Read more of the

The W.T.F. Report

February 5th, 2026

Thursday

February 5th, 2026

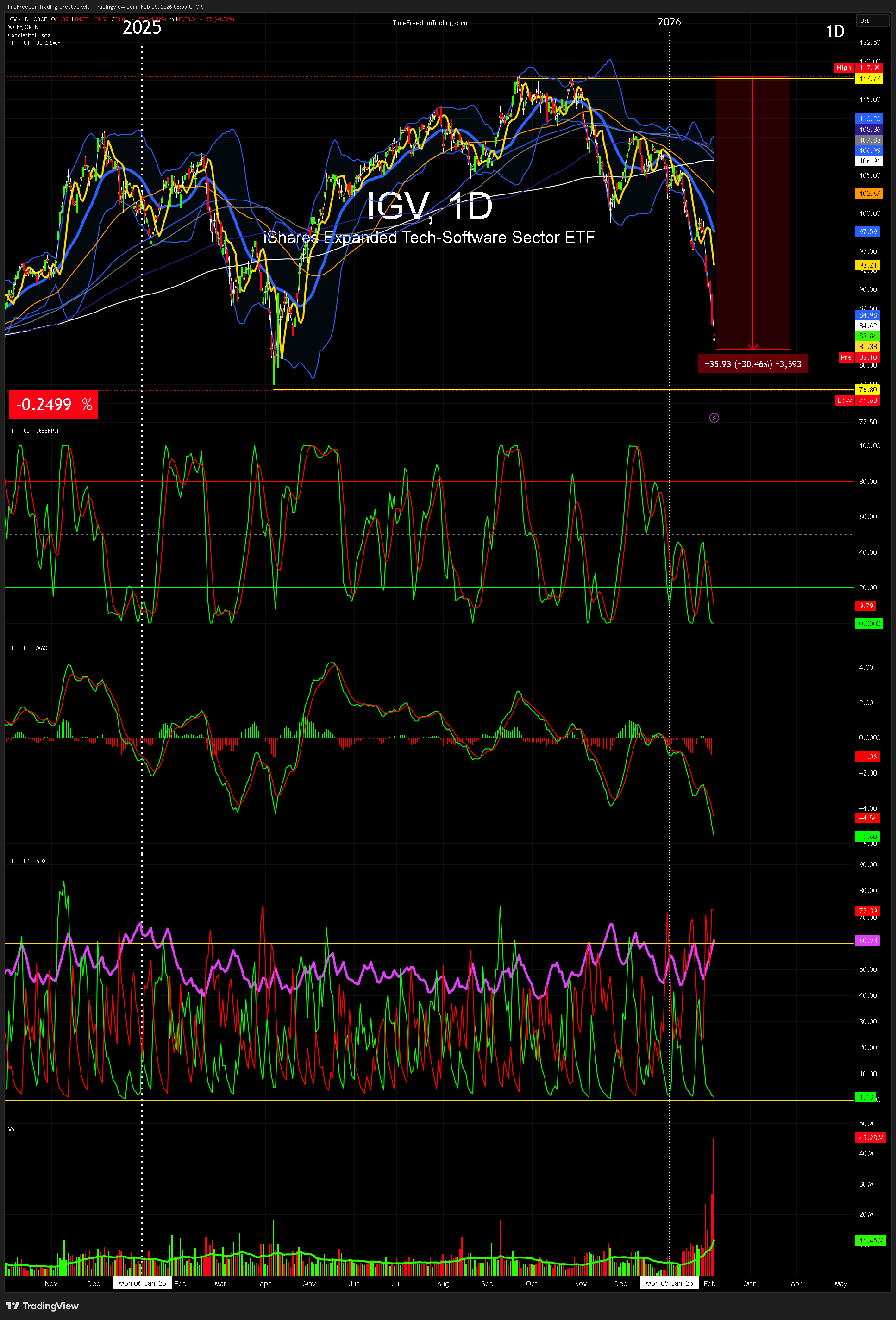

“The Software Ice Age”

AI is the meteor, software multiples

are the dinosaurs, and hedge funds are

out here selling the fossils on eBay.

Translation: this is a rotation event, not a feelings contest.

Tech is doing that thing where it “invests in your character.”

Three straight down days. Software is in a full-blown bear market cosplay—except it’s not cosplay, it’s a 30% haircut in IGV and hedge funds are cashing checks like they invented gravity.

The market’s not “confused.” It’s repricing the future.

When CAPEX starts sounding like “we’re going to burn cash faster,” Wall Street does what it always does:

It panics first… then asks questions later… then buys the dip like nothing happened.

How to think today:

-

Defense first. Don’t fight a falling elevator in software.

-

Rotate, don’t argue. If money is fleeing risk, stop pitching it a TED Talk.

-

Trade the turn—not the trauma. Wait for stabilization signals before going full hero.

AI Continues to eat software!

What's moving the Tape

Software selloff is accelerating as investors debate whether AI turns parts of enterprise software into “features,” not businesses.

IGV down ~30% puts software in a clear sector bear market. That changes the playbook: rallies become sell zones until proven otherwise.

Hedge funds reportedly up big shorting software — when that crowd presses, bounces can be violent… but often temporary.

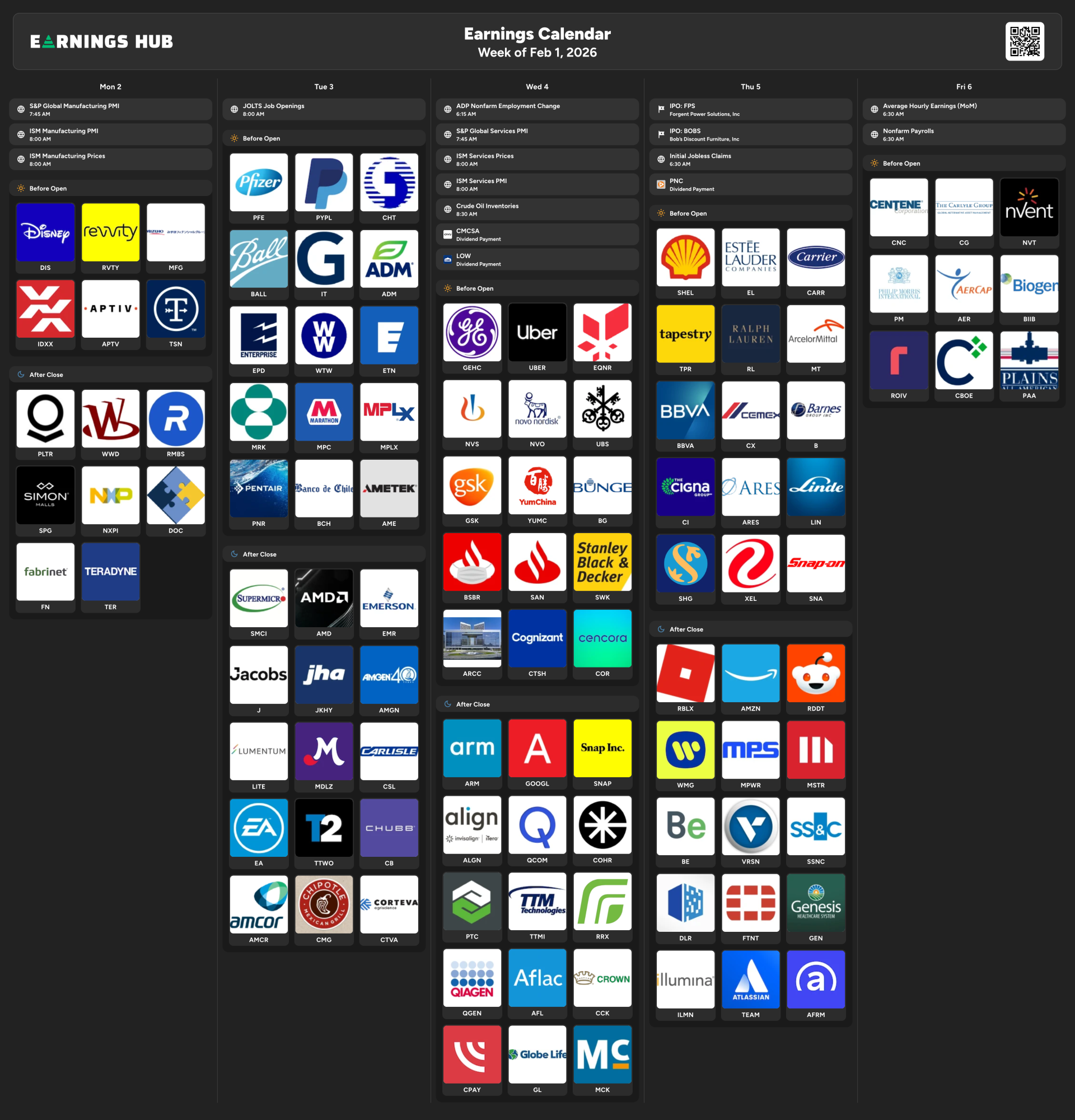

Google (GOOGL) down ~4% even after a beat because CAPEX guidance spooked the street. The market heard: “We’re spending a fortune,” not “We’re building the future.”

MSFT downgrade adds gasoline to the “AI spending hangover” narrative.

QCOM + ARM guidance misses and “memory shortage” chatter = supply chain anxiety creeping back into the room.

Bitcoin below 70K confirms the risk-off tone bleeding beyond equities.

Oil firming on Iran negotiations/talks — geopolitics keeping energy bid even while growth fear rises.

Labor market warning shots: ADP light + Challenger layoffs spiking = the economy may be cooling faster than the Fed’s ego.

Amazon earnings after the bell — tonight’s main event. If AMZN sneezes, the market catches pneumonia.

“You don’t need to be right. You need to make money.”

— George Soros

PRE-MARKET STATS

DOW: -0.31% — Old money acting like it’s “fine.” It’s not. It’s just slower to scream.

S&P: +0.75% — Broad market trying to hold the line while tech bleeds on the carpet.

NASDAQ: -0.93% — Tech wreck continues. No bailout for vibes.

RUSSELL: -0.66% — Small caps sniffing opportunity… or just lost.

VIX: 21 — Fear is awake, caffeinated, and looking for a second espresso.

BITCOIN: 69,795 — Below 70K. Risk-on just got benched. Watch 65K-60K zone.

GOLD: 4,861 — When confidence drops, shiny rocks start looking like wisdom.

SILVER: 75.17 — Still sliding. Volatility doing backflips.

WTI Crude: 63.45 — Iran headlines = premium pricing.

Brent: 67.44 — Same story, bigger microphone.

Nat Gas: 4.59 — Cooling off after the moon mission.

10-YR: 4.241% — Yields staying stubborn = valuations stay stressed.

Dollar: 97.68 — Steady… like a referee watching tech get mugged.

STOCKS IN THE GREEN (+)

TPR +7.5% — Coach parent strutting like luxury never left.

ELF +4.8% — Guidance raise = beauty stays undefeated.

HSY +3.0% — Candy beats stress eating. Recession-proofing… deliciously.

CPAY +3.0% — Payments beat. Boring businesses still print.

ALGN +2.7% — Invisalign smiling through the chaos.

BMY +2.0% — Pharma doing what pharma does: steady, strong, unbothered.

CAH +1.0% — Raised guidance. Quiet winner energy.

STOCKS IN THE RED (–)

ORLY -1.0% — Slight disappointment. Not a meltdown, just a frown.

GOOGL -3%+ — Beat the quarter, spooked the future with CAPEX.

HOOD -3.8% — Risk-off hurts the casino.

COIN -4.2% — Bitcoin dropped; Coinbase caught the stray.

MSTR -6.2% — Leverage + BTC down = math gets violent.

CARR -6.6% — Missed both lines. HVAC can’t cool that off.

ARM -6.6% — Guidance “fine” isn’t good enough in this tape.

PTON -9% — People still not paying monthly to suffer at home.

QCOM -11% — Forecast hit + memory shortage fears = big slap.

EL -12% — Beat EPS, still punished. The market wants perfection, not “pretty good.”

“Earnings are an opinion;

cash flow is a fact.”

| Alfred Rappaport

MARKET HEAT MAP - LIVE

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

Strengths:

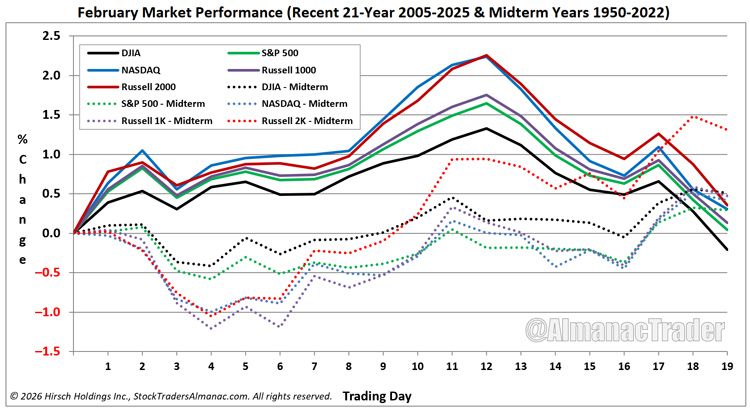

Volatility is back, and that’s a trader’s native language. A VIX at 21 means option pricing is alive, ranges expand, and premium strategies can pay—if you respect risk. Also, rotation is visible: while software is getting kneecapped, pockets like healthcare and select consumer brands are still acting resilient.

Weaknesses:

Tech leadership is cracking, and when leadership breaks, the index loses its spine. CAPEX fear is turning “AI investment” into “AI expense problem.” Add higher yields and you get the perfect cocktail: multiple compression with a side of regret.

Opportunities:

Sector bear markets create mean-reversion bounces and trend continuation setups—both can be traded, but only with confirmation. If software stabilizes, the snapbacks can be savage. If it doesn’t, rallies become short entries and put-spread zones on the right names/ETFs.

Threats:

Labor data delays + layoffs spiking is a confidence killer. If the jobs narrative breaks, markets shift from “soft landing” to “uh-oh.” Geopolitics can also reprice energy fast. And if Bitcoin keeps sliding, risk appetite dries up across the board.

TRUMP TACTICS — ACTIVE (2nd Term Playbook)

Trade & Tariff Posture: using tariffs/threats as leverage in negotiations and manufacturing reshoring narratives.

Energy Leverage: pushing “energy dominance” messaging while using geopolitical pressure to influence oil dynamics.

Border & Enforcement Optics: prioritizing visible enforcement actions to project control and urgency.

Regulatory Pressure: signaling tighter/looser regulation depending on industry alignment and public narrative.

Fed Influence Framing: increasing public pressure on monetary policy outcomes without owning the consequences.

Foreign Policy Hardline Negotiations: using public warnings + brinkmanship to extract concessions.

Corporate Signaling: spotlighting winners/losers publicly to shape business behavior through attention.

“In investing, what is comfortable is rarely profitable.” — Robert Arnott

Falling Knife = No Touch Zone… until the Handle Forms.”

A sector down 30% isn’t “cheap.” It’s guilty until proven innocent.

Your job: stop trying to be right and start trying to be paid.

How to Trade IGV When It’s Down 30%

-

Phase 1: Survive the slide

-

Define a No-Trade Zone: if IGV keeps making lower lows and lower highs, you don’t “average,” you avoid.

-

Trade smaller, trade cleaner, use defined risk.

-

-

Phase 2: Trade the bounce (only after confirmation)

-

Look for a base: multiple days holding a level without fresh lows.

-

Wait for the turn trigger: higher low + reclaim of key moving averages/VWAP zones.

-

Favor sort dated calls for max IV with defined risk) over naked puts.

-

-

Phase 3: Trade the trend continuation (bear rallies fail)

-

If a bounce stalls under resistance, that’s often a bear-market reset. Look for lower highs for entries!

-

Consider puts on rejection days—only when the tape confirms.

-

Historically, some of the biggest single-day percentage gains happen inside bear markets, because short-covering and forced rebalancing create face-ripping rallies.

That’s why we don’t chase red candles… and we don’t marry green ones.

TFT Rule:

In a sector bear market, you’re either selling premium, spreading risk, or waiting.

Hero trades are for movies… and divorced dads.

“Volmageddon” (Feb 5, 2018)

One of the most infamous volatility shocks in modern history hit on this date—markets reminded everyone that “low volatility forever” is a bedtime story adults tell themselves.

Surprising stat: Volatility products imploded so fast that entire strategies died overnight—proof that risk isn’t what you see… it’s what you ignored.

TFT Lesson: when VIX wakes up, your old playbook expires.

New regime = new rules.

Volmageddon was the day the market reminded everyone:

“Low volatility” is not a personality trait. It’s a phase.

Here’s what actually happened — and why it matters:

The Setup: A Crowded “Short Vol” Trade

In 2017 and early 2018, a massive trade became popular:

-

Sell volatility

-

Collect premium

-

Rinse, repeat

-

Print money (until it doesn’t)

It worked because volatility stayed unusually low for a long time.

So investors got bold.

And Wall Street did what it always does:

It turned a trade into a lifestyle.

The Spark: A Sudden Volatility Shock

On Feb 5, 2018:

-

The S&P 500 dropped ~4% intraday (one of the biggest hits in years at that time)

-

The VIX exploded higher (it spiked dramatically — the move was violent, not “normal”)

That alone is spicy.

But the real chaos came from the products tied to volatility.

The Weapon: Inverse VIX ETNs (Like XIV)

The most infamous product was:

-

XIV (Credit Suisse’s inverse VIX ETN)

What it did:

-

If volatility stayed calm, XIV tended to rise.

-

If volatility spiked, XIV could get wrecked fast.

And on Volmageddon?

-

XIV got obliterated after the close.

-

It lost so much so quickly that it triggered the product’s built-in “death clause.”

-

Credit Suisse announced liquidation shortly after.

Translation:

People went to bed thinking they owned a “strategy”…

and woke up owning a lesson.

The Mechanics: Why It Snowballed

This wasn’t just fear. It was forced buying.

When volatility rises, short-vol strategies often have to do the opposite of what you want:

-

They must buy volatility futures to rebalance hedges

-

They must sell equities to reduce exposure

-

That selling pushes the market down more

-

Which pushes vol up more

-

Which triggers more forced rebalancing

That’s a feedback loop.

A self-licking ice cream cone of pain.

What Volmageddon Proved

1) “Safe” can become “fatal” instantly

If the strategy requires daily rebalancing under stress, it can break fast.

2) Liquidity disappears when everyone needs it

People learned the difference between:

-

“I can exit”

-

and “I can exit when everyone else is exiting too”

3) Volatility is not random — it’s regime-based

Low vol regimes breed leverage.

Leverage breeds fragility.

Fragility breeds explosions

TFT Takeaway (The Trading Lesson)

Volatility isn’t the enemy. Unpriced risk is.

When VIX is sleepy:

-

Don’t get cocky.

-

Get systematic.

When VIX wakes up:

-

Trade smaller.

-

Trade defined risk.

-

Wait for confirmation.

-

Let the market show you the turn.

If a “boring” product like XIV can go from “money machine” to “liquidated” in a day…

what happens to your portfolio when the next volatility regime shift shows up and you’re still trading like it can’t?

Sector destruction creates elite opportunity—for the prepared.

When a theme gets crowded (like software leadership), the unwind can be brutal… but that same unwind sets up the next multi-month rotation.

Why it happens:

-

Crowded positioning breaks.

-

CAPEX fears hit margins and valuation.

-

Yields stay high → multiples compress.

-

Smart money rotates to where expectations are lower and cashflows are clearer.

TFT Lesson:

You don’t need to predict the bottom.

You need a repeatable process that captures the turn and compounds the move.

“The big money is not in the buying or selling, but in the waiting.”

- Jesse Livermore

“Whoever is slow to anger is better than the mighty, and he who rules his spirit than he who takes a city.” — Proverbs 16:32

When the Tape Turns Violent,

You Turn Disciplined

When volatility spikes, the market is basically yelling:

“Stop guessing.”

This is where pros separate from tourists.

Tourists need certainty.

Operators need a process.

Your edge today isn’t a prediction.

It’s emotional regulation + execution discipline.

Because the fastest way to blow up isn’t being wrong…

It’s being undisciplined while wrong.

That’s not just a verse.

“Whoever is slow to anger is better than the mighty, and he who rules his spirit than he who takes a city.” — Proverbs 16:32

That’s a trading manual.

Key principle: self-control beats raw power.

In markets: ruling your spirit beats forcing a trade.

TFT Mental Model: “Calm is capital.”

When you keep your state steady, you can see the TURN.

When you get emotional, you become liquidity.

Action for today:

-

Before your first trade, take 60 seconds.

-

Identify your No-Trade Zone.

-

Write one sentence: “I only trade aligned setups.”

-

Then execute like a surgeon, not a slot machine.

If you can’t rule your spirit on a VIX 21 day… what do you think happens when it hits 30 and the market starts throwing chairs?

Want to Learn More?

If you want the exact playbook for trading earnings pullbacks without becoming exit liquidity…

Get Tactical.

Plug into the Time Freedom Trading Tactics Newsletter and start building the skillset that turns volatility into a financial flywheel.

If you keep “winging it” through earnings season… how many more years are you willing to donate to the market as tuition?

Picture yourself 90 days from now — calmly collecting premium, stacking wins, and treating the market like a business instead of a mood.

-

Like / Subscribe / Share

-

Check the YouTube channel

-

DM me your questions (and your tickers — I’ll tell you what’s real)

“FAST FORWARD to DECEMBER of 2026"

If you want 2026 to be the year you stop reacting and start operating… join Time Freedom Trading.

You’ll learn to:

-

Trade the retracement instead of chasing breakouts late

-

Use the 50MA/200MA like a pro (structure, bias, risk)

-

Build a Wealth Operating System that compounds skill into freedom

Because the clock’s not ticking — it’s compounding.

And the market doesn’t pay hope… it pays execution.

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep living the way you lived in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, build a Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

IS TIME FREEDOM TRADING TAX DEDUCTIBLE?

If you’re paying for trading education but not structuring it properly…

you might be overpaying twice.

Once to learn.

Again at tax time.

Most traders guess.

The IRS doesn’t reward guessing — it rewards structure.

We broke down exactly when trading education may qualify as a tax deduction, how active traders set it up CPA-clean,

and what documentation actually matters.

👉 Read this before your CPA does:

Trading Education Tax Deduction – CPA-Ready Guide

If you’re already investing in your edge…

why let bad structure erode it?

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doom scrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your

broker that allow you to place a simple trade on autopilot and minimize

your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

26 DECISIONS THAT WILL DECIDE YOUR 2026

NEW YEAR: UNCERTAIN TIMES. CERTAIN EDGE.

#44 YOUR TRAINING YOUR AI REPLACEMENT.

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS