Read more of the

The W.T.F. Report

January 27th, 2026

Tuesday

JANUARY 27th, 2026

The Ice Melt Trade

Markets are like airports after a blizzard—chaotic at first, then suddenly everyone’s sprinting for the same open gate.

The Winter Dig-Out & Snap-Back Week

Welcome to the start of the post-storm thaw.

The ice is melting, the runways are reopening, and the market is doing that thing it always does after chaos—repricing reality at speed.

We’re staring down peak earnings season, a Fed “wait-and-see” meeting, a government shutdown countdown, and a dollar sliding to a four-month low thanks to fresh BOJ stimulus ripples.

Translation? Volatility isn’t a bug this week—it’s the feature.

Gold and silver are still partying like fiat just got canceled.

Tech is stepping up to the mic. Health insurers are getting punched in the face by policy risk. Airlines and energy are trading the storm hangover.

And AI? It’s officially in its awkward teenage years—growing fast, breaking things, and firing people along the way.

This is not a week for prediction.

This is a week for positioning, patience, and precision.

“Markets are never wrong—opinions often are.”

— Jesse Livermore

PRE-MARKET STATS

Dow: −0.64% (dragged by UNH −15%)

-

S&P 500: +0.24%

-

Nasdaq: −0.60%

-

Russell 2000: +0.01%

-

VIX: 16.07 (alert, not alarmed)

Hard Assets Flexing

-

Bitcoin: 87,875

-

Gold: 5,077/oz — still screaming “trust issue”

-

Silver: 1,011/oz — parabolic is an understatement

-

Copper: 1,319

-

Platinum: 2,652

Energy

-

WTI: 61.71

-

Brent: 65.71

-

Nat Gas: 5.32 — steady, still elevated

Rates & FX

-

10-Year: 4.236%

Dollar Index: 96.62 — still bleeding

What we are watching this week...

Winter storm fallout: airlines, energy, utilities

40–50% of flights canceled → operational stress = trade dispersion

SCOTUS rulings (headline risk)

Iran (geopolitical optionality)

Yen weakness & BOJ stimulus (global liquidity leak)

Fed meeting (no cut, all tone)

Mega-cap tech earnings: MSFT, META, TSLA, IBM, AAPL

Government shutdown clock: 5 days

AI moving from “cool demo” to “economic disruptor”

Whats moving the Tape this morning

Rare Earths Go Strategic

USA Rare Earth ripped higher after the Commerce Department took an equity stake—Washington just admitted supply chains are now national security.

Health Insurers Hit the Wall

UnitedHealth Group, Humana, CVS Health, and Elevance Health got smoked after Medicare Advantage rates came in basically flat. Policy risk is real. So is repricing.

Detroit Delivers

General Motors beat earnings, hiked its dividend 20%, and dropped a $6B buyback. Old-school capital discipline still works.

Boeing Rebuilds Lift-Off

Boeing posted a 57% jump in quarterly sales. Deliveries are back. Cash flow surprised. The turnaround isn’t theoretical anymore.

AI Infrastructure Arms Race

Meta inked a $6B fiber deal with Corning. AI isn’t software—it’s concrete, glass, power, and cable.

Layoff Reality Check

Pinterest cut ~15% of staff to double down on AI.

Nike axed 775 jobs while accelerating automation.

Efficiency is the new mercy.

STOCKS IN THE GREEN (+)

Corning +5.9%

General Motors +4%+

United Parcel Service +3.6%

American Airlines +3%

Boeing +2%

Salesforce +2.4%

STOCKS IN THE RED (–)

Nucor −2%

Centene −6%

CVS Health −13%

UnitedHealth Group −15%

Humana −16%

“Earnings are an opinion;

cash flow is a fact.”

| Alfred Rappaport

MARKET HEAT MAP - LIVE

“The reason you have a job....

is because your money is unemployed!

LETS FIX THAT!

STRENGTHS

The market’s core strength this week is forced transparency. Peak earnings season combined with a Fed meeting strips away narrative fluff and replaces it with hard numbers, guidance, and tone. Mega-cap tech earnings concentrate liquidity where it matters most, which reduces randomness and increases tradability for disciplined operators. Commodities continuing to rip—gold above $5,000 and silver going vertical—signal persistent macro stress, which paradoxically creates clarity: capital is still searching for real stores of value. Add a weaker dollar and global liquidity injections from Japan, and you get a market environment where price discovery accelerates, not stalls. This is fertile ground for traders who wait for confirmation instead of chasing headlines.

WEAKNESSES

The biggest weakness is policy whiplash. Health insurers just reminded everyone that one regulatory sentence can erase years of steady returns overnight. That fragility extends beyond healthcare—government shutdown risk, Fed communication risk, and geopolitical uncertainty all create headline-driven volatility that punishes overexposure. Internally, the market is also top-heavy: leadership is narrow, breadth is uneven, and single-stock risk is elevated during earnings. AI-driven layoffs add a psychological drag, reminding investors that productivity gains come with social and labor dislocation. This is not an environment that forgives sloppy entries or emotional decision-making.

OPPORTUNITIES

Opportunity lives in reaction, not prediction. Earnings season during a Fed week historically creates overreactions—both euphoric and catastrophic—that revert once positioning resets. That opens high-probability windows for mean reversion trades, post-earnings drift fades, and volatility compression strategies. Tech earnings provide asymmetric setups where expectations are extreme and guidance nuance matters more than headline beats. Commodities offer a parallel opportunity: continued strength in precious metals reflects distrust in fiat and policy credibility, which creates rotation potential into real assets and inflation hedges. For traders who operate with a framework, this week is rich with repeatable setups, not one-off gambles.

THREATS

The primary threat is complacency disguised as confidence. A calm VIX around 16 can lull participants into ignoring tail risk just as multiple catalysts stack on top of each other—Fed messaging, shutdown brinkmanship, geopolitical flare-ups, and AI-related legal and regulatory shocks. Liquidity can evaporate quickly if sentiment flips, especially in crowded trades. AI’s “adolescence” introduces second-order risks: lawsuits, regulation, labor backlash, and sudden repricing of growth assumptions. In short, the threat isn’t volatility—it’s underestimating how fast conditions can change when leverage, positioning, and narrative collide.

TRUMP TACTICS — ACTIVE (2nd Term Playbook)

Not a prediction. Just the visible operating pattern hitting markets right now.)

Framework Diplomacy: announce “frameworks” first, negotiate details later (markets trade headlines, not footnotes).

T.A.C.O. Bounce Buying: stir fear → reverse tone → risk assets pop → repeat.

Territory & Resources Leverage: Greenland narrative = strategic access without boots on the ground.

Regime Pressure Posture: using pressure + backchannels to influence outcomes (Cuba/Venezuela theme in the tape).

Tariff & Trade Threat Optionality: keeping Europe/partners off-balance to extract concessions.

Domestic Disruption Signaling: bold operational changes (like regulatory posture shifts) that reprice entire sectors fast.

Tech Earnings + Fed Week

Trade the Turn, Not the Tweet.

Historically, over 62% of S&P 500 stocks reverse their initial earnings-day move within 5 trading days during Fed meeting weeks.

Why? Positioning > fundamentals in compressed liquidity windows.

“Markets can remain irrational longer than you can remain solvent.”

| — John Maynard Keynese.

January 27th

The edge isn’t guessing beats—it’s waiting for emotional overshoots to snap back.

“The big money is not in the buying or selling, but in the waiting.”

- Jesse Livermore

This market is testing who you are, not what you know.

Winter storms grounded planes. Earnings shocks grounded portfolios. AI is grounding careers. And somewhere between the Fed’s “wait-and-see” and Washington’s shutdown theater, traders are being quietly sorted into two groups: those who react and those who remain rooted.

Here’s the truth most won’t admit:

Uncertainty doesn’t steal wealth. Impatience does.

When volatility rises, the amateur tightens their grip.

The professional loosens theirs—because they trust the process.

This is the season where your edge is not speed, prediction, or conviction.

Your edge is discipline under pressure.

You don’t need to trade everything.

You need to trade the right moment.

The market oscillates. Fear expands. Headlines scream.

But your job is simpler—and harder:

Stay anchored while everything else swings.

You will keep in perfect peace those whose minds are steadfast, because they trust in You.”

— Isaiah 26:3

That word steadfast matters.

It doesn’t mean stubborn.

It means unmoved by noise, committed to truth, obedient to process.

Abundance in Scripture is never promised to the frantic.

It’s promised to the faithful steward—the one who plans diligently, waits patiently, and acts decisively when the time is right.

So today, don’t ask:

-

“What’s the market going to do?”

Ask:

-

“Am I trading from fear… or from alignment?”

Because the traders who win this year won’t be the loudest.

They’ll be the calmest.

They won’t chase every candle.

They’ll compound clarity.

And here’s the real gut check:

If you can’t stay disciplined when conditions are unclear…

What makes you think you’ll handle abundance when they’re favorable?

The market doesn’t reward hustle.

It rewards obedience to a system.

Stay patient.

Stay prepared.

Stay positioned.

Providence favors the disciplined.

Want to Learn More?

If you want 2026 to be the year you stop “following markets” and start operating in them…

Join Time Freedom Trading and install the Wealth Operating System:

-

See the market in 3D (structure, rotation, catalysts)

-

Trade the TURN, not the noise

-

Defend capital, compound conviction, build the Financial Flywheel

Picture this: it’s December 2026… and your calendar isn’t owned by meetings.

It’s owned by choices.

-

Like / Subscribe / Share

-

Watch the YouTube channel

-

DM me with questions

“FAST FORWARD to DECEMBER of 2026"

If you want 2026 to be the year you stop reacting and start operating… join Time Freedom Trading.

You’ll learn to:

-

Trade the retracement instead of chasing breakouts late

-

Use the 50MA/200MA like a pro (structure, bias, risk)

-

Build a Wealth Operating System that compounds skill into freedom

Because the clock’s not ticking — it’s compounding.

And the market doesn’t pay hope… it pays execution.

Fast-forward 12 months.

It’s December 2026.

The Fed is doing whatever the Fed does.

AI is on its 7th hype cycle.

But here’s the only question that matters:

Are you still hoping rate cuts save your portfolio…

or are you calmly executing a proven trading operating system that funds your lifestyle, your legacy, and your time freedom?

You just read a full breakdown of:

-

How the macro winds are shifting.

-

Where rotation and reversal trades are setting up.

-

How to weaponize something as simple as an engulfing candle for asymmetric entries.

The next move isn’t more information.

It’s installation.

So ask yourself — honestly:

If you keep living the way you lived in 2025,

will you be any closer to time freedom by next December?

If the answer stings, good. That’s your signal.

Lock in a plan with Time Freedom Trading — the E.D.G.E. system, the $1K Way, the Tactics Newsletter, build a Financial Flywheel — and give your future self a very different December.

Because you’re one trade, one turn, one moment of clarity away from changing your life.

And if this hit you… you already know what you’re supposed to do next.

🎁 Build your Financial Flywheel.

🎁 Learn to trade with clarity, consistency, and conviction.

🎁 Step into the new year: take your time back.

Imagine compounding skill, capital, and confidence for 12 months straight…

Would that change your 2026?

You’re just one trade away.

IS TIME FREEDOM TRADING TAX DEDUCTIBLE?

If you’re paying for trading education but not structuring it properly…

you might be overpaying twice.

Once to learn.

Again at tax time.

Most traders guess.

The IRS doesn’t reward guessing — it rewards structure.

We broke down exactly when trading education may qualify as a tax deduction, how active traders set it up CPA-clean,

and what documentation actually matters.

👉 Read this before your CPA does:

Trading Education Tax Deduction – CPA-Ready Guide

If you’re already investing in your edge…

why let bad structure erode it?

Want to

"SEE"

the Market

Correctly?

SEE the Market

Like a Time Freedom Trader!

Most people stare at charts the way rookies stare at MRI scans —

lots of squiggles… zero understanding… and a whole lot of “uhhh, is this bad?”

Time Freedom Traders don’t look at the market.

We see it — in 3D, in real time, with clarity sharp enough to slice through Wall Street noise.

We see:

-

Rotation before it rotates

-

Catalysts before they explode

-

Turns before they trend

-

Opportunities while everyone else is still doom scrolling

This is the difference between traders and operators.

One guesses.

One reads the market like a playbook.

And it starts with using the right tools.

If you want to see what we see, the way we see it —

you need charts that don’t lie, lag, or limit your edge.

That means TradingView.

- Clean charts.

- Real-time data.

- Precision tools.

- Time Freedom Trading Custom Indicators - to "See" the MOVES correctly!

Everything you need to trade the turn, not chase the move.

👉 Sign up for TradingView today and start seeing the market like a Time Freedom Trader.

Your clarity starts the moment your charts go HD.

Because remember —

You’re just one trade away.

LIVE LIKE

A SUPER HERO!

A SUPER HERO!

If you’re ready... it’s time to level up.

Join our Coaching Cohort, where we teach traders how to:

- Think like a Trader and Investor

- Build your own "consistency code"

- Grow into Profits with Providence.

No more hesitation. Just a proven path to financial freedom.

Click below to join the Time Freedom Trading Coaching Cohort and start trading the $1KWay today!

Join the TIME FREEDOM TRADING Coaching Cohort Today!

Discover how Time Freedom Trading can help you start building your Financial Flywheel and your trading plan to HIT SIX in 2026!

Freedom awaits—are you ready to claim it?

| The "Bald Bull

P.S.S. PLEASE PAY IT FORWARD!

GIVE TIME FREEDOM - SHARE THIS LINK

Every one deserves Time Freedom!

If you know someone who would like to learn to earn time freedom, please forward this email / link and share the freedom!

Your network will appreciate it (and remember you) for sharing thoughtful content.

If you enjoyed this micro-lesson please share this link on social.

Get the "GET FREE" Bundle

10 TIME FREEDOM TRADING TACTICS YOU WILL LEARN!

- Learn your real freedom number to earn time freedom trading in the stock market. (it's smaller than you think!)

- Learn how to see market manipulation by large institutional investors and profit from their movements.

- Learn how to make money in an up, down, or sideways market. More importantly, you will learn a quantitative approach to know when NOT to trade in the stock market to protect your capital.

- Develop the proper paper trading skills and processes to prove your trading ability in the stock market before risking a single dollar!

- Learn the proper trading chart configurations to see the markets in 3D and clearly see market moves before your trade!

- Understand the difference between retail trading (prey) and professional trading (predator)strategies and how to profit from both mindsets in the stock market.

- Learn simple trading strategies that only require 5th-grade math. No complex calculations or buzzwords to confuse you.

- Create simple automated trading tactics with your

broker that allow you to place a simple trade on autopilot and minimize

your risk while maximizing your gain for a trade.

- Join a live daily trader community chat that will discuss market moves in real-time to accelerate your learning and close your experience gap faster.

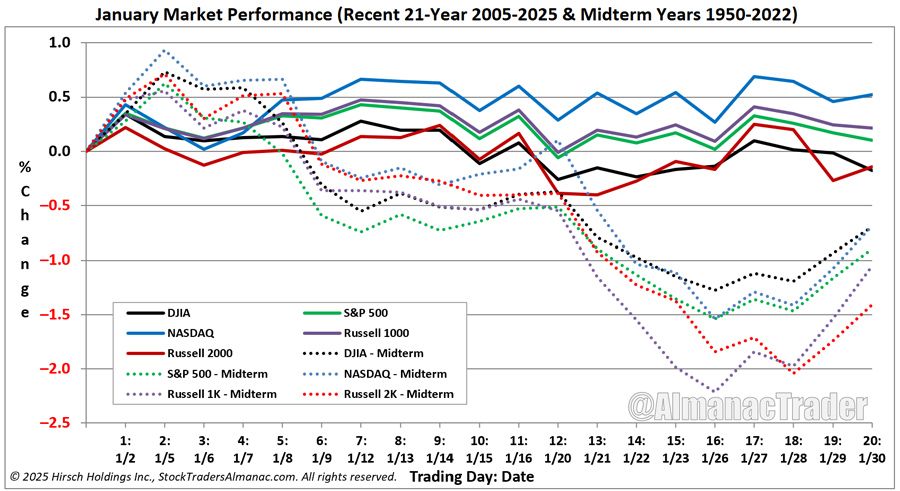

- Experience the seasonality of the stock market with a veteran trader to learn how to profit in all months and seasons of the year to earn time freedom!

✓ Quantified Strategies: Learn to identify repeatable trading patterns to profit in the markets with systematic, data-driven methods.

✓ Practical Examples: Real-world cases, demonstrated strategies in action.

✓ Consistent Results: Strategies that have proven successful for decades are now accessible to you.

When your ready;

There are five (5) ways I can help.

1.0 Subscribe to

The W.ith T.ime F.reedom Report

Join the Time Freedom Trading Community. SIGN UP for The W.ith T.ime F.reedom REPORT newsletter and learn how to earn TIME FREEDOM from your INBOX! Get trading strategies and get elements of the Time Freedom Trading Operating System in your inbox! Time Freedom Awaits!

The W.ith T.ime F.reedom Report

2.0 Subscribe to

TIME FREEDOM TRADING TACTICS

Get an "investing lesson" on the 1st of every month in your inbox with simple tactics you can implement immediately to start earning time freedom.

TIME FREEDOM TRADING TACTICS

3.0 The Time Freedom Trading

ON DEMAND COURSES

The #1 On-demand Trading Curriculum for learning Trading MECHANICS, Trading DYNAMICS, Trading STRATEGY, and Trading MINDSET.

Join the TIME FREEDOM TRADER COMMUNITY in our flagship courses. Time Freedom Trading teaches you exactly how to lose less and make more by learning a simple system to compound profits in the stock market.

Come inside and get over 25 years of trading expertise, proven methods, and actionable strategies to help Main Street earn Wall Street profits by trading and investing in the stock market.

Ondemand.TimeFreedomTrading.com

4.0 The Time Freedom Trading COACHING COHORT

Join Time Freedom Traders learning "live and in real-time" the seasonality of the stock market. This comprehensive Trader Coaching Cohort will teach you 1:1, in live Cohort sessions, and open office hours, specifically how to trade the seasons of the stock market and learn from live Market Moments for profitable trading strategies.

The WINTER, SPRING, SUMMER, and FALL seasons all have different dynamics to profit from in the stock market. Build the proper knowledge, process, and skills to leverage the exact system I used to gain TIME FREEDOM all year through by effectively trading the stock market with seasonal catalysts. Grow your account with real money with the $1K to $100K Way and earn time freedom your way.

Time Freedom Trading Coaching Cohort

5.0 The FREEDOM FRIENDS & FAMILY AFFILIATE PROGRAM

Join the Time Freedom Trading Affiliate Program at no cost to you, and GET PAID to share the gift of TIME FREEDOM with friends and family. Refer others to Time Freedom Trading and share your personal affiliate link ID to earn a commission on every offering we sell.

Help Time Freedom Trading scale to reach more TIME FREEDOM TRADERS and fund your $1K WAY to earn time freedom. Become a partner to scale the Time Freedom Trader Community.

Giving back and paying it forward with Time Freedom Trading is a WIN-WIN for all!

BECOME A FREEDOM FRIENDS & FAMILY AFFILIATE

"Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes."

- Jesse Livermore

SUBSCRIBE TO THE NEWSLETTER

Join TIME FREEDOM TRADERS who are readers of

The W.ith T.ime F.reedom Report for exclusive tips, strategies, and resources to learn how to trade and invest in the stock market.

More WTF REPORT!

26 DECISIONS THAT WILL DECIDE YOUR 2026

NEW YEAR: UNCERTAIN TIMES. CERTAIN EDGE.

#44 YOUR TRAINING YOUR AI REPLACEMENT.

#4 FIVE (5) REASONS EVERYONE SHOULD LEARN TO TRADE THE STOCK MARKET

# 38 FIVE YEARS FROM NOW, YOU'LL ARRIVE SOMEWHERE!

#40 Feeling FOMO for Missing the NVIDIA AI Bubble?

Share this Article on:

Learn to Earn Time Freedom;

FREE TO LIVE YOUR LIFE YOUR WAY!

Join us today

Join us today

Join us today

THANK YOU

Join us today

Join us today

Join us today

Learn to earn and earn time freedom with your profits in the stock market. Time Freedom Trading is helping MAIN STREET earn WALL STREET profits through real trading and investing strategies.

Forget the dogma of "set it and forget it" tactics with passive investing that keeps your advisor rich with fees and your account balance diminished with under performing portfolio strategies.

Time Freedom trading is helping MAIN STREET earn WALL STREET PROFITS. Can you afford to NOT find out? What is your old way of investing really costing you. Get started with TIME FREEDOM TRADING today!

Sponsor this Newsletter!

Have questions?

Hit reply to this email and we'll help out!

You are receiving this note because you joined us at one of the Time Freedom Trading websites.

Copyright © www.TIMEFREEDOMTRADING.com

All rights reserved.

About www.TIMEFREEDOMTRADING.com

THE TIME FREEDOM TRADING SYSTEM empowers Main Street with Wall Street knowledge and tools to compound wealth and earn time freedom through proven trading and investing strategies. Learning how the stock market works from the inside is critical to compounding wealth consistently in any market environment. Time Freedom Trading empowers you to build your own financial flywheel based upon your skills and goals. Regardless of the technology or market volatility, with TIME FREEDOM TRADING you will have the right mentor and mental coach who will reveal the patterns in human nature that don’t repeat but do rhyme which you can profit from. Whether it’s stocks, options, exchange-traded funds (ETFs), or futures, we empower you with an effective skill set and tools for everyone at every level of experience to earn time freedom.

Life is short.

MAKE IT WORTH WHILE!

Compounding wealth with Time Freedom Trading can make it long and worthwhile.

Earn time freedom to enjoy life, enjoy your family, and enable the life and legacy you deserve.

Become a Time Freedom Trader Today!

Your Time Freedom Awaits!

TIME FREEDOM TRADING DOES NOT PROVIDE RECOMMENDATIONS OR ADVICE.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. TIME FREEDOM TRADING content is offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer

LEGAL DISCLAIMERS

ADDITIONAL RISKS