefly.

China + NVDA chips: The narrative is still “AI demand finds a way.”

Wegovy pill strong launch: Weight-loss trade still has oxygen.

Greenland “framework” drama: Europe wants details. Greenland says sovereignty is a red line. Markets say: “Cool story—what’s the trade?”

Shutdown clock: Delayed… not deleted. The clock’s not ticking—it’s side-eyeing you.

THE WEEK AHEAD

Senate returns next week to deal with funding bills (aka “Will they / won’t they?”)

More earnings digestion (guidance season = volatility season)

Any fresh Trump headline can move rates, energy, defense, and risk-on/risk-off in one tweet-length burst.

PRE-MARKET STATS

DOW: -0.49%

S&P: -0.22%

NASDAQ: -0.32%

RUSSELL: -0.35%

VIX: 16.11

BITCOIN: $89,285

GOLD: $4,938 (5K in sight… acting like it owns the place)

SILVER: $99.67

WTI: $61.01

BRENT: $64.92

10Y: 4.250

DOLLAR: 98.32

STOCKS IN THE GREEN (+)

Life360 (LIFX): +23% — user growth + strong results = market claps.

Sallie Mae (SLM): +~8% — beat earnings + authorized buyback.

Booz Allen (BAH): +~6% — raised earnings outlook.

Intuitive Surgical (ISRG): +~2% — strong quarter beats expectations.

CSX: +~2% — intermodal revenue beat + upbeat 2026 view.

Nvidia (NVDA): +~1.5% — China visit chatter keeps the AI tape warm.

STOCKS IN THE RED (–)

Capital One (COF): -~2% — Brex deal + earnings miss = “show me the math.”

Clorox (CLX): ~flat — acquiring Gojo/Purell; market says “meh… for now.”

Intel (INTC): -13% — soft guidance nuked the victory lap.

“Earnings are an opinion;

cash flow is a fact.”

| Alfred Rappaport

MARKET HEAT MAP - LIVE

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

Strengths

The tape still has buyers underneath, especially when Davos confidence + “framework deal” headlines juice risk appetite. Inflation isn’t re-accelerating in a panic way, and that keeps the soft-landing fantasy alive—which is enough to support dips getting bought. Add Q4 earnings season: the market loves one thing more than fundamentals… a good story with numbers attached.

Weaknesses

We’re still stuck in a sideways grind under 7K, and chop is where good traders get bored and average traders get harvested. Rates are still elevated, inflation is still above target, and guidance is becoming the real market mover—not the actual quarter. Translation: beats don’t matter if the future whispers. INTC just demonstrated that in 13% font.

Opportunities

Volatility is a vending machine—if you stop smashing buttons and start choosing products. The clean opportunities right now are:

-

Earnings overreactions (fade panic, buy quality pullbacks in rotation leaders)

-

Winter storm trade setups (energy demand + utilities + airline mean reversion)

-

Metals trend as uncertainty insurance (gold/silver keep signaling “risk exists”)

Threats

Government funding is delayed, not solved. Global geopolitics remains one headline away from a volatility spike. And the retail dip-buy reflex is a double-edged sword—when it works, it lifts the floor… when it fails, it accelerates the trapdoor. Also: AI hype runs hot, and crowded trades don’t unwind politely.

TRUMP TACTICS — ACTIVE (2nd Term Playbook)

Not a prediction. Just the visible operating pattern hitting markets right now.)

Framework Diplomacy: announce “frameworks” first, negotiate details later (markets trade headlines, not footnotes).

T.A.C.O. Bounce Buying: stir fear → reverse tone → risk assets pop → repeat.

Territory & Resources Leverage: Greenland narrative = strategic access without boots on the ground.

Regime Pressure Posture: using pressure + backchannels to influence outcomes (Cuba/Venezuela theme in the tape).

Tariff & Trade Threat Optionality: keeping Europe/partners off-balance to extract concessions.

Domestic Disruption Signaling: bold operational changes (like regulatory posture shifts) that reprice entire sectors fast.

THE WINTER STORM TRADE™

A reusable Time Freedom Trading tactical asset for snow, ice, and Midwest → East Coast freeze cycles.

Winter storms don’t just shut schools.

They reprice demand, stress supply, and force reaction trades.

That’s where we step in.

This is not guessing the weather.

This is trading the second-order effects the market always underestimates.

THE CORE TACTIC

Trade the storm → then trade the snapback.

Storms create temporary demand spikes, logistics disruption, and panic headlines.

The market overreacts first… then mean-reverts.

We trade both phases.

THE STORM SECTOR PLAYBOOK.

Natural Gas & Power

(THE FIRST MOVE)

Cold = heating demand.

Utilities and nat gas spike before the storm peaks.

Primary Instruments

-

Cheniere Energy (LNG) – Export + domestic heating demand.

-

EQT Corporation (EQT) – Pure-play nat gas beta.

-

Antero Resources (AR) – Appalachia exposure (Midwest/East).

-

Range Resources (RRC) – Weather-sensitive flows.

Options Tactic

-

Short-dated call into the forecast confirmation.

-

Trim before the storm headlines peak.

The trade isn’t the snowflake. It’s the demand shock

Grid Stress & Backup Power

(THE STRUCTURAL WINNER)

Storms knock out power.

People remember who kept the lights on.

Primary Instrument

-

Generac Holdings (GNRC) – The poster child of freeze fear.

TFT Setup

-

Buy pullbacks, not breakouts.

-

Look for IV crush plays post-storm once fear fades.

-

This is often a multi-week swing, not a day trade.

Fear spikes fast. Equipment orders linger longer

Airlines

(THE OVERREACTION SHORT)

Snow = cancellations = panic selling.

But airlines recover quickly once skies clear.

Primary Instruments

-

Delta Air Lines (DAL)

-

United Airlines (UAL)

-

Southwest Airlines (LUV) – Most storm-sensitive headlines.

TFT Tactic

-

Wait for capitulation candles.

-

Sell put or buy shares into forced selling.

-

Target the 48–96 hour rebound.

Storms delay flights. They don’t delete demand

Logistics & Rails (THE QUIET SNAPBACK)

Frozen tracks and highways hurt… briefly.

Primary Instruments

-

CSX Corporation (CSX)

-

Norfolk Southern (NSC)

These names dip on disruption headlines and rebound when operations normalize

Retail & Home Improvement (THE LATE TRADE)

After the storm:

-

Pipes burst

-

Roofs leak

-

Shelves empty

Primary Instruments

-

Home Depot (HD)

-

Lowe’s (LOW)

This is not immediate.

It’s the repair cycle trade 1–3 weeks later.

WHAT / SO WHAT / NOW WHAT

WHAT?

A major winter storm hits the Midwest and East Coast.

Cold temps. Snow. Ice. Power outages. Travel chaos.

SO WHAT?

Markets misprice temporary disruption as permanent damage.

Energy demand spikes. Airlines oversell. Infrastructure stress exposes real winners.

Volatility rises.

Emotion overrides probability.

That’s our edge.

NOW WHAT?

-

Trade nat gas & power early

-

Fade airline panic

-

Accumulate GNRC on fear

-

Wait for retail repair demand

-

Exit when headlines peak

We don’t chase snowstorms. We trade the market’s reaction to them

TFT EXECUTION RULES

-

Trade forecast confirmation, not weather hype.

-

Use options for asymmetry, not leverage addiction.

-

Respect No-Trade Zones during illiquid panic opens.

-

Let mean reversion do the heavy lifting.

“The market doesn’t fear the storm. It fears uncertainty. And uncertainty always overpays.”

“Markets can remain irrational longer than you can remain solvent.”

| — John Maynard Keynese.

January 23rd

What happened:

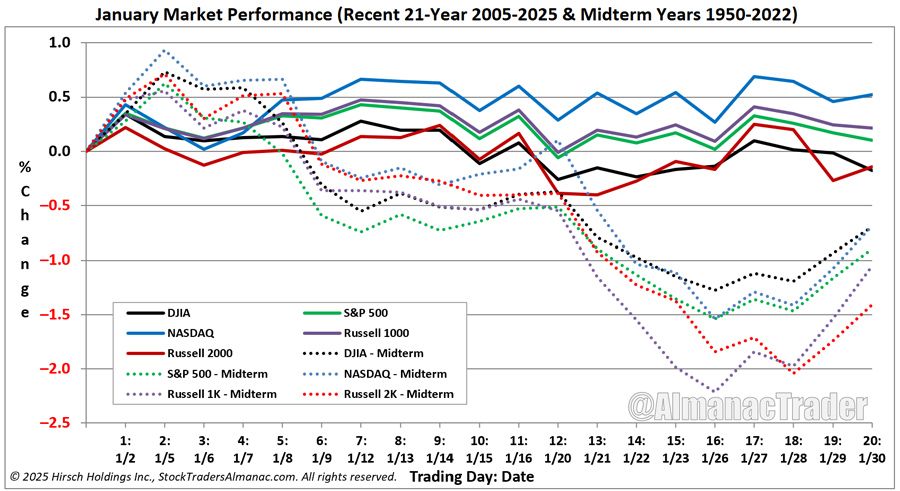

On January 23, 2018, the S&P 500 recorded one of its strongest January momentum surges, closing at a record high after a powerful multi-week rally that kicked off what traders later called the “January melt-up.” Volatility had been crushed, dip-buying felt effortless, and complacency was quietly building.

What most people missed:

That strength wasn’t random—it was fueled by January positioning, earnings optimism, and fresh capital deployment after the new year. But beneath the surface, leverage was increasing and volatility was being underpriced… setting the stage for the sharp February 2018 volatility shock (the VIX “volmageddon”) just days later.

Why it matters today:

Late-January strength often masks risk, not removes it. When markets grind higher or sideways in the back half of January, it’s frequently a positioning phase, not a trend confirmation. Smart money uses this window to rotate, hedge, and prepare, not chase.

Time Freedom Trading Takeaway:

January doesn’t reward excitement—it rewards situational awareness.

When optimism feels easy and volatility feels “gone,” that’s usually when risk is being repriced quietly.

“The greatest danger in times of turbulence is not the turbulence—it is to act with yesterday’s logic.” — Peter Drucker

“January shows you the door. February decides who walked through prepared.”

The stock market is one of the only places where you can control asymmetric exposure.

One clean options structure can risk 1 unit to potentially make 3–10 units in a volatility event— without “all-in” behavior, without praying, without needing a miracle candle.

That’s the difference between wealth operators and button mashers.

“The big money is not in the buying or selling, but in the waiting.”

- Jesse Livermore

You need more obedience to process.

Because average traders feel their way into losses.

Time Freedom Traders grade their way into consistency.

“Be on your guard; stand firm in the faith; be courageous; be strong.”

— 1 Corinthians 16:13

Diligence is a trading edge.

Haste is a hidden tax.

If you keep “winging it” through 2026… how many more months are you willing to donate to the market as tuition—before you finally learn the system?

Want to Learn More?

If you want 2026 to be the year you stop “following markets” and start operating in them…

Join Time Freedom Trading and install the Wealth Operating System:

-

See the market in 3D (structure, rotation, catalysts)

-

Trade the TURN, not the noise

-

Defend capital, compound conviction, build the Financial Flywheel

Picture this: it’s December 2026… and your calendar isn’t owned by meetings.

It’s owned by choices.

-

Like / Subscribe / Share

-

Watch the YouTube channel

-

DM me with questions

“FAST FORWARD to DECEMBER of 2026"

If you want 2026 to be the year you stop reacting and start operating… join Time Freedom Trading.

You’ll learn to:

-

Trade the retracement instead of chasing breakouts late

-

Use the 50MA/200MA like a pro (structure, bias, risk)

-

Build a Wealth Operating System that compounds skill into freedom

Because the clock’s not ticking — it’s compounding.

And the market doesn’t pay hope… it pays execution.

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep living the way you lived in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, build a Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

IS TIME FREEDOM TRADING TAX DEDUCTIBLE?

If you’re paying for trading education but not structuring it properly…

you might be overpaying twice.

Once to learn.

Again at tax time.

Most traders guess.

The IRS doesn’t reward guessing — it rewards structure.

We broke down exactly when trading education may qualify as a tax deduction, how active traders set it up CPA-clean,

and what documentation actually matters.

👉 Read this before your CPA does:

Trading Education Tax Deduction – CPA-Ready Guide

If you’re already investing in your edge…

why let bad structure erode it?

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doom scrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your

broker that allow you to place a simple trade on autopilot and minimize

your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

26 DECISIONS THAT WILL DECIDE YOUR 2026

NEW YEAR: UNCERTAIN TIMES. CERTAIN EDGE.

#44 YOUR TRAINING YOUR AI REPLACEMENT.

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS