Read more of the

The W.T.F. Report

January 26th, 2026

Monday

JANUARY 26th, 2026

“The Snowplow Market.”

Progress doesn’t come fast. It comes loud, messy, and sideways—until suddenly the road is clear and everyone wonders how they missed the turn.

The Winter Dig-Out & Snap-Back Week

The market is shoveling ice off the driveway while earnings trucks are backing up to the curb. Two straight weekly losses for the S&P, a dollar at a four-month low, commodities screaming higher, and a Fed that’s brought a lawn chair to a knife fight.

This is the week where frozen pipes burst… and so do expectations.

New week. New money. Last lap of January.

If you’re waiting for “clarity,” congrats—you’ve officially volunteered to buy the top.

“Markets are never wrong—opinions often are.”

— Jesse Livermore

THE WEEK AHEAD

Winter Storm Fern: Airlines grounded, energy & utilities front-and-center.

SCOTUS ruling: Policy risk = volatility fuel.

Iran: Geopolitical tail risk stays bid.

Yen / BOJ: More stimulus, weaker dollar, global ripples.

Fed Meeting: Wait-and-see (translation: trade the reaction, not the hope).

Tech Earnings: Microsoft, Meta Platforms, Tesla, Apple, IBM

Government Shutdown: Six days out. Political theater meets market math. MN ICE events may keep Democrats from voting.

Last Week of the Month: Rebalances, window dressing, sharp moves.

PRE-MARKET STATS

DOW = +0.17%

Old money buying the dip like it’s on clearance. Defensive optimism. No champagne yet.-

S&P = +0.13%

Broad market trying to stand up after back-to-back losses. Still testing its balance. -

NASDAQ = 0.00%

Flat as a frozen driveway. Tech is waiting on earnings before making a move. -

RUSSELL = -0.09%

Small caps still stuck in the snowbank. Liquidity hasn’t come to rescue yet. -

VIX = 16.49

Volatility creeping higher. Not panic—anticipation. Earnings + Fed = tension coil. -

BITCOIN = 87,910

Cooling off but holding altitude. Risk appetite hasn’t left the building. -

GOLD = $5,056/oz

Gold still rallying. This isn’t fear—it’s a vote against fiat and central banks. -

SILVER = $10,980/oz

Parabolic behavior. When silver moves like this, inflation whispers turn into shouts. -

COPPER = $1,316.50

Dr. Copper still diagnosing global demand. Industrial pulse remains alive. -

PLATINUM = $2,813.96

Quietly ripping. Supply constraints meeting energy-transition reality. -

WTI CRUDE = $60.83

Energy bid from winter demand and geopolitical friction. Inflation tail still wagging. -

BRENT CRUDE = $64.88

Global growth expectations stabilizing—no collapse priced in. -

10-YR = 4.21%

Rates refusing to come down. The bond market isn’t buying the “easy Fed” story. -

DOLLAR = 97.145

Four-month low. Weak dollar = rocket fuel for commodities and multinational earnings.

Bottom line:

Equities are tiptoeing. Commodities are sprinting. Bonds are stubborn.

This isn’t a risk-off market—it’s a rotation market.

Trade the flow. Not the headlines.

Whats moving the Tape this morning

3,500 flights canceled this morning. 12,000 yesterday. 1 inch of ice. 1 million without power.

This isn’t weather — it’s a stress test. Airlines are learning (again) that margins don’t survive ice storms. Utilities and energy get paid. Airlines get excuses.-

Largest flight cancellations since COVID

Same movie, different villain. Back then it was a virus. Today it’s Mother Nature with leverage. Markets don’t care why planes aren’t flying — they care that revenue isn’t.

-

CoreWeave +10% after a $2B check from Nvidia

This isn’t “investment.” This is Nvidia planting flags. If you’re building AI factories, Jensen wants a toll booth on every on-ramp. Infrastructure is where the real power sits. -

USA Rare Earth +20% on Commerce Dept equity stake

When the government buys shares, that’s not stimulus — that’s strategy. This is the U.S. saying, “We’re done renting minerals from China.” National security > free markets.

-

Megacap Earnings Week: Meta Platforms, Microsoft, Tesla, Apple

This is the Super Bowl of balance sheets. Guidance will matter more than beats. One bad tone-deaf sentence and trillions reprice. -

Apple losing top-customer crown at TSMC to Nvidia

That’s not symbolic — that’s structural. The tech totem pole just got reordered. Hardware elegance bows to compute hunger.

-

Winter storm = 20+ states in emergency mode

Translation: volatility loves chaos. Short-term dislocations create long-term rotation. Energy, utilities, nat gas don’t need sunshine to rally. -

Natural gas and power prices spike (especially near data centers)

AI runs on electricity, not optimism. When Virginia sneezes, global power markets catch a cold. Data centers are the new factories.

-

Memory chip shortage expected through 2027 (per Synopsys CEO)

This is the quiet constraint no one’s pricing correctly. AI demand is sprinting while supply is limping. Scarcity always wins

STOCKS IN THE GREEN (+)

USA Rare Earth (+21%)

This isn’t a squeeze — it’s a strategic bid. Government equity stakes scream supply-chain sovereignty. Dumb money chases charts. Smart money chases national security.

CoreWeave (+10%)

When Nvidia writes a $2B check, it’s not a vote — it’s a command. AI infrastructure is becoming the new oil pipeline.

SkyWater Technology (+7.3%)

Foundry leverage meets AI demand. This move is about capacity control, not headlines.

Newmont (+4%)

Gold north of $5K turns miners into cash-flow machines. This is margin expansion math, not speculation.

Allied Gold (+3%)

M&A premium in a gold bull tape. Acquirers don’t buy tops — they buy cash flow visibility.

IonQ (+2.7%)

Quantum consolidation = early land grab. This is long-duration optionality getting repriced.

AppLovin (+2%)

Analyst upgrade confirms what price already knew. Ads + AI + scale = operating leverage.

STOCKS IN THE RED (–)

Airlines: United Airlines, American Airlines, Delta Air Lines, Southwest Airlines (~-1%)

Ice storms kill margins fast. Fixed costs don’t care about weather excuses. This is operational risk pricing.

Enphase Energy (-2%)

Layoffs = margin defense. Solar still needs rate relief, and the bond market isn’t cooperating.

“Earnings are an opinion;

cash flow is a fact.”

| Alfred Rappaport

MARKET HEAT MAP - LIVE

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

STRENGTHS

The market’s core strength right now is where the money is hiding—not if it exists. Commodities are ripping, AI infrastructure is absorbing capital at scale, and megacap tech is about to justify (or reset) valuations through earnings. Gold above $5K, silver going vertical, and rare earths catching government backing all signal the same thing: hard assets and strategic inputs are in demand. Volatility remains controlled, not chaotic, which keeps options pricing attractive for disciplined traders. This is a market with power under the hood—just not evenly distributed.

WEAKNESSES

Breadth is thin and fragile. Back-to-back S&P losses, small caps lagging, airlines crippled by weather, and retailers trimming guidance all point to an economy where margins are under pressure. The dollar sliding and yields staying sticky create a squeeze that exposes weak balance sheets fast. Add in tariff cost creep and operational disruptions from winter storms, and you’ve got a market where excuses don’t protect earnings. Weak hands are being identified in real time—and priced accordingly.

OPPORTUNITIES

This is a trader’s tape, not a tourist’s market. Earnings reactions—especially from megacap tech—offer asymmetric setups where volatility meets liquidity. FX-driven commodity strength creates clean trend continuation trades. Weather-induced dislocations in energy, utilities, and nat gas are tactical opportunities, not long-term investments. M&A Monday energy, government-backed supply chain plays, and AI infrastructure spending all provide rotation lanes for capital that knows where it’s going next. Opportunity favors preparation, not prediction.

THREATS

The real threats aren’t the headlines—they’re the intersections. A Fed meeting layered on top of megacap earnings, government shutdown theatrics, geopolitical flare-ups, and policy uncertainty can spike volatility without warning. Overcrowded AI trades risk air pockets if guidance disappoints. Liquidity can vanish quickly at month-end as funds rebalance. This is not the environment to freestyle trades. Mis-timed conviction gets punished faster than bad analysis.

TRUMP TACTICS — ACTIVE (2nd Term Playbook)

Not a prediction. Just the visible operating pattern hitting markets right now.)

Framework Diplomacy: announce “frameworks” first, negotiate details later (markets trade headlines, not footnotes).

T.A.C.O. Bounce Buying: stir fear → reverse tone → risk assets pop → repeat.

Territory & Resources Leverage: Greenland narrative = strategic access without boots on the ground.

Regime Pressure Posture: using pressure + backchannels to influence outcomes (Cuba/Venezuela theme in the tape).

Tariff & Trade Threat Optionality: keeping Europe/partners off-balance to extract concessions.

Domestic Disruption Signaling: bold operational changes (like regulatory posture shifts) that reprice entire sectors fast.

TECH EARNINGS + FED WEEK

Surprise stat: historically, ~65% of the weekly gains during peak earnings seasons come from the first 48 hours after results, not before.

Let price confirm, then deploy options for asymmetric risk.

“Markets can remain irrational longer than you can remain solvent.”

| — John Maynard Keynese.

January 26th

“The big money is not in the buying or selling, but in the waiting.”

- Jesse Livermore

This market is loud on purpose.

Ice storms. Canceled flights. Fed headlines. Earnings landmines.

The noise isn’t accidental — it’s designed to rush you into action without clarity.

Here’s the truth most traders never internalize:

Urgency is not opportunity.

The disciplined trader doesn’t confuse movement with meaning. When volatility rises and headlines stack, the temptation is to do something—anything—to feel in control. But control is an illusion.

Stewardship is the edge.

Stewardship says:

“I don’t need to predict the storm. I need to position myself so it can’t wipe me out.”

This is where Time Freedom Traders separate themselves. While others panic-trade the headlines, you wait for alignment. You respect process. You protect capital. You understand that not trading is often the most profitable decision of the week.

The market always tests patience before it rewards precision.

“Be still before the Lord and wait patiently for Him;

do not fret when people succeed in their ways.”

— Psalm 37:7

This verse isn’t about passivity. It’s about posture.

Stillness doesn’t mean inactivity.

It means refusing to be emotionally hijacked.

Patience isn’t delay.

It’s discipline under pressure.

When everyone else is reacting to what just happened, you’re preparing for what must happen next. That’s abundance thinking. That’s maturity. That’s trading with faith instead of fear.

Mental model for today:

-

You don’t need every move.

-

You need your move.

-

And it will come—after the noise does its job.

The storm clears.

Liquidity returns.

Trends reassert themselves.

And the trader who waited…

is the one who gets paid.

Because average traders chase relief.

Time Freedom Traders earn clarity.

Want to Learn More?

If you want 2026 to be the year you stop “following markets” and start operating in them…

Join Time Freedom Trading and install the Wealth Operating System:

-

See the market in 3D (structure, rotation, catalysts)

-

Trade the TURN, not the noise

-

Defend capital, compound conviction, build the Financial Flywheel

Picture this: it’s December 2026… and your calendar isn’t owned by meetings.

It’s owned by choices.

-

Like / Subscribe / Share

-

Watch the YouTube channel

-

DM me with questions

“FAST FORWARD to DECEMBER of 2026"

If you want 2026 to be the year you stop reacting and start operating… join Time Freedom Trading.

You’ll learn to:

-

Trade the retracement instead of chasing breakouts late

-

Use the 50MA/200MA like a pro (structure, bias, risk)

-

Build a Wealth Operating System that compounds skill into freedom

Because the clock’s not ticking — it’s compounding.

And the market doesn’t pay hope… it pays execution.

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep living the way you lived in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, build a Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

IS TIME FREEDOM TRADING TAX DEDUCTIBLE?

If you’re paying for trading education but not structuring it properly…

you might be overpaying twice.

Once to learn.

Again at tax time.

Most traders guess.

The IRS doesn’t reward guessing — it rewards structure.

We broke down exactly when trading education may qualify as a tax deduction, how active traders set it up CPA-clean,

and what documentation actually matters.

👉 Read this before your CPA does:

Trading Education Tax Deduction – CPA-Ready Guide

If you’re already investing in your edge…

why let bad structure erode it?

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doom scrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your

broker that allow you to place a simple trade on autopilot and minimize

your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

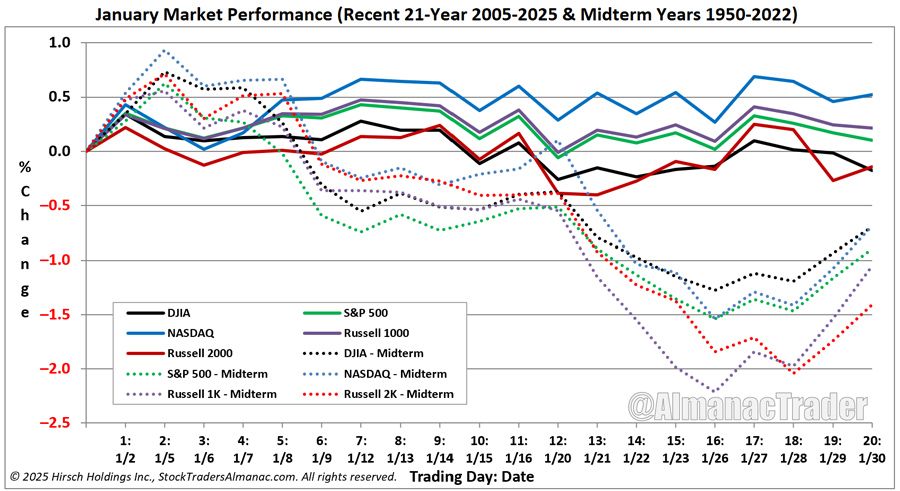

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

26 DECISIONS THAT WILL DECIDE YOUR 2026

NEW YEAR: UNCERTAIN TIMES. CERTAIN EDGE.

#44 YOUR TRAINING YOUR AI REPLACEMENT.

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS