Read more of the

The W.T.F. Report

February 2nd, 2026

Monday

February 2nd, 2026

Welcome to February!

It’s Groundhog Day… and Punxsutawney Phil saw his shadow.

So yes: more winter.

Also yes: more volatility.

Because apparently the market wanted a sequel to January’s “AI euphoria” called: “Deleveraging: The Reckoning.”

Between the weekend Bitcoin face-plant, the precious metals trapdoor, and a fresh Fed chair pick that screams “higher for longer,” traders are starting the month a little… tight in the shoulders.

And the back-to-back winter storms?

Half the country is frozen.

Liquidity is frozen too.

Coincidence? Sure. Like “algorithmic manipulation doesn’t exist.”

Here’s What We’re Keeping an Eye on Today

This morning feels like the market woke up, looked outside at the deep freeze, and said:

“Perfect. Let’s also freeze risk appetite.”

Here’s the vibe: AI is getting exposed. Not AI itself—the AI slop.

You know, the “spray-and-pray funding rounds,” the “infinite TAM” decks, and the “trust me bro, it’s revolutionary” valuations.

Case in point: Nvidia is down after reports its OpenAI mega-investment is stalled / questioned, with Jensen Huang publicly pushing back on how the deal is framed. Translation: the market heard “nonbinding” and immediately priced in “noncommittal.”

Meanwhile, the shiny-object crowd that chased silver and gold into the ceiling just learned gravity still works. The dollar bounced, margins tightened, and the unwind got… biblical.

And then there’s the cherry on top: Kevin Warsh as the new Federal Reserve pick—market hears “hawk” and immediately starts hiding under the couch cushions.

Key Catalyst Today

2) Project Vault = rare earths pop Donald Trump reportedly pushing a $12B strategic critical minerals stockpile (“Project Vault”) to reduce dependence on China. That’s a real industrial policy tailwind for domestic miners.

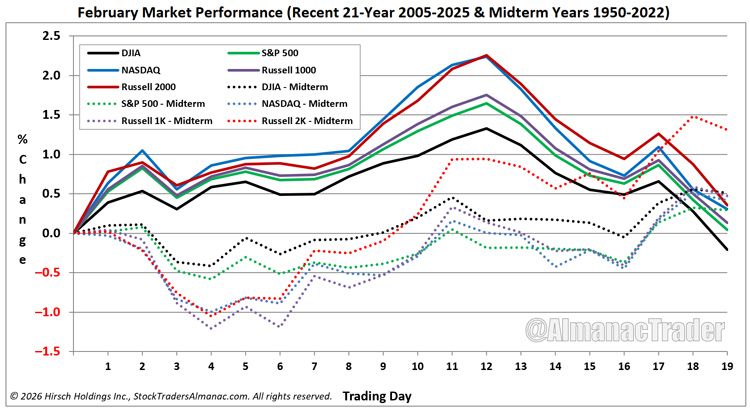

New Month Highlights

“February: The Reality Check Month”

AI Slop showing cracks

Funding is still big… but scrutiny is bigger. If the leaders wobble, the “AI tourists” get tossed off the boat first.

Crypto mood shift

Bitcoin breaking below $80K over the weekend screams: “risk-off is back on the menu.”

Metals: squeeze stories meet margin reality

When a trade is powered by “viral shortage narratives,” it can reverse like a car in an alley. Fast. Loud. Expensive.

Experience Economy flex

Disney reminding everyone: when people get stressed, they buy escapism—with churros. Their Experiences division hitting $10B quarterly revenue is a real signal.

THE WEEK AHEAD

- Catalysts That Can Punch You in the Face

Buckle up. This is one of those weeks where the calendar is basically yelling.

-

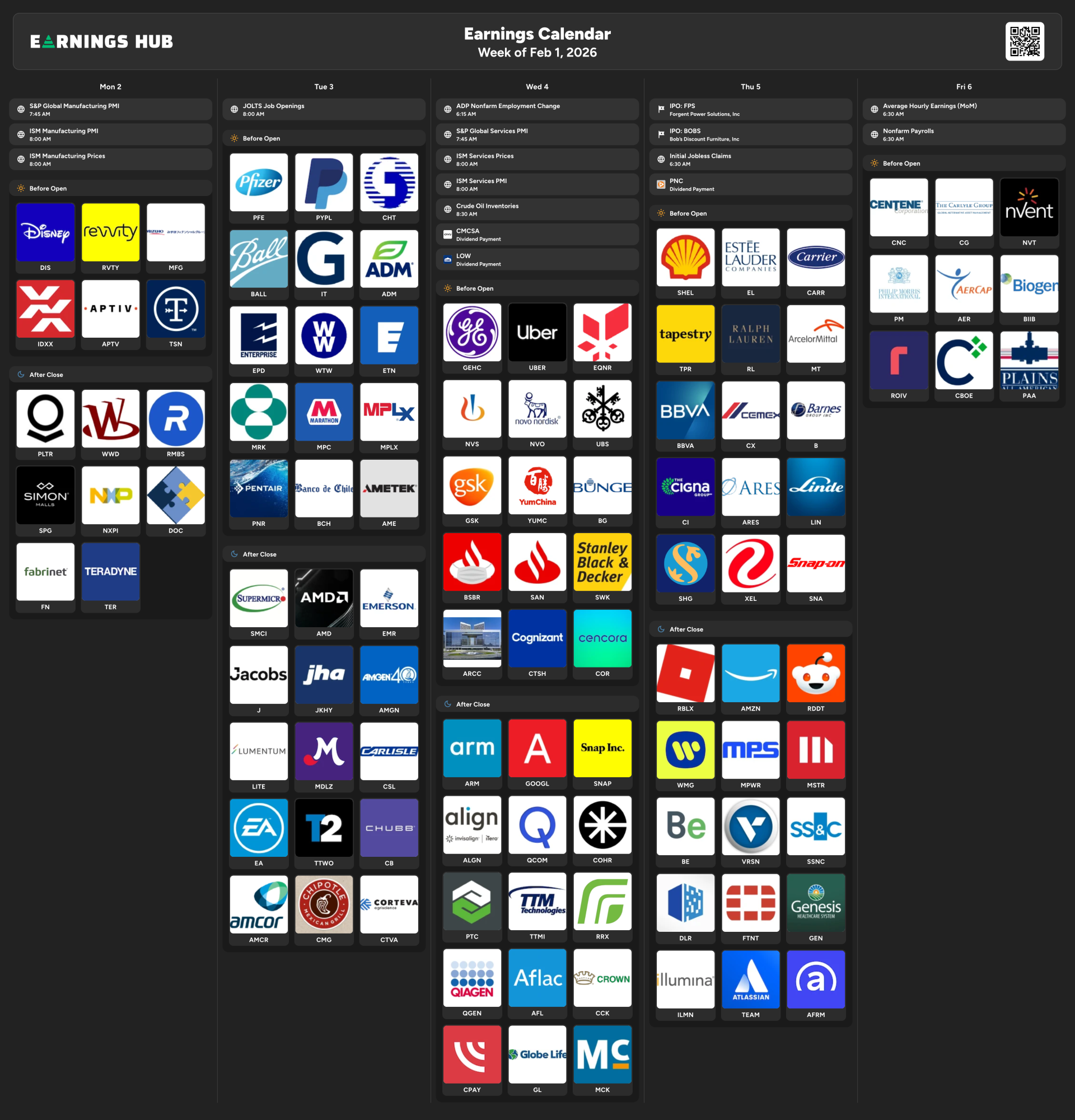

Monday: Palantir earnings after the bell

If it prints clean, AI bulls cheer. If it doesn’t, “AI slop” gets blamed for everything including your uncle’s Wi-Fi. -

Tuesday: Merck, Pfizer, PepsiCo, PayPal + JOLTS

Jobs data + big brands = recession rumor machine fuel. -

Wednesday: Eli Lilly, Yum Brands, Uber; then after the bell: Alphabet, Qualcomm, Snap + ADP

This is the “growth narratives get audited” day. -

Thursday: Tapestry, Peloton Interactive; then Reddit, Amazon, Affirm

Consumer health check. If the consumer coughs, the market catches pneumonia. -

Friday: Under Armour + Nonfarm Payrolls

The market’s weekly “truth serum.”

Also hovering over everything: the partial government shutdown drama—House leadership signaling a path to end it, but the tape will trade every headline like it’s CPI.

“Markets are never wrong—opinions often are.”

— Jesse Livermore

PRE-MARKET STATS

DOW = +0.04% — green by a hair. Like a cat pretending it didn’t fall off the couch.

S&P = -0.31% — broad market says: “cool story, now show me earnings.”

NASDAQ = -0.51% — growth getting the side-eye. Again.

RUSSELL = -0.11% — small caps shrugging: “we were never invited to the AI party anyway.”

VIX = 18.41 — not panic… but definitely not nap time.

BITCOIN = $78,295 — weekend damage still visible. Risk appetite bruised.

GOLD = $4,736 (pulling back) — the “safe haven” that just did a backflip off the roof.

SILVER = $81.75/oz — when a squeeze breaks, it doesn’t “ease”… it evaporates.

COPPER = $1,232 — growth expectations cooling.

PLATINUM = $2,138 — collateral damage trade.

OIL (WTI) = $62.32 — demand nerves + macro uncertainty.

BRENT = $66.24 — same story, different accent.

NAT GAS (spot) = 4.76 — winter premium still lurking.

10Y = 4.253 — rates staying sticky = valuation math staying violent.

DOLLAR = 97.51 — stronger dollar = tighter financial conditions = less fun.

STOCKS IN THE GREEN (+)

Critical Metals Corp +8% — Project Vault hype + domestic supply chain tailwind.

Energy Fuels +5% — same thesis, different ticker.

Oracle +3% — big capital raise = big AI capacity signal.

Disney +2% — Experiences unit flexing real-world demand.

Newmont ~+1% — bounce attempt after the metal chaos.

Freeport-McMoRan ~+1% — miners trying to stabilize.

Idaho Strategic Resources +1% — tag-along bid.

STOCKS IN THE RED (–)

Nvidia -1% — OpenAI mega-deal uncertainty = narrative dent.

Tesla -2% — valuation nerves + Waymo fundraising chatter.

Strategy -7% — beta on beta… in a risk-off tape.

“Earnings are an opinion;

cash flow is a fact.”

| Alfred Rappaport

MARKET HEAT MAP - LIVE

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

Strengths: The market still has a backbone: earnings are coming in with enough wins to keep the longer-term uptrend alive. The index just came off record behavior recently, and big players still have cash, buybacks, and positioning to defend key levels when fear spikes. The bull case survives as long as earnings remain real and liquidity doesn’t vanish overnight.

Weaknesses: This tape is addicted to leverage. When the “hot corner” trades (crypto, metals, AI momentum) wobble, the unwind spills into everything—because the same hands own the same risk. Add a hawkish Fed-leadership vibe, and suddenly every valuation feels like it needs to re-earn the right to exist.

Opportunities: Volatility is not a curse—it's a pricing engine. Dislocations create clean levels, cleaner risk, and better asymmetry for prepared traders. Also, domestic industrial policy (like critical minerals stockpiling) is a rotation catalyst: money doesn’t disappear—it moves.

Threats: The real threat is a confidence shock: if markets start believing “policy will tighten into weakness,” you get a feedback loop—strong dollar, tighter conditions, forced selling, weaker risk appetite, repeat. Layer in shutdown uncertainty and storm-driven disruptions, and you have headline landmines everywhere.

TRUMP TACTICS — ACTIVE (2nd Term Playbook)

Fed Power Move: naming Kevin Warsh signals a harder line on inflation and balance-sheet activism.

Critical Minerals Security: “Project Vault” to build a strategic stockpile and blunt China supply leverage.

Immigration / DHS Pressure: enforcement and funding standoff spilling into shutdown optics and risk headlines.

Geopolitical Tone Management: markets reacting to de-escalation signals and shifting risk premiums in energy.

Industrial Re-shoring Narrative: pushing domestic supply chains as an economic + national security lever (rotation fuel).

“First-Day-of-February Rule: Don’t Chase…

Let Price Confess.”

Day one of a new month tempts traders to swing early.

But the smarter edge is this: wait for the market to show its hand.

Here’s your TFT move:

-

Tune In: If the dollar is rising and VIX is elevated, treat early rallies as tests, not truths.

-

Understand Rotation: watch where money hides (quality, cash-flow, defense) vs. where it bleeds (over-owned momentum).

-

Retracement Zone Setup: let the first 30–60 minutes form levels. Then trade the turn—not the headline.

-

Nail the Power Zone: only press when catalyst + trend + confirmation align.

Surprising stat to anchor it: academic research shows a persistent “turn-of-the-month” return bump around month-end into the first days of the new month—strong enough to be measured across markets over time. Meaning: flows can create an early push… but you still need confirmation to avoid being the exit liquidity.

Earnings season reality check: FactSet data shows a strong share of companies beating estimates so far this quarter—earnings can still support the tape, but only if the market stops paying “infinite multiples” for “infinite stories.”

“Losers average losers.” — Paul Tudor Jones

If you keep trading without waiting for confirmation… how many more “small losses” are you planning to compound into a big one this month?

“In investing, what is comfortable is rarely profitable.” — Robert Arnott

On this day (Feb 2, 1998): the S&P 500 closed above 1,000 for the first time (1,001.27).

What happened: a psychological milestone got reclaimed.

Why it matters today: round numbers magnetize emotion—then price either accepts the level… or rejects it violently. Same human behavior, new decade, faster algos.

TFT takeaway: treat big milestones like battle zones. Don’t predict. Wait for acceptance, then execute.

“In the short run, the market is a voting machine…” — Benjamin Graham

Round numbers don’t predict. They expose.

The stock market is one of the few places where time + compounding + liquidity can turn disciplined decisions into outsized outcomes.

A clean example of structural leverage: options.

One contract can control 100 shares with defined risk.

So a measured move in the underlying can translate into a multiple on the premium—without needing billionaire capital.

The real “freedom flex” isn’t gambling leverage.

It’s asymmetric leverage with rules, so one great trade can meaningfully accelerate your flywheel—while one bad trade can’t ruin your life.

OPTIONS GIVE YOU FREEDOM !

The market is one of the only places where you can risk a few hundred bucks… and get paid like you took a second job.

That’s not luck. That’s asymmetric leverage done with rules.

Example Trade: Single Call Contract on a Breakout

-

Stock: $100

-

Setup: Post-earnings breakout above resistance at $102

-

You buy: 1 Call Option

-

Strike: $105

-

Expiration: 30 days out

-

Cost (premium): $2.00 per share = $200 per contract

-

What happens:

-

Stock runs to $112 over the next week (+12% move)

-

That call now has about $7.00 of intrinsic value ($112 − $105)

-

Options usually still carry time value, but even using intrinsic only:

Value ≈ $7.00 x 100 = $700

Profit ≈ $700 − $200 = $500

Return on risk = $500 / $200 = 250%

The Freedom Point:

A 12% stock move produced a 250% options return with a fixed max loss of $200.

That’s why options—used correctly—can accelerate the Financial Flywheel.

If you never learn how to structure a trade like this… how many years are you willing to keep trading your time for raises that don’t even beat inflation?

“The big money is not in the buying or selling, but in the waiting.”

- Jesse Livermore

“The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.” — Proverbs 21:5

That verse is a trading system in one sentence.

Diligence = process.

Haste = impulse.

Today’s tape is built to bait impatience: falling crypto, crashing metals, AI drama, Fed hawk vibes, storm headlines.

The market wants you emotional because emotional traders donate liquidity.

So here’s your move: slow down on purpose.

Diligence means you do your checklist even when the screen is screaming.

You don’t chase—you retrace.

You don’t trade noise—you trade the turn.

And when you trade like that… you don’t just make money.

You build the kind of repeatable discipline that earns time freedom.

Want to Learn More?

If you want 2026 to be the year you stop “following markets” and start operating in them…

Join Time Freedom Trading and install the Wealth Operating System:

-

See the market in 3D (structure, rotation, catalysts)

-

Trade the TURN, not the noise

-

Defend capital, compound conviction, build the Financial Flywheel

Picture this: it’s December 2026… and your calendar isn’t owned by meetings.

It’s owned by choices.

-

Like / Subscribe / Share

-

Watch the YouTube channel

-

DM me with questions

“FAST FORWARD to DECEMBER of 2026"

If you want 2026 to be the year you stop reacting and start operating… join Time Freedom Trading.

You’ll learn to:

-

Trade the retracement instead of chasing breakouts late

-

Use the 50MA/200MA like a pro (structure, bias, risk)

-

Build a Wealth Operating System that compounds skill into freedom

Because the clock’s not ticking — it’s compounding.

And the market doesn’t pay hope… it pays execution.

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep living the way you lived in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, build a Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

IS TIME FREEDOM TRADING TAX DEDUCTIBLE?

If you’re paying for trading education but not structuring it properly…

you might be overpaying twice.

Once to learn.

Again at tax time.

Most traders guess.

The IRS doesn’t reward guessing — it rewards structure.

We broke down exactly when trading education may qualify as a tax deduction, how active traders set it up CPA-clean,

and what documentation actually matters.

👉 Read this before your CPA does:

Trading Education Tax Deduction – CPA-Ready Guide

If you’re already investing in your edge…

why let bad structure erode it?

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doom scrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your

broker that allow you to place a simple trade on autopilot and minimize

your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

26 DECISIONS THAT WILL DECIDE YOUR 2026

NEW YEAR: UNCERTAIN TIMES. CERTAIN EDGE.

#44 YOUR TRAINING YOUR AI REPLACEMENT.

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS