Read more of the

The W.T.F. Report

February 6th, 2026

Friday

February 6th, 2026

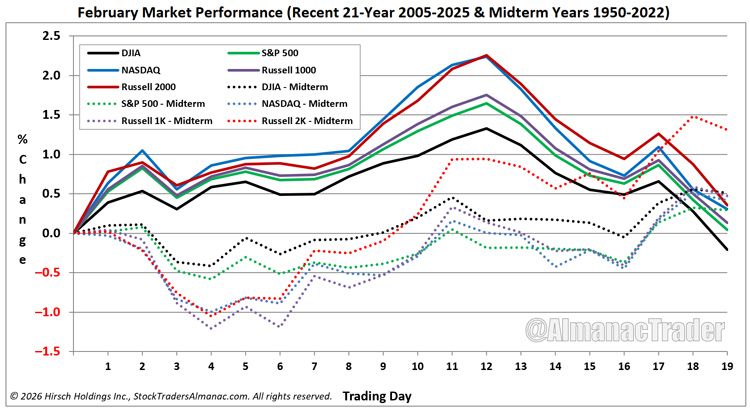

It's Payday Friday… Poised for a Bounce?

Tech has logged 4 straight red days and software got body-slammed into a sector bear market. Meanwhile Bitcoin kissed $60K support like it owed it money… then bounced. Volatility is still hanging around 20 VIX like an uninvited houseguest who “just needs a couch for a few nights.”

The AI sugar rush is getting audited.

Amazon’s big spend plan is forcing the market to ask the question nobody wants to answer:

Are we investing… or just lighting cash on fire to win a compute arms race?

This week alone, big tech market caps got shaved hard, and the software/services complex has bled roughly $1T since late January, depending on the basket you track.

That’s not “a dip.” That’s a re-rating.

Also: the government shutdown noise is still messing with data timing (classic).

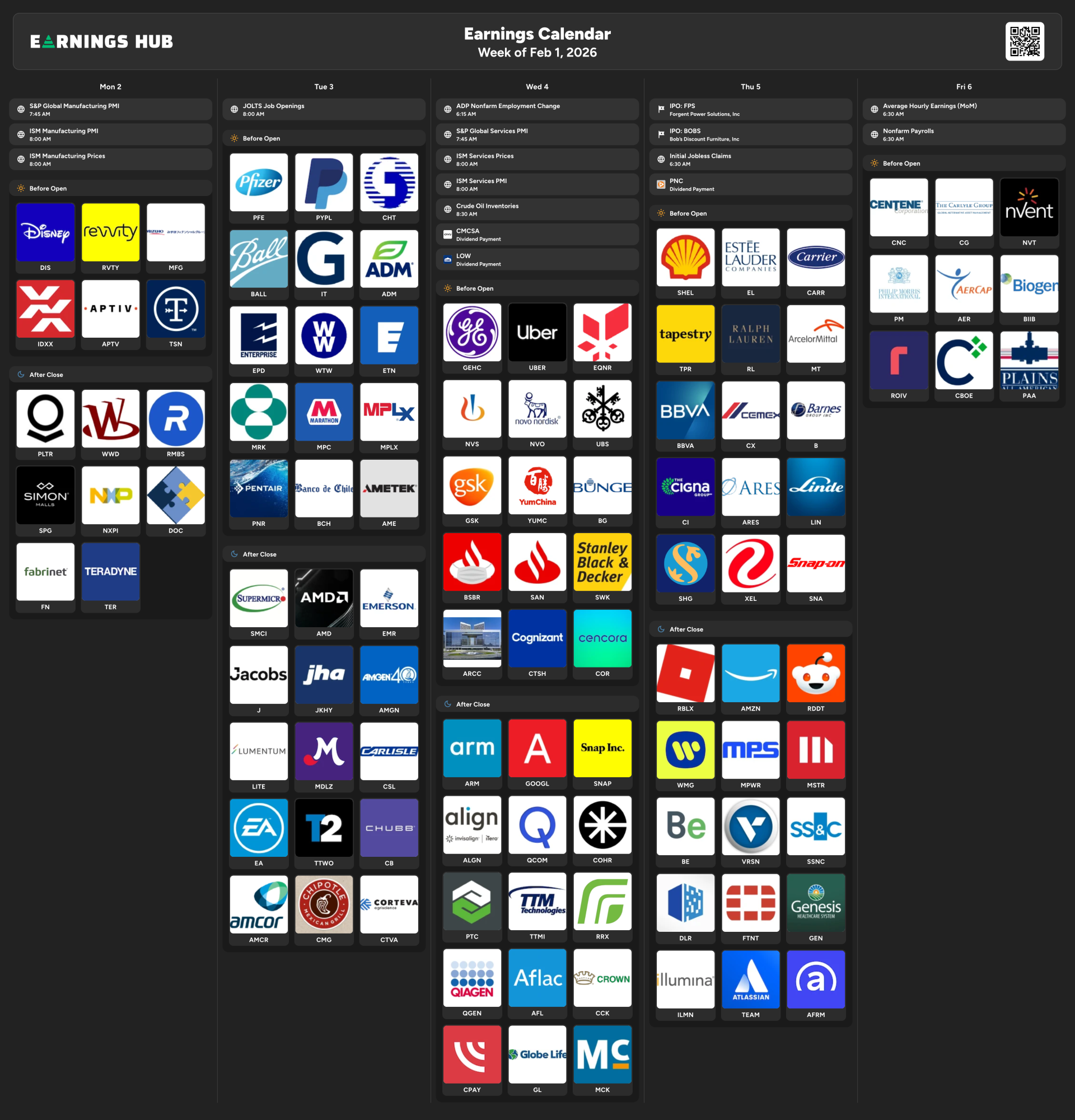

What's moving the Tape

AMZN: beat revenue, missed EPS by a hair, and dropped the $200B CapEx flex — market said “cool story, bro” and sold it.

AI Spend Anxiety: Wall Street is now pricing disruption + overspending at the same time.

Software ETF carnage (IGV): this isn’t one bad day — it’s a multi-session unwind with fear that AI is eating the margins of traditional software.

AI ad beef (Altman vs Anthropic): Super Bowl week drama… but the market cares more about monetization + trust than jokes.

Stellantis: nuked premarket on overhaul hit expectations (risk-off tape hates big “reset” numbers).

Jobs data timing is messy thanks to the shutdown headlines and shifting schedules.

University of Michigan Consumer Sentiment (Prelim Feb) — 10:00am ET (watch inflation expectations in the details).

Ongoing earnings digestion: CapEx guidance is now the market’s lie detector.

“You don’t need to be right. You need to make money.”

— George Soros

PRE-MARKET STATS

DOW +0.59% — Old man strength. Still refuses to die.

S&P +0.57% — Attempting a dignity bounce.

NASDAQ +0.66% — Tech popping like it remembered it’s allowed to go up too.

RUSSELL +1.46% — Small caps waking up like, “Wait… you guys were panicking?”

VIX 20 — Fear is not gone. It’s just pacing.

BITCOIN 67,775 — Bounce off $60K support; still down ugly on the week.

GOLD 4,951 — When people get nervous, shiny rocks get promoted.

SILVER 75.38 — Retail’s favorite rollercoaster resumed its “Wheee!” phase downward.

WTI 62.77 / BRENT 66.60 — Energy calm… for now.

NAT GAS 4.63 — Cooling off after kissing all-time highs.

10Y 4.241% — Rates still sitting high enough to make valuation math cry.

DOLLAR 97.68 — Holding steady. Like a poker face with anxiety.

STOCKS IN THE GREEN (+)

Reddit (RDDT) +13% — Beat + upbeat guide + buyback energy.

Strategy (MSTR) +8% — Bitcoin bounce = MSTR trampoline.

Novo Nordisk (NVO) +8% — FDA enforcement tone hits copycats; branded players perk up.

Eli Lilly (LLY) +4% — Same theme, smaller pop.

STOCKS IN THE RED (–)

Hims & Hers (HIMS) -6% — “Copycat” crackdown headlines = sentiment hit.

Amazon (AMZN) -7% — CapEx shock + margin math.

Molina (MOH) -28% — Healthcare miss + guidance pain = trapdoor.

“Earnings are an opinion;

cash flow is a fact.”

| Alfred Rappaport

MARKET HEAT MAP - LIVE

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

Strengths:

A bounce attempt on a Friday after a brutal tech slide is not random — it’s positioning, short-covering, and “I don’t want to hold max fear into the weekend.” With VIX holding ~20, traders are still paying for protection, which often creates fuel for sharp snapbacks when sellers pause. The dollar steady and yields not spiking further gives the tape room to breathe.

Weaknesses:

Software and AI-adjacent names are getting repriced on two fronts: higher cost of capital and fear of product disruption. When a whole sector starts trading like it’s guilty until proven innocent, rallies can be fast but fragile. CapEx guidance is the new landmine — “great future” is nice, but the market wants to see the bill split.

Opportunities:

Sector bear markets create the cleanest rotations because losers become obvious and leadership becomes precious. The edge is not guessing bottoms — it’s stalking mean-reversion bounces after capitulation signals (volume spikes, breadth washouts, volatility stabilization). Also watch for “AI winners inside the wreckage” — firms positioned to absorb AI, not be replaced by it.

Threats:

If the shutdown keeps distorting data flow, traders can overreact to vibes instead of facts. Add in Super Bowl weekend liquidity quirks and you get thin conditions where algos can slap price around for sport. The bigger threat: the market starts believing the story that software demand gets structurally clipped — that’s not a dip-buying story, that’s a multiple reset.

TRUMP TACTICS — ACTIVE (2nd Term Playbook)

Family / savings incentives: Promotion of “Trump Accounts” as tax-advantaged savings for children, with private sector matching support highlighted publicly.

Housing / affordability posture: Executive actions framed around limiting Wall Street competition with Main Street homebuyers.

Public health + enforcement tone: “Make America Healthy Again” branding + agencies signaling tougher stances on certain markets/products (feeds into pharma headlines).

Government reform branding: “DOGE / Reform Government” positioning as a central priority theme.

Border + security priority stack: “Secure the Border / National Security” remains top-line messaging focus.

Energy push: “Unleash American Energy” framing stays active as a stated priority domain.

Foreign policy signaling: Recent executive actions include targeting perceived threats (example: Cuba-related EO listing).

“In investing, what is comfortable is rarely profitable.” — Robert Arnott

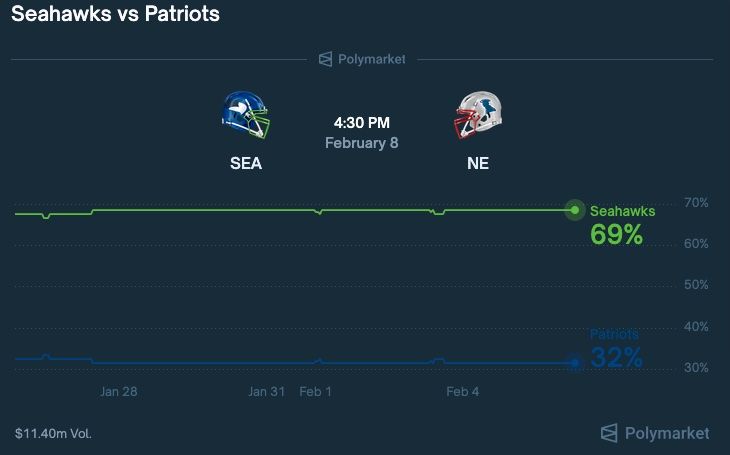

The Super Bowl “Betting Bloom” Trade

AKA: when America turns into a dopamine day-trader for 4 hours.)

Super Bowl week isn’t about who wins the game.

It’s about who wins the attention + transaction war.

Your edge:

Trade the tide of hype… then respect the mean reversion when the confetti hits the floor.

The Watchlist (Sportsbook Exposure)

Primary (cleanest read):

-

DKNG (DraftKings)

-

FLUT (Flutter / FanDuel parent)

Secondary (messier, but tradable on narrative):

-

MGM (BetMGM exposure)

-

PENN (sportsbook + media drama factor)

The Pattern (What usually happens)

1) Buy the Buzz (pre-game run-up)

Money front-runs the headlines.

Stocks often climb before the event… because traders love the party invite.

2) Sell the News (post-game reality check)

After the game, the market asks:

“Cool story… where’s the margin?”

If the stock ripped into the event, you often see profit-taking + fade risk.

3) Volatility peaks into the event, then cools after

Options traders: this is where people overpay for excitement.

IV tends to inflate into the week… and can get crushed after.

The 3 Trade Windows (Simple & Repeatable)

Window A: 7–15 trading days BEFORE

Goal: Ride momentum if price confirms.

-

Look for relative strength vs indexes

-

Breakouts from clean bases

-

Don’t chase gaps like a tourist chasing a taxi

Window B: GAME WEEK

Goal: Protect the edge.

-

Expect chop and headline spikes

-

Size down or tighten risk

-

Let price come to your zone

Window C: 1–3 sessions AFTER

Goal: Trade the snapback or the fade.

-

If it ran hard into the event → watch for mean reversion pullback

-

If it sold off into the event → watch for relief bounce when “nothing catastrophic” happens

The TFT Trigger (Use the T.U.R.N. checklist)

-

T – Tune In: Is the market risk-on or risk-off? (Don’t fight the tide.)

-

U – Understand Rotation: Is money rotating into growth/consumer names or hiding in defense?

-

R – Retracement Setup: Let price pull back into a defined zone—don’t pay retail.

-

N – Nail the Power Zone: Enter on confirmation, not vibes.

Gut-Check (before you click)

-

Are you trading a catalyst… or renting excitement?

-

If this rips pre-game, do you have the discipline to take profit like a pro?

If you keep treating event trades like entertainment… how expensive does that habit get by December?

Sector Bear Market + The Law of Losses

When a sector drops -20%, it’s not “on sale.” It’s on trial.

Here’s the brutal math your ego hates:

-

-50% requires +100% just to get back to even.

That’s not motivation. That’s a warning label.

Mental Model: “The Down-Escalator Rule.”

In a sector bear market, prices don’t fall like stairs.

They fall like an escalator going down while you’re trying to run up in dress shoes.

So the game changes:

-

Don’t “buy and hope.”

-

Trade the turn.

-

Or step into a No Trade Zone™ until the tape proves stability.

Surprising stat to tattoo on your trigger finger:

This AI/Software drawdown has been severe enough that Reuters compared it to major shock periods like 2008, 2020, and 2022 in terms of intensity for the software/services complex.

Translation: this is not a normal pullback. Treat it like live fire.

TFT Tactical Insight (what to do with this)

-

Stop marrying sectors in bear mode. Date them.

-

Hunt bounce setups only when: volatility stabilizes, selling pressure cools, and price reclaims key levels with confirmation.

-

If you must participate: use defined-risk options structures and size like a professional, not a TikTok hero.

-

Rotate into relative strength. Let weak sectors earn back your attention.

“Being too far ahead of your time is indistinguishable from being wrong.”

— Howard Marks

On Feb 6, 1986, the Dow closed at a record ~1,600.69, part of a powerful mid-80s bull run that rewarded trend-followers and punished stubborn bears.

Why it matters today (post-Mag 7 earnings, pre-Super Bowl):

The market loves narratives… but it pays price.

When leadership is clear, trends can run longer than people expect.

When leadership cracks (like software this week), the tape forces humility fast.

TFT takeaway:

Don’t chase noise — track leadership.

When leadership breaks, you don’t “believe harder.”

You rotate smarter.

TFT Epigram:

“When the crown slips off the leader, don’t bow to it — trade around it.”

$1 trillion.

That’s the approximate market-cap value Reuters says the S&P 500 software/services sector has lost since late January as investors price in both AI disruption and the cost of the CapEx arms race.

Why it happened:

Because markets don’t just price earnings — they price certainty.

This week, certainty got punched in the mouth:

-

AI tools are moving from “cute” to “competitive.”

-

Spending plans got massive.

-

And investors realized the margin story might not be linear.

TFT lesson:

When a sector goes from “leader” to “liability,” you don’t average down blindly.

You defend the flywheel, stalk the turn, and let the market prove the new regime.

“The big money is not in the buying or selling, but in the waiting.”

- Jesse Livermore

“Give careful thought to the paths for your feet and be steadfast in all your ways.” — Proverbs 4:26

Clarity before commitment.

This is a trading verse disguised as wisdom.

Because the market punishes two things relentlessly:

-

Impulsiveness

-

Ego

Payday Friday energy makes people sloppy.

They want the dopamine of a “big bounce” more than the discipline of a qualified entry.

So ask yourself:

-

Am I reacting… or executing?

-

Am I chasing a feeling… or following a framework?

-

If I keep winging it, what does my account look like by summer — and what does that cost my family’s options?

Biblical truth that hits traders:

Stewardship isn’t passive.

It’s intentional.

And intention starts with choosing the right path before you take the step.

Want to Learn More?

Get tactical. Get selective. Get paid without gambling.

Join the TFT Tactics Newsletter and get the extra edge:

-

monthly tactical targets

-

rotation reads

-

execution lessons

-

mindset conditioning

…so you’re not guessing — you’re operating.

And if you’re ready to make 2026 your “I should’ve started sooner” year:

Join Time Freedom Trading.

Build the Wealth Operating System.

Start the flywheel. Stack precision. Compound freedom.

Imagine it’s May 2026.

Your mornings aren’t panic-scrolling futures.

They’re calm. Structured. Surgical.

Because you finally learned how to trade the turn instead of chasing the top.

“FAST FORWARD to DECEMBER of 2026"

If you want 2026 to be the year you stop reacting and start operating… join Time Freedom Trading.

You’ll learn to:

-

Trade the retracement instead of chasing breakouts late

-

Use the 50MA/200MA like a pro (structure, bias, risk)

-

Build a Wealth Operating System that compounds skill into freedom

Because the clock’s not ticking — it’s compounding.

And the market doesn’t pay hope… it pays execution.

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep living the way you lived in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, build a Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

IS TIME FREEDOM TRADING TAX DEDUCTIBLE?

If you’re paying for trading education but not structuring it properly…

you might be overpaying twice.

Once to learn.

Again at tax time.

Most traders guess.

The IRS doesn’t reward guessing — it rewards structure.

We broke down exactly when trading education may qualify as a tax deduction, how active traders set it up CPA-clean,

and what documentation actually matters.

👉 Read this before your CPA does:

Trading Education Tax Deduction – CPA-Ready Guide

If you’re already investing in your edge…

why let bad structure erode it?

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doom scrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your

broker that allow you to place a simple trade on autopilot and minimize

your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

26 DECISIONS THAT WILL DECIDE YOUR 2026

NEW YEAR: UNCERTAIN TIMES. CERTAIN EDGE.

#44 YOUR TRAINING YOUR AI REPLACEMENT.

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS