Read more of the

The W.T.F. Report

February 4th, 2026

Wednesday

February 4th, 2026

The AI Shark Tank & The Re-Opened Pool.”

It’s still doing cannonballs into volatility while tech gets chewed like a squeaky toy. The “AI tools eating software companies” storyline is turning yesterday’s darlings into today’s appetizers.

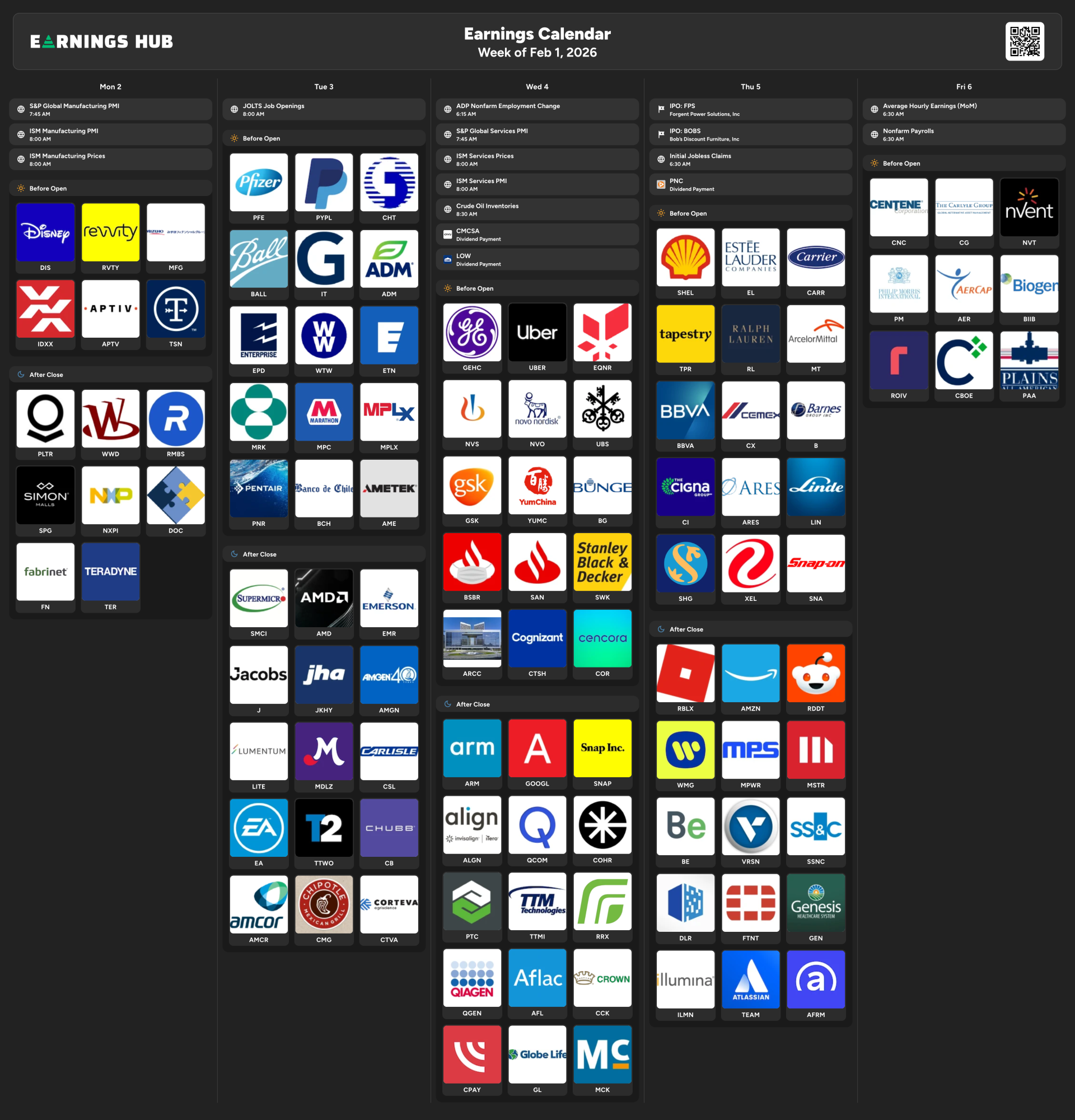

Meanwhile yields are higher, futures are cranky, and earnings season is basically a daily stress test for anyone emotionally attached to a ticker.

Welcome back to functioning civilization — the government is reopened… which is adorable, because they still handed DHS a two-week “we’ll talk later” sticky note. Markets see that and whisper: “So… we’re just speed-dating fiscal policy now?”

At the same time, ADP came in light (22K), which sounds like “rate cuts soon!” until you remember yields are higher anyway — because bonds don’t care about your feelings, they care about inflation math and credibility.

Yesterday’s tech selloff was the market reminding everyone that hype has a shelf life. AI tools keep compressing old software margins, and the tape is punishing anything that looks like “growth” but trades like “hope.”

Now the spotlight swings to GOOGL after the bell — and with AMD down ~9% premarket and UBER down ~8%, we’re in that earnings season phase where guidance matters more than results. Translation: trade the reaction, not the headline.

If you’re hunting opportunity, zoom out: money is rotating into real businesses with pricing power (Walmart flexing a trillion-dollar market cap) while crowded trades get trimmed.

What's moving the Tape

Tech dump yesterday dragged Nasdaq and the S&P as software got slapped by the “AI eats your margins” narrative.

Bright spots: Walmart hit $1T market cap and Pepsi popped on results — money is paying for cashflow, not vibes.

Government reopened… but DHS only got a short extension, so the “shutdown sequel” trailer is still playing.

ADP jobs light (22K) reinforces the “low-hire, low-fire” backdrop.

Semis: consolidation headline — TXN buying SLAB — while AMD’s guidance moodiness reminds you this sector can be a rocket ship and a trap door.

Health/GLP-1 wars: Eli Lilly ripped premarket on strong numbers and outlook while Novo’s weakness lingers as a “pricing pressure” warning shot.

AI consumer push: Amazon rolling Alexa+ wider with pricing clarity is another “AI gets productized” data point.

“You don’t need to be right. You need to make money.”

— George Soros

PRE-MARKET STATS

SLAB +50% — TXN buyout headline lit the fuse.

ENPH +23% — guidance glow-up.

LITE +11% — strong quarter + strong guide.

SMCI +9% — AI server demand = real revenue.

LLY +7% — beat + strong 2026 view.

MTCH +7% — earnings beat, cash flow talk.

TTWO +5% — raised 2026 outlook.

STOCKS IN THE RED (–)

TXN -4% — buyer’s dip (the market’s “congrats, now pay for it”).

CMG -5% — traffic softness still a thing.

UBER -8% — guidance needs an Uber… ironically.

AMD -9% — “good isn’t great” punishment.

BSX -10% — guidance disappointment.

VRNS -14% — forward outlook face-plant.

“Earnings are an opinion;

cash flow is a fact.”

| Alfred Rappaport

MARKET HEAT MAP - LIVE

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

Strengths:

Outside of tech, the tape is proving it can still reward execution. Walmart crossing the trillion-dollar line is the clearest signal that “boring, scaled, cash-flow machines” are becoming the new status symbol. When the market starts paying premiums for logistics, subscriptions, ads, and pricing power, it’s telling you liquidity hasn’t disappeared — it’s getting pickier.

Weaknesses:

Tech remains vulnerable because multiples are being re-priced by two forces at once: higher yields and AI-driven margin compression (especially in software). Add earnings season guidance landmines (AMD, UBER) and you get the perfect cocktail for sharp intraday reversals and gap risk.

Opportunities:

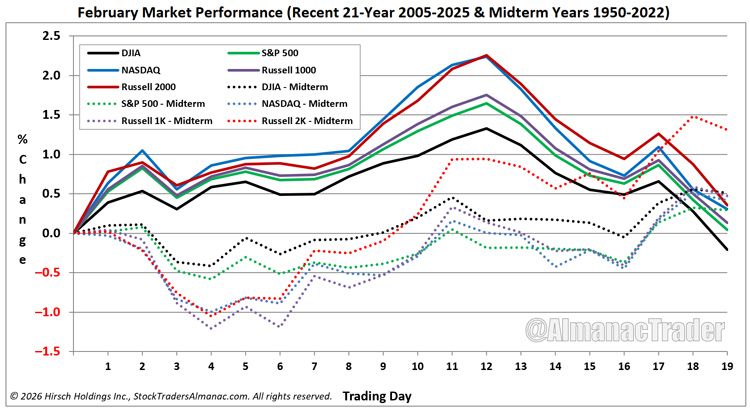

Rotation is the opportunity. When Nasdaq is heavy but Russell is green, the market is hinting that leadership can broaden — which creates cleaner swing setups outside the crowded megacap trade. Also, earnings volatility creates premium… and premium is a weapon when you know how to deploy it (hello, covered calls).

Threats:

Policy uncertainty didn’t end — it got postponed. The government reopened, but DHS funding is still a near-term negotiation cliff, which can re-inject headline risk fast. And globally, trade re-wiring is accelerating (watch India/US deal implications for energy, defense, and tariffs).

TRUMP TACTICS — ACTIVE (2nd Term Playbook)

Tariff leverage as negotiation weapon — lowering/raising tariffs to force counterpart concessions and reshape supply chains.

Energy realignment through trade — pushing allies toward U.S. energy supply as a geopolitical lever.

Fed pressure + chair reset — nominating Kevin Warsh and amplifying “rates should be lower” messaging, keeping markets sensitive to independence risk.

Immigration/visa tightening via agency action — policy shifts influencing labor flows and international education pipelines.

Regulatory tone shift (especially crypto/markets) — a more receptive posture toward digital asset rulemaking and market structure changes.

“In investing, what is comfortable is rarely profitable.” — Robert Arnott

Covered Calls in the February Pullback (Post-Earnings)

When earnings hit and a stock gets smacked, most traders do one of two things:

-

panic sell at the lows, or

-

revenge buy at the highs.

Time Freedom Traders do the third option: get paid to wait.

Covered calls are built for this exact environment: choppy tape, elevated VIX, and earnings-driven gaps. You sell premium against shares you’re willing to hold anyway, and you turn uncertainty into cashflow — while everyone else is “hoping” their thesis feels better tomorrow.

The Cboe BXM (a covered-call buywrite benchmark) shows materially lower volatility than the S&P 500 historically (about 10.7% vs 15.2%) and a less severe max drawdown (-35.8% vs -50.9%) over its long sample. That’s the math version of “premium cushions the fall.”

Earnings season kicker:

Implied volatility often drops hard right after earnings (“IV crush”), meaning buyers overpay and sellers get paid.

That’s why a post-earnings pullback can be a covered call sweet spot: price stabilizes, premium is still decent, and you’re monetizing patience.

Market Memory — Feb 4

Historical Event: NASDAQ was founded (1971).

Feb 4, 1971 is the paperwork birthday of the exchange that eventually turned “electronics” into “everyone’s favorite casino with rules.” Trading started a few days later, but this is the day the all-electronic market got its official green light.

What happened:

NASDAQ was created to modernize how stocks traded—less floor shouting, more screens, more speed, more liquidity… and eventually, more tech dominance.

Why it matters today:

Fast forward to 2026 and you’re watching the grandkids of that moment: AI + algorithms + higher yields repricing tech in real time. When the market is electronic, the punishment is instant. Earnings misses don’t “fade over time”… they get speed-bagged in premarket (hi, AMD and UBER).

TFT Takeaway:

In an electronic market, reaction beats opinion.

Don’t marry the story. Date the setup.

Trade the turn—not the tweet, not the talking head, not your ego.

The “Ignorance Tax” in Numbers

Most traders don’t lose because they’re dumb.

They lose because they’re impatient.

Earnings weeks are the ultimate trap: the market prices a move, then reprices it instantly post-announcement via volatility crush — so you can be directionally right and still lose money if you paid too much premium.

Freedom comes from process, not prediction.

“The big money is not in the buying or selling, but in the waiting.”

- Jesse Livermore

The market punishes haste because haste is emotional outsourcing. It’s you handing the steering wheel to dopamine and calling it “strategy.” Diligence is different: diligence is stewardship. It’s showing up with a plan, a checklist, and the humility to let price confirm before you commit capital.

Mental Model: Stewardship Over Speed

-

Faith (Why): You’re not chasing money — you’re building a life with margin, purpose, and freedom.

-

Stoicism (How): Control what you can: entries, exits, risk, size, discipline.

-

System (What): Execute only when alignment shows up — catalyst, trend, setup, confirmation.

Ask yourself:

If you traded like a professional for the next 30 days… what would your confidence look like by March

“The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.” — Proverbs 21:5

Want to Learn More?

If you want the exact playbook for trading earnings pullbacks without becoming exit liquidity…

Get Tactical.

Plug into the Time Freedom Trading Tactics Newsletter and start building the skillset that turns volatility into a financial flywheel.

If you keep “winging it” through earnings season… how many more years are you willing to donate to the market as tuition?

Picture yourself 90 days from now — calmly collecting premium, stacking wins, and treating the market like a business instead of a mood.

-

Like / Subscribe / Share

-

Check the YouTube channel

-

DM me your questions (and your tickers — I’ll tell you what’s real)

“FAST FORWARD to DECEMBER of 2026"

If you want 2026 to be the year you stop reacting and start operating… join Time Freedom Trading.

You’ll learn to:

-

Trade the retracement instead of chasing breakouts late

-

Use the 50MA/200MA like a pro (structure, bias, risk)

-

Build a Wealth Operating System that compounds skill into freedom

Because the clock’s not ticking — it’s compounding.

And the market doesn’t pay hope… it pays execution.

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep living the way you lived in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, build a Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

IS TIME FREEDOM TRADING TAX DEDUCTIBLE?

If you’re paying for trading education but not structuring it properly…

you might be overpaying twice.

Once to learn.

Again at tax time.

Most traders guess.

The IRS doesn’t reward guessing — it rewards structure.

We broke down exactly when trading education may qualify as a tax deduction, how active traders set it up CPA-clean,

and what documentation actually matters.

👉 Read this before your CPA does:

Trading Education Tax Deduction – CPA-Ready Guide

If you’re already investing in your edge…

why let bad structure erode it?

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doom scrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your

broker that allow you to place a simple trade on autopilot and minimize

your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

26 DECISIONS THAT WILL DECIDE YOUR 2026

NEW YEAR: UNCERTAIN TIMES. CERTAIN EDGE.

#44 YOUR TRAINING YOUR AI REPLACEMENT.

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS